Better High Yield ETF Buy: JEPI Vs. QYLD

Summary

- Rising interest rates are driving strong demand for high yield funds.

- Both JEPI and QYLD are benefiting from this trend thanks to their sky-high yields.

- We compare them side by side and share our view on which is the better buy at the moment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

AndreyPopov

Rising interest rates are driving strong demand for high yield funds, especially among retirees.

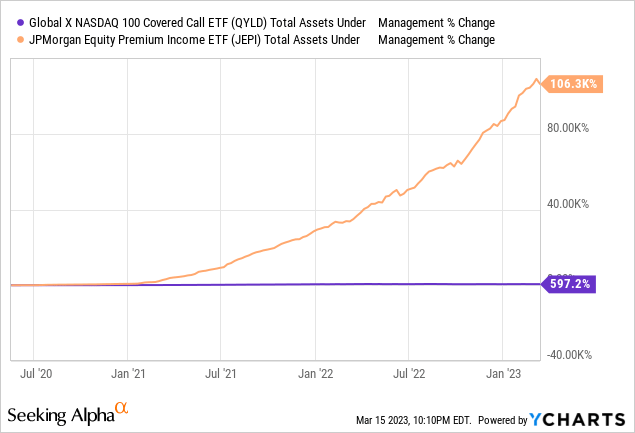

Both the Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) and the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) are benefiting from this trend thanks to their sky-high yields as evidenced by their rising assets under management in recent years:

In this article, we compare these opportunities side by side and share our view on which is the better buy at the moment.

JEPI Analysis

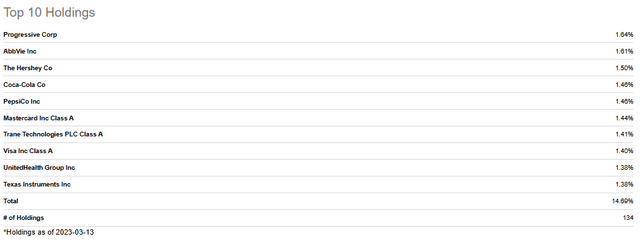

Investors are flocking to JEPI largely due to the fact that it has been paying out an average monthly dividend yield of just over 1% of its current share price, resulting in a trailing twelve month yield of 12.1%. Furthermore, it has a well-diversified portfolio. JEPI's portfolio consists of 134 holdings, with its top 10 holdings accounting for only 14.69% of its total assets.

JEPI Top Holdings (Seeking Alpha)

The portfolio is well spread out across the financial, industrial, health care, consumer defensive, technology, consumer cyclical, and utilities sectors, along with smaller allocations to the communication, materials, real estate, and energy sectors.

JEPI Allocation (Seeking Alpha)

The reason that JEPI is able to pay out such substantial monthly dividends to shareholders is due to the fact that it implements a covered call strategy by selling out of the money call options on the S&P 500 (SPY). As a result, it generates significant options premiums that it pays out to investors via its dividend.

This strategy prioritizes increased cash flow generation each month over the upside potential, resulting in more stable and predictable short-term total returns by smoothing out the stock market's volatility. However, it is unlikely to have a significant impact on the fund's long-term risk-adjusted total return potential.

QYLD Analysis

QYLD also offers investors a very attractive monthly income yield that is roughly on par with JEPI's. In fact, it is slightly higher than JEPI's at 12.67% annualized over the past twelve months.

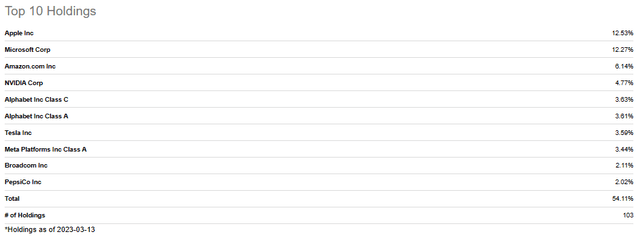

It currently has 103 holdings, which is less than what JEPI has, but is still plenty of diversification. That said, the biggest difference between the two in terms of diversification is that its top 10 holdings represent a whopping 54.11% of its total assets under management, making them a very concentrated fund in reality. The good news is that all but one of its holdings (PepsiCo (PEP)) are mega cap technology stocks like Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOG)(GOOGL), Tesla (TSLA), and Meta (META), so its concentration is at least in very large and well-capitalized businesses with powerful moats.

QYLD Top Holdings (Seeking Alpha)

Given this concentration, it is not surprising that roughly half of the portfolio is invested in technology stocks, with sizable allocations to the communication and consumer cyclical industries as well. The portfolio is then rounded out by smaller allocations to the health care, consumer defensive, industrial, utilities, financial, energy, and real estate sectors.

QYLD Allocation (Seeking Alpha)

QYLD employs a similar covered call methodology for generating significant cash flow from the options premiums. It then returns this cash to shareholders via its monthly dividend

Similar to JEPI by emphasizing cash flow generation each month, this strategy prioritizes stable and predictable short-term total returns by mitigating the stock market's volatility.

Investor Takeaway: Which Is The Better Buy?

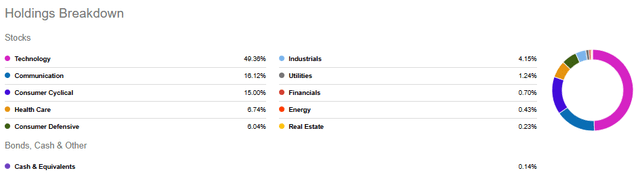

Over the period in which both funds have traded publicly, JEPI has handily outperformed QYLD, though both have trailed SPY:

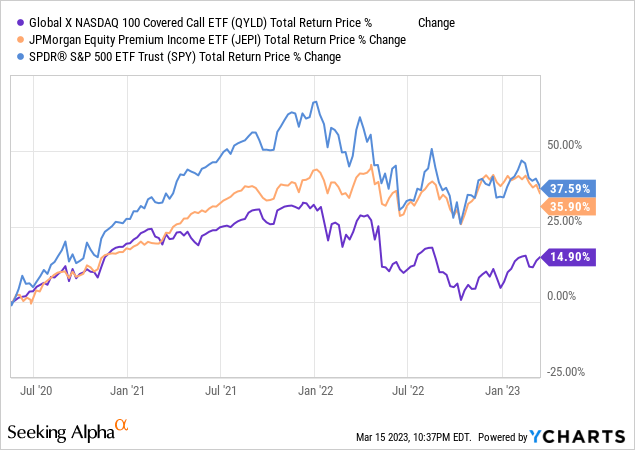

It is important to keep in mind that JEPI's underlying holdings more closely resemble those of a dividend ETF like the Schwab U.S. Dividend Equity ETF (SCHD) whereas QYLD's portfolio is more closely related to the Nasdaq (QQQ). Given that SCHD has meaningfully outperformed QQQ by a similar amount as JEPI has outperformed QYLD over a similar time period indicates that QYLD's underperformance is more driven by its sector focus rather than by its fund strategy/management:

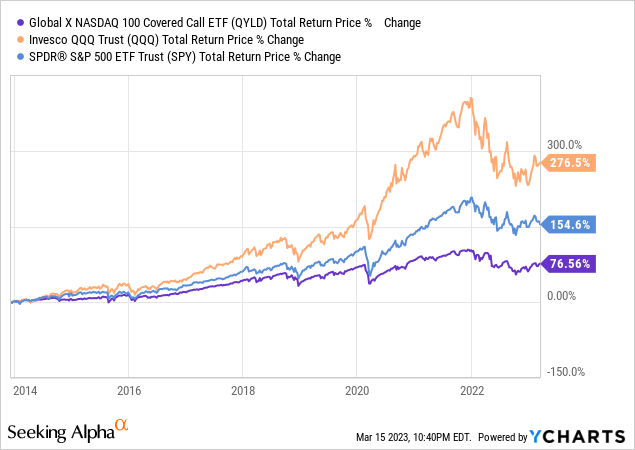

That said, QYLD has badly trailed both SPY and QQQ over the course of its publicly traded life, so clearly it has struggled to perform at a high level for investors:

Another strike against QYLD is that its expense ratio is 0.6%, whereas JEPI's is significantly lower at 0.35%.

Both funds employ similar strategies and have generated below index level returns over the course of their publicly traded lives. This is largely the product of them charging fairly high management fees as well as the fact that the market has been generally in a bull market and also quite volatile over the course of their publicly traded lives. This is a negative for these funds because selling options is effectively a bet that volatility will be below average, so above average volatility will typically lead to below average returns for options sellers. Furthermore, covered call strategies often underperform during bull markets because stock prices often rise above the strike price on covered calls, meaning that investors who sell calls against their long positions often miss out on significant upside in bull markets.

At the end of the day, the choice between these two boils down to sector focus. If you want greater concentration in mega cap tech, QYLD is likely the better bet. If you want greater concentration in higher yielding dividend growth powerhouses and/or more broad sector diversification, JEPI is the better bet. Given that they pay out similar dividend yields, there is no strong differentiator on that front.

That said, all else being equal, we prefer JEPI given that it is much better diversified and also has a meaningfully lower expense ratio. With QYLD, you may just be better off over the long-term by buying shares of AAPL, MSFT, and AMZN instead of QYLD (since they constitute nearly 1/3 of its portfolio anyway) and then just selling covered calls against them to generate a similar income yield as that which is offered by QYLD. At least this way you don't have to pay the hefty management fee.

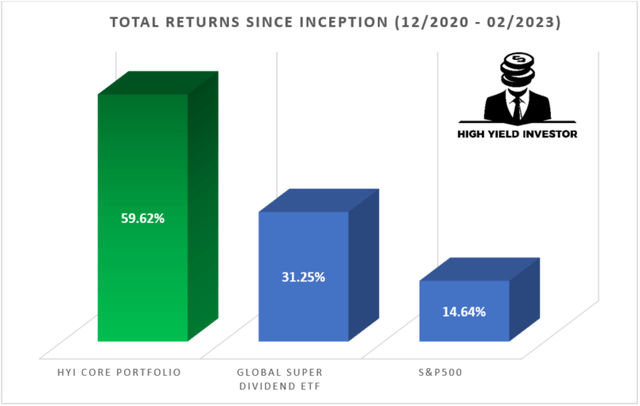

At High Yield Investor we take a different approach, complementing high-yielding positions found in the infrastructure, energy, BDC, real estate, and financials sectors with dividend growth stocks, providing us with a sufficiently diversified portfolio that combines immense outperformance relative to the broader market with a ~7% dividend yield.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain. There's also a $251 discount for new members who join TODAY!

Start Your 2-Week Free Trial Today!

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.