February CPI Report Suggests More Interest Rate Hikes To Come

Summary

- A slowly cooling inflationary environment may not be enough for the economy to avoid further rate hikes in March.

- Increasing pressure on the banking system has culminated in the failures of institutions such as Silicon Valley Bank.

- Significant uptick in negative market sentiment could sour hopes of the economy achieving a soft landing.

- Uncertain financial landscape creates a difficult and frustrating situation for investors.

VisionsofAmerica/Joe Sohm/DigitalVision via Getty Images

February CPI Overview

The Consumer Price Index is a key gauge of how inflation is impacting the real price of living in the United States. The latest report by the Bureau of Labor Statistics illustrates that while peak inflation has passed, we still have a long way to go before the fed’s targets are met.

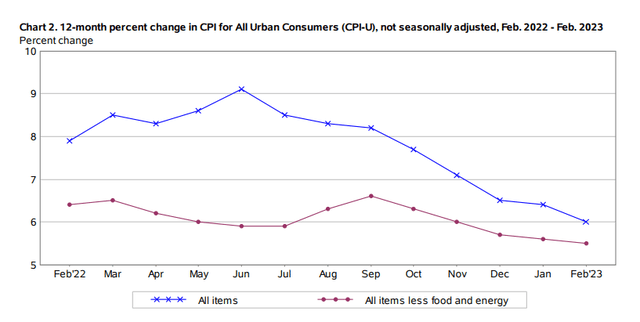

For the year ended in February, the CPI measured 6%, down from 6.4% in January of 2023. This matched many economists’ expectations and supports the thesis that inflation has begun to cooldown.

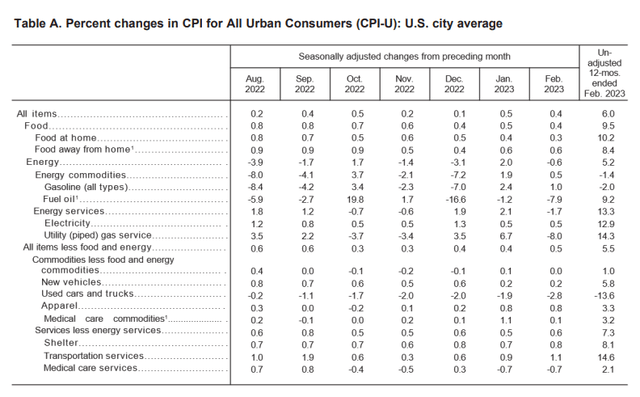

On a monthly basis overall pricing levels saw a rise of 0.4%, once more falling in line with consensus estimates. Core CPI saw a rise of 0.5%.

The primary driver for the monthly rise in CPI was a rise in shelter prices which was responsible for 70% of February’s total gains. Shelter prices increased 0.8% throughout the month ending 8.1% up YoY.

Among the other indexes that rose in February was the index for recreation, which increased 0.9%, and the index for household furnishings and operations which increased 0.8%. The airline fares index rose 6.4%, ending a string of four consecutive declines which was welcomed news for many aviation shareholders.

Fortunately, not all indexes showed price increases. While the food index saw a 0.4% increase in February, key subindexes such as Meat, poultry, fish and eggs saw a 0.1% decrease.

This decrease was a first for the index since December 2021 and suggests the Fed’s continued rate hikes may finally have begun to see a response from the economy.

Energy prices also saw key declines in pricing levels which is very positive news. The overall energy index fell 0.6% in February after seeing another increase in January. Certain segments such as natural gas and fuel oil saw declines of 8% and 7.9% respectively.

While gasoline prices rose another 1.0% in February, this still represented a slowdown of 1.4% since January.

Perhaps the single biggest issue still hindering the economies’ ability to cool-off on inflation is the continued pricing increases in the services segment. The index rose another 0.1% from January finishing February off at 0.8%. This continued growth is a key signal of inflation remaining “sticky” which is one of the Fed’s key and ongoing concerns.

Where does the Fed go from here?

Clearly, while the CPI along with certain key metrics have shown concrete evidence of decreasing inflationary pressures, the rate at which price levels are slowing is below the Fed’s expectations.

The Fed’s required month-on-month target for core inflation is 0.2%. This would allow annual inflation to reduce back down to the Fed’s target rate of 2%. However, as the Fed chair Jerome Powel told congress, there is still a “long-way to go” until this target is met.

Clearly, the key issue remains a hot services segment which is only driven further by a still booming job market. In February over 311,000 jobs were added in the U.S.

While the job market did slow significantly from January’s 504,000, the overall strength of the labor force will undoubtedly continue pushing against the desired cooldown the Fed so desperately is looking to achieve.

Unfortunately for the Federal Reserve, the fight against inflation has become even more difficult over the past couple weeks. The significant instability being experienced in the banking system suggests further rate hikes may cause even more damage to the financial sector.

Silicon Valley Bank - Homepage

The failures of banks such as Silicon Valley Bank suggest further rate hikes could cause even more banks to collapse under the increasing pressures of a high-interest rate market.

Nonetheless, I believe the Fed has no other choice than to increase interest rates further in March. A 0.25-point increase would most likely result in a good balance between increasing the downward pressure on inflation without risking further collapse in the banking system.

While a 0.50-point increase would significantly help to increase the ability for the economy to align with the 2% inflation target set-out to be achieved by 2023, I believe this could subject the financial sector to excessive instability.

The Fed’s cooperation with the FDIC and the Treasury to ensure customers of Silicon Valley Bank will have access to their money suggests that significant consideration is being placed on how best to curb inflation while restoring citizens confidence in America’s banking system.

What about investors?

Simply put, the future looks uncertain. The lack of confidence in America’s banking system is an issue not to be understated. Such falling levels of trust can often instill significant negative sentiments towards potential future economic growth.

While this should help curb inflation, I believe the risk for a recession grows greater.

Therefore, it is difficult to advocate for the likes of market-tracking ETFs such as the Nasdaq-100 (QQQ) or even the S&P 500 (SPY). While more stability could be present in certain strategic stock picks, it is undeniable that the overall market outlook for 2023 is mediocre at best.

When combined with the recent cooling and turning market sentiments towards the bear-rally started at the end of 2022, finding value generating opportunities in this turbulent market will be difficult.

Summary

The lack of concrete evidence towards a cooling services sector combined with the accompanying threat for core inflation to keep creeping-up throughout March creates unwelcomed levels of uncertainty in markets.

An instable banking system spearheaded by the collapse of key banks suggests consumer sentiment and trust in the economy achieving a soft-landing have soured. I maintain that the threat for a recessionary period in the U.S. economy in 2023 has increased.

These complex issues create a difficult situation for the Federal Reserve. Should interest rates be increased a further 0.50-points to put a resolute blockade on inflation, the economic outlook for 2023 might turn even bleaker.

Conversely, a 0.25-point rate hike may help restore some confidence that the banking system can survive, but ultimately could lead to an even slower reduction in inflation.

The unfortunate truth is that no matter what the Fed chooses to accomplish, little tangible evidence exists for investors to utilize in their decision-making process. The result is a fundamentally frustrating financial environment which in my opinion, will only further act to put the U.S. economy into a recession.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own.

Please conduct your own research and analysis before purchasing a security or making investment decisions.