Can Salesforce Stock Recover To $200 In 2023?

Summary

- Salesforce has increased its revenue substantially over the years mainly via acquisitions.

- The year just ended was uninspiring and disappointing to say the least.

- Elliott Management is proposing new board members.

- CRM has a huge $20 billion share buyback in place.

- Next year's profit projections are by far the highest in the company's history.

- Looking for a helping hand in the market? Members of Turnaround Stock Advisory get exclusive ideas and guidance to navigate any climate. Learn More »

Overview:

Hispanolistic

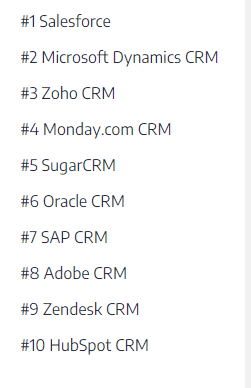

Salesforce, Inc. (NYSE:CRM) is the largest CRM (Customer Resource Management) software vendor in the world, with sales in excess of $31 billion in fiscal 2023 ending January.

As with every business CRM has competition and some of them such as Microsoft (MSFT), Oracle (ORCL), and SAP (SAP) are far larger than CRM.

Here are the top 10 CRM vendors.

Ascendix

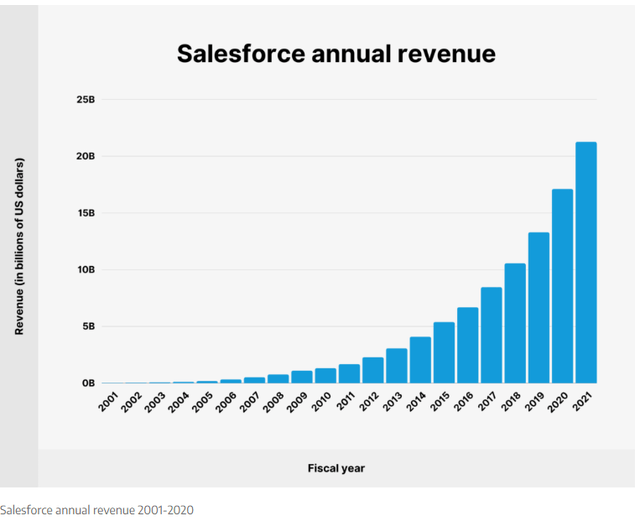

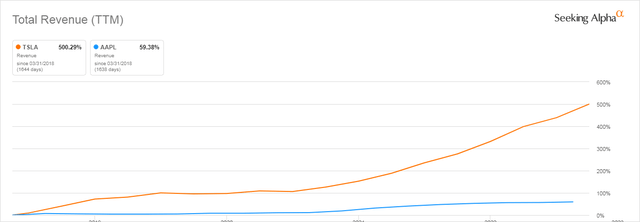

CRM's sales have grown exponentially since they started up in 2001 as can be seen in the following chart.

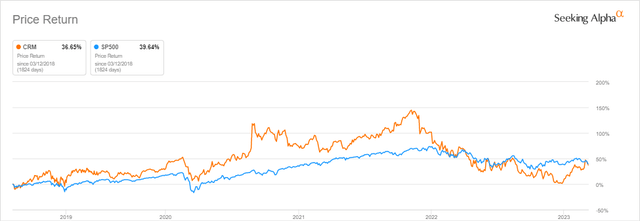

Despite the huge increases in revenue, CRM has failed to keep up with the S&P 500 (SPY) in Total Return (including dividends) over the last 5 years growing only 37% compared to SPY's 52%.

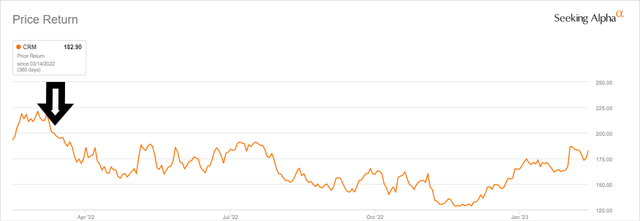

Since November 2021, CRM's price has dropped from over $300 to less than $175. It hasn't seen $200 for almost a year.

CRM's erratic past results seem to be coming to an end with great 4th quarter results and projected earnings the best they have ever been. Add in a huge $20 billion share buyback and activist firm Elliott Management on the board, and CRM should exceed $200 per share in 2023.

CRM Stock Key Metrics

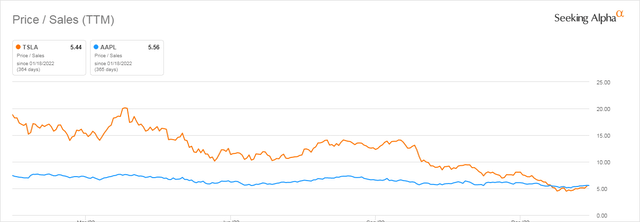

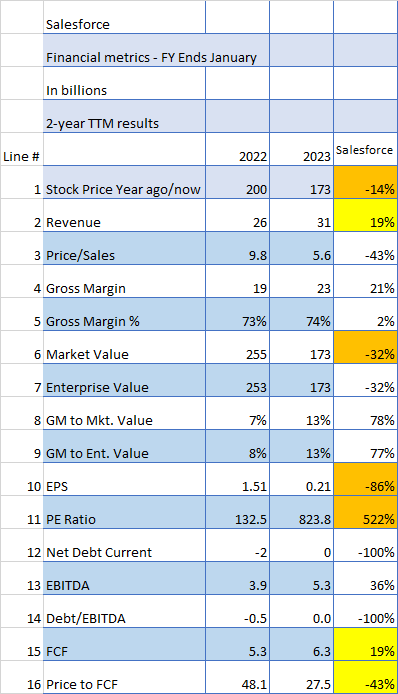

If we look at CRM's financial metrics comparing the latest TTM (Trailing Twelve Months) with the previous year, we can make a reasonable comparison of today's value versus last year's value. Once we have made that comparison, we will make an attempt to see how the coming year may play out.

Seeking Alpha and author

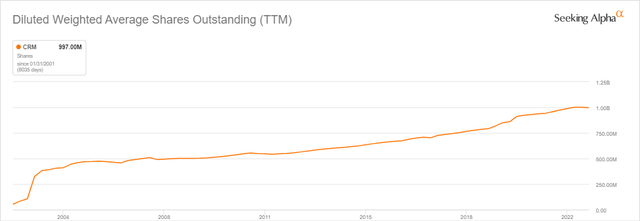

Looking at the orange items first we start with the most basic (Line 1) - the price has dropped by 14%. Accordingly, Market Value (line 6) is also down by 32%. That is the result of more shares outstanding. In fact, CRM has increased its share count consistently over the last 20-plus years as it constantly acquires smaller competitors.

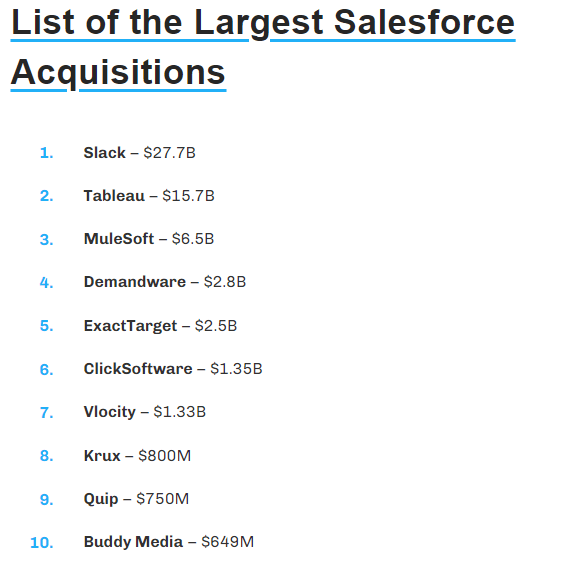

Here's a list of CRM's Top 10 acquisitions.

salesforceben.com

The acquisitions are why CRM has been able to grow its revenue at a substantial rate.

EPS also took a huge hit dropping by 86% from last year's results.

The good news is Revenue (line 2) is up 19% continuing CRM's consistent and substantial year-over-year increase. We will talk more about revenue later in this article.

Also, Free Cash Flow (Line 15) also increased substantially.

CRM has had an elevated P/E ratio (line 11) forever, but this year it jumped to an unsustainable level of over 800x.

And lastly, the Price/FCF (free cash flow) (line 16) has dropped 43%.

Add to that the Net Debt position is basically zero meaning CRM has as much cash as it does long-term debt.

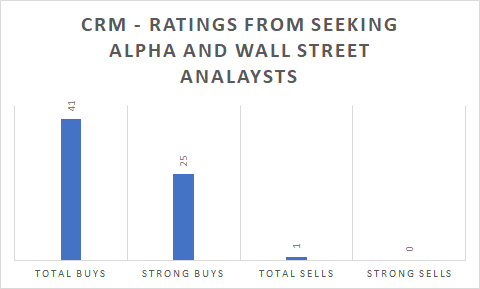

What Do Analysts Think?

Wall Street and Seeking Alpha analysts are very positive on CRM with 41 Buys versus only 1 Sell. Among those Buy recommendations are 25 Strong buys, a very high number.

Seeking Alpha and author

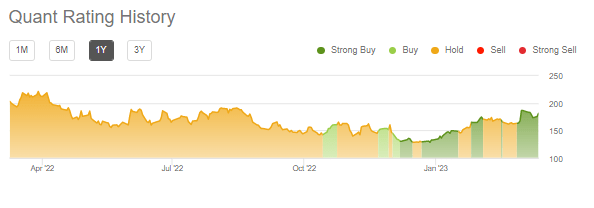

Quants are equally enamored with a Strong Buy rating since February 27.

Seeking Alpha

It is rare for analysts and quants to agree so strongly on a stock. This is a definite plus for CRM's price going forward.

Is Salesforce Expected To Grow This Year?

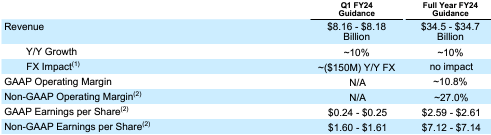

The main reason for the high ratings from analysts and quants was the very encouraging, even eye-popping projections from CRM management for Fiscal 2024 ending next January. In those projections, GAAP earnings are projected to increase by more than 1,000% ($.21 to $2.50) and non-GAAP earnings are projected to hit an amazing $7.12 per share.

These numbers were on an estimated revenue increase of only 10%.

SalesForce

Source: CRM

In addition to that CRM has a $20 billion share buyback in place, looks to lay off 10% of its employees, and has Elliott Management clamoring for board seats.

What's not to like?

What Is The Current Price Target For CRM?

After the earnings projections for next year, analysts quickly updated their price targets.

Wedbush Securities analyst Dan Ives called the results "eye popping," and raised his target price to $220.

Goldman Sachs analyst Kash Rangan raised his price target to $320 from $310.

NASDAQ has analyst targets with a low price of $145, an average price of $223, and a high price of $320.

Can Salesforce Stock Recover To $200 In 2023?

With next year's earnings results projected to grow by more than 1,000%, it would take a significant market drop or a big mistake by Salesforce for CRM not to hit at least $200 in 2023.

The last time it was at $200 was in April of 2022. And remember that was coming off 2023 earnings of $.21 as opposed to 2024 projections of over $2.50.

Based on analysts' ratings and analysts' price targets CRM should easily hit $200 in 2023.

Bottom Line

Salesforce results have been up and down over the last few years and last year was really a downer as the price chart in the previous paragraph shows.

But it looks like CRM has gotten religion and is now going to concentrate on earnings and not acquisitions and revenue growth.

And 1,000's of layoffs indicate a new interest in cutting costs rather than purely concentrating on revenue even though revenue is estimated to increase by 10% next year.

Then $20 billion in potential share buybacks and putting Elliott Management directors on the board shows a new interest in shareholder returns rather than just acquisitions and revenue.

Then there are rumors of CRM possibly selling Slack which has been something of a disappointment but would certainly add billions of dollars to CRM's coffers. More money to buy shares back or who knows maybe do a dividend?

Seeing the potential for a huge turnaround, I find CRM to be a Strong Buy.

If you found this article to be of value, please scroll up and click the "Follow" button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.