Kimberly-Clark: Dividends Are Good But No Upside

Summary

- Kimberly-Clark Corporation produces and sells personal care and consumer tissue products globally through brands such as Kleenex and Andrex.

- KMB has modernized its operations, setting itself up well for continued success long term.

- Management has delivered a robust performance in FY22, balancing price increases based on the inelasticity of their product's demand.

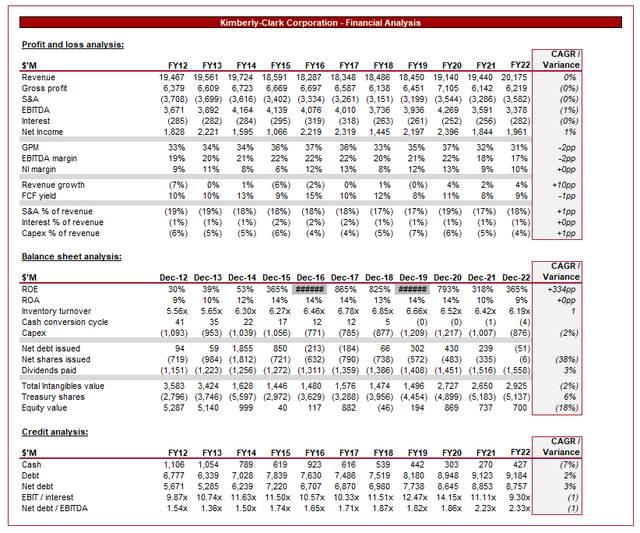

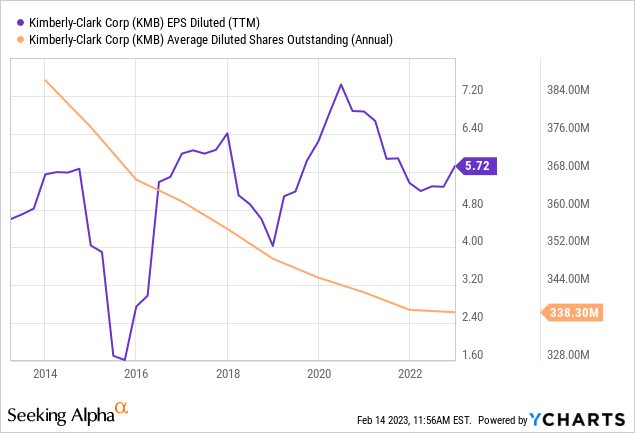

- The last decade of financial performance can be described as consistent but stagnant. This has been good enough to drive consistent dividend and buyback growth.

- We see no capital appreciation upside, so rate KMB stock a hold but consider it a safe dividend play.

ASIFE

Company description:

Kimberly-Clark Corporation (NYSE:KMB) produces and sells personal care and consumer tissue products globally. It operates through three business segments: Personal Care, Consumer Tissue, and K-C Professional. The largest brands under their umbrella are Huggies, Kleenex, and Andrex.

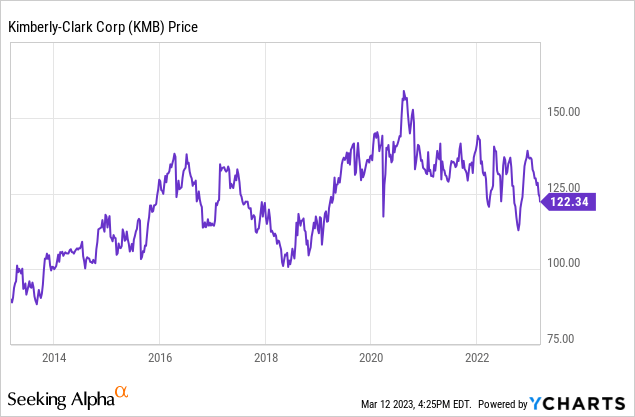

Over the last decade, KMB's share price has trended upward, driven by consistent profits contributing to an attractive dividend yield. The business is notorious for being a robust staple, providing a haven for capital and reliable returns. However, despite this growth in the stock, the company's financial performance has not been exceptional, leading to underperformance compared to the overall market.

Given the current market uncertainty with softening economic conditions, our goal is to evaluate whether KMB is a safe investment option. We will accomplish this by conducting a bottom-up analysis and examining significant trends affecting the industries it operates within.

Sustainability

One of the key trends impacting the company and the consumer goods industry more broadly is the shift towards sustainable and eco-friendly products. In response to this trend, Kimberly-Clark has made significant investments in sustainable technology and practices, such as reducing water usage, energy consumption, and waste.

The following captures some such activities.

KMB activities (Kimberly-Clark)

The need for this transition is driven by consumers becoming more environmentally conscious and demanding more sustainable products, especially when it comes to household and personal care goods. According to McKinsey analyst Sebastian Gatzer, "One out of four consumers say they are planning to focus more on environmental issues and will pay more attention to social aspects in their shopping behavior". Therefore, the move towards sustainable operations is not necessarily an opportunity to capitalize on, but to ensure KMB does not fall behind.

Digital Transformation:

The rise of e-commerce and digital technology is changing the way consumers shop for household and personal care goods. Brands like KMB need to adapt to these changes by investing in e-commerce platforms and digital marketing strategies to reach consumers where they are spending more of their time. KMB is currently utilizing social listening tools and investing heavily in IT infrastructure to help drive engagement, which MIT has found to be successful in driving consumer engagement.

Recession proof?

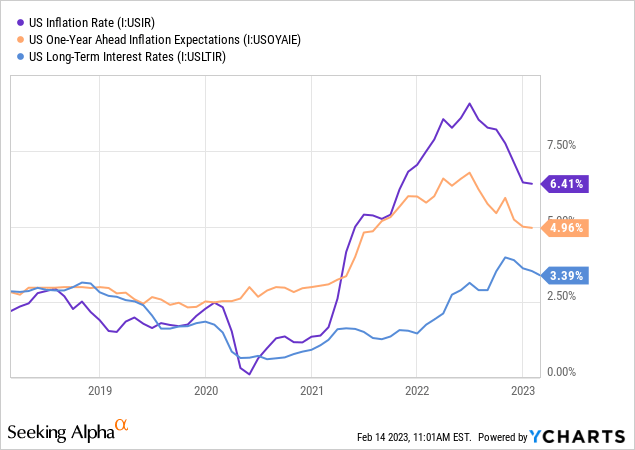

The current economic conditions are marked by a challenging environment for businesses and consumers alike. Heightened inflation rates, which we are projecting to remain so in 2023, have contributed to a decrease in demand for goods, as consumers are facing rising living costs.

In the US, the economic response has come by way of raising interest rates, with the objective being to cool demand. Although this has contributed to the slowing of inflation, consumers and businesses have struggled further as a result. The US' February CPI figures show inflation falling again, but not to the degree required.

One of the key factors driving inflation is supply-side issues, driven by disruptions in the energy market and supply-chain issues. These challenges mean companies are struggling to pass on all cost increases to customers, contributing to margin tightening.

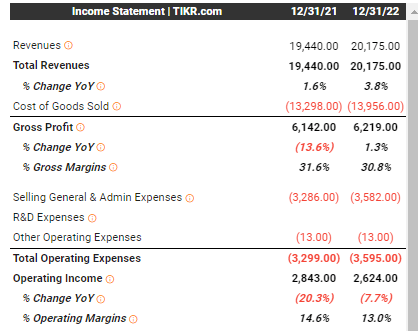

In the case of KMB, the impact of such an environment can be in both directions. It can increase its prices due to the relative inelasticity of the products they sell, people are not going to stop using the toilet or washing their hands. Conversely, with operations around the globe, these businesses are vulnerable to increased costs, especially transportation. So far, the net effect has been positive, as its GPM has only slightly decreased (80 bps), while its revenue has increased by 3.8%.

KMB GPM (Tikr Terminal)

KMB has Once again shown its ability to remain resilient during times of economic weakening. For many, this is the key attribute required for this stock, as it is viewed as a defensive pick.

Competition from Private Label Brands:

Store-brand and generic products are becoming even more popular and posing a threat to KMB's brands. The appeal of these products lies in their ability to provide what is believed to be comparable performance/quality at a lower cost to consumers. Generic providers have been able to achieve this by making sacrifices in areas where KMB cannot. For example, supermarkets may run some essentials as a loss to get consumers in the door.

Recently Tesco, the supermarket in the UK, froze the price of products including Kleenex from Oct22 to Easter 2023. Once this is lifted, the price delta between KMB's products and the store-brand price will jump as KMB is still increasing prices.

Financials:

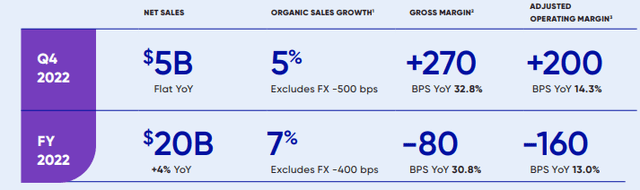

KMB has struggled to achieve consistent revenue growth, driven in part by adverse movements in FX rates. The business generated 52% of its revenue within the US in 2021, which leaves them susceptible to changes in rates. In the case of FY22, organic sales growth was actually 7% but was adversely impacted by a -400bps (rounded) FX movement.

Further, from a zoomed-out view, we can see the impact of the current economic conditions. GPM looks to have contracted from the 34-36% region to 31%. There is a reason to be positive, however, as GPM in Q4'22 was 33%. Management commentary across all segments of the business suggests cost pressures are easing and operational efficiency gains are being made.

Management has also balanced this reduced profitability with a marginal reduction in Capex, contributing to a relatively flat FCF yield. This has allowed the business to comfortably maintain its dividends, something it has grown for several decades. Not only this but shares have been consistently repurchased, declining 12% in 10 years.

One of the indicators of weakening performance for a company producing goods is a slowing inventory turnover and/or increasing CCC. In the case of KMB, inventory turnover has only marginally increased and CCC has improved. Net, we see nothing of concern going into 2023.

KMB's debt balance has net increased in recent years, driven in part by a change in accounting standards, but is not a cause for concern as it remains a healthy ratio of EBITDA.

Forecast:

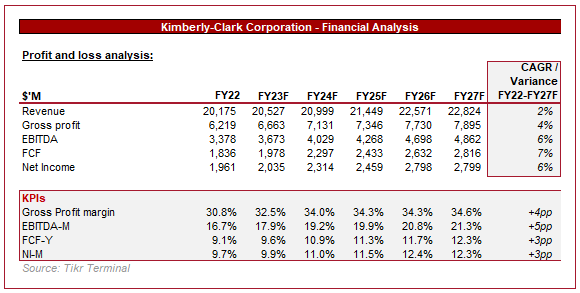

Analyst consensus estimates (Tikr Terminal)

Analysts are forecasting consistent revenue growth and an impressive improvement in margins, resulting in a 7% growth rate in net income. Barring an unusual movement in FX rates, we concur with the growth assessment, however, the net income view looks optimistic.

Despite this, our view is that dividends are sustainable, and Management should be able to achieve another year of growth in 2023.

Peer group analysis:

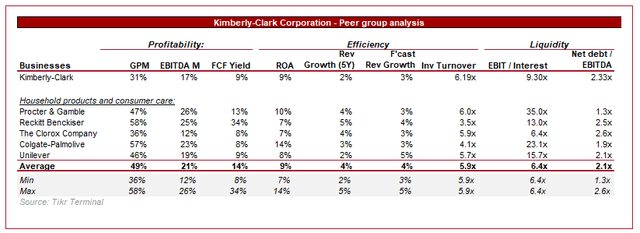

Consumer goods businesses compared (Tikr Terminal)

Present above is a comparison of several consumer goods businesses on key financial metrics.

KMB marginally underperforms the cohort on a profitability basis and is in line with them on an FCF basis when Reckitt B. is excluded. Despite this, our view is that KMB holds up well.

Moving onto growth, KMB once again marginally underperforms, on both a historic and forecast basis. All businesses in the cohort have varying degrees of overseas exposure impacting FX fluctuations, with the rest attributable to improving the strategic position of products.

Valuation

Market valuations (Tikr Terminal)

In order to value KMB, we have considered both its relative valuation to peers and a fundamentals-based approach.

When compared to the cohort, KMB stock is trading at a lower EBITDA multiple and a much larger P/E discount. This said KMB remains significantly above its historical average, having trended up in the last decade. Based on the profitability and growth delta, our view is that a marginal discount is appropriate. We have calculated this as a 15% discount to the cohort's average EBITDA multiple.

To consider a different perspective, we have also conducted a DCF valuation. The key assumption we have made are:

- Revenue growth of 2-3%, in line with analyst forecasts. Management is forecasting organic growth of 2-4%.

- Marginal improvement to FCF conversion, diverging from analysts' forecast of significant improvements.

- Perpetual growth of 2% and a future EBITDA exit multiple of 13x.

Based on this calculation, we derive an upside of 9%, above our relative fair valuation calculation.

With the margin for error in mind, our conclusion on the valuation is that KMB is appropriately valued.

Final thoughts:

Kimberly-Clark is successfully transitioning its brands to reflect current consumer values/trends, including digital expansion and a commitment to sustainability. As a result of the former, the company has experienced growth in organic sales, though much of this progress has been masked by FX movements. Although this is unfortunate, it means the fundamentals of the business remain strong.

Despite the challenging economic landscape, KMB has managed to perform well and we are expecting this to continue in the future. Based on its current valuation, the company appears to be priced appropriately. For those seeking a steady source of income and growing dividends, investing in KMB stock may be a good option, but to enter now for capital appreciation would not yield a substantial amount.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.