PFL: Great Bond Fund Selling At A Small Premium

Summary

- Investors are desperate for income as inflation still remains high and most things continue to have negative real yields.

- PIMCO Income Strategy Fund invests in a portfolio of bonds and applies leverage to provide its investors with a very high level of current income.

- The fund is very well-diversified in many ways and should be insulated against anything but interest-rate risk.

- The 12.13% yield appears to be reasonably safe.

- PIMCO Income Strategy Fund is trading at a small premium, but it might be worth paying.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

arsenisspyros

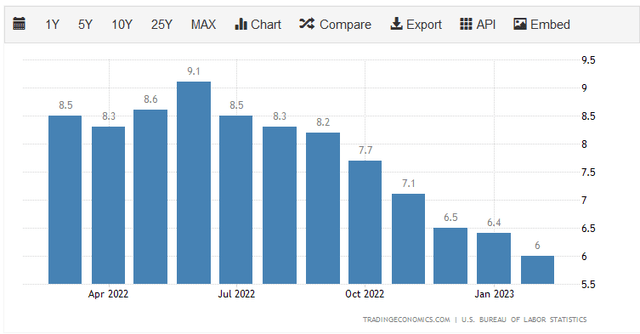

For most of the past eighteen months, the biggest problem facing the average American was the pervasive invasion that swept the economy. As I have mentioned in many previous articles, there has not been a single month over the past year in which the consumer price index did not appreciate by at least 6% year-over-year:

This inflation has had a particularly insidious impact on those of limited means since two of the areas that saw the greatest price increases were food and energy, both of which are necessities. This is one of the reasons why credit card balances are at record levels and have increased every month since early 2021:

In short, the average person is desperate for income, and this is one reason why the job reports keep coming in strong despite some industries conducting massive layoffs. After all, getting a second job is a good way to get the extra income that is needed to survive in the current climate.

Fortunately, as investors, we can put our money to work for us in order to generate the extra income that we need to maintain our purchasing power. One of the best ways to do this is to purchase shares of a closed-end fund, or CEF, that specializes in the generation of income. These funds are not exactly well-covered by the investment media nor are they the most well-known asset type, but they do offer substantial advantages for investors. This is because they provide easy access to a diversified portfolio of assets that can usually generate a higher yield than any of the underlying assets possesses.

In this article, we will discuss the PIMCO Income Strategy Fund (NYSE:PFL), which is one fund that falls into this category. This fund sports a phenomenal 12.13% yield, which is certainly enough to boost the income of any investment portfolio. I have discussed this fund before, but that was several months ago so a lot of things have changed. However, the overall thesis remains the same as this is still a fund that one buys in order to get income. This article will focus specifically on the changes over the past few months, though, as well as provide an updated analysis of the fund's financial condition.

About The Fund

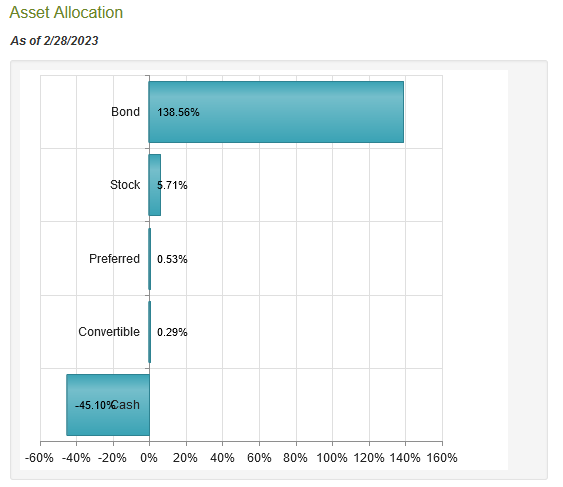

According to the fund's webpage, the PIMCO Income Strategy Fund has the stated objective of providing its investors with a high level of total income. This is not particularly surprising considering that this is a PIMCO fund. PIMCO in general is known for being a fixed-income fund house and most of its funds invest in fixed-income securities. This one is certainly no exception to this as it is invested almost entirely in bonds:

CEF Connect

One of the defining characteristics of bonds is that they deliver most to all of their investment return in the form of direct payments made to investors. Their potential to earn capital gains is quite limited because they have no connection with the growth or prosperity of the issuing company. After all, a company does not pay its creditors more interest simply because its profits go up.

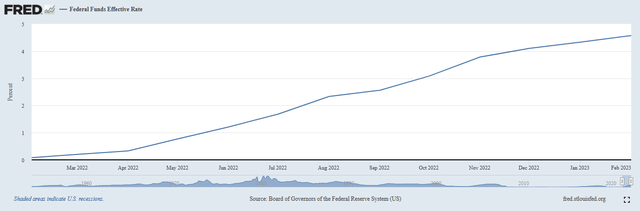

With that said, bonds do change in price based on interest rates. In short, when interest rates increase, bond prices go down, and vice versa. This is something that is very important today since the Federal Reserve has been aggressively raising interest rates and tightening monetary conditions in the United States since March. As shown here, the effective federal funds rate is 4.57% today, up from 0.08% in February of last year:

Federal Reserve Bank of St. Louis

The central bank has shown no signs of stopping this interest rate hiking cycle, particularly given the latest inflation figures. Despite the fact that we have seen three banks collapse in the United States over the past eight days, analysts are still projecting that the Federal Reserve will increase rates by 0.25% at its next meeting. This will likely have the effect of pushing down the value of the assets held by this fund.

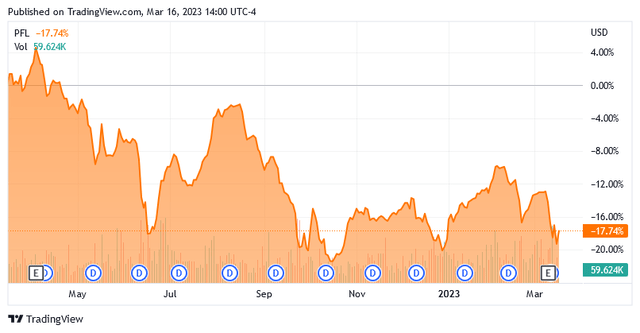

The fund has already seen the value of its assets decline by quite a lot over the past year, and its share price reflects this. Over the past twelve months, the PIMCO Income Strategy Fund has fallen by 17.74% in terms of market price:

This is quite a bit worse than the 8.46% decline of the Bloomberg U.S. Aggregate Bond Index (AGG) over the same period, but when you consider that the PIMCO fund has a higher yield, the total returns of the two funds are much closer (although the index was still a better performer overall). With that said, I would not be surprised if the worst is behind us at this point since the recent bank collapses are essentially forcing the Federal Reserve to choose between the stability of the financial system or fighting inflation and, since the Federal Reserve is owned by the nation's banks, it will almost certainly be forced to pause on the rate hike cycle in the near future.

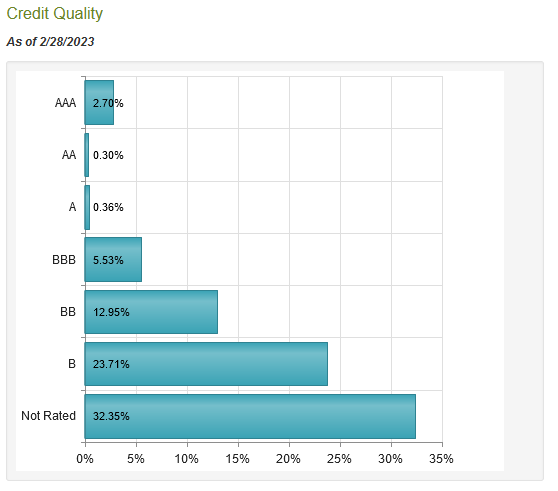

In the last article published on this fund, I noted that the PIMCO Income Strategy Fund is heavily invested in speculative-grade securities. This is still the case, as seen here:

CEF Connect

An investment-grade bond is anything rated BBB or higher. As we can see, that only represents 8.89% of the portfolio. The remainder of the bonds is considered speculative-grade or "junk bonds." That is something that may be concerning to those investors that are interested in conserving principal, which is something that has become even more important than ever over the past week. However, we can see that 36.66% of the portfolio is invested in bonds that are rated BB or B by the major rating agencies. These are the two highest ratings possible for speculative-grade bonds and they should not have outsized default risk, despite what fearmongers may have led you to believe in the past. According to the official bond ratings scale, companies whose bonds are issued with these ratings have sufficient financial capacity to service their existing debt as well as the ability to weather any short-term economic disruptions without defaulting. While these companies will not have as strong a balance sheet as an investment-grade firm, they should be able to handle whatever might happen in the near future, including another financial crisis. Thus, it appears that we should not have to worry too much about most of the bonds in the fund's portfolio.

One way that the fund can reduce its risk of losses in the event of a default is by having a very large number of positions. This is because such a strategy should reduce the percentage of the portfolio that is represented by any individual position. As of the time of writing, the PIMCO Income Strategy Fund has 384 individual positions, which should mean that the proportion of the fund's assets represented by any individual issuer is less than 1%. Thus, the losses that would transpire from any individual company whose bonds are held by the fund should be negligible compared to the entire portfolio. Overall, there should be nothing to worry about in terms of risk here, other than interest rate risk as already discussed.

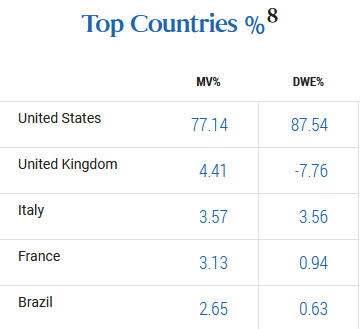

In the previous article on this fund, I noted that one nice thing about it is that the PIMCO Income Strategy Fund is a global fund. This remains the case, and the fund's allocation to the United States has decreased somewhat from the last time that we reviewed it:

PIMCO

The reason why international diversification is nice is because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take some action that has an adverse impact on an asset in which we are invested. In addition to this, different countries have different amounts of debt. For example, the United States currently has a debt-to-GDP ratio of 120.36%, whereas Switzerland has a public debt-to-GDP ratio of just 47.80%. Research has shown that any number over 90% is a drag on a country's economic growth and naturally the more debt the country has relative to its productive capacity, the riskier investment in it can be. Unfortunately, every country on the list above has a public debt-to-GDP ratio of more than 90% (the United States has the lowest ratio). Thus, it would be nice to see some less indebted countries represented here in order to reduce the overall risk.

Leverage

In the introduction to this article, I mentioned that closed-end funds like the PIMCO Income Strategy Fund have the ability to generate a higher yield than any of the underlying assets. This is very important for bond funds since, despite the Federal Reserve's interest rate hikes, real bond yields remain negative. The usual way that the funds boost their yields is through using leverage. Basically, the fund borrows money and uses that borrowed money to purchase bonds or other assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. The PIMCO Income Strategy Fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, so this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage increases both gains and losses. As such, we want to ensure that the fund is not using too much debt because that would expose us to too much risk. I generally do not like to see a fund's leverage over a third for this reason. The PIMCO Income Strategy Fund fulfills this requirement. As of the time of writing, the fund's levered assets comprise 30.84% of the portfolio. Thus, this fund appears to be striking a reasonable balance between risk and reward.

Distribution

As stated earlier in this article, the primary objective of the PIMCO Income Strategy Fund is to provide its investors with a high level of current income. In order to achieve this, the fund purchases bonds, most of which are junk bonds, and then applies a layer of leverage to boost the effective yield. In addition, PIMCO has a reputation for trading bonds more actively than many other fund houses so this can be expected to generate some capital gains that the fund can pay out. Overall, we should be able to expect this fund to boast a very high yield.

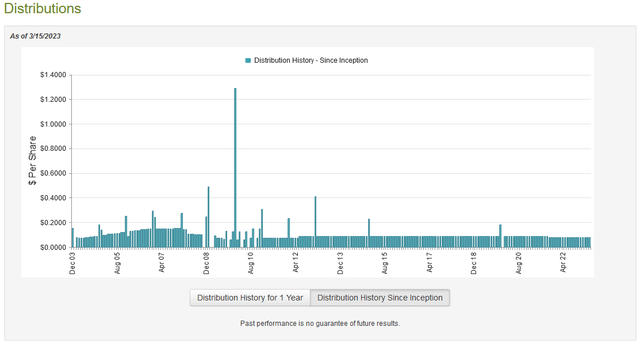

That is certainly the case as the PIMCO Income Strategy Fund pays a monthly distribution of $0.0814 per share ($0.9768 per share annually), which gives the fund a whopping 12.13% yield at the current price. This fund has been more consistent about this distribution than many other bond funds, although it has still varied its payout over the years:

The fact that the fund's payout has varied might be a bit of a turn-off to those investors that are most interested in getting a consistent and sustainable source of income to use to pay their bills or otherwise finance their lifestyles. However, when compared to most other bond funds, this one fulfills its goal of being a reliable income source admirably. As is always the case though, we want to ensure that the fund can actually afford the distribution that it pays out. After all, we do not want to be the victims of a distribution cut since that would certainly reduce our incomes and will probably cause the fund's share price to decline.

Fortunately, we do have a very recent document that we can consult for the purpose of analyzing the fund's finances. The fund's most recent financial report corresponds to the six-month period that ended on December 31, 2022. This is a much more recent report than we had available the last time that we discussed this fund, which is nice because it will give us insight into how the fund performed in the second half of 2022, which was not particularly a good environment for bonds due to the rising interest rates. During the six-month period, the PIMCO Income Strategy Fund received $19.541 million in interest along with $173,000 in dividends from the assets in its portfolio. This gives the fund a total income of $19.714 million during the period. It paid its expenses out of this amount, leaving it with $15.623 million available for the shareholders. This was not enough to cover the $17.766 million that the fund paid out in distributions during the six-month period, but it did get pretty close. However, this may still be concerning at first glance since the fund did not have enough net investment income to cover its expenses.

The fund does have other methods available through which it can obtain the money needed to cover the distribution. For example, it might have had capital gains that it can pay out. As expected from the weakness in the bond market, the fund did generally fail at this. However, it managed to achieve net realized gains of $7.195 million but this was offset by $17.063 million in net unrealized losses. The fund's net investment income plus net realized gains were enough to cover the distributions, though. Overall, the fund's assets declined by $1.370 million during the period after accounting for all inflows and outflows due to the fact that the fund issued new shares during the period. I am not as concerned about the new share offering as I sometimes am though since the fund is not relying on the new money to cover the distribution. All it did was payout net investment income and some of its net realized gains so there probably is not too much of a reason to worry about a distribution cut here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a sub-optimal return on that asset. In the case of a closed-end fund like the PIMCO Income Strategy Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all of the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund's assets for less than they are actually worth. This is, unfortunately, not the case with this fund today but that is typical for a PIMCO fund. As of March 15, 2023 (the most recent date for which data is currently available as of the time of writing), the PIMCO Income Strategy Fund had a net asset value of $7.92 per share but the shares currently trade for $8.18 per share. This gives them a premium of 3.28% to net asset value at the current price. This is quite a bit better than the 6.54% premium that the shares have traded at over the past month, but it is still a premium. Thus, by buying it today, you are overpaying for the fund's actual assets. As the premium is small though, some might be willing to do that in order to get access to quality management.

Conclusion

In conclusion, the PIMCO Income Strategy Fund appears to be a very good way to get the income that we all need to maintain our lifestyles in the face of today's high inflation. The fund has a diversified portfolio of bonds and management has done quite an admirable job of maintaining the portfolio value and returns in a very challenging market. This could prove advantageous going forward as there are no signs that the Federal Reserve will stop its monetary tightening in the near term. The yield is very high but surprisingly appears sustainable, offering a great income opportunity. In fact, the only real concern that I can see here is that the fund's price is a little high. It might be worth paying a small premium for the good things in PIMCO Income Strategy Fund, though.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.