VPL: Asia Pacific Equities A Value Despite A Bearish Near-Term Chart Feature

Summary

- The Far East region tends to perform well following the Fed's final rate cut, data shows.

- I am bullish on VPL based on its low valuation, but a near-term technical pattern makes me cautious.

- Thus, a 'buy the dip' strategy may work best right now, but buyers should stand ready to pull the trigger given high volatility.

whitemay/E+ via Getty Images

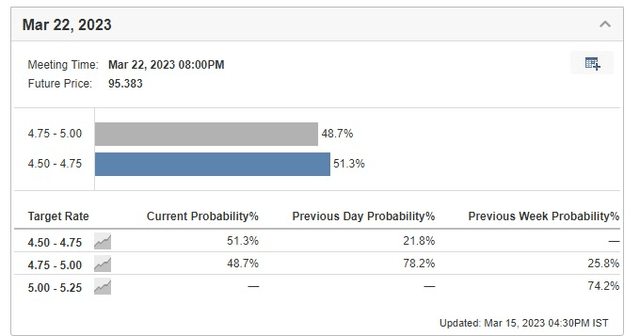

The Fed’s final rate hike has likely moved a whole lot closer. In fact, I believe the FOMC could already be done with its rate-increase cycle. The probability of no change in the Effective Federal Funds target rate is now 51% according to the CME Group. It was just a week ago when the terminal rate was seen in September above 5.5%. Global financial market turmoil quickly changed the landscape.

Is the Final Rate Hike Already In?

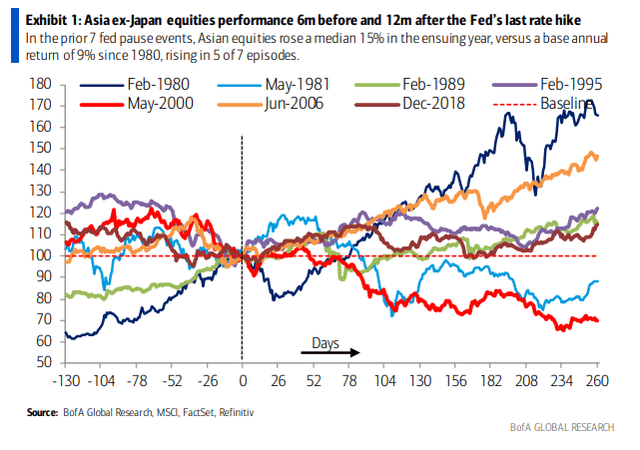

But according to BofA, Asia equities tend to perform well in the 6 months after the final rate hike and in the year following. The Vanguard FTSE Pacific ETF (NYSEARCA:VPL) tracks the entire region, and I see the fund as being an ideal spot to broaden exposure to stocks at a low cost.

Asia (ex-Japan) Tends to Rally Hard Post-Final Fed Hike

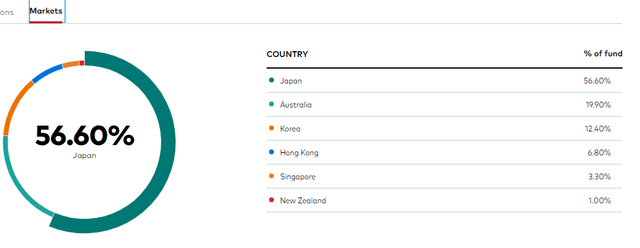

According to the issuer, the Vanguard FTSE Pacific ETF tracks the performance of the FTSE Developed Asia Pacific All Cap Index, which measures the investment return of stocks issued by companies located in the major markets of the Pacific region. The fund holds stocks of companies located in Japan (the major index component), Australia, Hong Kong, New Zealand, and Singapore and employs a passively managed, full-replication approach.

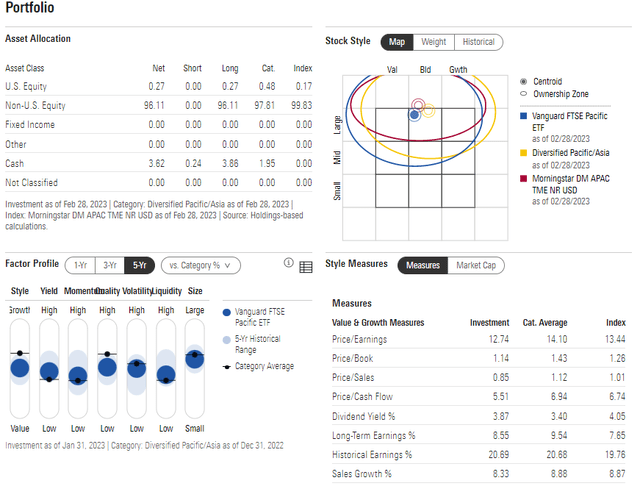

With an annual expense ratio of just 0.08% and a 30-day median bid/ask spread of a single basis point, VPL has strong tradeability. Volume is also respectable above 700,000 shares as of March 14 on a 25-day average basis. VPL is a diversified index fund as it holds nearly 2500 equities with a median market cap of $20 billion, so it is also a much smaller-size fund compared to the S&P 500. On valuation, the price-to-earnings ratio is low near 12 with high-single-digits long-term earnings growth, according to Morningstar.

Digging into the portfolio, VPL plots as a large-cap blend fund, but is very close to the value side of the style box. Other factor measures are simply middle-of-the-road with the ETF, but I view the 2.7% trailing 12-month dividend yield as being rather decent.

VPL: Portfolio & Factor Profiles

VPL holds primarily Japanese companies, but there’s diversification across the Far East with exposure to Australia, Korea, and Hong Kong among other areas. It also has sector diversification with 18% of VPL invested in Financials and Industrials, respectively. Tech comprises just 14% of the ETF, much lower compared to the growth-oriented sector’s position in the S&P 500. VPL is thus more of a value play in my eyes and stands to benefit from higher long-term interest rates going forward.

VPL Country Exposure

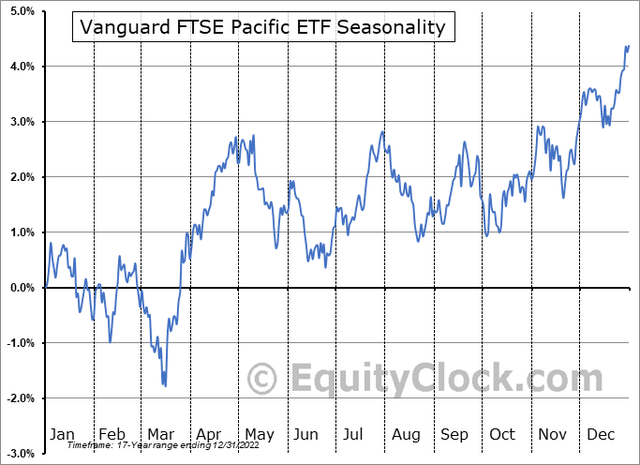

Seasonally, mid-March has historically been a bullish time to buy VPL. Notice in the seasonal chart below from Equity Clock that the fund, on average, bottoms right now and rallies hard through April before trading sideways until late in the typical year.

VPL: Seasonal Tailwinds Blowing Starting Today

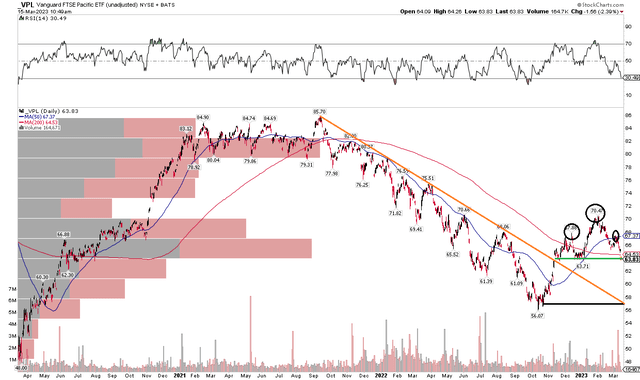

The Technical Take

With an attractive valuation and good diversification marks, the technical picture looks more uncertain at the moment. Notice in the chart below that shares are threatening to put in a bearish head and shoulder top over the last handful of months. The price target should the $63 to $64 range break would be near $57 – just above the October 2022 low. What’s more, the fund has broken its falling 200-day moving average after breaking out from its 2021 to Q4 2022 downtrend, and that line comes back into play at $57, too. So, I am inclined to buy the dip in the upper $50s on VPL rather than buying today.

VPL: Bearish Short-Term Head & Shoulder Pattern In Play

The Bottom Line

Putting it all together, I am a buy on VPL but would choose to take a cautious ‘buy the dip’ approach using the technical strategy outlined. With a low valuation and cheap cost, VPL is a strong long-term holding for investors in my view.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.