Ryan Specialty Holdings: Strong Financials But Wait For The Right Opportunity

Summary

- Ryan Specialty Holdings posted solid FY22 and Q4 FY22 results.

- The management has provided optimistic revenue guidance for FY23.

- RYAN stock is showing bearish signs and can fall up to $32.

- I assign a hold rating on RYAN.

VioletaStoimenova

For insurance brokers and carriers, Ryan Specialty Holdings (NYSE:RYAN) provides specialty products and solutions. They serve as managing underwriters and wholesale brokers, offering services in distribution, product development, and risk management. They serve the industrial and government sectors. They recently announced their FY22 and Q4 FY22 results. Their revenue and net income rose significantly in FY22. In this report, I will analyze its financial performance and give my thoughts on its future growth potential. They are fundamentally strong, but I believe we might see a correction in the stock price soon. So I assign a hold rating on RYAN.

Financial Analysis

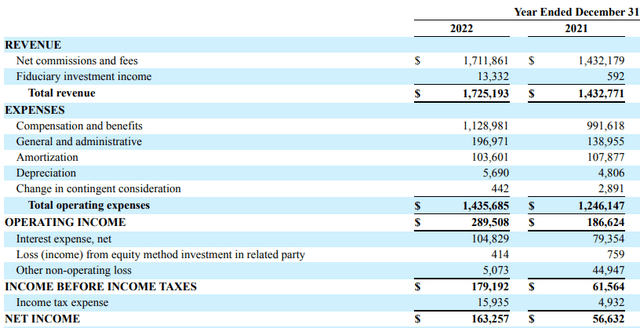

RYAN recently announced its Q4 FY22 and FY22 results. The total revenue for FY22 was $1.7 billion, a rise of 20.4% compared to FY21. The purchase of Keystone and Crouse in 2021 and new product lines, both of which exceeded their growth goals in FY22, are what I think are primarily responsible for the increase. I also think a strong organic growth rate of 16.4% helped them to post record revenue of $1.7 billion. The net income for FY22 was $163.2 million, a rise of 188.2% compared to FY21. I think that lower IPO-related costs and higher fiduciary investment income were the primary drivers of the increase.

The total revenue for Q4 FY22 was $435 million, a rise of 15% compared to Q4 FY21. I think the growth was primarily caused by new client wins and continued E&S industry expansion. The organic growth in Q4 FY22 was 10.3%. The net income for Q4 FY22 was $45.7 million, a rise of 54.5% compared to Q4 FY21. I believe high revenue growth and increased income from fiduciary investment were responsible for the rise in net income. The financial performance of RYAN in FY22 was quite impressive. Despite several macroeconomic headwinds and weaker markets, their revenue and net income grew significantly in FY22.

Technical Analysis

RYAN is trading at the level of $36.6. The price has corrected more than 15% since reaching $44 in January 2023. RYAN stock is displaying bearish indicators, and I don't think there is currently a good time to purchase. The stock should be purchased once it hits $32 because that is the next significant support level. The stock has repeatedly touched $32 levels, and each time it did, the stock rose more than 25%. This is why I am stating it.

Should One Invest In RYAN?

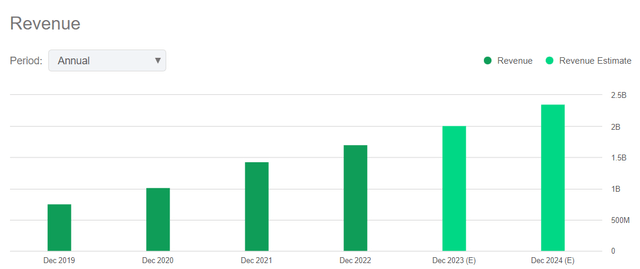

The revenue estimate for FY23 is around $2 billion, which is 17% higher than FY22 revenue. Since the past few years, their revenues have increased considerably, and I am confident they will meet their revenue goal. There are several justifications for my statement. Recent acquisitions include griffin financing services. This acquisition will enable them to broaden their geographic reach and enhance their products in the Pacific Northwest. Additionally, the management anticipates that its E&S market will keep expanding. 97% of their producers were kept on, demonstrating the management's effectiveness.

Now talking about the valuation. I will use two valuation metrics to judge its valuation. The first is the P/E ratio which is calculated by dividing the share price of a company by the annual EPS of a company. They have a P/E [FWD] ratio of 27x compared to the sector ratio of 8.26x. It shows that they are overvalued. The second ratio is the PEG ratio. The PEG ratio is a valuation measure used to assess the relative trade-off between the cost of a stock, its earnings per share, and its prospects for expansion. They have a PEG [FWD] ratio of 2x compared to the sector ratio of 1x. After looking at both ratios, I believe they are currently overvalued.

Despite reporting strong financial results, I won't advise purchasing the company at the moment. They are presently overvalued and overpriced, in my opinion. However, in my opinion, the stock can be purchased when it hits $32 because there is a strong support zone, and it is most likely that it will reach $32 in the near future as the stock is showing bearish signs.

Risk

Their operational success is reliant on the ability of insurance carriers to continue to properly and sufficiently underwrite risk and provide coverage, which in turn is reliant on the ability of those insurance companies to obtain reinsurance. Additionally, a failure of the insurance industry or halting the writing of some of the insurance policies they provide to their customers. These things are beyond their power. They might not be able to secure the types or amounts of coverage that their clients want, and the coverage they are able to secure for their clients might be more expensive or less comprehensive than is acceptable, to the extent that reinsurance becomes less widely available or noticeably more expensive.

Bottom Line

In FY22, both their sales and net income increased significantly, and their growth trajectory appears to be strong. They have a variety of products and are growing their business operations. The management has also provided an upbeat revenue estimate for FY23. The only issue is that they are now overpriced, therefore in my opinion, it is not a good idea to purchase them at the current price. The stock is displaying negative characteristics, and I believe it could approach $32 in the near future. As there is a solid support zone at $32, one can add the stock at that price. As a result, after considering all the factors, I rate RYAN stock as a hold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.