VOX Vs. VGT: Opportunities From ChatGPT-Style AI And A Possible TikTok Ban

Summary

- OpenAI's ChatGPT with its chatbot and ability to generate text through chatting is termed as Generative AI, different from the other flavors of artificial intelligence.

- There are opportunities in the Generative AI market for both VOX and VGT, plus the increased possibility of a TikTok ban favors Vanguard's telecom ETF more as it provides exposure to Alphabet, Snap, and Meta.

- However, amid all the frenzy created by new product launches, it is important to be cautious and highlight what can go wrong.

- Also, in an economic context characterized by a high degree of uncertainty, the benefits which Generative AI can bring to a company must be highlighted.

- Both ETFs are buys, with tech also likely to benefit from a looser monetary policy, but, be cautioned that volatility will reign in case the Fed fails to appease the stock market.

stockcam/iStock Unreleased via Getty Images

In the wake of the Silicon Valley Bank Financial (SIVB) crisis, some may think that it is not the right time to talk about ChatGPT's conversational type of AI, but it is indeed important amid higher recessionary risk and where cost-cutting is important. The technology may also increase Microsoft's (MSFT) Bing's chances to win the Internet search engine war against Alphabet's (GOOG) (GOOGL) Google. However, it also has its own flavor of Generative AI and there are others that should also benefit from a higher degree of machine-based intelligence in business operations.

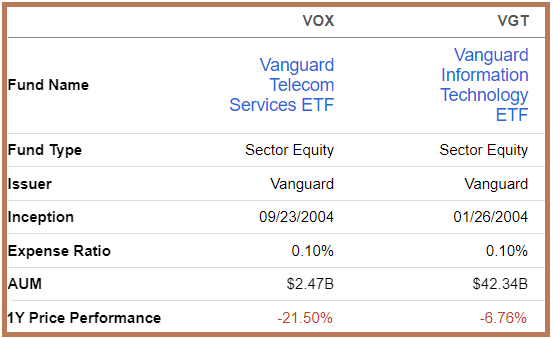

By adopting a comparative approach, the aim of this thesis is to show that Vanguard Telecom Services ETF (NYSEARCA:VOX) is better positioned than the Vanguard Information Technology ETF (NYSEARCA:VGT) to take advantage of these opportunities. This means that the underperformance of the telecom ETF with respect to its IT counterpart is not justified as per the comparison of the key metrics below.

Comparison VOX and VGT (seekingalpha.com)

I start by providing insights about the evolution of AI to become more generative and also the reasons why ChatGPT is gaining more adoption, plus how a TikTok ban should be particularly helpful to VOX.

Migrating to Generative AI

First, unlike previous generations of AI which focused more on the analysis of data (analytics AI) or providing recommendations based on user profiling (Recommendation AI), Generative AI allows machines to generate content from existing data. In this respect, the latest models using OpenAI's DALL-E can generate very realistic images. Moreover, despite the answers not being completely accurate, and pictures lacking integrity, the technology is being adopted by many, including employees at the University of California San Diego to write job descriptions or codes for software applications.

Now, in order to surf the wave of Generative AI, Microsoft has integrated ChatGPT features into its Bing search engine, but for the full functionality, users have to use the Microsoft Browser Edge which comes with Windows. Noteworthily, more than just a search box, it is an artificial intelligence chatbot as pictured below.

Bing with the Chat feature (blogs.microsoft.com)

In response, feeling that its leadership positions in the search engine and browser war are at stake, Alphabet retaliated by launching its own AI-powered chatbot called Google Bard. The aim is to augment Google's search tools capabilities as well as enable clients to perform automated support and other human-like interaction tasks. Now, Google already commands the top spot with 93% of the market share compared to only 2.8% for Bing which implies that it will take a lot of effort for Microsoft to gain market share.

Next, as for Alphabet's video streaming service YouTube, Generative AI will soon be available to content creators, as well as Google Workspace which is a productivity and collaboration tool that also harnesses the power of Generative AI to create, connect, and collaborate more optimally. There are also opportunities for marketers in the advertising world where Alphabet has generated revenues of $224.47 billion in 2022.

In addition to Alphabet, there are two other companies including Meta Labs (META) and Snap (SNAP) which are launching ChatGPT-like tools for content creators and advertisers.

Valuing the Opportunities for VOX and VGT

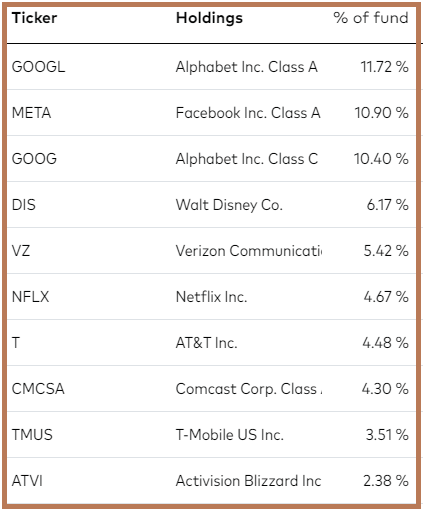

Now, for investors looking to invest in these three companies using the ETF route instead of individually, there is VOX, with its holdings pictured below.

VOX Portfolio Composition (investor.vanguard.com)

Now, Meta launched Advantage+ back in August last year where shopping campaigns use AI to circumvent the manual steps of ad creation as well as automate the process of combining up to 150 creations. Introduced at a time of high inflation and economic uncertainty, the objective is to help marketers to optimize their ad spend.

In this way, with Meta AI-driven advertising tools, for every $1 spent on performing a website ad campaign, clients were generating $7 in revenues. This has helped them to offset the amount lost by Apple (AAPL) changing its privacy policies as I will elaborate upon in the next section.

As for Snapchat, it has introduced AI integration, called My AI, and its own chat box within its own subscription service called Snapchat +. The idea here is to speak to AI every day in addition to friends or relatives. While some may be skeptical about whether it will work, there are reasons to be optimistic given that ChatGPT garnered 100 million monthly active users only two months after launch.

Looking specifically at the global Generative AI market, it is anticipated to reach $109.37 billion by 2030, after expanding at a CAGR of 34.6% from 2022 to 2030. Now, in order to translate this growth into VOX's value, Alphabet, Meta, and Snap together constitute a third (33.68%) of its overall assets. Thus, assuming that the ETF grows by roughly 11% (or a third of 34.6%) in 2023, I have a target of $99.72 (89.84 x 1.11), based on the current share price of $89.84.

On top of this, the probability of TikTok facing a ban in the U.S. where it competes with Snap, Meta, and YouTube has gone up as lawmakers focus on the security threat the video-sharing app poses. For investors, TikTok is owned by China-based ByteDance Ltd and its closure potentially means billions of dollars of additional advertising revenues for the three U.S. companies it competes with.

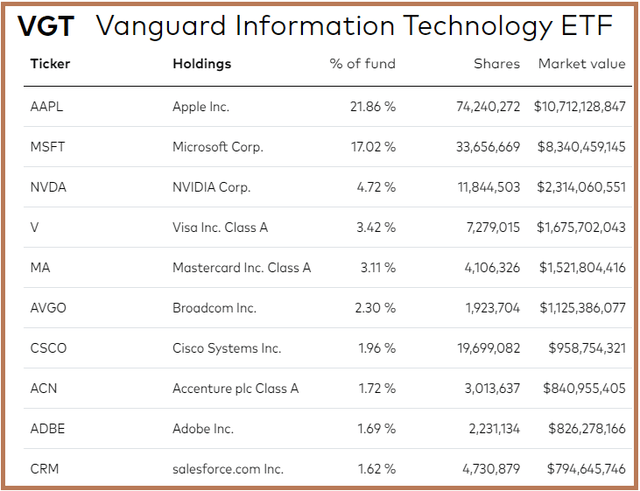

Now, for valuing VGT, in addition to Microsoft, NVIDIA (NVDA) forms part of the ETF as pictured below. This semiconductor company's share price has risen by nearly 13% during the last year while the wider tech sector tracking Invesco QQQ Trust (QQQ) has fallen by 6.5%. Part of the reason could be due to its A100 Tensor Core GPUs being used to train ChatGPT's algorithms.

VGT's top holdings (investor.vanguard.com)

Now, Microsoft and NVIDIA together constitute around one-fifth (21.74%) of VGT's assets. Considering that the $109.37 billion Generative AI market is growing at 34.6% CAGR, one-fifth of this figure comes to around 7%, which is the rate of growth I assume for VGT in 2023. Hence, by adjusting the share price of $357.46 by 7%, I obtain a target of $382.48.

To justify this optimism in a highly uncertain economic environment, there is the ability of Generative AI to reduce advertising costs, namely by automating specific tasks like content creation, rather than hiring additional staff for the purpose. This means fewer staff costs, which is appealing during this period of high wage inflation. For this matter, according to a survey by KPMG, 60% of respondents reported that AI was yielding significant cost savings.

Adopting a Dose of Realism

Now, after raising investors' expectations, there is a need for inducing some caution. In this respect, in contrast to Recommendation or Analytics AI, Generative AI is still in a development phase, a fact which Alphabet appeared to have forgotten when they hastily launched its Google AI Chatbot Bard on February 6. This was not successful as it provided users with some inaccurate answers, all resulting in investors punishing the company's stock with a correction of over $100 billion.

This may be the reason why Snap seemed to have apologized in advance in case its ChatGPT-powered chatbot is subject to deficiencies.

Therefore, there is still a long way to go before Generative AI starts to form part of our daily routines in the same way as Google's search box. There are also factors like copyright to look into.

Looking further, there are others at the device access level that may throttle innovation, like Apple blocking the AI-enhanced update of the email app BlueMail on the grounds that the content is inappropriate for those under-17. Here, some will note that as the administrator of the IOS system that powers iPhones and iMACs devices throughout the world, Apple's privacy policy affected the advertising businesses of Meta and Snap throughout 2021.

As for NVDIA, there is also the cost factor to consider, as one has to be realistic about the opportunities. In this case, according to TechTarget, it takes at least 10K Nvidia GPUs for a private corporate AI project, for those companies not wishing to make all their information available in the public domain. Investigating further, with one Nvidia tensor GPU costing around $10K, a single implementation could carry a total price tag of $100 million, which is insanely expensive for a technology still in development.

Therefore, as exemplified by Microsoft's $10 billion investment into OpenAI, the owner of ChatGPT, there is the cost factor to consider, which should impact profitability for both ETFs' holdings in case AI-related revenues take time to materialize.

Concluding with Caution

Therefore, investing in innovation is not without risks, especially in case corporations completely freeze their IT budgets during a recession, signifying that a long-term investment perspective has to be envisaged. In this respect, this thesis has highlighted how it is VOX that should benefit more than VGT due to some of its holdings that have rapidly reengineered their services to become more innovative and provide better cost structures for customers. Also, with VOX, investors have access to shares of Meta, Snap, and Alphabet which compete with TikTok.

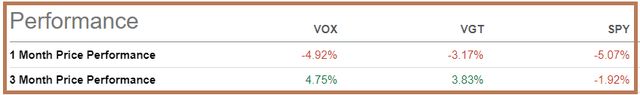

Thus, going ahead, investors are more likely to reward the telecom fund as has been the case during the last three months (table below), a period that coincided with the popularization of ChatGPT.

Comparison of key metrics (seekingalpha.com)

However, investors will note that during the current period of economic uncertainty, the stock market tends to favor mega caps that have delivered consistently, and two of these are VGT's top two holdings, Apple and Microsoft. This is unlike VOX's Meta which suffered from a 24.6% downside when its CEO failed to convince investors about the viability of its metaverse strategy in the second half of 2022. I think this is the reason why VGT has fared relatively well during the last month as pictured above.

For comparison purposes, I have also included the SPDR S&P 500 ETF (SPY) which includes 10.73% of financials as part of overall assets, to show that during the current turmoil, tech stocks seem to be relatively spared as they should benefit from a more dovish tone in the wake of the demise of SVB as I explained in a recent thesis. Finally, VOX and VGT consist of 115 and 367 publicly listed companies, not tech startups, but, investors are reminded that cracks have started to appear in the liquidity front, and in case the Fed is not able to appease the market next week, volatility should reign.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.