Synchrony Financial Preferred Shares On Sale At 10% Yield

Summary

- Synchrony Financial earnings will be lower in 2023 as loan charge-offs return to historical levels.

- Deposits, mostly from retail customers, make up 80% of the asset base. They are nearly completely FDIC-insured and earn a high interest rate.

- The preferred shares are a small part of the capitalization and dividends look covered even in a more stressed scenario than company guidance.

- The preferred shares have gotten more beat up than the common shares, which makes no sense for a higher tranche in the capital structure.

- At a yield of nearly 10%, the preferreds are a Strong Buy.

J. Michael Jones

Priced For Bank Run Despite Sticky Deposits

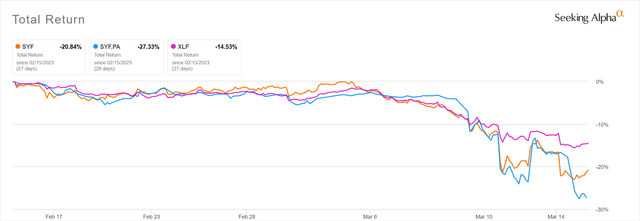

Synchrony Financial (SYF) (NYSE:SYF.PA) has been beaten up in the current bank panic with common shares down 20.8% in the past month, worse than the Financial Select Sector SPDR (XLF). Most of the decline has been since March 10 when Silicon Valley Bank (SIVB) was shut down. The preferred shares have declined even more, down 27.3%.

The greater decline makes no economic sense as the preferreds are higher in the capital structure. At one point on March 15, the preferreds yielded over 10%. With risk-free rates down over 1% in the last few days, the spread has increased even more than the yield. This indicates that the market is pricing in increased risk for this security. Even if the risk has increased, the preferreds should not be marked down more than the common stock.

Synchrony is a consumer-focused bank that offers credit card and installment loans with its retailer and service provider partners. The company also offers its own Synchrony branded general-use Mastercard (MA). These loans are about 80% financed through customer deposits with the remainder split between securitized borrowings and unsecured notes (bonds).

Synchrony's deposits are largely from retail customers with less than $250,000 per account and thus FDIC-insured. Unlike many large banks and even regional banks, Synchrony already pays a strongly-competitive interest rate on deposits, for example 2.25% on a money market account, 4% on high-yield savings, and 5% on a 14-month CD. The insured status and interest rate are strong incentives for customers to keep their deposits with the bank, unlike what we saw with SVB.

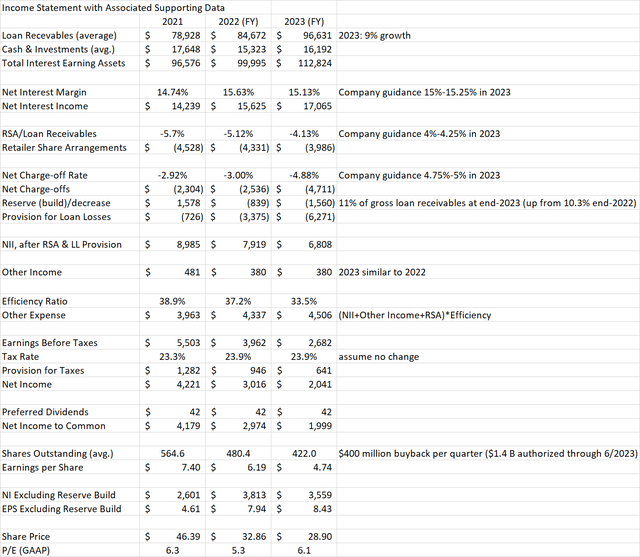

Synchrony is expecting lower earnings this year as credit card charge-offs normalize back to their historical (pre-2020) levels. Nevertheless, the common stock is still cheap at 6.1 times 2023 earnings based on company guidance. Risk of missing this forecast may be increasing due to the macro environment, so I can understand passing on the common stock at this time even though I continue to own it. The preferreds, however, are a massive bargain at around $14, yielding 10%. Preferreds are a small part of the capitalization at $734 million compared to $12.1 billion common equity. Preferred dividends amount to $42 million per year, which is only 1.4% of 2022 actual net income or 2.4% of my estimated 2023 net income. As I will show below in my financial model, the preferred dividends are covered even in a more stressed scenario than the company guidance. This makes the preferreds a Strong Buy at these panic-induced price levels.

Financial Model And Sensitivity

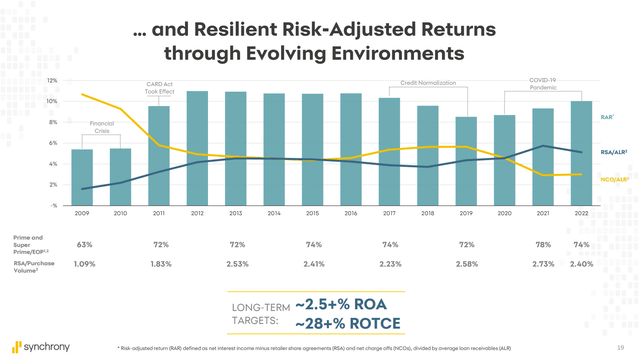

The biggest driver of the expected earnings decline in 2023 is a return of loan charge-offs back to pre-2020 levels. Charge-offs have been low in recent years as consumers received government stimulus payments and paid their credit card bills on time. As this effect fades, Synchrony expects charge-offs to return to the 4%-6% range they were in from 2011-2019. Charge-offs were higher in the 2009 Financial Crisis, but consumer balance sheets and Synchrony's loan underwriting standards have improved since then. Additionally, Retailer Share Arrangements, or incentives paid to retail partners, serve as a partial hedge against charge-offs as they decline when charge-offs increase.

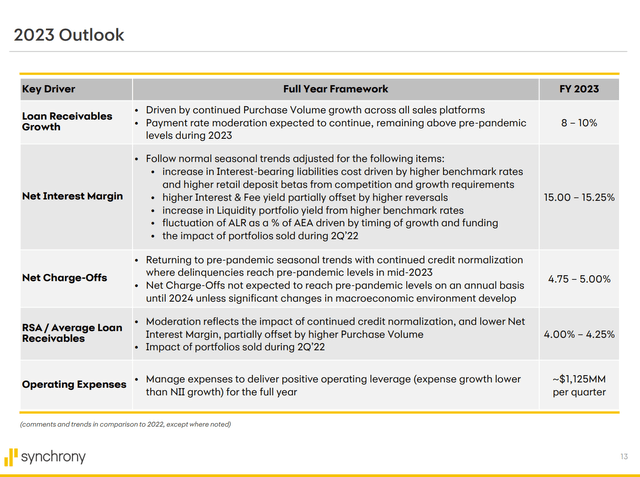

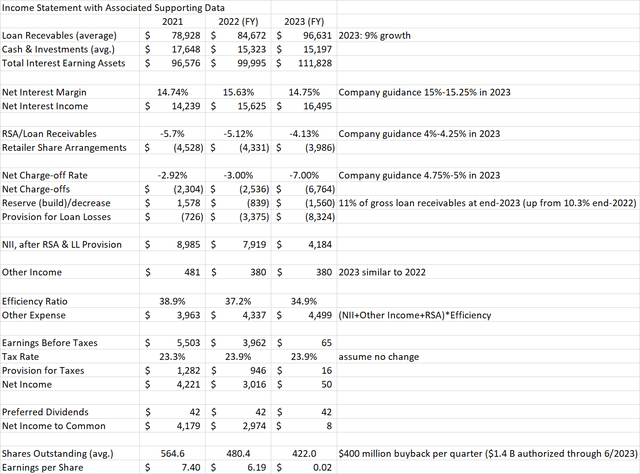

On the 4Q 2022 earnings call, Synchrony issued guidance for 2023. The company forecasted better loan growth, net interest margin, and RSA costs than I assumed in my October 2022 article. However, the charge-off rate was higher. The loss reserve build will also be higher due to the higher forecasted loan balance.

Feeding these assumptions into my earnings model, I estimate EPS of $4.74 in 2023. This is a decline of 23.4% from 2022 but still represents a cheap P/E of 6.1 based on the latest closing price of $28.90.

While the common stock is still a good long-term value, macro conditions in 2023 could add downside risks compared to the company guidance. In that case, it is worth looking at a scenario where EPS goes to zero, but the preferred dividend is still covered.

In the "stress" case, I lower net interest margin to 14.75%, similar to 2021 levels. I also increased the charge-off ratio to 7%. This is still less than during the 2009 financial crisis, but over 1% higher than any year since 2010. In this case, EPS drops to near zero, but the preferred dividend is still covered.

More Details On The Preferred Shares

Synchrony first issued the Series A Preferreds (the only series outstanding) in November 2019 with a coupon rate of 5.625% based on par value of $25. The dividend is non-cumulative. The shares are callable at par in November 2024. They are rated BB- by S&P and not rated by Moody's.

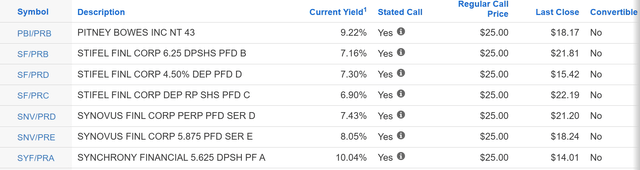

Of the 8 preferred issues listed in my broker's screener with an S&P rating of exactly BB-, SYF.PA is easily the highest-yielding.

While I don't expect a call in November 2024, if these shares eventually do get called, they would produce a capital gain of 78% from the $14.01 level, in addition to the 10% yield on cost paid until then. The shares can be called on any dividend payment date starting 11/15/24.

Conclusion

The current bank stock panic started by the failure of Silicon Valley Bank has impacted stocks across the Financial sector. Synchrony is a very different company compared to SVB. Synchrony's loan portfolio has more risk of non-performance if consumers get impacted by recession. These loans would also be much more difficult to unload at book value if it was hypothetically forced to by a declining deposit situation. However, the good news is that Synchrony's deposits are held in small accounts by consumers, overwhelmingly insured by the FDIC, and already pay attractive interest rates. This makes them much less susceptible to a run like SVB experienced last week.

Preferred stocks in general tend to suffer steep declines during panic selling, followed by equally steep rebounds once the panic subsides. I believe that is the situation currently present for Synchrony preferred shares. The 10% yield may not last long for those who want to take advantage. I increased my position in SYF.PA by 70% at $14.01 on March 15. I consider these shares a Strong Buy at these levels and a Buy anywhere below the pre-crash levels around $18-$19.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SYF.PA, SYF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Also long SYNCHRONY FINL 3.95% NOTES DUE 12/01/27 (CUSIP: 87165BAM5), Synchrony 14-month CD, and Synchrony High Yield Savings account.