Mobileye Global: Demand For Driver Assistance Systems Will Return

Summary

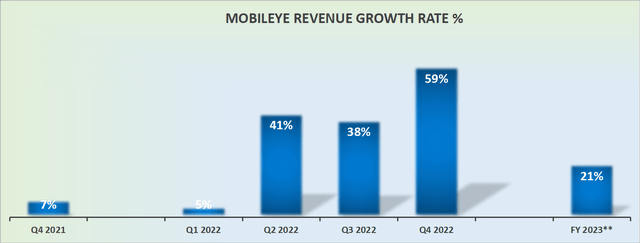

- Mobileye Global Inc.'s guidance points to a substantial slowdown from the exit rates out of Q4 2022.

- The crown jewel of this investment thesis is that the business reports significant cash flows and now has a clean balance sheet.

- Mobileye Global is reasonably priced at 80x forward free cash flow, with a potential to see its free cash flows meaningfully increasing as it exits 2023.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Kinwun/iStock via Getty Images

Investment Thesis

Mobileye Global Inc. (NASDAQ:MBLY) is an autonomous driving solutions company. It is the pioneer behind the widely adopted advanced driver assistance systems (''ADAS'').

Previously, I said:

In actuality, the fact of the matter is that the guidance for fiscal 2023, in the best case, now appears to conceivably be at, or even a nudge lower than, the low end of my previous assumption of 25% CAGR.

Simply put, it appears that MBLY's growth is decelerating, meaning that its guidance isn't fully aligned with the underlying narrative of high demand for autonomous vehicles.

The one aspect that I believe the bulls are right about is that the business has the potential to be strongly free cash flow yielding.

Hence, I now find myself more bullish on Mobileye Global Inc. prospects than I was previously.

Revenue Growth Rates Decelerate

MBLY revenue growth rates, S-1 filing

MBLY's guidance points to the year ahead growing its revenues by 21% y/y, at the high end of its target. That's a dramatic deceleration from the exit rates in Q4 2022.

This assertion rapidly materializes two problems for the bull case.

Firstly, the deceleration in MBLY's revenue growth rates can be succinctly echoed by the graphic below.

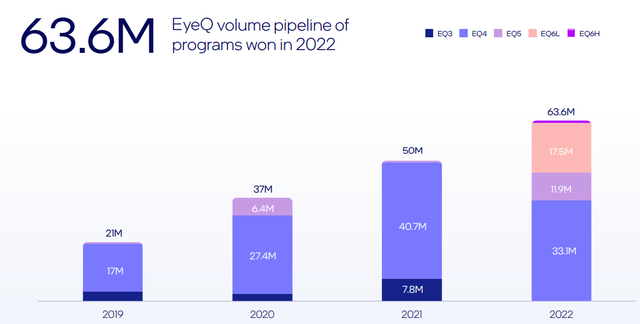

While the economy was strong, there was a massive demand for ADAS technology, and MBLY saw significant pricing power too. This led MBLY's CEO Amnon Shashua to state:

Our advanced products carry a much higher price per vehicle than our historical products, and we saw a clear evidence of that in 2022, where one-third of our revenue growth came from higher ASPs [pricing power].

In other words, in a favorable economic environment, there was significant pricing power. But now that the economic outlook has become restrictive, that will suppress MBLY's pricing power.

In other words, there's a gap between where the narrative is headed and where the facts on the ground are found. Essentially, the pace of adoption of ADAS solutions isn't as likely to be as strong as in 2022.

Or perhaps, a more accurate explanation is that ADAS adoption will continue to tick higher in 2023. But with demand so high, today there's just too much competition. Technological advances can only leap so much and so far in a short period of time.

Allow me to provide an example: the difference between the latest iPhone (AAPL) and its next upgrade has substantially diminished with time.

This is not to say each iterative EyeQ model won't have substantial price power over prior models. That's not what I'm arguing for. Every new model will have some price power, but less overall pricing power will be expected in 2023 versus 2022.

In support of this contention, this is what MBLY said on the Q4 earnings call:

On both the EyeQ and SuperVision businesses, volume and revenue are expected to be lower in Q1 2023 versus Q4 2022. This appears to be general conservatism on the part of our customers, as well as some impact from elevated purchases ahead of the EyeQ price increase that went into effect on January 1.

However, that's not where this story ends.

The Crown Jewel of the Bull Case

The reason why I'm bullish on MBLY is that the business makes a significant amount of free cash flow. Case in point, 2022 saw MBLY report $440 million of free cash flow on the back of $685 million of adjusted operating income.

This means that there is some lag between its adjusted operating income and free cash flow levels. Nonetheless, we can easily surmise that MBLY is substantially free cash flow producing.

Therefore, this naturally begs the question of how much free cash flow could MBLY make in 2023? Given its guidance for 2023 of approximately $600 million, I suspect this could translate into at least $400 million of free cash flow in 2023. Putting the stock priced at 80x forward free cash flows.

The Bottom Line

This is the one-line summary. Mobileye Global Inc. is attractively priced and highly profitable.

The nuanced thesis highlights that paying 80x forward free cash flows isn't cheap in any circumstance. But if we believe that with time, demand for more autonomous solutions could increase, this could lead to a strengthening in pricing power, which could easily drive Mobileye Global Inc.'s free cash flows to get to $600 million or even $650 million in free cash flows, thereby matching its guided adjusted operating income for 2023 with its free cash flows.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.