Silicon Valley Bank's Failures Highlight SoFi's Exemplary Execution

Summary

- The main factors that led to Silicon Valley Bank's failure were diminishing deposits, deposit concentration, duration risk of assets, and poor risk management.

- SoFi, by contrast, sees strength in each of these individual areas.

- SVB's failures and oversights only serve to highlight how exemplary SoFi's execution has been.

JLGutierrez

The banking sector has seen more fireworks in the last week than it has since the Great Financial Crisis. People everywhere have had a crash course in fractional reserve banking, we had a good ol' fashioned bank run, and not one but two of the top 30 US banks by assets were completely wiped out over a single weekend.

SoFi (NASDAQ:SOFI) has fallen in sympathy with these failed banks. However, look under the hood and you'll realize that the failures at Silicon Valley Bank (SIVB) only serve to highlight how well run SoFi is relative to its peers in both the traditional banking sector and the fintech space. SVB failed due to a number of factors, but the main ones were a weakening deposit base, poor capital allocation into assets that got blown up with rate hikes, bad risk management, and an executive team that sat on its hands while the macroenvironment deteriorated around them until it was far too late. We'll cover these one at a time, but let's start by taking a look at the only link between the banks, a risk retention line of credit provided by SVB to SoFi.

Exposure of SoFi to SVB

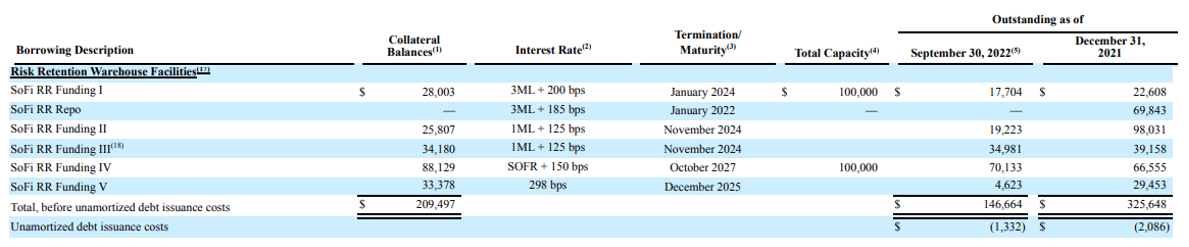

SVB provides one of SoFi's risk retention facilities. You can read the press release from SVB here. SoFi has five different risk retention warehouse facilities. This is from the 3Q22 10-Q since they did not update this in the 10-K to this level of detail:

SoFi's risk retention facilities (SoFi 10-Q)

I cannot find the breakdown for which of these risk retention facilities are from different banks, but here is what SoFi filed in their 8-K:

SoFi Technologies, Inc. (the "Company") informs its investors that it does not hold assets with Silicon Valley Bank. The Company has an approximately 40 million dollar lending facility that is provided through Silicon Valley Bank, which is unaffected by the Federal Deposit Insurance Corporation's receivership of Silicon Valley Bank

The lending facility will continue to be open and operated as before.

Deposits

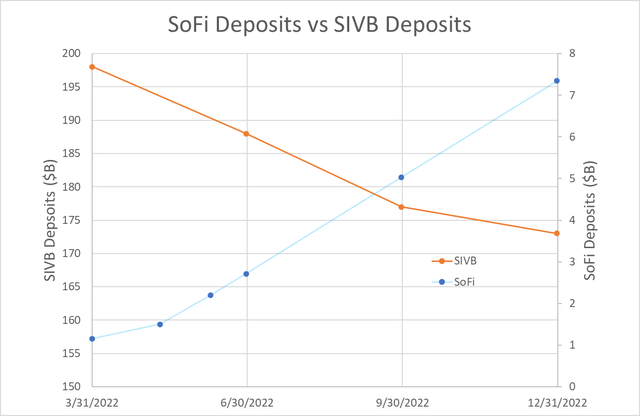

SVB's clients were primarily venture-backed startups. These commercial customers had huge cash raises over the past few years, and all that raised cash went into SVB deposits. When venture funding dried up in 2022, these clients continued to burn cash, resulting in net outflows in deposits over the last calendar year. (Be careful when interpreting the chart below as there are two different y-axes. I did this because the large discrepancy between the SoFi deposits and SVB's deposits renders the chart useless if you put them on the same scale. However, I want to call out that difference because I do not want to mislead anyone).

A comparison of Silicon Valley Bank's deposit decline and SoFi's deposit growth (Author)

SoFi, on the other hand, first received their banking charter in January of 2022 and has seen massive deposit growth ever since. While SVB caters to commercial companies, SoFi only serves individuals. SoFi does not yet offer business checking, although it is a vertical that they will likely enter at some point in the future. SoFi's deposit growth has been bolstered by the high APY they offer on their checking and savings accounts (2.5% and 3.75% respectively as of time of writing).

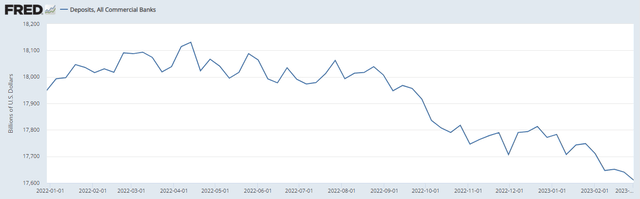

The dwindling deposits were the first domino to fall in SVB's failure. Decreasing deposits led to the liquidity crisis that forced SVB to sell their assets at a loss. That realized loss led to their dilutive offering, which spooked their customers and caused a run on the bank. What makes SoFi's rapid increase in deposits all the more impressive is that it comes at a time when total deposits across all banks have been dwindling.

Deposits of all commercial banks (FRED)

Concentration Risk

What's more, SVB had extremely high concentration risk in their deposits. According to Bloomberg, only $8B of the $173B of deposits were insured, meaning that over 95% of deposits were uninsured and at risk of being lost unless they were withdrawn in the event of a run on the bank. SoFi is the polar opposite, with 90% of deposits under the FDIC insurance limit of $250,000 (as a side note, with SoFi the limit is $250,000 per person per account, so a joint checking and savings account results in a $1,000,000 insurance limit for a married couple). There is no reason for SoFi depositors to fly to safety as the vast majority are completely covered by FDIC insurance. The lack of concentration risk and the fact that 88% of their deposits come from direct deposit customers means their deposits are much safer than almost any other bank outside of the big 4 banks of JPMorgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), and Citi (C). You can never be completely sure about anything, but there is virtually no chance of a run on SoFi Bank in my view.

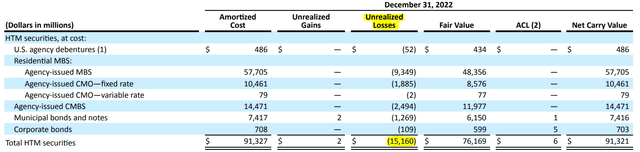

Capital Allocation

The second mistake that SVB made was to buy up long-dated bonds (either treasuries or mortgage-backed securities) that have collapsed in value as rates increased. These type of investments are marked as either available for sale (AFS) or held to maturity (HTM) and are accounted for under GAAP at their purchased value and not reported at fair market value. These unrealized losses mounted as rates kept rising. SVB had over $15B in unrealized losses in their most recent 10-K.

Silicon Valley Bank HTM securities (SIVB 10-K)

Part of the reason for the high losses is because $86B of those bonds, which is over 94% of their HTM portfolio, matured after 10 years. Longer duration bonds are more susceptible to rising rates.

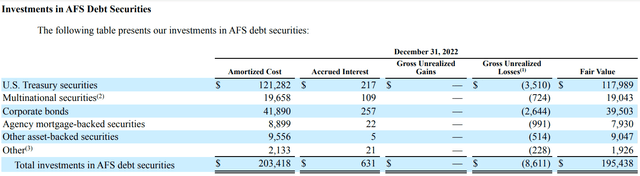

SoFi has similar securities, but they make up a tiny portion of their balance sheet. SVB's unrealized losses were almost 9% of their total deposits, and their total HTM securities were almost half of their total assets. By contrast, SoFi's unrealized losses are a paltry $8.6M. That is 0.1% of their deposits and AFS securities make up less than 1.1% of their total assets.

SoFi AFS Securities (SoFi 10-K)

Additionally, SoFi does not have the type of duration risk that SVB had. Of SoFi's $203M in AFS securities, 48% of them are due within a year and 93% come due inside of 5 years. SoFi has minimal exposure to the type of securities that caused problems for SVB, and the securities they do hold are much shorter duration.

Risk Management

We already covered duration risk, but there are other risks that should be discussed. What many would consider the riskiest part of SoFi's balance sheet is their exposure to unsecured personal loans. Personal loans is the biggest asset class that SoFi holds on their balance sheet, totaling 41.8% of their total assets and 57% of the loans on their balance sheet. The risk here is two-fold. First, if their borrowers default on their loans, then SoFi has to write off the remaining principal as a loss since there is no collateral on an unsecured loan. Second, just like any other loan or bond, increasing rates means a decrease in the fair value of the loan.

Delinquency Risk

As expected and called out by SoFi's management, delinquencies are normalizing for their portfolio after a period of overperformance due to pandemic stimulus. However, whereas the personal loan industry at large is seeing elevated delinquencies compared to before the pandemic according to Upstart's (UPST) 4Q earnings call, SoFi's on-balance sheet delinquency and charge-off rates are still below pre-COVID levels. SoFi's current annualized charge-off rate is 2.47% and they can maintain their target margins at 8% life of loan losses, which means they have room for delinquencies to almost double from current levels. Furthermore, their 2023 guidance calls for unemployment to rise to 5% in 2023, giving a lot of room for overperformance if the macro environment does not deteriorate to those levels.

SoFi manages delinquency risk by maintaining extremely high credit standards. Their personal loan borrowers have a weighted average income of $165,000 and a weighted average FICO of 747. They have a hard cut off at a FICO score of 680, below which they will not lend at all. This puts them well above peer lenders such as Upstart, who cater to subprime and near prime borrowers, and LendingClub (LC), who lend primarily to prime and prime plus borrowers. For comparison, LendingClub's HFI portfolio has an average FICO of 729 and average income of $116,000. SoFi has exposure to increased delinquencies and defaults, but the quality of their borrower should keep them insulated unless we see a very deep recession. If we see a deep recession, mounting losses could derail SoFi's growth story and profitability projections, but in most scenarios their loans will outperform their targeted loss rates.

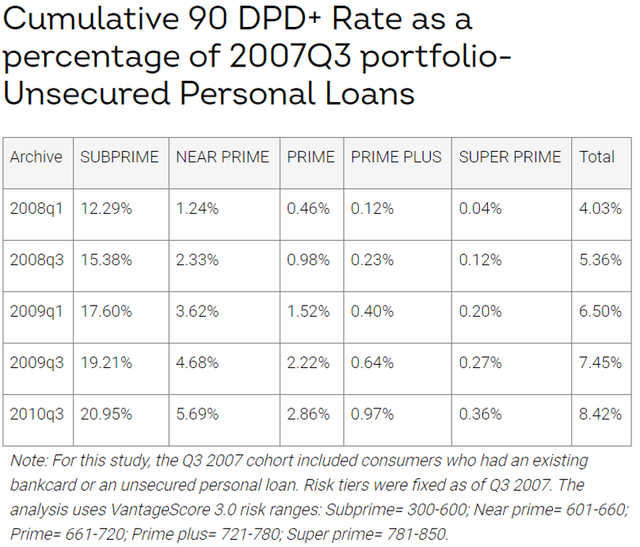

There is also data that firmly reinforces that higher quality borrowers insulate lenders from defaults even during an economic downturn. Transunion, one of the premier credit reporting agencies, wrote an analysis on personal loan and credit card delinquencies during the Great Financial Crisis. They looked at the FICO scores of borrowers in 3Q 2007 who held personal loans at that time and tracked their delinquency rates over the next three years. The table below shows their findings:

Cumulative delinquency rates during the Great Financial Crisis (Transunion)

This data includes all loans that had been originated and were still to be paid off, so it also includes seasoned loans with vintages prior to 2007. However, the data show that FICO score provides a significant margin of safety to lenders. SoFi's borrowers fit squarely in the Prime Plus category, which showed a cumulative default rate from 2007 until 2010 of less than 1%. I understand those who worry about defaults if we are entering a recession. However, this is not the first recession we've ever had and there is plenty of data that we can look at to help us make accurate predictions about what happens during a recession. I seek to be data driven in my analysis, and this data suggest that FICO score is an excellent predictor of the risk of delinquency, even in recessions.

Rate Sensitivity Risk

I find it somewhat amusing that often over the last year I have spent a great deal of time answering criticism of the fact that SoFi uses held-for-sale accounting, which does not require them to take CECL provisions on their personal and student loans, but does require them to mark their loans to market each quarter and report those loans at fair value. Many have been very quick to highlight how the lack of upfront provisioning is a massive risk to the underlying business. I have found it very ironic that the recent bank failures came not as a result of massive delinquencies, but because of unrealized fair value losses, a risk that many completely overlooked and dismissed when I pointed it out in the past.

Just as any other bond or loan, the fair value of existing personal loans goes down as rates increase. In the case of SVB, this resulted in the $15B hole in their balance sheet that ultimately came back to haunt them. SVB took no actions to mitigate their risk. Their portfolio was overweight in these long-term "low risk" assets and they took no corrective action or hedges to mitigate that risk and it led to insolvency.

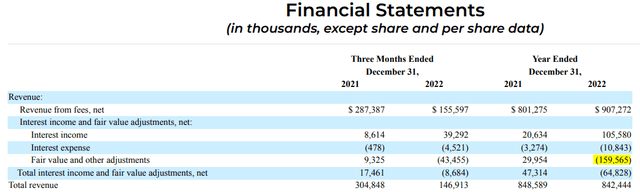

Upstart revenue breakdown highlighting fair value adjustments (Upstart 10-K)

A similar story exists for Upstart (though not nearly as dire). Upstart maintains a portfolio of auto and personal loans that ranged from $598M in 1Q22 to $1,010M in 4Q22. Over the course of the year, their losses from fair value adjustments was -$159.6M, which was actually more than the interest income they gained from holding those loans for the whole year (which was $105.6M). Upstart's fair values are also very rate sensitive because their clientele typically have lower FICO score customers whose default rates are more likely to rise under adverse economic conditions. Default rates are a large part of fair value calculations.

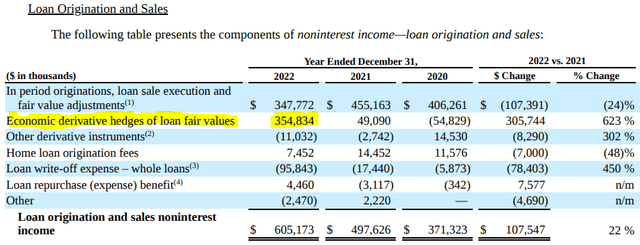

SoFi's personal loan portfolio was almost $8B by the end of 2022. If they did nothing to offset the risks of rate hikes like SVB or Upstart, the fair value changes of their loans would have eaten up $355M of their $1,540M of revenue. However, SoFi purchases hedges against interest rate movements, mostly in the form of credit swaps. Perhaps I'll write about this more in depth another time, but the basic idea is that it allows them to recoup any losses from unforeseen movements in interest rates to maintain the fair value of their loans. CFO Chris Lapointe addressed this at a recent conference:

We've been very successful over the course of 2022 with our hedging program. What we end up doing is we hedge out our -- the loans that are susceptible to rate volatility. And the pure intent of doing that is to offset any increases or decreases in rates and the offsetting impact on the fair market value of those loans. Our goal is to hedge 100% of that volatility, and that's -- you saw that come through in the P&L this past year.

To be clear, SoFi is not making strategic bets on rates going up or down, they are simply insulating themselves from rate volatility in either direction having undesired consequences on their revenues. These same derivatives are available to SVB, Upstart, LendingClub and others, and yet SoFi is the only one to use them. This is an excellent example of the prudent foresight that SoFi exhibits in all aspects of their business. Their execution in this macro environment has truly been second to none.

SoFi non-interest income breakdown highlighting their gains from hedges (SoFi 10-K)

If SVB had shown the same foresight and had the same risk management strategy as SoFi, they would most likely still be solvent today.

Capital Ratios and Liquidity

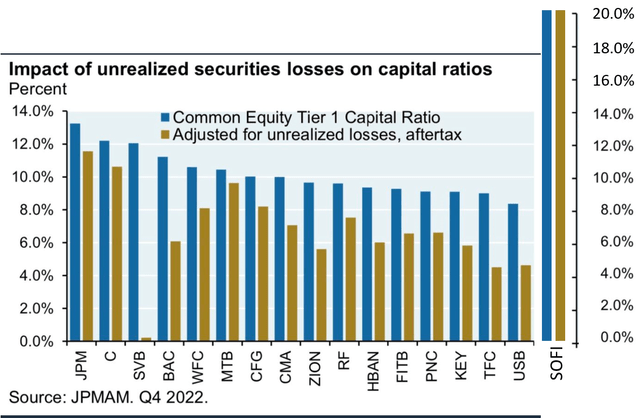

How much liquidity does SoFi have? There is a graphic that JPMorgan has put out that has been doing the rounds about Tier 1 capital ratios. I have taken that graphic and added SoFi to the list of banks that were represented. This is an apples to apples comparison of the Tier 1 capital ratios of these businesses:

Impact of unrealized losses on capital ratios (JPM and Author)

The two SoFi bars look like they are the same height. They are not, but the difference is imperceptibly small. The blue bar is 20.31% and the brown bar is 20.26%. This highlights that SoFi has a huge amount of room to stretch their capital ratios and have excess capital available. LC's Tier 1 capital ratio is at 15.8%, so they also have significant leverage available if needed and are very well capitalized.

SoFi's Execution Has Been Outstanding

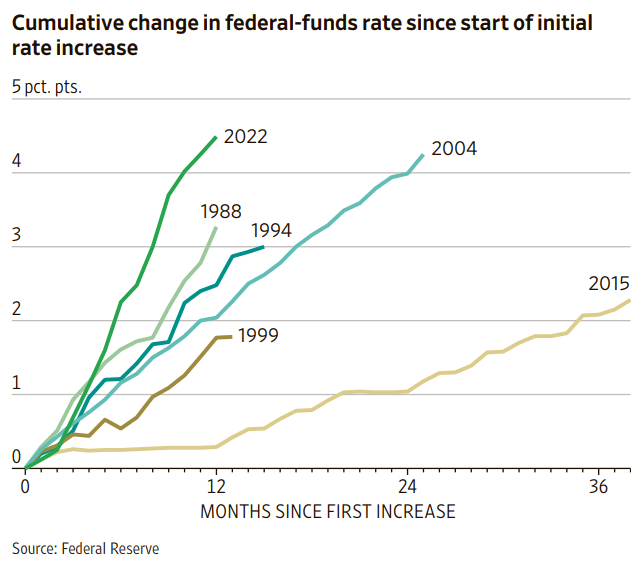

When SoFi came public in the summer of 2021, if you could handpick the two worst possible macro headwinds that would derail the company, they would be:

- A never-ending student loan moratorium to hamstring their biggest and most lucrative line of business and remove their biggest funnel for new customers.

- A rate hike cycle the likes of which has literally never been seen before.

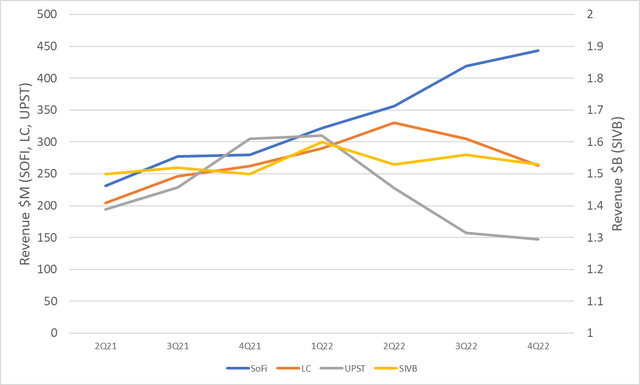

Cumulative change in fed funds rate since initial increase (Federal Reserve)

If you're keeping score, we are currently 2 for 2 on the worst headwinds SoFi could have faced. Despite them facing greater headwinds than their competitors with the removal of their core student loan business that accounted for 60%+ of revenue in 2019, they've had better, more consistent, and more sustainable growth than LendingClub, Upstart, or Silicon Valley Bank. Note that this graph has a separate y-axis for SVB compared to the financial institutions represented.

Revenues of SOFI, LC, UPST, and SIVB since SoFi went public (Author)

Many people have asked me over the past week what my takeaway for SoFi was from the bank runs and subsequent fallout. SoFi's stock has fallen about 17% since in a week in sympathy with the panic over the banking system. Let's do a quick rundown on the differences between SVB and SoFi:

- SVB saw falling deposits as their customers burned through their cash reserves while SoFi is seeing a massive influx in their deposits.

- SVB had huge deposit concentration risk with huge commercial accounts meant 95% of deposits were uninsured while SoFi's consumer direct deposit accounts give them a sticky clientele and 90% of client deposits are insured.

- SVB reached for yield and overinvested in long-term securities that left them with huge unrealized losses while SoFi's AFS portfolio is a tiny part of their portfolio and is short in duration.

- SVB showed woeful risk management while SoFi's hedging program has allowed them to maintain liquidity, growth, and expanding margins during the entire rate hike cycle.

So what is my takeaway from all of this? The only thing this did was highlight how exceptionally competent SoFi's business model is, as well as its executive team. Analyzing factors that led to SVB's collapse and comparing them with what SoFi is doing further strengthens the argument that SoFi is differentiating itself from all competitors by unmatched execution of a more robust business model in my view. As long as that holds true, I will continue to dollar cost average into more shares.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SOFI, LC, UPST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.