'Hold' Block For Now, Square Is Under Pressure

Summary

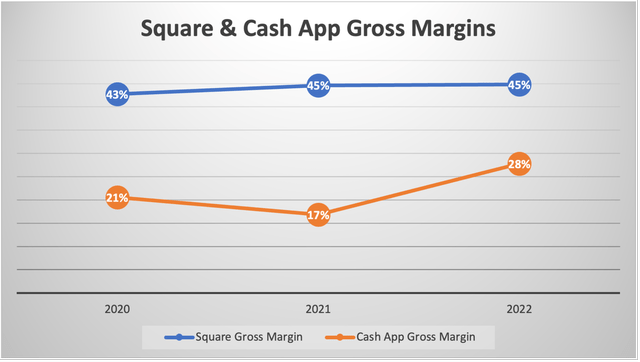

- Square has the highest gross margin across Block’s reported segments.

- The fact that outbound sales will play a greater role in Square’s seller acquisition efforts is an implicit admission that growth in inbound queries is subduing, due to intensifying competition.

- Square’s new sales strategy leverages the power of verticalization and should bolster the fintech giant’s customer acquisition efforts, and ultimately its revenue growth.

- Amid the intensifying competition, Block is being forced to offer pricing discounts to various large sellers, in order to acquire and retain business from these firms.

- Growth in GPV through onboarding large sellers may not necessarily improve Square’s gross margin, given the company’s diminishing pricing power.

mladenbalinovac

Block’s (NYSE:SQ) Square is a leader in the Point-of-Sale [POS] industry, and overtime has also expanded into offering e-commerce solutions. The tech giant’s verticalized offerings to serve industry-specific needs remains a key selling strategy. Though competition has been intensifying, putting pressure on profit margins. Nexus Research maintains a ‘hold’ rating on SQ stock.

Square under competitive pressure

Square is Block’s second- largest revenue segment, making up 38% of total revenue in 2022, behind only the Cash App ecosystem, which made up 61% of sales revenue. Square revenue constitutes of subscription revenue and transaction-based revenue. Subscription revenue comprises of monthly subscription fees paid by merchants to use Square’s Point-of-Sale and e-commerce solutions. Transaction-based revenue primarily relates to payment processing fees per payment transaction, which depends on the Gross Payment Volume [GPV] processed periodically.

Square gross profit growth slowed to 30% in 2022, after having grown 54% in 2021, and executives primarily blamed the economy for the slowdown. Block CFO & COO Amrita Ahuja mentioned on the Q4 2022 earnings call:

We saw a moderation in the GPV growth rates for discretionary verticals in the US beginning in November, primarily for food and drink and retail

Given the high inflationary environment, it is unsurprising to witness consumers cutting back on discretionary spending, which subsequently reduces payment processing fees for Square. That being said, aside from the diminishing macro conditions, Square is also facing increasing competitive pressures.

One rising competitor in the POS space is Shopify (SHOP). In partnership with Stripe, Shopify has successfully expanded into also offering POS solutions to facilitate offline commerce, in addition to online commerce.

This has allowed Shopify to offer a robust omnichannel sales solution, and by including POS software into their e-commerce subscription plans, it became an obvious choice for Shopify's digital merchants that wanted to expand operations into offline channels post-COVID. In fact, on the Q4 2022 earnings call, Shopify’s President Harley Finkelstein proclaimed that:

We have now merchants coming to us primarily for point-of-sale, I mean, now that point-of-sale can now power 1,000 retail stores, our merchants that come first and foremost for point-of-sale and then expand to online store as well.

Shopify is just one of the several POS competitors, such as PayPal Zettle, Toast POS, and Lightspeed Retail. Make no mistake, Square is still a leader in the POS industry, but intensifying competition does have implications for the fintech giant. Moreover, on the Q4 2022 earnings call, Block CFO & COO Amrita Ahuja shared that they “expect outbound sales to be a bigger contributor to seller acquisition over time.”

For context, inbound sales are when prospective customers reach out directly to a company to enquire about their products/ services. Outbound sales are when a company’s sales representatives reach out to potential clients to pitch their products/ services. The fact that outbound sales will play a greater role in Square’s sales & marketing efforts is an implicit admission that growth in inbound queries is subduing, reflective of the intensifying competitive landscape.

That being said, Square is also increasingly focusing on verticalization to embolden their sales strategy and drive merchant acquisition growth.

Vertical Point of Sale solutions

Amrita Ahuja had mentioned on the earnings call:

We're building verticalization into our team. So where in the past, we had a more generalized sales team, we've started to now verticalize across our three key areas of restaurants, retail and services and expect this to benefit deal cycle times and win rates over time.

One of Square’s most compelling strategies is that it provides vertical POS solutions which are tailored towards serving particular industries. These vertical solutions include Square for Retail, Square for Restaurants, Square for Appointments, on top of the standard POS solution. For instance, its Square for Restaurants POS solution entails menu, table and order management features.

These specified vertical solutions play a key role in Square's merchant acquire endeavors in these specific industries. It allows Square to better serve merchants’ needs for services that are specifically-oriented towards their industries.

It also incurs a self-reinforcing network effect, whereby the more businesses use these vertical solutions, the more industry-specific data Square is able to collect. This intelligence feeds into enhancing Square’s understanding of particular industry dynamics and operational requirements, conducive to continuously advancing the industry-specific features of the vertical POS solutions, which in turn leads to more entrepreneurs opting for Square’s services to run their businesses, and so forth.

Square is now doubling down on this verticalization strategy with more niche-focused sales teams, as Amrita Ahuja explained on the last earnings call:

From an outbound perspective, we're also enhancing our capabilities here around targeting specific verticals and seller sizes using better data and signals that enable our team to be able to reach those sellers at the right time with the right message.

This new sales strategy leverages Square’s industry-specific knowledge and should bolster the fintech giant’s customer acquisition efforts, and ultimately its revenue growth.

CEO Jack Dorsey had mentioned on the Q3 2022 earnings call that Square is “looking for other opportunities for more vertical services”, in order to continue capitalizing on sellers’ industry-specific needs. Offering a growing range of vertical solutions targeted towards specific industries is a crucial strategy to continue acquiring sellers and subsequently drive revenue growth.

Block Financials & Valuation

Square has the highest gross margin across Block’s reported segments.

Data compiled from company filings

Square’s gross margin has been relatively stable, seeing only moderate growth since 2020. The increasingly competitive landscape of the POS industry hinders gross margin expansion. Moreover, amid the intensifying competition, Block is being forced to offer pricing discounts to various large sellers, in order to acquire and retain business from these firms. In the ‘Risk Factors’ section of the 2022 annual report, Block states:

We may also face pricing pressures from competitors. Some competitors may offer lower prices by cross-subsidizing certain services that we also provide through other products they offer. Such competition may result in the need for us to alter our pricing and could reduce our gross profit. Also, sellers may demand more customized and favorable pricing from us, and competitive pressures may require us to agree to such pricing, reducing our gross profit. We currently negotiate pricing discounts and other incentive arrangements with certain large sellers to increase acceptance and usage of our products and services. If we continue this practice and if an increasing proportion of our sellers are large sellers, we may have to increase the discounts or incentives we provide, which could also reduce our gross profit.

This competition is only likely to intensify amid the rise of players like Shopify in the POS industry. Consequently, growth in GPV through onboarding large sellers may not necessarily improve Square’s gross margin, given the company’s diminishing pricing power.

Nonetheless, Square’s intentions to widen the range of industry-specific verticals, and also verticalizing its sales teams, should bolster the company sales & marketing efforts, and subsequently support the company’s pricing power.

Cash App, Block’s largest revenue segment, is more unstable. This is primarily due to the fact that majority of Cash App revenue is derived from Bitcoin trading, which is more unstable in nature and saw declines last year amid the crypto market sell-off. As a result, Cash App revenue overall declined in 2022, while gross margin improved, as other financial services made up a larger portion of revenue last year. Given Block’s ambitions to turn Cash App into an e-commerce destination, this will offer new revenue growth potential, and also open the doors for higher-margin solutions, namely advertising.

On a company-wide basis, Block became unprofitable again in 2022. Block’s Forward PE (non-GAAP) currently stands at nearly 43x. The 5-year average is almost 144x. Though Block remains expensive relative to the sector median of just over 19x.

Block is well-positioned to benefit from the secular growth trends in the fintech industry over the long-term. The deeper verticalization of Square’s POS solutions, accompanied by Cash App’s e-commerce endeavors offer attractive growth avenues. That being said, investors should be wary of moderating profit margin growth, particularly in Square, given the intensifying competition. This may subdue stock price gains going forward, especially given that the stock remains expensive.

Summary

Square has the highest gross margin across Block’s reported segments. The fact that outbound sales will play a greater role in Square’s seller acquisition efforts is an implicit admission that growth in inbound queries is subduing, due to intensifying competition. On the other hand, Square’s new sales strategy leverages the power of verticalization and should bolster the fintech giant’s customer acquisition efforts, and ultimately its revenue growth.

Amid the intensifying competition, Block is being forced to offer pricing discounts to various large sellers, in order to acquire and retain business from these firms. Consequently, growth in GPV through onboarding large sellers may not necessarily improve Square’s gross margin, given the company’s diminishing pricing power.

Block is well-positioned to benefit from the secular growth trends in the fintech industry over the long-term. Though investors should be wary of moderating profit margin growth, particularly in Square, given the intensifying competition. This may subdue stock price gains going forward, especially given that the stock remains expensive. Nexus Research maintains a ‘hold’ rating on the stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.