Ingersoll Rand: An Emerging Compounding Story

Summary

- IR’s revenue and margins should benefit from carryover pricing impact from FY22 and an additional price hike in FY2023.

- Momentum in order growth should remain positive, given good demand from large cycle projects related to energy efficiency and onshoring.

- In the long term, the company should benefit from its bolt-on acquisition strategy which, according to management, should add an additional 400 bps to 500 bps to revenue growth.

- Valuation is attractive.

Kameleon007

Investment thesis

Ingersoll Rand Inc. (NYSE:IR) is expected to benefit from the carryover pricing impact of increases from the last year and additional price hikes this year. The company should also see continued order growth due to sustainability and the onshoring trend. The company's inorganic growth prospects also look good and, earlier this year, it completed two acquisitions of Paragon Tank Truck and SPX Flow and signed 11 letters of intent (LOI) with potential target companies.

On the margin front, the company is expected to benefit from moderating inflation, coupled with price hikes made last year and expected ones this year. Moreover, the company should benefit from synergy and cost-cutting related to Seepex integration. In the long run, the company is likely to benefit from a mix shift to higher-margin aftermarket services, due to its customers' increased use of IIOT-enabled (Industrial Internet of Things) products.

The stock is trading at a discount versus its historical average and other industrial compounders, making it a buy.

Revenue Analysis and Outlook

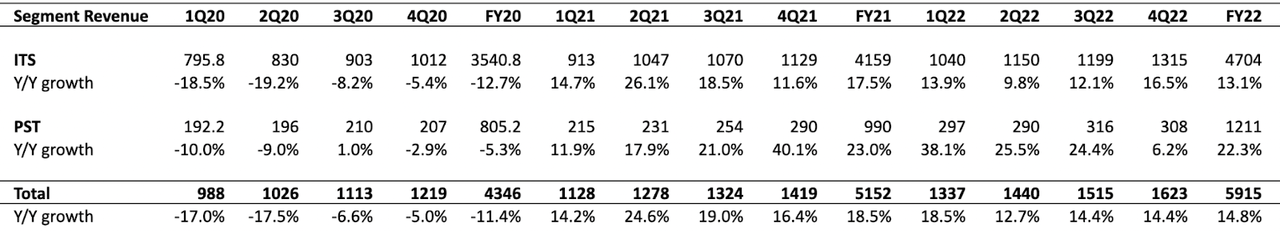

Last year, the company experienced robust topline growth of 14.8% Y/Y, and its revenues reached ~$5.9 billion. This growth was primarily driven by pricing, volume, and acquisitions, partially offset by forex and supply chain-related headwinds. During the year, the company witnessed 7.9% Y/Y volume growth, thanks to solid demand from the core industrial end market, which was complemented by ~8% Y/Y price increases. Additionally, the company made significant portfolio changes by divesting its special vehicle technology business and high-pressure solution business while making several tuck-in acquisitions, resulting in a 4.4% Y/Y tailwind for revenue from inorganic growth in FY2022. However, forex-related headwinds impacted the topline by -5.6% Y/Y.

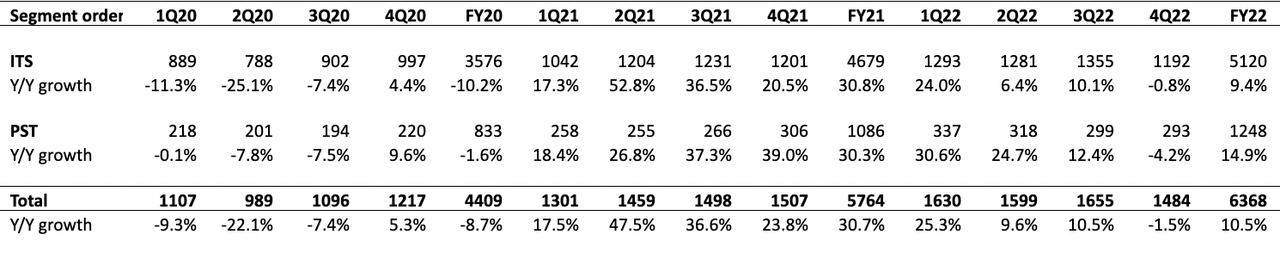

During 2022 the company booked orders worth $6.36 billion (up 10.5% Y/Y). The increase was primarily driven by 11.4% Y/Y organic growth due to a strong core industrial end market which was complemented by 4.4% Y/Y growth from acquisitions. However, forex-related headwinds impacted the orders by -5.3% Y/Y.

Ingersoll Rand revenue growth (Company data, GS Analytics Research)

The company continued to experience strong revenue growth in 4Q22, reporting $1.6 billion in revenue, up 19% Y/Y on an organic basis. However, new orders declined 1% Y/Y to $1.48 billion, though on an organic basis, orders were up 2%. The unexpected decline in order growth was due to the slippage of a large order to 1Q23 in the Industrial Technologies and Services (ITS) America Business. The PST segment order was also impacted by tough Y/Y comparisons resulting from a large hydrogen order intake in 4Q21. Despite this, the company ended the year with a $2 billion backlog, almost 1.5x the normal backlog levels. The increased backlog levels were due to supply chain issues and labor shortages.

Ingersoll Rand's new order growth (Company Data, GS Analytics Research)

Looking ahead, IR is expected to benefit from high backlog levels, price increases, and continued order growth, which should increase revenue in the coming quarters.

As previously mentioned, the backlog level was 1.5x the historical levels due to supply chain constraints and labor shortages. However, the situation is improving with the supply chain constraints easing, which should facilitate a higher backlog-to-sales conversion rate and support revenue growth in FY2023.

The company has a policy of increasing pricing by 1-2% every year, which it has been successful in implementing due to the mission-critical nature of its products. In 2022, the company raised prices multiple times beyond the usual increase due to increased inflation pressure, hiking pricing by ~8% during the year. These increased prices, especially during the back half of the year, should have carryover impacts in FY23. This, coupled with the usual price hikes, means that FY23 will be another strong year for pricing for the company.

In addition to pricing-related tailwinds, the company is expected to grow its new orders at a decent pace which should help FY23 revenues. While orders were down in 4Q22, they turned positive again in January. The demand in the company's end market continues to be strong with the rising opportunities in sustainability and onshoring benefiting the company.

As more companies and organizations target being more sustainable, they are revamping their capacity with products that are more energy efficient and helps conserve resources like water. Almost 30% of the company's revenue is from water-efficient products, and 100% is from energy-efficient products. A good example of IR's sustainable offering is the company's Runtech business, a Turbo Blower technology for the pulp and paper industry that reduces water usage by 90% and energy usage by 50%. Moreover, many of IR's customers are onshoring their production facilities which is helping IR's order growth.

Besides organic growth, IR is also focused on growing its revenue inorganically. In 2022, IR acquired 12 companies with a cumulative investment of ~$800 million, adding ~$300 million to the company's topline. In 2023, this inorganic growth momentum is expected to continue. So far in FY23, the company has signed 11 letters of intent and completed two acquisitions of SPX Flow and Paragon Tank Truck worth $525 million and $40 million, respectively. The two completed deals already had a combined revenue of $205 million in 2022, and given more potential acquisitions this year, I expect a strong contribution from inorganic growth this year as well. In the long run, the company aims to deliver 400bps to 500bps of Y/Y topline growth from M&A till 2025, which seems reasonable given the company's strong balance sheet position. As of the last quarter's end, the company had a net debt to EBITDA of 0.8x, which is below its target of 2x net debt to EBITDA, giving it good headroom in terms of inorganic growth in the coming years.

Margin Outlook

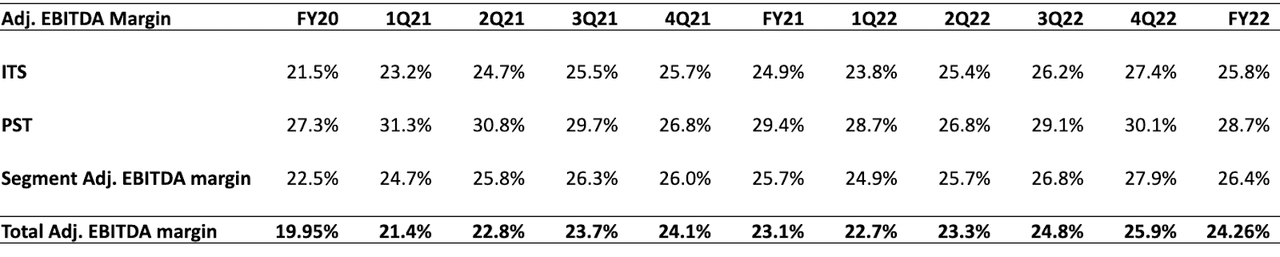

In 2022, the company experienced a 70 basis points Y/Y segment-adjusted EBITDA margin improvement to 26.4%, primarily driven by strong ~8.2% Y/Y price increases. On a segment basis, the ITS segment's adjusted EBITDA margin improved by 90 basis points, while the PST segment's adjusted EBITDA margin declined 70 basis points Y/Y.

During 4Q22, the IST segment achieved a 170 bps adjusted EBITDA margin improvement to 27.4%, with an incremental margin of 38%. Meanwhile, the PST segment's adjusted EBITDA margin improved 330 bps Y/Y to 30.1%, benefiting from price cost improvement and synergy benefits from the Seepex acquisition.

Adjusted EBITDA margin (Company data, GS Analytics Research)

Looking ahead, I expect the company's margins to benefit from the carryover price increase implemented last year and the synergy benefits from the Seepex acquisition. In FY2022, the company raised its product prices by ~8% on average to offset increasing input costs and maintain a positive price-cost equation. Looking forward, raw material prices are expected to stabilize or decrease in the coming quarters, but the company is expected to retain its earlier price increase, resulting in a margin tailwind.

Additionally, the PST segment, in particular, is expected to continue benefiting from the synergy benefits related Seepex acquisition made in 3Q21. Before the acquisition, the overall segment had an adjusted EBITDA margin of around 30%, which decreased to the mid-20s due to the inclusion of mid-teens EBITDA Seepex business. Over the last five quarters, the company integrated the Seepex business and realized synergy benefits. By 4Q22, the Seepex business had a mid-20s EBITDA margin, which is expected to approach the overall segment-level margin of around 30% over the coming quarters. The recent SPX Flow acquisition with EBITDA margins in the mid-20s is also expected to achieve similar synergy benefits and help IR's overall margins.

Apart from near-term margin tailwinds, the company aims to increase higher-margin aftermarket revenue in the long term. The company plans to leverage the Industrial Internet of Things (IIOT) to increase its aftermarket revenue by offering customers service contracts, part subscriptions, and system optimization services. In 2021, the company derived 10% of its revenue from IIOT-enabled products, which increased to 19% in 2022. The increased adoption of IIOT-enabled products should result in higher aftermarket revenue in the coming years. The company aims to increase its aftermarket services revenue from the mid-30s to the mid-40s.

During the investor day in 2021, the company set its long-term adjusted EBITDA margin target in the high 20s. The target is expected to be achieved through expanding IIOT products, footprint optimization, M&A synergies, direct material and supply chain optimization, and implementation of lean manufacturing and automation. In 2021, the company had an adjusted EBITDA margin of 23.1%, which the management intended to increase by approximately 100 bps annually until 2025. The company delivered a 120bps improvement in 2022 and is expected to have another 80-90 bps improvement this year. I believe the company is on track to achieve its target and reach its goal by 2025.

Valuation

The stock is currently trading at a forward P/E of 20.79x based on the FY23 consensus EPS estimate of $2.55 which is a discount to its 5-year average forward P/E of 37.58x. I believe the company can post mid-single-digit organic growth in the long term which coupled with bolt-on acquisitions and margin improvement prospects can help it deliver high single-digit revenue growth and low double-digit EPS growth in the medium to long term. If we look at other high-quality industrial compounders like Danaher (DHR) following a similar bolt-on acquisition and margin improvement strategy, they are trading at a P/E in the mid-20s range. Ingersoll's P/E might re-rate and reach a similar range as it continues to execute well. This, coupled with good EPS growth prospects, makes the stock a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Pradeep R.