Still Avoiding Innoviva

Summary

- The latest financial results have been lackluster to put it mildly. Revenue and net income are down significantly.

- In spite of this, the shares are more expensive now than they were when I last reviewed the name.

- Everything in investing is relative, and in a world where you can earn 4.25% risk free, why would you buy this?

cemagraphics

It’s been about 3 months since I recommended avoiding Innoviva, Inc. (NASDAQ:INVA), and in that time, the shares are down about 13% against a loss of about .4% for the S&P 500. A stock that’s 13% cheaper is, definitionally, a less risky investment than the same stock when it was more expensive, obviously. For that reason, I’m willing to review the name again to see if it makes sense to buy or not. Innoviva has released financials since I last checked on the company, and I want to review those. I’m also going to see if the valuation is more compelling today.

We’re a busy group of people in the Seeking Alpha community. Some of you have interesting lives to lead, go to great parties, read great books. I’ve got some Young and Restless to catch up on, and some figures to paint for my upcoming Dungeons & Dragons game. The point is, all of our time is stretched. For that reason, I want to do my best to give you the highlights of my thinking up front so you can get the gist of my arguments and then get back to your bonsai hobby or whatever. This “thesis paragraph” is for those people who want a little bit more than they get from titles and bullet points, and a great deal less than they’d get from an entire article. You’re welcome. In a world where it’s possible to earn over 4% from a risk free investment, it makes no sense to buy this stock in my view. The company continues to suffer financial difficulties, with revenue and net income down significantly in 2022 compared to 2021. Cash on the balance sheet has exploded higher, but a quick review of debt maturity schedules indicates that that cash will be absorbed this year. So, there are no financial “bright spots” in my view. In spite of that, INVA stock is even more richly priced today than it was 3 months ago. I am going to continue to avoid this name, and I would recommend others do the same.

Financial Snapshot

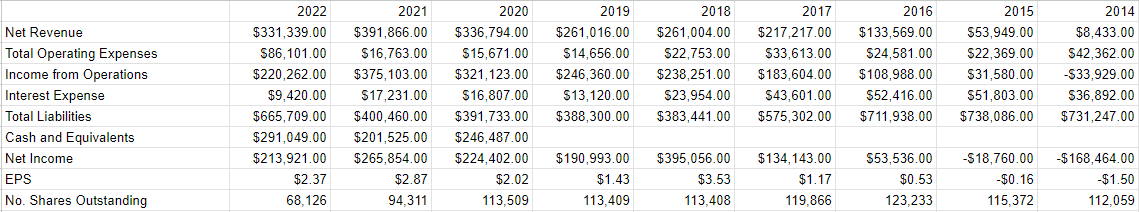

I think the most recent financial performance here has been rather bad. When compared to 2021, revenue, net income, and EPS are down 15.5%, 19.5%, and 17.4% respectively. I’ll admit that net income was negatively affected by a $20.6 million loss on debt extinguishment, which is more of a “one off”, but more persistent issues are present also. For example, SG&A expenses in 2022 nearly trebled from the year before.

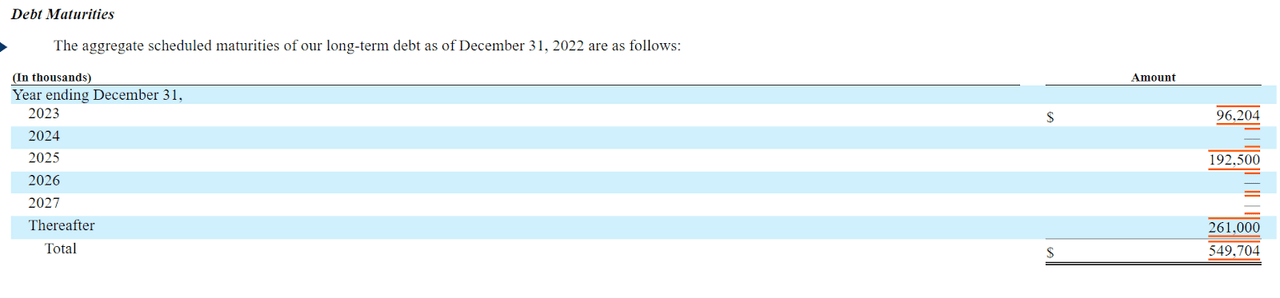

On the bright side, net interest expense dropped massively from $17.2 million in 2021 to $9.4 million last year. That was a record low interest expense, and far below the high water mark of $43.6 million in 2017. Additionally, the capital structure improved as evidenced by the fact that cash and equivalents were up by $89.5 million, or 44%. The problem is that all of that cash and more is due this year, as evidenced by the following table plucked from page 125 of the latest 10-K for your viewing pleasure.

Innoviva Debt Maturities (Innoviva 2022 10-K)

Given the above, I’d be willing to buy this stock, but only at a rather significant discount.

Innoviva Financials (Innoviva investor relations)

The Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. A business invests in a number of inputs, various chemical compounds, and the like, adds value to those inputs by turning them into various medicines, and then sells the results for a profit. That process is fairly straightforward, though sometimes volatile. The stock, on the other hand, is a traded instrument that reflects the crowd's aggregate belief about the long-term prospects for a given company, and the stock is buffeted by a number of forces, some of which may have little to do with the underlying business. Inflation and interest rate changes may affect a broad swath of businesses, and thus the appetite for “stocks” as an asset class. Strangest of all in my mind, stock investors can be mesmerized by the pronouncements of Fed officials, as if the difference between a 50 and 75 basis point move in the overnight rate matters all that much.

Although it's tedious to see your favorite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we'll do well over time. It's typically the case that the lower the price paid for a given stock, the greater the investor's future returns. This is why I only ever want to buy a stock that is relatively cheap, and it's why I'm reconsidering Innoviva now that the shares are down by about 12% since I last reviewed the name. My hope is that the crowd is feeling particularly down in the dumps about this name, and that would present an opportunity.

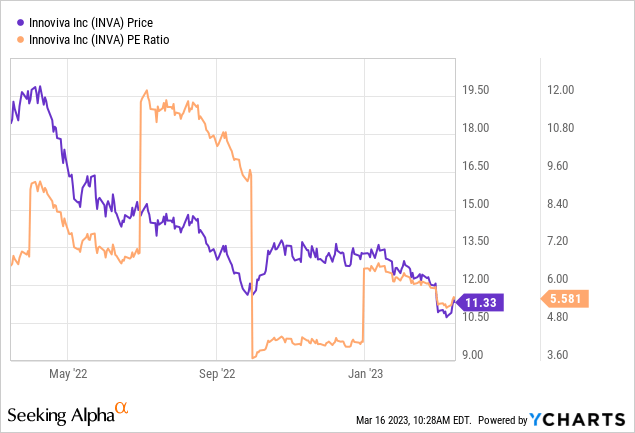

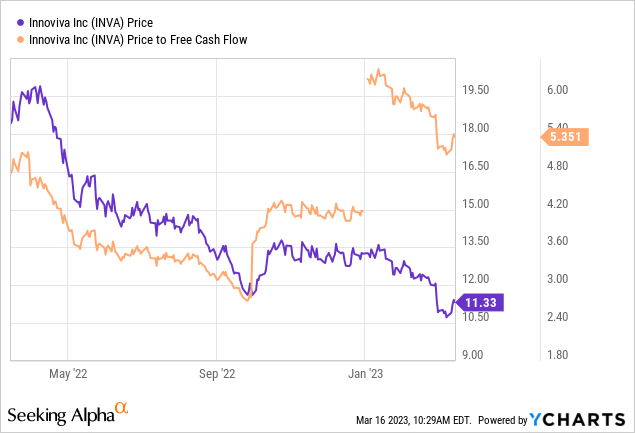

As my regulars know, I use a host of measures to judge the relative cheapness (or not) of a given stock, some of which are quite simple, some of which are quite sophisticated. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think "cheaper wins", I want to see a company trading at a discount to both the overall market, and the company's own history. In case you've forgotten, I eschewed Innoviva when it was trading at a P/E ratio of about 4.2 times and a price to cash flow of about 4.18 times. Fast forward a few months, and the market is paying even more for the reduced earnings and cash flow. Specifically, the shares are between 29% and 34% more expensive, per the following:

The fact that the shares are actually more expensive now than they were when I determined that they weren’t trading at good value doesn’t fill me with confidence.

One more thing my regulars know is that I want to try to understand what the crowd is currently "assuming" about the future of a given company, and in order to do this, I rely on the work of Professor Stephen Penman and his book "Accounting for Value." In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is "thinking" about a given company's future growth. This involves isolating the "g" (growth) variable in this formula. In case you find Penman's writing a bit dense, you might want to try "Expectations Investing" by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently "expecting" about the future.

Anyway, applying this approach to Innoviva at the moment suggests the market is assuming that this company will grow profits at a rate of about 3% from here. In my view, that is a pretty optimistic forecast, especially given what’s going on with the company at the moment.

Given that I think capital preservation is far more important than trying to make gains, and given also that it’s possible to earn 4.26% risk free. I think it would be very imprudent to invest in these shares. I’m going to continue to avoid them, and I would recommend others do the same.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.