PHYS: Warming Up To Gold

Summary

- PHYS provides exposure to allocated gold bullion stored at the Royal Canadian Mint.

- The Fed is stuck between a rock and a hard place as inflation continues to soar, while cracks start to emerge in the banking system.

- If the Fed stops raising interest rates in the coming months before inflation is tamed, I expect inflation expectations to soar and gold prices to rally in sympathy.

- To play this theme, I have rebuilt a long position in PHYS and will be looking to add on any pullbacks.

edwardolive

In late January, I became cautious on gold investments, as I foresaw the weak-U.S. dollar driven gold rally was long in the tooth. After a brief consolidation period, gold has rallied strongly in recent days on the back of market fears and uncertainty due to the failure of SVB Financial (SIVB).

Looking forward, the Federal Reserve is in a tough spot, with rising banking system risks while inflation remains stubbornly high. If the Fed abandon its fight against inflation, we may see inflation expectations become unanchored. This could spur the next major leg higher in gold prices.

One way to play this bullish view on gold is via the Sprott Physical Gold Trust (NYSEARCA:PHYS), which holds fully-allocated gold bullion at the Royal Canadian Mint. Other gold investments such as the SPDR Gold Trust ETF (GLD) and the VanEck Vectors Gold Miners ETF (GDX) should also benefit.

Fund Overview

The Sprott Physical Gold Trust is a closed-end trust that holds unencumbered and fully-allocated physical gold bullion stored at the Royal Canadian Mint.

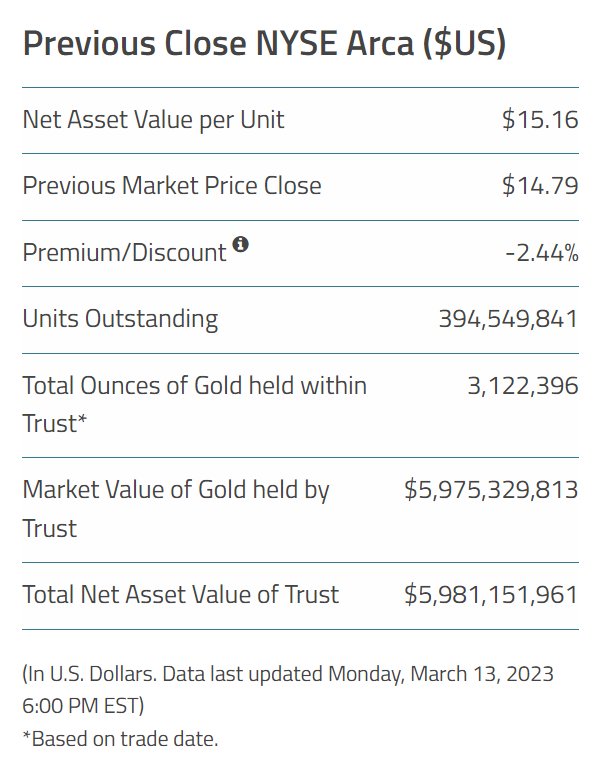

The PHYS trust holds more than 3 million oz of gold worth $6.0 billion in assets and charges a 0.41% management expense ratio.

Fully Allocated And Redeemable Metals

As mentioned above, the PHYS fund holds fully allocated gold bullion held in trust. What this means is that investors are the ultimate owners of the metal and that Sprott is merely the custodian. In the event of a bankruptcy of the custodian, allocated account holders are the legal owners of the bullion while unallocated account holders must fend with other creditors for title to their bullion.

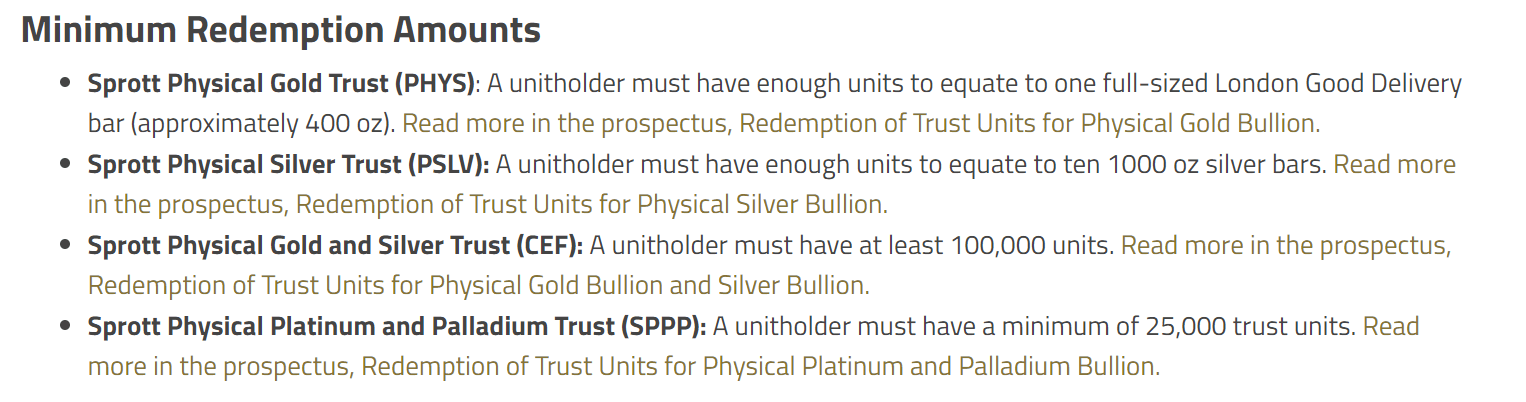

Another unique feature of Sprott physical bullion products is that unitholders can choose to redeem their holdings for physical bullion, provided they meet the minimum redemption requirements (Figure 1). For PHYS unit holders, they can redeem for physical gold bullion provided they own units equivalent to more than 1 full-sized London Good Delivery bar (~400 oz). To my knowledge, Sprott is the only provider offering this feature.

Figure 1 - PHYS has physical redemption feature (Sprott.com)

Portfolio Holdings

The PHYS trust's holdings are only gold bullion. As of March 13, 2023, the PHYS trust holds 3.1 million oz of gold in trust at the Royal Canadian Mint worth $6.0 billion (Figure 2).

Figure 2 - PHYS portfolio holdings (sprott.com)

Returns

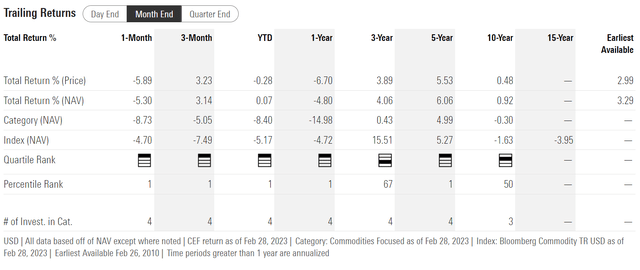

The PHYS trust's historical returns follow that of gold bullion. Over the long run, the PHYS trust has provided modest returns, with 3/5/10Yr average annual returns of 4.1%/6.1%/0.9% respectively to February 28, 2023 (Figure 3).

Figure 3 - PHYS historical returns (morningstar.com)

The Fed Is Caught Between A Rock And A Hard Place

By now, countless articles have likely been written on the SVB Financial debacle. I will not go over the timeline of events in this article, but interested readers may read my previous articles on what happened at SIVB.

One main takeaway of SIVB's failure is that cracks are starting to appear in the U.S. banking system as a direct result of the Fed's rapid pace of rate hikes in 2022. How will the Fed react in the upcoming FOMC meetings?

Inflation Remains Stubbornly High

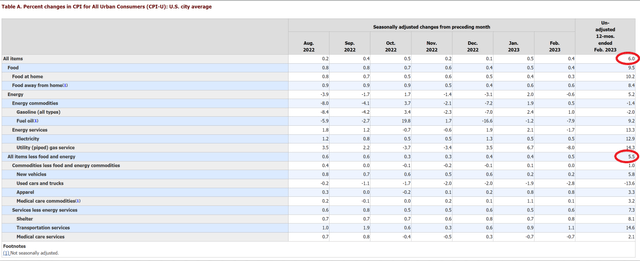

On the one hand, February CPI inflation remains far too high for the Fed to declare victory, with headline CPI inflation of 6.0% YoY and core inflation of 5.5% YoY (Figure 4).

Figure 4 - CPI Inflation remains too high (BLS)

In fact, MoM core inflation readings appear to be accelerating, from 0.3% in November to 0.4% in December and January to 0.5% in February. Strictly from the data, the pace of core inflation should argue for a faster pace of rate hikes in order to stop inflation from becoming entrenched.

Fed Faces Pressure To Stop Raising Interest Rates

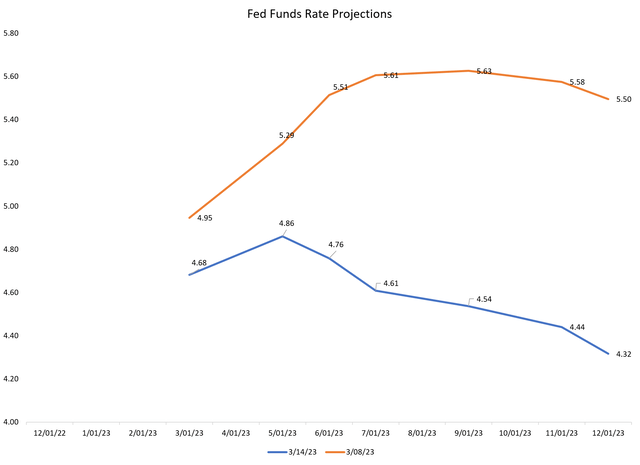

On the other hand, with multiple regional banks failing, there is intense political pressure on the Fed to pause their rate hikes, if not outright cut interest rates. In fact, if we look at traders' expectations of terminal Fed Funds rates, we can see a dramatic collapse in forward interest rate hike expectations in the past few days (Figure 5).

Figure 5 - Traders have dramatically repriced Fed rate hikes (Author created with data from CME)

On March 8th, following Jerome Powell's mildly hawkish Senate and Congress testimony, traders were expecting the Fed to continue increasing interest rates well into H2/2023, with a terminal Fed Funds rate of 5.63%, or roughly four and a half additional rate hikes.

However, following the SIVB debacle, on March 14th, forward rate hike expectations have collapsed, with traders now expecting only a 75% chance of a rate hike in March, and terminal rates peaking at 4.86%, or roughly one and a half additional hikes. Some economists are even calling for the Fed to cut interest rates at the upcoming FOMC meeting on March 22, 2023.

Gold Loves Rush To Safety

As fear re-entered the markets and traders price in a dramatic Fed 'pivot', gold prices have rocketed higher in the past few days, rallying by roughly $100 / oz since troubles began at SIVB (Figure 6).

Figure 6 - Gold prices have rocketed higher as a safe haven trade (tradingeconomics.com)

Is this move in gold prices sustainable?

Real Yields May Start To Drive Gold Price

Looking forward, if the Federal Reserve is indeed finished raising interest rates for this cycle in the next few months due to heightened banking system fears, then that could be an implicit admission of defeat in its fight against inflation.

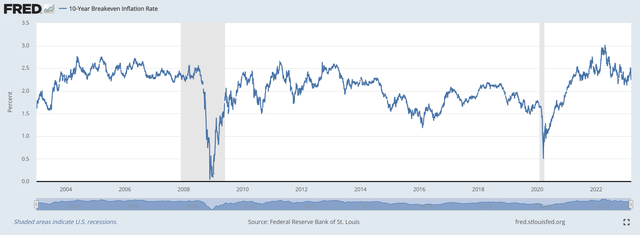

So far, despite soaring inflation in 2021 and 2022, investors have generally been sanguine about long-term inflation as they trust the Fed will be able to bring inflation back under control, with 10-Yr breakeven rates still well anchored below 3% (Figure 7).

Figure 7 - Long-term inflation expectations remain well anchored (St Louis Fed)

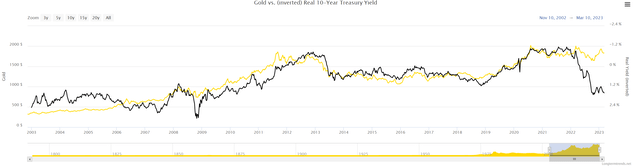

Historically, gold prices have a -0.82 correlation to 10-Yr real interest rates, measured as the Nominal 10-Yr Treasury Yield subtract the 10-Yr Inflation Breakeven Rate (Figure 8).

Figure 8 - Gold is highly correlated to real interest rates (longtermtrends.net)

One of the main reasons I was cautious on gold previously was because the Fed appeared intent on driving nominal interest rates higher while inflation expectations remain well anchored. As shown in Figure 8 above, if we were to model gold in terms of the 10-Yr real interest rates, the implied gold price should be far lower, ~$1000 / oz.

But if the Fed stop raising interest rates, then nominal interest rates will likely stay flat or even decline, as traders price in rate cuts. Furthermore, with inflation stubbornly high and the Fed 'giving up' on inflation, inflation expectations may become un-anchored to the upside. The combination of flat to lower nominal yields plus higher inflation breakevens could spur the next major move higher in gold.

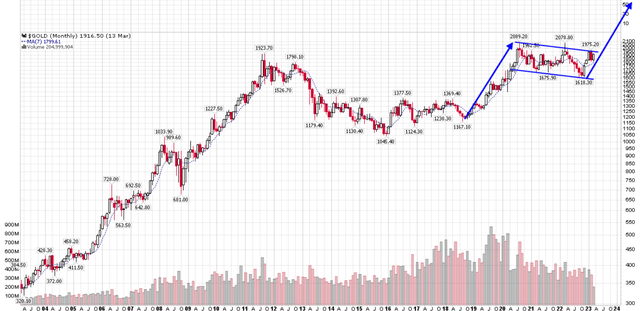

Technicals Consolidating Below Breakout Level

In late January, I called for a consolidation in gold prices, as the weak-U.S. dollar driven rally from October 2022 was long in the tooth and prone to negative surprises. That proved to be the correct assessment, as we are still consolidating below the January high in gold prices.

If we take a step back, the technical picture has certainly improved, with gold prices on the cusp of breaking out of a multi-year bullish flag pattern (Figure 9).

Figure 9 - Gold prices on the cusp of a major breakout (Author created with price chart from stockcharts.com)

Depending on whether Jerome Powell and the Federal Reserve continue to raise interest rates in the next few FOMC meetings, we could see further consolidation in gold prices.

However, a setup is starting to emerge that if the Fed stop raising interest rates before taming inflation, then we could see a dramatic breakout in gold prices as inflation expectations become un-anchored.

Conclusion

The Sprott Physical Gold Trust gives investors exposure to allocated gold bullion safely stored at the Royal Canadian Mint. After having correctly called the consolidation in gold prices, I am beginning to warm up to gold as I see the Federal Reserve being stuck between a rock and a hard place. Inflation remains stubbornly high while the U.S. banking system is starting to show cracks from the Fed's 2022 rate hikes.

If the Fed abandon its fight against inflation, we may see inflation expectations become un-anchored and gold prices soar. To play this theme, I have rebuilt my core position in gold via the PHYS fund, and will be looking to add gold exposure on any upcoming pullbacks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PHYS:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.