Colgate-Palmolive: The Perfect Buffett-Style Dividend Aristocrat Buy

Summary

- The Financial Times reports the largest deposit shifts towards large banks in over a decade. The SVB Financial Group crisis might not be fully contained.

- The bond market just experienced a 1-in-a-million day event, signaling potential financial panic among bond investors who expect a recession as early as September.

- Colgate-Palmolive Company is one of the best "anti-bank" defensive dividend kings you can buy, with an AA-rated balance sheet, a 60-year dividend growth streak, and historically low volatility in bear markets.

- Colgate's S&P risk management score is 100th percentile, in the top 80 companies on earth. This is a 217-year-old company that hasn't missed a dividend payment in 128 years.

- Colgate is 5% historically undervalued, a classic Buffett-style "wonderful company at a fair price." Long-term analysts expect about 11% returns, and it could double in six years, doubling the returns of the S&P 500. If you're worried about recession and the financial system, Colgate is one of the best very low risk dividend aristocrats you can buy now.

- Looking for more investing ideas like this one? Get them exclusively at The Dividend Kings. Learn More »

tiero

The full video version of the article was published on Dividend Kings on Tuesday, March 14th.

---------------------------------------------------------------------------------------

Recently, we've seen some of the craziest financial markets in decades.

World-class banks crashing as much as 20% in a day.

Regional banks cratering as much as 80% in a day.

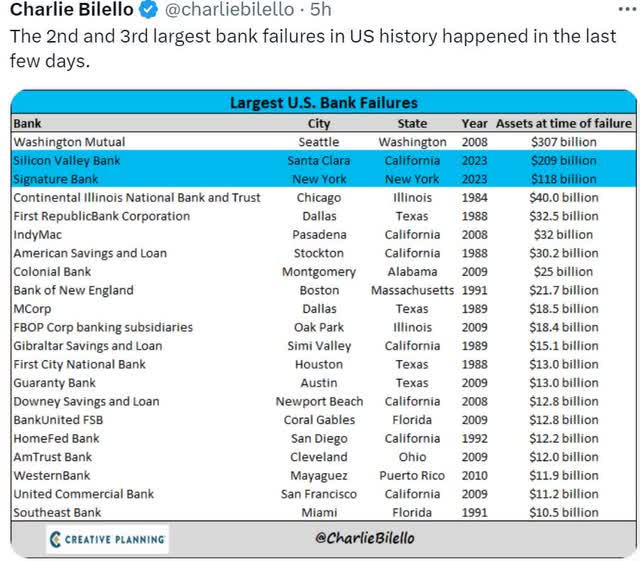

Two of the biggest bank failures in history.

The bond market is trading like crypto.

We live in troubled times, and many people worry that a new financial crisis has begun.

Let's look at what's happening with the financial system, recession risk, and, most importantly, why Colgate-Palmolive Company (NYSE:CL) is a perfect Buffett-style dividend aristocrat buy for these troubled times.

Because no matter what's coming next for inflation, interest rates, or the economy, Colgate truly is an ultra sleep-well-at-night blue-chip you can trust with your hard-earned savings.

An Update On The SVB Banking Crisis

- an introduction to the SVB crisis and the government's response.

Is the regional banking crisis over? While the Fed, Treasury, and FDIC have backstopped all US banking deposits, it's too early to tell if this has fully contained the crisis.

People familiar with the matter told the FT that large financial institutions, including JPMorgan Chase, Citi, and Bank of America, are speeding up the normal onboarding process in response to a deluge of requests from people seeking to move money from smaller banks.

Executives tell the FT that the deposit movement is the largest in over a decade." - FactSet (emphasis added).

The news of the Main Street American Deposit bailout (my term for the new policies) broke on Monday. Hence, it's too early to tell whether or not the most at-risk regional banks will fail or whether the new liquidity guarantees by the Fed will stem the tide of deposit runs.

Most At-Risk Banks, According To Bloomberg

First Republic Bank of California (FRC): $176 Billion In Deposits

Silicon Valley Bank (SIVB): $173 billion in deposits

Signature Bank (SBNY): $89 billion in deposits

Zions Bancorp (ZION): $72 billion in deposits

Western Alliance Bancorp (WAL): $54 billion in deposits

PacWest (PACW): $34 billion in deposits

Silvergate Capital (SI): $6.3 billion in deposits

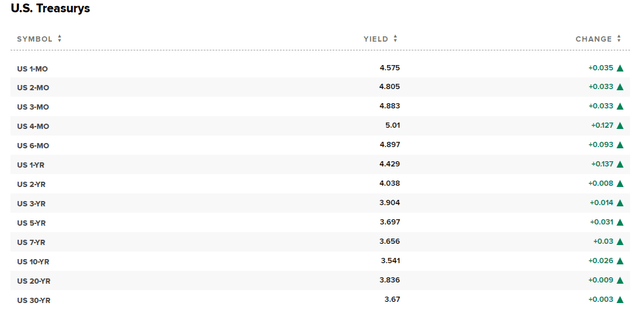

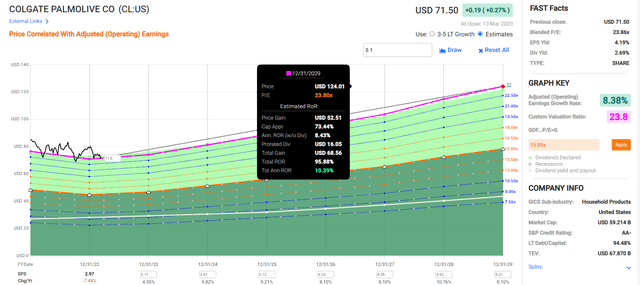

The Bond Market Is Worried About Recession

Bloomberg

The 2-year yield, a proxy for the Fed funds rate in the bond market, just fell over 1% in three days.

- 61 basis point decline on Monday, March 13th

- a five standard deviation event

- 1 in 1 million day event.

The 3-day drop in 2-year yield was the largest since Black Monday 1987.

- when the S&P fell 20% in a single day.

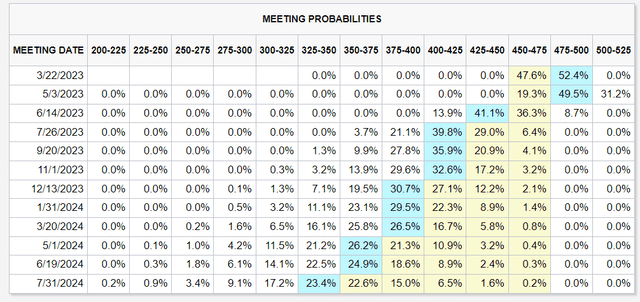

The bond market is calm as of March 14th, with bond yields modestly recovering from their historical decline (the mother of all bond rallies).

The bond market is now pricing in a coinflip that the Fed won't hike anymore and could even start cutting rates as early as June.

In fact, the bond market is pricing in 3 rate cuts by the end of the year and five cuts by July of 2024.

- due to recession

- which the bond market says might now be starting as early as September.

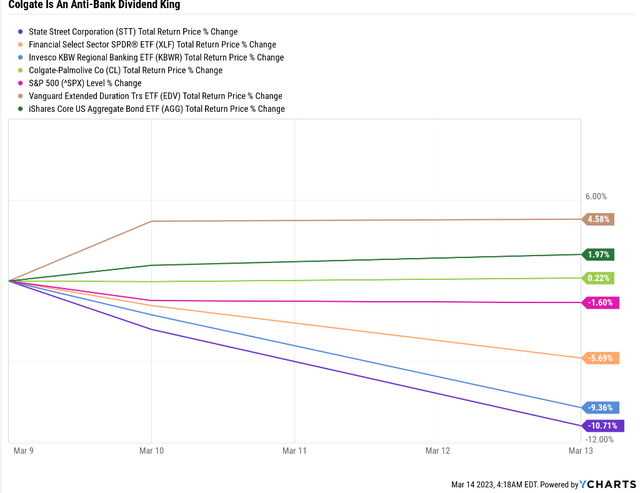

So let's consider why Colgate is one of the best "anti-bank" dividend kings you can buy right now.

Reason One: One Of The Safest And Highest-Quality Companies On Earth

While Colgate isn't a bond alternative, it has held up very well during the SVB crisis.

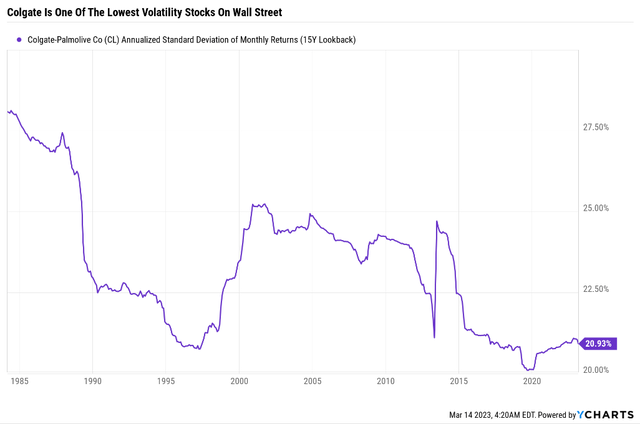

For context, the average annual volatility for standalone companies is 28%, and for dividend aristocrats, it's 24%. Johnson & Johnson (JNJ) is the lowest for any individual company at 15%.

- In any given year, JNJ can fall 15%, CL 20%, aristocrats 25%, and regular stocks 28%.

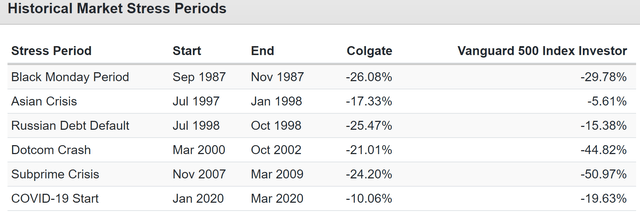

In most periods of market crisis, Colgate falls about 41% as much as the S&P 500.

Colgate is a defensive recession-resistant dividend king and one of earth's most dependable dividend blue chips.

- 97% very low risk 13/13 Ultra Sleep-Well-At-Night dividend king

- 60-year dividend growth streak

- 128 years without missing a dividend payment.

Colgate was founded in 1806 by William Colgate in NYC and has survived and thrived for 217 years, including:

44 recessions

11 depressions

the Great Depression

two world wars

six killer pandemics

including the Spanish Flu pandemic that killed 5% of humanity

over 23 bear markets

including an 86% market crash

inflation as high as 22%

interest rates as high as 20%.

Colgate is built to last and will likely outlive not just us but our grandchildren as well.

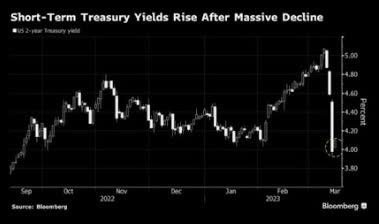

FactSet Research Terminal

Colgate is a highly diversified company, with 67% of sales coming from outside the U.S.

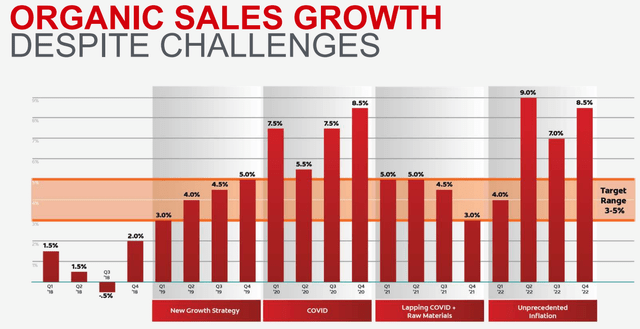

Under CEO Noel Wallace (a 30-year company veteran), Colgate has refocused on R&D (2% of sales) and new product development, and the results have been impressive.

- 15 consecutive quarters of sales growth meeting or exceeding its 3% to 5% sales growth guidance.

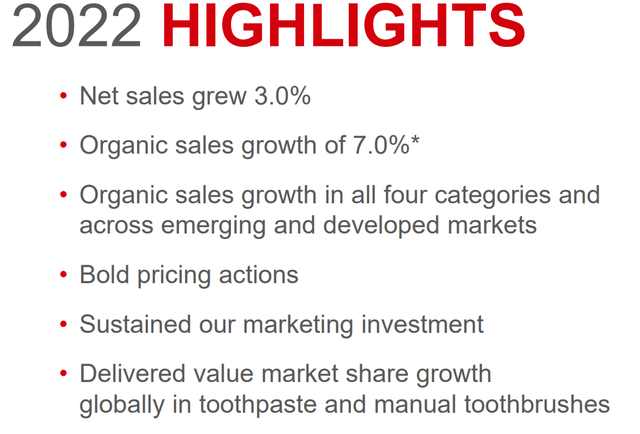

In 2022 Colgate achieved 7% organic sales growth in constant currency and 3%, including negative currency effects from the strong dollar.

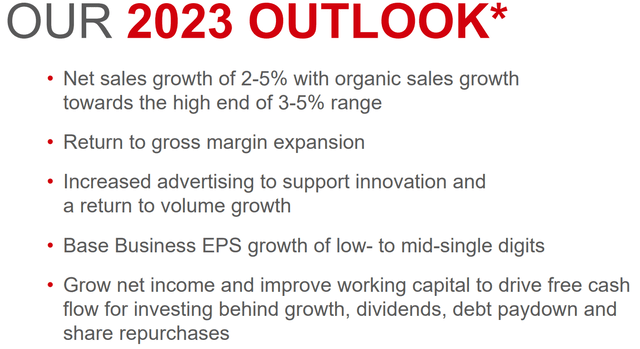

For 2023 management expects organic sales growth of nearly 5%, with about 5% EPS growth.

- in a recession year.

Colgate has consistently delivered organic growth within its target range and has had strong pricing power in recent quarters, allowing it to post the strongest growth in years.

Colgate spends 12%-13% of sales on marketing to maintain its wide moat and strong market share.

While rising supply costs are a problem (for the entire industry), Colgate is cutting costs by $100 million per year via supply chain efficiency management.

Thus it's working to reduce costs while not sacrificing product development or effective marketing to maintain its brands.

How effective is Colgate's marketing? How strong is its moat? Just take a look at its market share:

- 40% worldwide toothpaste market share (2.5X more than its 2nd largest rival)

- 40% market share in India (2nd largest peer is low teens)

- 67% market share in Brazil (Procter & Gamble #2 at 10% and Unilever #3 at 7%)

- 27% in China (P&G #2 at 13%).

Gurufocus Premium

Colgate's economies of scale allow it to maintain stable margins in the top 20% of 1828 global peers, confirming its wide and stable moat.

That includes a return on capital of 70% over the last year.

- Greenblatt's favorite proxy for quality and moatiness

- annual pre-tax profit over the cost of running the business

- for every $1 it takes to run Colgate, the company earns $0.70 in pre-tax profit.

Colgate's cash return on invested capital is 21% compared to average borrowing costs of 2.51%.

Why can Colgate borrow at negative real interest rates?

Colgate Credit Ratings

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | AA- stable | 0.55% | 181.8 |

| Moody's | Aa3 (AA- Equivalent) Stable Outlook | 0.55% | 181.8 |

| Consensus | AA- Stable Outlook | 0.55% | 181.8 |

(Sources: S&P, Moody's.)

This AA-rated company has a fundamental risk of 0.55% of losing all your money in the next 30 years.

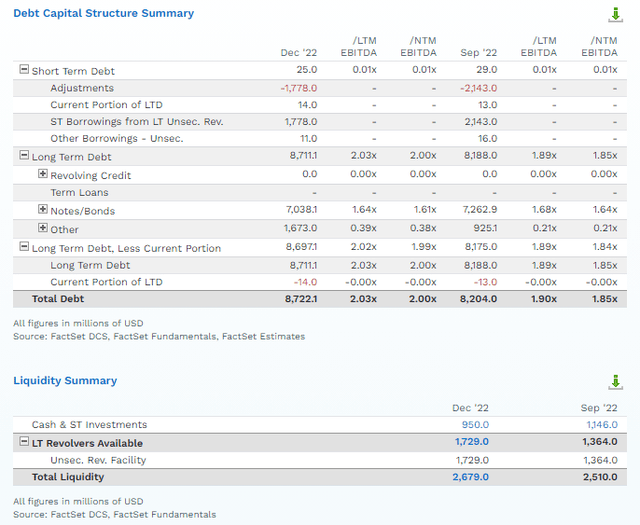

Colgate's debt/EBITDA (leverage) ratio is 2X; half the 4X rating agencies consider safe for this industry.

Its net debt/EBITDA ratio is just 1.9X, and its interest coverage ratio is 24.5X, three times the 8+ rating agencies consider safe.

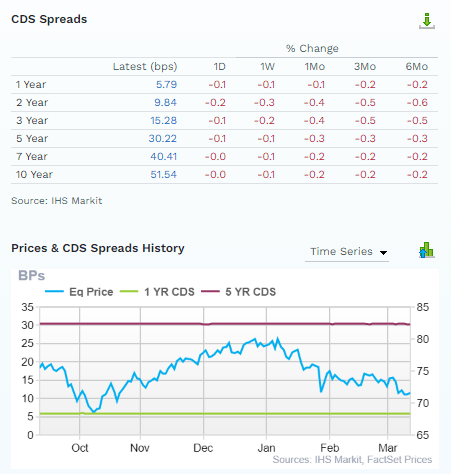

FactSet Research

Credit default swaps are publicly traded insurance policies the bond market takes out against potential default. They represent real-time fundamental risk estimates from the "smart money" on Wall Street.

Colgate's fundamental risk is dead steady over the last six months, as the bond market ignores price volatility and focuses purely on fundamental risks to the business.

Bottom Line: Colgate is a low volatility, defensive ultra-swan dividend king you can trust no matter what happens next with the economy or the banking system.

Reason Two: One Of The Best Growth Profiles In Its Industry

There are many defensive consumer staples aristocrats, but I like Colgate more than most because of its superior growth outlook.

| Metric | 2022 Growth | 2023 Growth Consensus (recession year) | 2024 Growth Consensus (possible recession year) | 2025 Growth Consensus |

| Sales | 4% | 5% | 4% | 5% |

| Dividend | 4% | 2% | 6% | 12% (62-year growth streak) |

| Earnings | -7% | 5% (guidance) | 10% | 9% |

| Operating Cash Flow | -22% | 33% | 7% | 6% |

| Free Cash Flow | -32% | 43% | 9% | 7% |

| EBITDA | -6% | 11% | 7% | 6% |

| EBIT | -7% | 11% | 7% | 7% |

(Source: FAST Graphs, FactSet Research.)

Colgate's fundamentals are expected to hold up well in the 2023 recession and then accelerate in the coming years.

- 8% long-term dividend growth and a 62-year streak by 2025.

Colgate is expected to translate 4% sales growth into 8% EPS growth long-term, according to the 24 analysts who cover it on Wall Street.

Consensus Long-Term Return Forecast

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| ZEUS Income Growth (My family hedge fund) | 4.2% | 10.3% | 14.5% | 10.2% |

| Schwab US Dividend Equity ETF | 3.6% | 9.4% | 13.0% | 9.1% |

| Vanguard Dividend Appreciation ETF | 2.2% | 10.0% | 12.2% | 8.5% |

| Nasdaq | 0.8% | 10.9% | 11.7% | 8.2% |

| Colgate | 2.7% | 8.1% | 10.8% | 7.6% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Source: DK Research Terminal, FactSet, Morningstar.)

That means a total return potential of about 11%, slightly better than the dividend aristocrats and S&P 500.

Historical Returns Since 1985

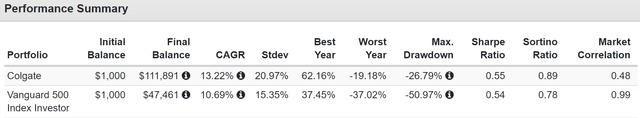

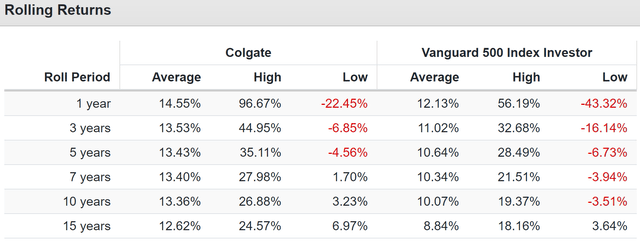

Over the last 37 years, Colgate has delivered 112X returns or 13% annually.

- 40X adjusted for inflation vs 17X for the S&P 500.

Colgate is expected to grow slightly slower than in the past but still deliver superior returns to the market with low volatility and one of the safest dividends on earth.

Inflation-Adjusted Consensus Return Potential Per $1,000 Initial Investment

| Time Frame (Years) | 7.9% CAGR Inflation-Adjusted S&P 500 Consensus | 8.5% CAGR Inflation-Adjusted CL Consensus | Difference Between Inflation-Adjusted CL Consensus And S&P Consensus |

| 5 | $1,465.25 | $1,504.35 | $39.10 |

| 10 | $2,146.96 | $2,263.07 | $116.11 |

| 15 | $3,145.84 | $3,404.45 | $258.61 |

| 20 | $4,609.44 | $5,121.48 | $512.04 |

| 25 | $6,753.99 | $7,704.49 | $950.50 |

| 30 (retirement time frame) | $9,896.29 | $11,590.25 | $1,693.96 |

| 35 | $14,500.55 | $17,435.79 | $2,935.24 |

| 40 | $21,246.95 | $26,229.53 | $4,982.58 |

| 45 | $31,132.11 | $39,458.39 | $8,326.28 |

| 50 | $45,616.37 | $59,359.22 | $13,742.85 |

| 55 | $66,839.43 | $89,297.03 | $22,457.59 |

| 60 (investing lifetime) | $97,936.56 | $134,333.96 | $36,397.40 |

| 100 (philanthropy time frame) | $2,080,852.87 | $3,523,516.81 | $1,442,663.95 |

(Source: DK Research Terminal, FactSet.)

Over the next 30 years, CL is expected to potentially deliver 12X inflation-adjusted returns, slightly better than the S&P 500.

| Time Frame (Years) | Ratio Inflation-Adjusted CL Consensus vs. S&P consensus |

| 5 | 1.03 |

| 10 | 1.05 |

| 15 | 1.08 |

| 20 | 1.11 |

| 25 | 1.14 |

| 30 | 1.17 |

| 35 | 1.20 |

| 40 | 1.23 |

| 45 | 1.27 |

| 50 | 1.30 |

| 55 | 1.34 |

| 60 | 1.37 |

| 100 | 1.69 |

(Source: DK Research Terminal, FactSet.)

Colgate is one of the lowest risk and least volatile ways to potentially beat the market long-term while enjoying a higher and much safer yield.

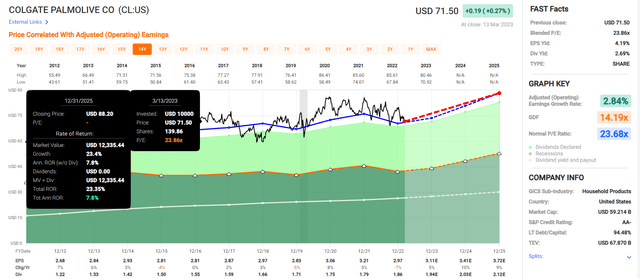

Colgate 2025 Consensus Return Potential

Colgate 2029 Consensus Return Potential

Over the next six years, CL has about 2X the return potential of the S&P and could realistically double.

- 10% to 13% five-year consensus return potential range.

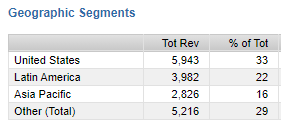

Reason Three: A Classic Buffett-Style "Wonderful Company At A Fair Price"

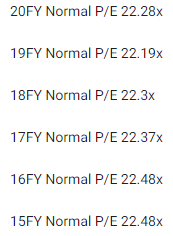

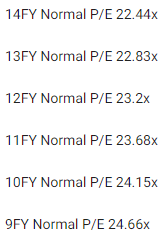

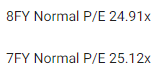

Over the last 20 years, billions of collective income investors have consistently paid between 22 to 25X earnings for Colgate.

FAST Graphs, FactSet FAST Graphs, FactSet FAST Graphs, FactSet

- 91% statistical probability this range includes intrinsic value.

| Metric | Historical Fair Value Multiples (all Years) | 2022 | 2023 | 2024 | 2025 | 12-Month Forward Fair Value |

| 5-Year Average Yield | 2.40% | $77.50 | $80.00 | $80.00 | $87.92 | |

| P/E | 22.57 | $167.47 | $70.19 | $76.96 | $221.86 | |

| Average | $105.96 | $74.78 | $78.45 | $125.93 | $75.55 | |

| Current Price | $71.50 | |||||

Discount To Fair Value | 32.52% | 4.38% | 8.86% | 43.22% | 5.37% | |

Upside To Fair Value (including dividend) | 48.20% | 4.58% | 9.72% | 76.13% | 8.36% | |

| 2023 EPS | 2024 EPS | 2023 Weighted FFO | 2024 Weighted FFO | 12-Month Forward P/E | Historical Average Fair Value Forward P/E | Current Forward P/E |

| $3.11 | $3.41 | $2.45 | $0.72 | $3.17 | 23.8 | 22.5 |

Historically valued at 24X earnings, including dividends, Colgate is a classic Buffett-style "wonderful company at a fair price" trading at 22.5X earnings.

- 15.0X cash-adjusted earnings.

Analyst Median 12-Month Price Target | Morningstar Fair Value Estimate |

| $81.21 (25.6X earnings) | $74.00 (23.3X earnings) |

Discount To Price Target (Not A Fair Value Estimate) | Discount To Fair Value |

| 11.96% | 3.38% |

Upside To Price Target (Not Including Dividend) | Upside To Fair Value (Not Including Dividend) |

| 13.58% | 3.50% |

12-Month Median Total Return Price (Including Dividend) | Fair Value + 12-Month Dividend |

| $83.13 | $75.92 |

Discount To Total Price Target (Not A Fair Value Estimate) | Discount To Fair Value + 12-Month Dividend |

| 13.99% | 5.82% |

Upside To Price Target ( Including Dividend) | Upside To Fair Value + Dividend |

| 16.27% | 6.18% |

Morningstar's discounted cash flow model estimates CL is worth $74, almost exactly what its historical fair value suggests.

Analysts expect Colgate to hit 26X earnings within a year, resulting in a 16% upside, though just half that gain would be justified by its fundamentals.

| Rating | Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $74.78 | $78.45 | $75.55 |

| Potentially Good Buy | 5% | $71.04 | $74.53 | $71.78 |

| Potentially Strong Buy | 15% | $63.56 | $66.68 | $64.22 |

| Potentially Very Strong Buy | 25% | $53.28 | $58.84 | $56.67 |

| Potentially Ultra-Value Buy | 35% | $48.60 | $50.99 | $49.11 |

| Currently | $71.50 | 4.38% | 8.86% | 5.37% |

| Upside To Fair Value (Including Dividends) | 7.27% | 12.41% | 8.36% |

Colgate is a potentially good buy for anyone comfortable with its risk profile.

Risk Profile: Why Colgate Isn't Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Colgate's Risk Profile Includes

- competition risk (from local brands in other countries and private labels in the U.S.)

- margin risk (from commodity prices)

- international expansion risk (Colgate's brands aren't as well established as in the U.S. in all markets)

- supply chain risk: disrupted in the pandemic

- labor retention risk: tightest job market in 54 years

- currency risk: 67% of sales outside the U.S. and -4% currency effects in 2022

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global's global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

CL scores 100th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management.

CL's Long-Term Risk Management Is The 8th Best In The Master List 99th Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 | Very Good | Very Low Risk |

| Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

CL's risk-management consensus is in the top 80 of all global companies according to S&P, on par with:

- British American Tobacco (BTI)

- Illumina (ILMN)

- SAP (SAP)

- Cigna (CI)

- S&P Global (SPGI)

- Waste Management (WM)

- Cisco (CSCO).

The bottom line is that all companies have risks, and CL is exceptional, at managing theirs, according to S&P.

How We Monitor CL's Risk Profile

- 24 analysts

- two credit rating agencies

- 26 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk assessment.

When the facts change, I change my mind. What do you do, sir?" - John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Colgate Is The Perfect Buffett-Style Dividend Aristocrat For Troubled Times

Let me be clear: I'm NOT calling the bottom in CL (I'm not a market-timer).

Even Ultra SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

While I can't predict the market in the short term, here's what I can tell you about CL.

- one of the highest-quality companies on earth (top 17% of all blue-chips)

- a defensive dividend king Ultra SWAN with a 60-year dividend growth streak (and hasn't missed a dividend payment in 128 years since 1895)

- very safe 2.7% yield (growing 8% over time)

- 10.8% long-term return potential Vs. 10.2% S&P

- historically 5% undervalued (Buffett-style wonderful company at a fair price."

- 22.5X earnings vs. 22 to 25 historical

- 15X cash-adjusted earnings (GARP)

- 94% consensus return potential over the next five years, 11% to annually, 2X more than the S&P 500.

If you're worried about the recent banking crisis, consider Colgate, a company that's survived and thrived through 11 depressions.

If you're worried about a recession, consider Colgate, a company that has been raising its dividend for six consecutive decades and hasn't missed a payment since 1895.

If you're looking for an ultra SWAN dividend growth blue-chip with low volatility that can handle anything the economy throws at us in the coming years, there are few better choices today than Colgate-Palmolive Company.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.