Veolia: Global Utility With A Double-Digit Dividend Growth

Summary

- Veolia is a France-based utility company with an almost 200-year history. It may be old, but it's not stagnating. Quite the opposite.

- The company has seen high growth in all three of its segments (water, waste and energy) in 2022 and expects double-digit growth to continue.

- The company has impressive upside from here, but I'll wait for a pullback to a key technical level before buying.

- See my analysis below.

Ceri Breeze/iStock Editorial via Getty Images

Dear readers/followers,

Today I want to cover Veolia (OTCPK:VEOEY) which is a France-based defensive utility company with almost a 200 year history, solid growth potential and a portfolio of essential services that our society cannot exist without. I believe the company can be a good fit for most defensive and income oriented investors because of its safe and growing dividend and very low volatility of the underlying business. Moreover the business should do well even at times of high inflation as 70% of their revenue has CPI linked indexation. Below I present my analysis of the company.

Note: Veolia is a French-based company. This means that native shares are EUR-denominated and trade on the Paris Euronext Exchange under the ticker VIE. These are the shares I will be referring to in my article. Shares can also be purchased across other major European exchanges or as an ADR under the ticker VEOEY. Always do your own research on tax implications.

Basics

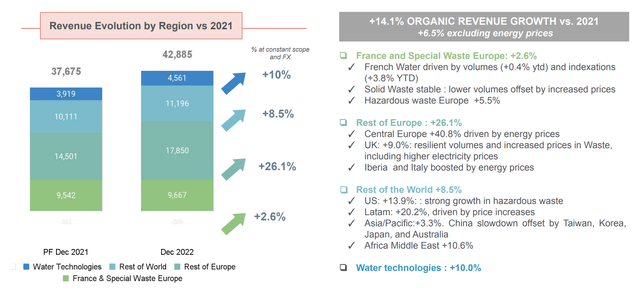

The company originated in France but has become a global player and of the largest utility companies in the world with revenues of nearly EUR 50 Billion. Revenues are roughly split into thirds between France, the rest of Europe and the rest of the world with operations on every single continent. Veolia has operations in three major segment. Let's have a look at these one by one.

Their largest segment, the water business accounts for 42% of total revenues and grew by 8.2% YoY to EUR 18.3 Billion. The growth was primarily attributed to tariff indexations across all countries, good volumes and good performance in their water technology segment (technologies related to water purification, desalination etc.).

The waste business which accounts for 37% of revenues saw a 6.8% YoY increase to EUR 15.8 Billion primarily driven by strong volumes and continued price increases in their hazardous waste segment which alone increased by over 12% YoY. Their global presence in hazardous waste is quite notable, because there aren't any other major companies that operate in this space on a global scale. It is also a segment which will likely see high growth going forward.

Lastly their smallest segment (21% of revenue), the energy business grew by a massive 44% YoY to EUR 9.2 Billion. This sizeable increase was of course primarily fuelled by the sharp increase in energy prices in Central Europe which is where 90% of Veolia's district heating comes from. Higher prices alone accounted for a 37% increase while higher volumes did the rest.

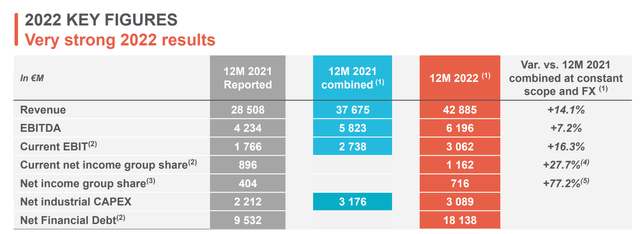

Financials

The three segments combined resulted in overall revenue growth of 14.1% in 2022 (6.5% excluding the effect of energy price increases). Net income increased by almost 30% YoY to EUR 1.2 Billion. For 2023 management guided towards an EBITDA increase of 5-7%, driven by EUR 350 Million of efficiency gains and over EUR 280 Million of cumulated synergies from their recent acquisitions. Net income is expected to grow double digits and reach EUR 1.3 Billion by year-end and management expects 40% EPS accretion by 2024, this means that EPS could reach EUR 2.00 per share by the end of 2024.

These very strong results lead to a dividend increase of 12% to EUR 1.12 per share. At the current price of EUR 27.50 per share the dividend yield is 4.1%. The dividend is expected to grow in line with EPS so I expect another double-digit increase in 2023. With EPS of EUR1.54 the dividend is quite well covered with a payout ratio of just above 70%.

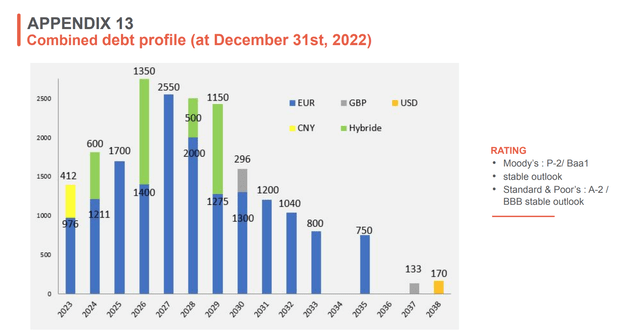

The company has a BBB-rated balance sheet with EUR 27 Billion in long term debt. The majority (65%) of debt is EUR-denominated which helps keep the average interest rate low at just 2.47% (83% fixed rate). With EUR 9 Billion in cash the company should have no problem managing its upcoming debt maturities. Net debt/EBITDA stands at 3x which is reasonable, but debt still represents a potential risk for the company if rates remain higher for longer.

Valuation

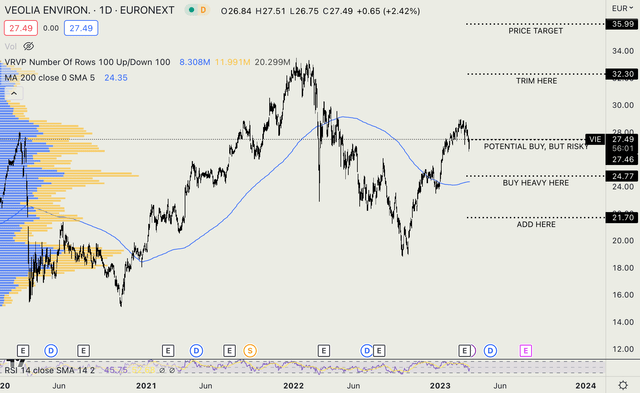

So we have an expected 2023 EPS of EUR 1.82 per share. At today's stock price of EUR 27.50 that means a forward P/E of 15x which is still quite low compared to the levels where Veolia has traded historically. Over the past 20 years, the stock has traded very close to a P/E of 22x for most of the time, in fact the divergence we have today is the biggest we've seen since the 2008 crisis.

Am I willing to value it at 22x earnings today? Not really. The company does have a significant level of debt with net debt/EBITDA of around 3x and therefore their interest expense will likely go up as they refinance their debt due each year. Moreover in a high interest rate environment multiples tend to be lower.

Personally I think it's reasonable to pay up to 18x forward earnings for a company of this quality. At 18x earnings, the company is about 17% undervalued here and could return 30% over the next two years (in addition to growing dividends) if management delivers on their EPS guidance. As such, I have a price target of EUR 36.00 per share and expect the stock to achieve this by 2024/2025.

So with that said, let's summarize what we can reasonably expect from Veolia over the next two to three years:

- a 4.1% dividend yield (likely to grow by double digits per year)

- a double-digit earnings growth until at least 2024

- 17% upside from multiple expansion as the stock returns to 18x earnings

- market beating total annual return of 20-30%

That's really solid alpha. I already own a small position in the company, but I am not comfortable adding at the current level. I rate Veolia as a "HOLD" here at EUR 27.50 per share. This is not because the upside is not there, but because we've seen a massive 50% rally from the October low and I don't like jumping into stocks after such big rallies. That's why I will wait for a pullback before adding to my position. If you don't have a position yet, and want in, maybe consider waiting as well. There's a key technical level just under EUR 25.00 per share which is where I would go heavy. I have no idea if the stock will get there, but if it does, it will represent a great entry point. You can consider writing naked puts at EUR 25.00 per share to get paid to wait.

Authors analysis on Tradingview

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VEOEY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.