Sell Alert For Virgin Orbit Stock: A Massive Failure (Rating Downgrade)

Summary

- Virgin Orbit Holdings, Inc. faces divergence between development, projections and funding capability.

- Years late on development, the company still is not consistently booking successful launches.

- Virgin Orbit shareholders face massive dilution, as the company does not have funds available to operate a full quarter beyond Q1 2023.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Hugh Hastings

In January 2023, I covered Virgin Orbit Holdings, Inc. (NASDAQ:VORB). At the time, I had a Hold rating on the stock for the simple reason that the company either thrives and rewards investors richly or it becomes a massive failure and you are going down with the ship. Holding the stock has so far resulted in a negative return of 56%, but that is really the risk of investments in names such as Virgin Orbit. I saw other contributors with a Buy rating on the stock, and that is a rating that not in the slightest recognized the risks associated to the business.

In this report, I will be addressing the most recent development regarding Virgin Orbit, and that is that the company is basically in an operational pause of a week and delaying payments, which is a nice way of saying that it is preserving cash because it may not have enough to operate going forward.

What Is The Point Of Virgin Orbit?

What many companies have found is that launching payloads into space is difficult, though there is a huge addressable market. This market can only be unlocked to a greater extent when the high cost burden is lowered. Virgin Orbit aims to do that with air-launched solutions, which on paper provide a more mobile and dynamic launch environment even though there are some strings attached.

Launch Failure Crumbled Virgin Orbit Space Dreams

As I pointed out in my previous report, the road towards success is littered with failures. The key is to learn from those failures and climb a certain learning curve which should result in consistent mission success. The launch failure on the 9th of January made one thing painfully visible, and that is that Virgin Orbit is not yet at this stage. While the company has been aiming for $2.1 billion in revenues by 2026, before they can think about scaling they have to think about improving the reliability which already has been a challenge beyond the plan of increasing launch events by 3x annually for the coming years.

Initially, Virgin Orbit expected first launches by 2016, and they are running five years behind on that schedule when looking at the actual first successful launch. The launch failure also meant that there is significant uncertainty regarding launch plans this year. Virgin Orbit did not provide an official schedule for 2023 launches, but it looked like it would launch seven payloads this year. However, with the first out of seven launches being a failure, the timeline for the other six launches has been unknown, pushing schedules and revenue generation to the right.

Why Is Virgin Orbit Stock Dropping?

So, why is Virgin Orbit down? The answer is very easy. The company is likely going to run out of cash before it will have a reliable product, unless fresh funds are arranged. What Virgin Orbit is experiencing is the effect of having a delayed product development and maturing phase, which runs significantly out of phase with future projections and the funding capacity.

Your product can only be great and return value to investors if:

- It comes at the market when there is demand from it.

- Sufficient funding is available to scale towards more economic deployment.

- It is mature enough to be deployed reliably supporting the scaling effort.

- Sufficient funding is available to mature the product when needed.

Virgin Orbit would only be able to check the box on the first point.

Since the end of the third quarter, Virgin Group has pumped money into Virgin Orbit via Virgin Investments Limited via secured convertible notes, and this is in no way free money. On default, the annual interest of the debt is 12%, and this increases to 16% in the case of continued defaulting on the loan. This is not some money Branson and his group are putting into Virgin Orbit to keep a passion project alive, but an ice cold business decision that gives Virgin Group control over the Virgin Orbit assets in case of default since the notes are secured. Furthermore, for every $1,000 invested the company, can convert debt to 345.525 shares. That would imply that shareholders will be diluted and Virgin Investments Limited could own up to 6% of the company via debt conversion. That itself does not sound too bad, but with a current share price of $0.71, it is highly likely that VIL will want a better debt to conversion rate on its existing notes and any future investments which means that the company could own up to 20% of the company from existing notes at amended terms plus the conversion of any future notes.

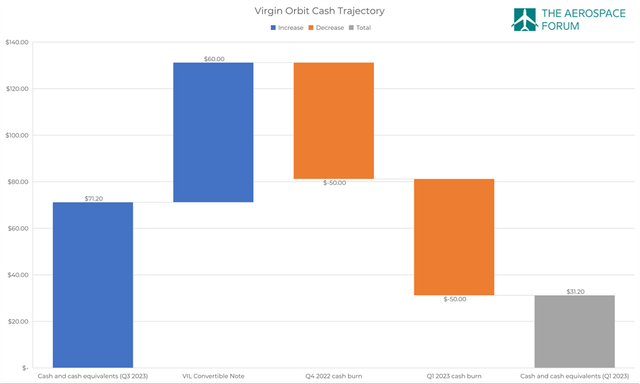

So, things are looking ugly, and it is not the case that Virgin Orbit can go without additional funding. The trend suggests that Virgin Orbit would burn around $45 million during the fourth quarter, and the free cash flow outlook suggests a cash burn that would be around $50 million per quarter plus or minus $5 million. What does this mean? Very simply, it means that at this point Virgin Orbit doesn't have the funds to fund a quarter ahead. That also explains the timing of the week-long shutdown.

Conclusion: Virgin Orbit Stock Is A Sell

In my previous report, I still considered Virgin Orbit Holdings, Inc. a hold. Probably closer to a sell given the financials of the company and the misalignment with the development and maturity of the product but I also noted that upside could be significant in case of success. Chances of success, however, have shrunken further - or at least success that also benefits shareholders - because Virgin Group has been providing funds to keep Virgin Orbit Holdings, Inc. alive, but it comes at a cost. As a result, I think a Sell rating is more appropriate because the way it is looking now is that Virgin Orbit Holdings, Inc. investors have been paying for the development and maturity at a crucial time, but when it comes to harvesting the success, Virgin Group can take it all away.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.