Fidelity MSCI Utilities Index ETF: Fasten Your Seatbelts

Summary

- Traditional risk-on/risk-off behavior is making a comeback.

- Fidelity MSCI Utilities Index ETF’s earnings profile is weak, but its qualities as a defensive asset may come in handy.

- The diminishing effects of the “higher for longer” narrative could reflect well on utilities.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Laurence Dutton

Accidents hurt, but safety doesn't. - Anonymous

The Fidelity MSCI Utilities Index ETF (NYSEARCA:FUTY), is a low-cost (expense ratio of just 0.08%), and stable (annual turnover ratio of just 3%) exchange-traded fund ("ETF") which gives you access to a portfolio of U.S.-based utility stocks. In this article, I'll touch upon a few reasons why this product may be pursued at this juncture.

Why FUTY?

As noted in a post on the Lead-Lag Report Instagram page, March has seen a return of volatility and the flight to safety positioning, themes that had been elusive for large parts of last year. While the front end of the treasury curve will likely continue to gravitate according to the Fed's rhetoric, some interesting things have been happening at the long end. Troubles within the banking sector may or may not be exaggerated, but what it's certainly triggered, is the safe haven status of long-duration treasuries.

I touched upon this in my conversation with volatility and risk management expert Cem Karsan, who had recently popped up on the Lead-Lag Live portal for a chat on market positioning in March. Long-term treasuries are now outperforming by 300 odd bps, and we explored how the analogy of a stretched rubber band may well apply to this segment.

It isn't just long-duration treasuries; we've even seen a spike in credit spreads with gold, too, joining the bandwagon. Meanwhile, Deborah Fuhr, a veteran of the ETF industry, had appeared on Lead-Lag Live, where she noted how high-risk- leveraged ETFs were losing their mojo. All things considered, it looks like we could see the return of traditional risk-on/risk-off characteristics. So how does this impact FUTY, you ask?

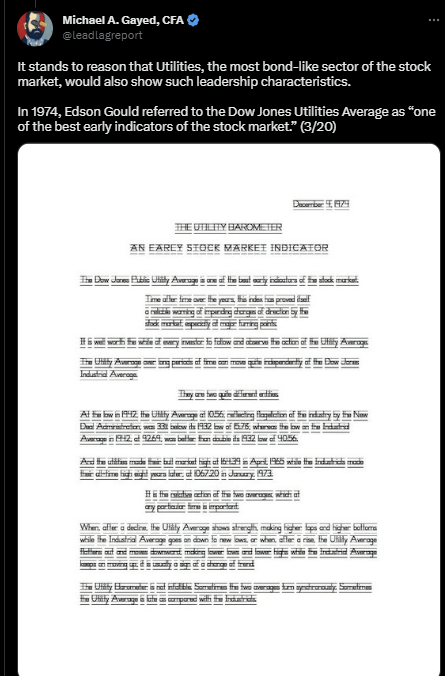

Twitter

Well, market observers who've followed my work over the years would note that I've always characterized the utility sector as the most bond-like segment of the equity markets. Put another way, if bonds aren't your cup of tea, and you're looking for safe-haven plays in the equity markets, few sectors offer you the safe-haven qualities that utilities do.

Granted, utilities aren't the most exciting sector around. If you're looking for high earnings growth, and brisk pronounced uptrends, this isn't the sector to be in. For perspective, note that over the last 5 years, this is a sector whose revenues have grown at less than 1% CAGR. Meanwhile, YCharts estimates point to just 2% earnings growth this year, a far cry from the 17% average earnings growth expected by the constituents of the S&P500!

However, as far as portfolio management goes, we're not looking to the utility sector to provide our home runs, rather these are the lifebuoys that could come to our rescue when things go awry and risk sentiment turns for the worse. David Stockman, who was a guest on Lead-Lag Live, highlighted some of the economic travails that are just around the corner, and if some of his prophecies turn out to be true, the broader markets may have to take it on the chin.

Twitter

During times like that, FUTY's low sensitivity to the market (a beta of just 0.52x) could prove to be very useful in limiting damages to your portfolio from a potential accident. As noted on Twitter, I think there's scope for another leg lower in the equity markets, after we see a pullback of sorts and complacency sets in.

Twitter

Also consider that even though FUTY is an ETF that covers utilities across different buckets of market-cap, its relatively low exposure to small-caps (only 1.5% of the total holdings) could work in its favor. As noted in the Leaders-Laggers section of this week's Lead-Lag Report, small-caps which had been a steady performer all through 2022, witnessed some pretty drastic drawdowns last week, with the small-cap to large-cap ratio making a sharp and decisive reversal.

It's also easy to forget that utilities are intrinsically quite financially geared. For instance, if you look at the table below, it highlights the capital structure of FUTY's top holdings, which have considerable weight in aggregate. With the exception of Consolidated Edison (ED) and Sempra Energy (SRE), all these other stocks currently have a much higher debt-to-equity ratios relative to their historical averages.

YCharts

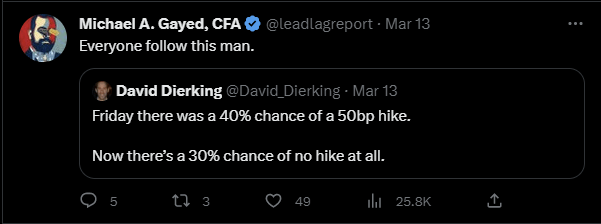

Until recently we've had to deal with the growing clamor of the Fed's "higher for longer" narrative, but since the onset of the banking crisis last week, the narrative has changed considerably, thus also raising the allure of utilities. As noted in a tweet on the timeline of The Lead-Lag Report, last week, we were staring at a 40% probability of a 50bps hike, but since then the equations have changed significantly. Meanwhile, year-end expectations for peak rates, which stood at 5.5% last week, have dropped to just 3.9%. Any reprieve in the higher cost of debt servicing could do a world of good for these utilities' interest coverage ratio.

Twitter

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.