J.B. Hunt Transport Services: Attractive IRR If It Can Hit FY27 Target

Summary

- J.B. Hunt Transport Services reported lower-than-expected earnings due to declining box turn improvement from falling demand.

- Despite inconsistent growth in recent years, there is room for JBHT to exceed industry averages for domestic intermodal growth and achieve high-single-digit growth rates if it reaches its 2027 goals.

- Assuming JBHT can maintain mid-single to low-teens growth rates and a 21x forward PE multiple, the returns algorithm suggests an IRR in the mid-teens in the coming years.

jimfeng

Overview

I am recommending a long position for J.B. Hunt Transport Services (NASDAQ:JBHT) as I believe the business can generate above-average secular growth from Intermodal. Despite the fact that growth has been inconsistent (and sometimes downright discouraging) in recent years, I believe there is room to exceed the industry average for domestic intermodal growth over the past few years. Assuming 1.8x box turns over the period, I estimate that JBHT can generate high-single-digit growth rate if it reaches its long-term goal of 150,000 container count by 2027. Bears may point out that this rate of expansion is significantly lower than the average for the last century. However, I think investors can profit from this disparity in expectations moving forward.

4Q22 earnings

Regarding earnings, JBHT reported 4Q22 EPS of $1.92, which was lower than the consensus estimate of $2.45 per share. Among the many ups and down from the earnings, I am particularly worried about the decline in box turn improvement due to falling demand, which caused a volume shortfall in the quarter. Note that box turn is a key driver for JBHT to hit the FY27 target, in my opinion, and there is still quite a gap from where it is today to the 1.8x target. Nevertheless, I am still somewhat optimistic based on the statements made by management regarding the enhancement of rail service until the end of the year. Although there has been a decrease in demand, I am still optimistic that JBHT will experience an increase in volume through 2023 due to the enhancement in service, which could counterbalance the decline in demand and result in some volume growth. Overall, I think JBHT is going to see some tailwinds in FY23 as reduced congestion should allow for increased volume and margin improvement.

Global trade growth

Underlying my belief that JBHT can hit its long-term target is that global trade growth will continue to be strong, albeit modestly slower than the past. I would expect resumption in global trade to somewhat match global GDP growth. For reference, over the past 2 decades, global trade growth has grown at ~4% while global GDP growth is around ~5%. The reopening of China and the revival of manufacturing expansion could also lead to a temporary acceleration in growth. Given China's slower growth rate in recent years, it's reasonable to expect global trade growth to be somewhat weaker than in previous decades. In addition, there is the ever-present idea of re-shoring and re-routing the supply chain to prevent supply chain disasters. But I think that's just a shifting of origin; goods still need to be moved from A to B; and all these impacts happen over a long period of time, giving JBHT and investors time to readjust their positioning.

Rail service productivity

To grow at a CAGR 10% requires JBHT to win market share from trucks and possibly other intermodal players, improve its transloading capacities, and, most importantly, experience better rail service. In addition, the capability of rail service partners to enhance service consistency will be critical if other intermodal players are planning to add capacity as well. With this, JBHT will be able to increase both its volume and its price-setting power, even as new supply enters the market.

As such, the second leg to growth is improvements made in Rail Service. On their 4Q22 conference call, JBHT said that rail service performance was at an all-time high since 1Q20 when things went south. I expect overall rail service to improve and possibly become more consistent now that congestion in the supply chain has been reduced and demand growth rates have slowed to more typical levels. It stands to also reason that as service quality improves, more and more shippers will feel comfortable using rail service providers again, which will boost intermodal's modal conversion penetration. All of these have a direct impact on JBHT's bottom line through increased output, enhanced efficiency, decreased expenses, and, most importantly, better box turns. By increasing the efficiency of the box turn, JBHT would be able to take a larger share of the underlying industry volumes entering the ports. Another thing I'd like to mention is that shipping via rail and intermodal might be a good way to lessen a company's environmental impact, since doing so would mean fewer trucks on the road.

Valuation

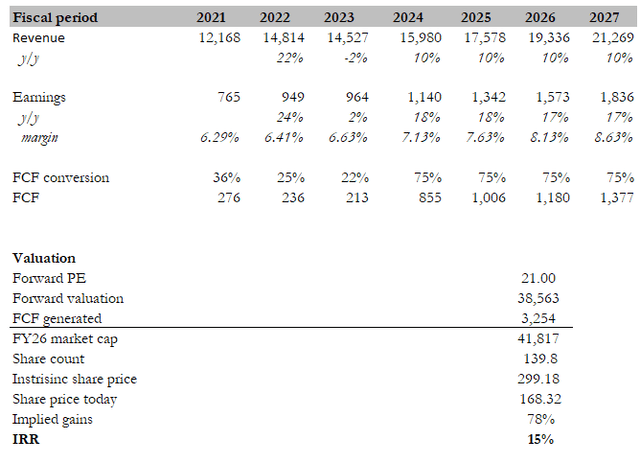

Taken together, I believe JBHT can achieve mid-single to low-teens growth, depending on how many containers and turns it can achieve. Assuming JBHT can maintain these rates of growth and attaching the forward PE multiple of 21x, the returns algorithm is as follows: 10% top-line growth + some margin expansion + FCF yield + 21x Fwd PE= IRR in the mid-teens. As for valuation, JBHT currently trades at a premium (17x forward earnings) as compared to peers like XPO, Knight-Swift Transport, Werner, and Old Dominion in the low teens. The reason for this disparity, I believe, is due to JBHT having a path for faster growth.

Specifically, this is how it would look like in a model:

Risks

There are various risks that could hinder the global recovery in 2H23, such as the possibility a great recession, slow performance in rail service even after the recovery, and competition from new digital players in the brokerage industry. Additionally, there are long-term risks such as excess capacity in the industry, which demand cannot keep up with, thereby leading to depressed pricing.

Conclusion

In conclusion, I am recommending a long position for JBHT due to its potential for above-average secular growth from Intermodal, driven by global trade and internal productivity improvements. Although 4Q22 earnings showed a decline in box turn improvement due to falling demand, I remain somewhat optimistic about the enhancement of rail service until the end of the year, which could lead to increased volume and margin improvement.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.