The Worst Lies Ahead Of Us: Part II - The Bear Market Deepens

Summary

- The long and variable lags of monetary policy are beginning to be felt throughout the economy.

- Bank runs have begun, and I believe this is a canary in the coal mine for future stress in the banking system.

- The bear market continues to deepen, as we approach the waterfall edge, where fear rises, and the cycle progresses toward new lows.

24K-Production

Part I of this series, Euphoria's Last Stand, looked at the first quarter action, and snap back in unprofitable tech companies that has characterized this first quarter rally. As we approach the second quarter things are getting demonstrably worse. On March 10th the FDIC closed Silicon Valley Bank (SIVB), a key source of funding for startups, largely in technology and life sciences, quickly the contagion spread in the stock market. SIVB started the week at nearly $300 a share and ended the week at the final halted price just under $40. This should be a warning to investors of how quickly one's fortunes can change. Near mid-day, the FDIC made a statement saying that Silicon Valley Bank had been closed by California regulators.

Over the weekend, Signature Bank (SBNY) was also closed, as contagion spread. Monday morning, regional bank stocks tanked, even after the government came out with a plan to secure deposits. I do not believe the government's action is enough to stop the domino effect from continuing. The reality here is that it is the responsibility of executive management of a corporation to ensure that their cash and banking relationships are managed with proper risk controls in place. I do not believe this will be the end, more bank failures could very well happen. As Warren Buffett said, when the tide rolls out, you see who is swimming naked. In this case, you see which banks do not know how to manage their business, and have exposed their investors, and depositors to huge risks.

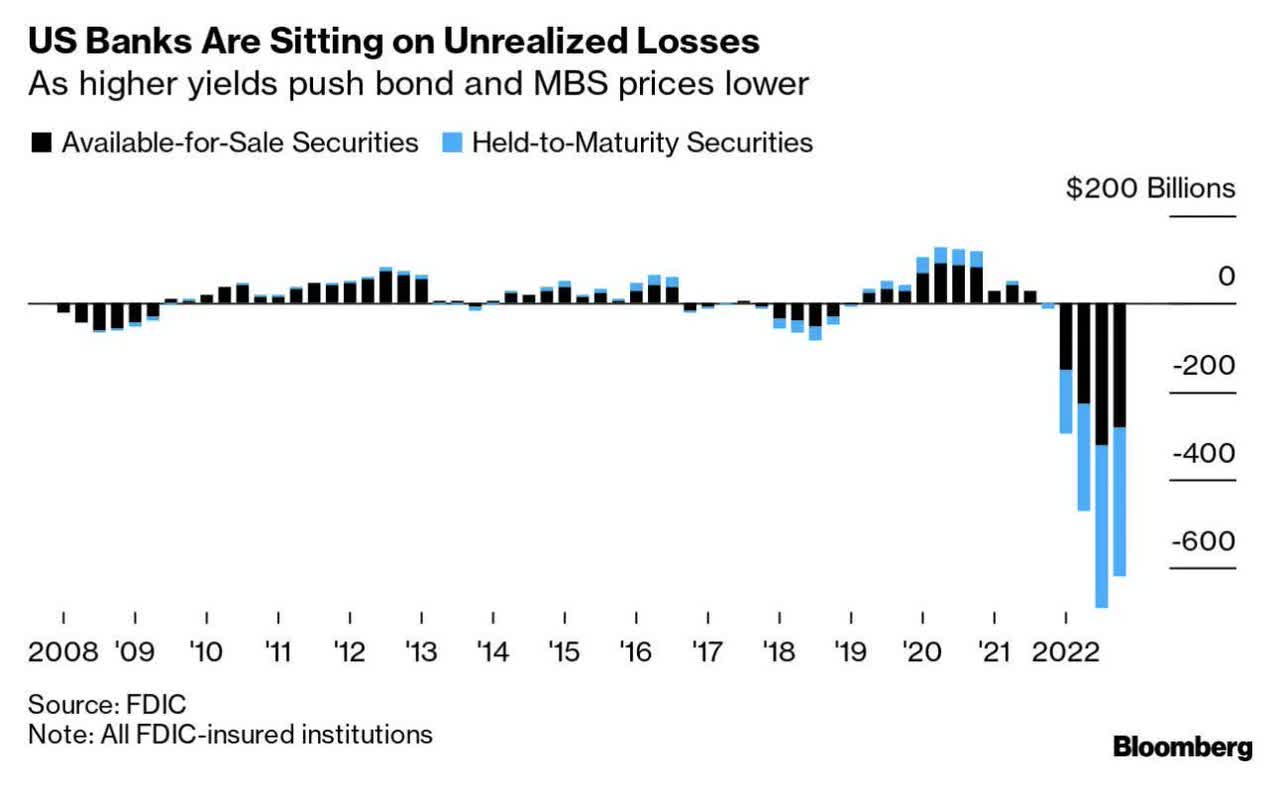

US Banks Are Sitting on Unrealized Losses (Bloomberg)

In a report, Moody's has downgraded the US banking sector to negative citing a "rapidly deteriorating operating environment."

“We have changed to negative from stable our outlook on the US banking system to reflect the rapid deterioration in the operating environment following deposit runs at Silicon Valley Bank (SBV), Silvergate Bank, and Signature Bank (SNY) and the failures of SVB and SNY,"

“We expect pressures to persist and be exacerbated by ongoing monetary policy tightening, with interest rates likely to remain higher for longer until inflation returns to within the Fed’s target range,” Moody’s said. “US banks also now are facing sharply rising deposit costs after years of low funding costs, which will reduce earnings at banks, particularly those with a greater proportion of fixed-rate assets.”

The firm said it expects the U.S. economy to fall into recession later this year, further pressuring the industry."

It is clear that risks are rising in this environment, and despite the efforts of government agencies to bring calm to the markets, there is no escaping the reality that recession remains on the horizon, risks remain unusually high in this environment, and investors should be particularly cautious as we move through the cycle.

Inflation Remains a Risk, Even with Disinflationary Impulses

The February jobs report came in hot at 311,000 jobs far above the 225,000 expected. The participation rate ticked up, along with the unemployment rate. We all know that employment is a lagging indicator, and it is clear that due to the difficulty of finding workers in recent years, companies are reluctant to let them go, even as weakness in various lines of business are being felt.

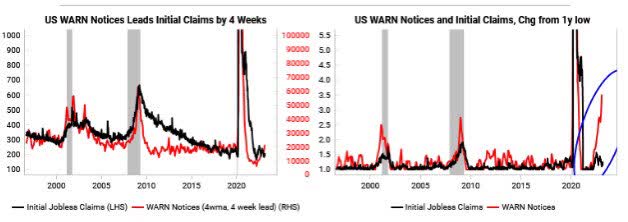

Bank of America CEO, Brian Moynihan, talked on Bloomberg about his banks strategy to have a natural attrition rate, by ending hiring, and not replacing employees who move on from the bank. This is just one example of how businesses are not outright firing workers, instead they are taking a different approach, that ultimately results in headcount reduction over time. We are seeing an increase in WARN notices, which tend to lead unemployment claims by 4 weeks. This could be an indication that things are about to get a whole lot worse for the labor market.

US WARN Notices (@GavinSBaker)

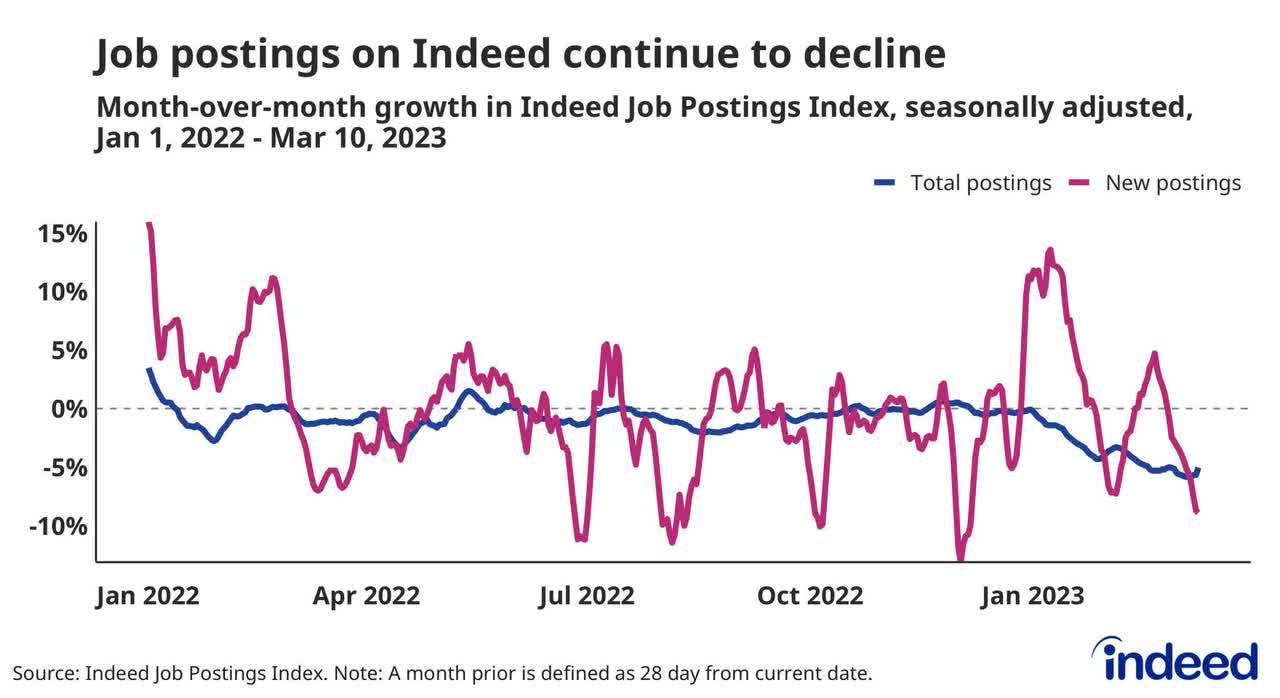

Additionally, there has been a notable reduction in the number of jobs being offered on indeed. These may both be an indication that companies are starting to slow hiring and reduce headcount more aggressively.

@GavinSBaker

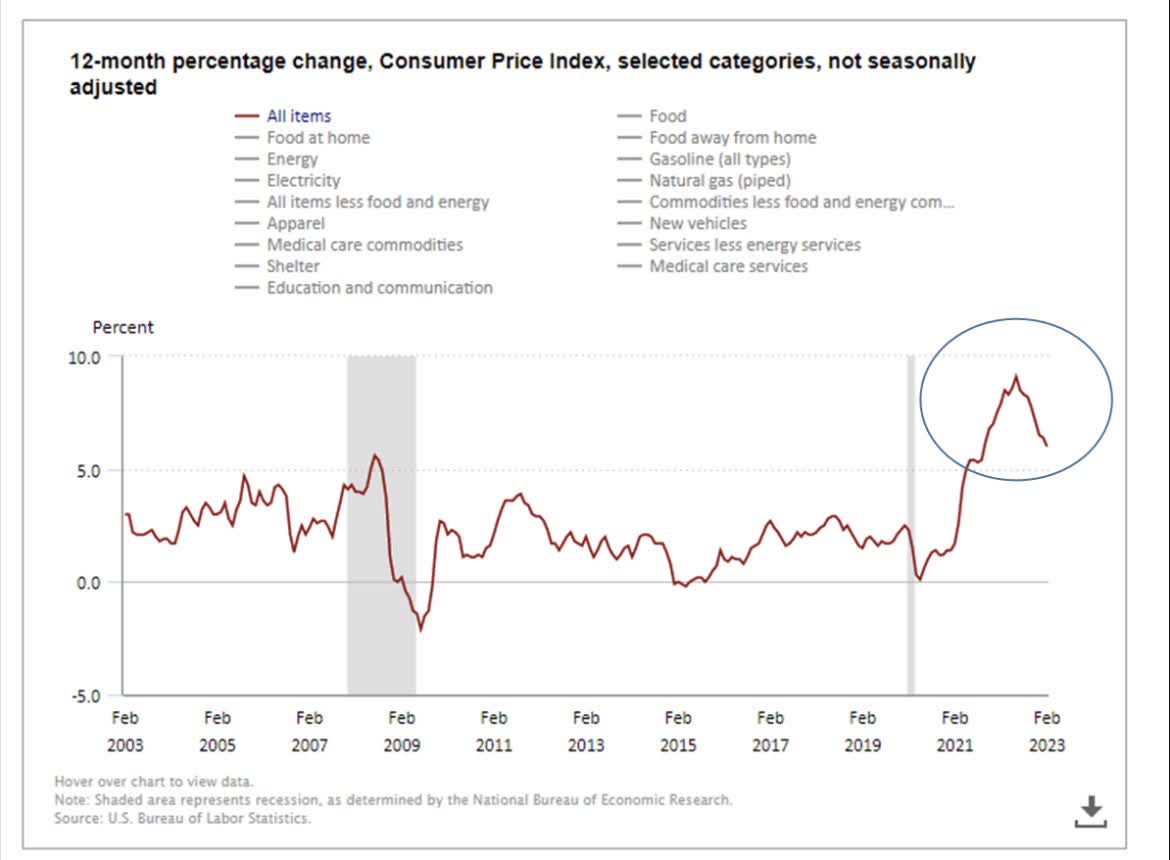

The Fed has indicated they will keep at it, with consistent 25 basis point hikes in the Fed funds rate. I see them having to go out into the summer months before we reach a terminal rate that very well could eclipse 6%. Many are now contending that the closure of these banks has changed the game, I demur. No, it has not. The Fed's job is price stability within a context of full employment. Inflation continues to be an issue for this economy, even as we are seeing slight moderation.

The Fed will need to continue with the path they have set forth. 25 basis point hikes also allow them the flexibility to assess incoming data on inflation, but past episodes indicate that even if inflation shows moderation, it is important to keep at it, until the Fed is relatively sure, it is going to return to the 2% target. Thus, the Fed will stay on its path even if expectations from the market of Fed movements has moved rather starkly in response to market dynamics.

@Wolfof53rdSt

There is no doubt that disinflationary impulses are at work in the economy, and the result has been a slight moderation in inflation. The shock of SVB and other banks being closed, and consumers questioning whether their bank is safe, will undoubtedly have a ripple effect through the economy as a strong deflationary impulse. It forces consumers and businesses to reevaluate, and ultimately become more cautious. Future readings on consumer confidence and other measures will indicate just how much consumers are pulling back from spending, if at all.

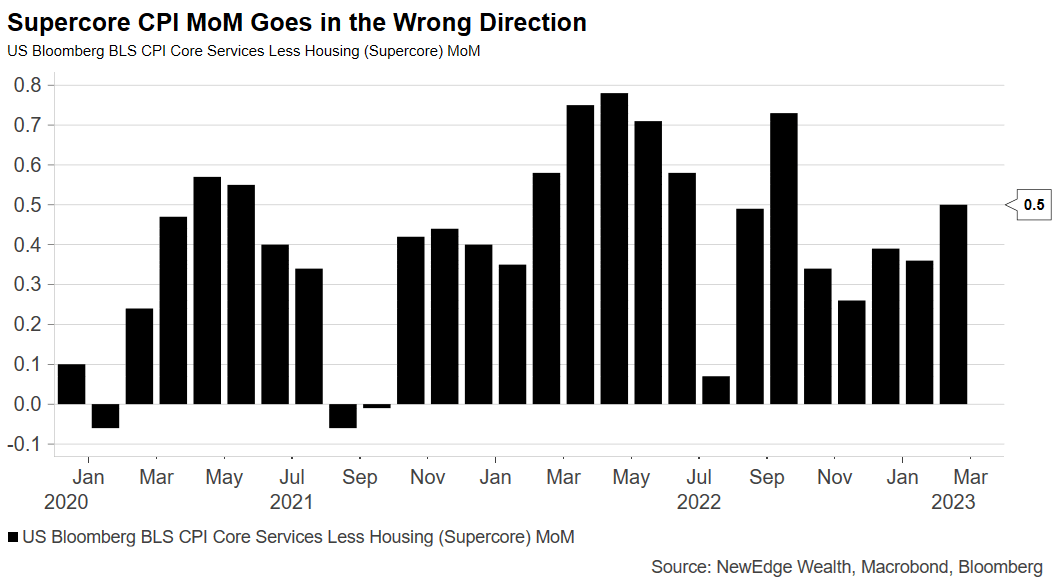

The inflation report on March 14th showed that inflation is running at an annualized rate of 6%, after showing a rise in February of 0.4%. This demonstrates the Fed still has a great deal of work to do to get inflation to move down towards the 2% target rate. Even worse is the reacceleration of Supercore CPI, which is core services less housing, accelerating from 0.36% in January to 0.5% in February.

@CameronDawson

The Fed is coming to a fork in the road where they will have no choice but to force a hard landing which means an inevitable recession. I am not sure where the talking heads in financial media who claim the Fed has done too much and needs to stop, are coming from. The evidence clearly shows that inflation continues to be a problem and the Fed needs to eradicate it before it becomes entrenched.

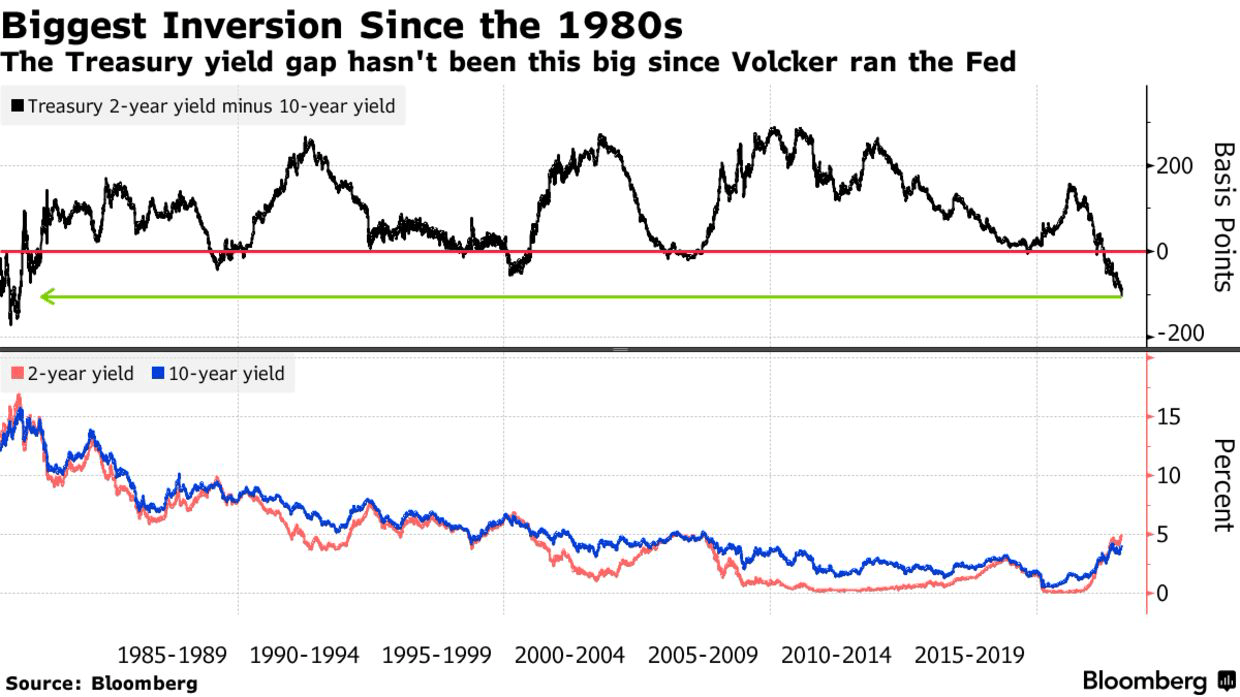

Bloomberg

How High Should Rates Go?

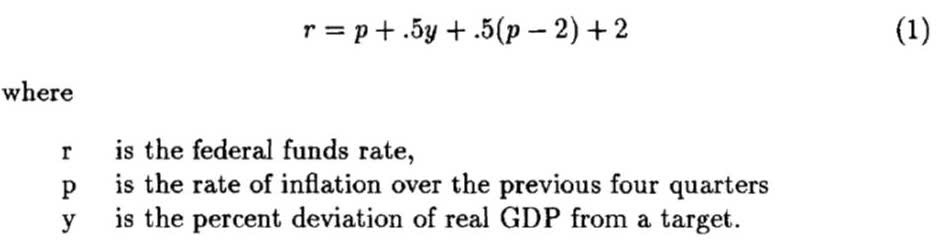

Personally, I would be raising rates much more aggressively. For example, just one methodology, The Taylor Rule, which ties monetary policy to inflation and economic growth, would indicate that rates should be up closer to 6-7%. Even if, we dismiss this as too high, or question the utility of the Taylor rule, it is clear that inflation is too high, and rates should be higher than they are today to achieve the Fed's goal of long-term price stability.

The Taylor Rule

Discretion Versus Policy Rules in Practice (John Taylor, Stanford Economics)

The Bear Market Deepens

The setup for a severe bear market has not been stronger since 2008. We are in an environment where the entire banking system is being downgraded by ratings agencies, the Fed is attempting to stop the ravages of inflation by continuing to hike rates, and the bill is coming due for a host of interest rate sensitive industries and consumers who are increasingly tapped out and accessing credit to survive. Add in a drastic overvaluation in the equity markets, increasing stress on the economy, and panic in the regional banking system, and you have a recipe for lower lows, which I believe we will see this year.

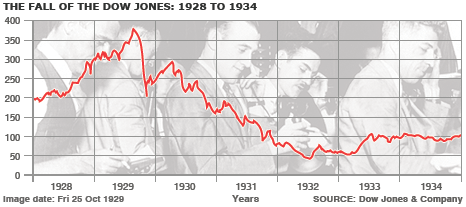

The reality is that the market crash that I believe is coming, will come in waves, very similar to what we saw in the 1929-1932 crash. As the chart below shows, it wasn't the initial drop alone that caused investors to lose the majority of their net worth. It was the continued grind lower and lower in the early 1930s. In fact, an investor who had the misfortune of placing their money in the market at the peak in 1929, did not get back to 0% total return, until 1953, illustrating that valuation matters a great deal, even to long term investors.

Dow Jones & Company

While it is true. that we have much more regulation today than we did then, and no two periods are truly analogous, the mathematical principle of return to the mean remains in effect. After years of above average equity returns, the only way to get back to the mean is to experience several years of below average or even negative equity returns, to bring the long run average in line. Starting from today's overvalued market, investors who put cash to work today, are likely to realize negative returns as equities fall to new lows in the coming months.

The next shoe to drop, I believe will be in commercial real estate, and to a lesser extent residential real estate. The overvaluation in the real estate sector, coupled with significant headwinds from the economy, interest rates, and the labor dynamics at play could lead to significant stress for the broader market and this sector specifically.

The Long-Term Treasury Rally Continues

In such an environment, investors are enticed to sit in money market cash and earn negative real returns, in exchange for the knowledge that they won't participate in this bear market. Some of the bolder market participants are attempting to buy, what they see, as bargain prices for high beta equities. But both of these options pale in comparison to the opportunity available in U.S. Treasury bonds, specifically at the long end of the curve. I believe we are on the verge of a left tail event, in such periods the convexity and duration exposure of U.S. Treasury bonds at the long end of the curve have provided investors with outsize returns as the equity market comes under duress and the negative correlation of U.S. Treasury securities shines.

Some have contended that this negative correlation no longer exists. I believe this past week that has seen bank failures and intense stress put on the equity markets quiets the critics as U.S. Treasury Bonds rallied significantly, amid a flight to safety.

Bloomberg

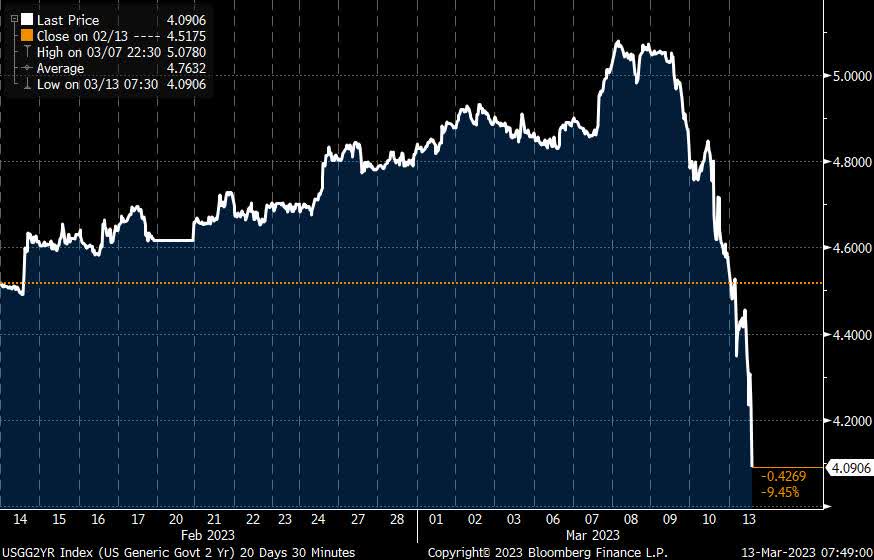

We began the month with Treasury rates elevated after a backup in rates that has since disappeared. The two-year Treasury could have been bought last week at a 5% yield, that yield has now collapsed over 100Bps amidst the stress in the markets subsequent to the SVB collapse, a 12 standard deviation event.

Likewise, the long-term Treasury has rallied significantly with the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) gaining 4.1% in the month, and the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSEARCA:ZROZ) gaining 5.62% during the same period, and 9.92% for the year.

Given the extent of the movement in rates, I would not be surprised to see some giveback and yields back up a bit in the short run. Still, I believe we will be looking at much lower long term Treasury rates in the near term.

Dynamics in the market are moving in favor of the U.S. Treasury security, and I continue to believe that long-term Treasury bonds will continue to act as a port in the storm as we move further and further into this bear cycle.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of 30-YEAR ZERO COUPON U.S. TREASURY BONDS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes only and is not an offer to buy or sell any security. It is not intended to be financial advice, and it is not financial advice. Before acting on any information contained herein, be sure to consult your own financial advisor. This article does not constitute tax advice. Every investor should consult their tax advisor or CPA before acting on any information contained herein.