Euronext: A Possible Compounder

Summary

- Euronext operates in an interesting market that has historically delivered market-beating returns.

- They are also undervalued when compared to their peers.

- And if they continue to add value through their M&A activity, they have the potential to be an interesting compounder.

SusanneB

Thesis

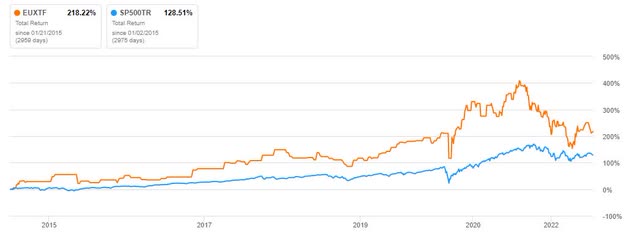

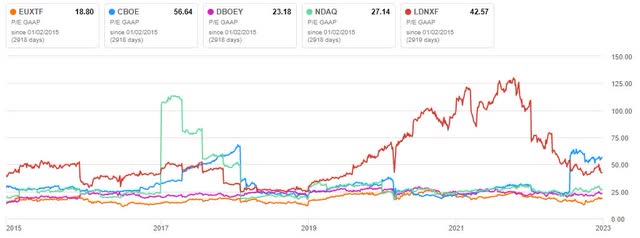

Investing in stock exchanges has been a good investment over the past 5 years, as most of them have outperformed the S&P 500 in terms of total return over this period.

Euronext (OTCPK:EUXTF) has almost doubled the return of the S&P since its IPO in early 2015. I believe Euronext is a better company today than it was 8 years ago because of the good capital allocation through M&A that they have done.

I would say that their combination of growing revenues + growing dividends and strategic acquisitions has the potential to make Euronext a long-term compounder. Their lower P/E ratio also gives them the potential for multiple expansion, as they have better business metrics than most of their direct competitors.

As a result, I would say that Euronext could grow at a CAGR of 10%+ over the next 10 years.

Short Introduction

Euronext is active in securities listings, cash and derivatives trading, market data and market solutions. It is currently the number one equity listing venue in Europe and the number one debt listing venue globally. Equity trading volume on its platform is twice that of the London Stock Exchange (OTCPK:LDNXF) and Deutsche Borse (OTCPK:DBOEY). With the acquisition of Borsa Italiana in 2021, they now have their own clearing house, which offers fantastic opportunities for the future.

Analysis

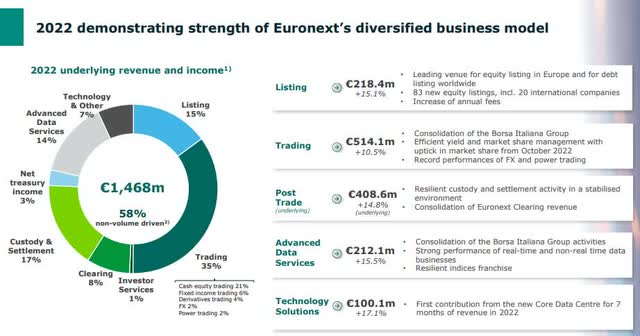

Despite a not so good fourth quarter due to the current economic headwinds, Euronext's full year revenues were up 13% year on year. In 2020, they even achieved the targets they had set for the end of 2022, growing revenue by 6.4% in recent years instead of the 2-3% guidance they had given.

In their latest Investor Toolbox, they gave a revenue guidance of 3-4% CAGR, which is a conservative guidance and they will probably beat it.

The integration of Borsa Italiana will probably have nice synergies that will be in place by the end of 2023. Having their own clearing house as a result of this acquisition should also help them as they try to diversify their revenue mix. As you can see in the chart above, they are trying to reduce the impact of volume-driven revenues and now 58% of all revenues are non-volume driven.

As part of their strategy, they try to identify companies that want to join the largest liquidity pool in Europe. But they are not trying to grow at any price. For example, they withdrew their bid for Allfunds a few weeks ago.

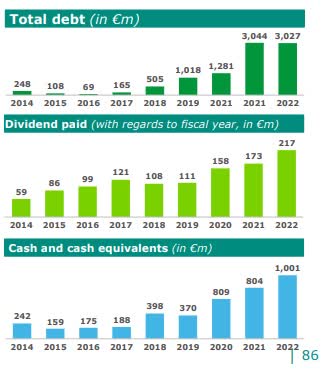

Their payout target of 50% of net profit has increased by 13% over the past year, and given the potential results over the next few years, this could be a dividend growth story, with the current 5-year historical dividend growth rate of 22.79%.

The EPS growth rate over the last 9 years has been ~10% per annum + the dividend yield of 3.22% + the dividend growth rate should give a total return in the low double digits if they can keep up their performance.

Competitors

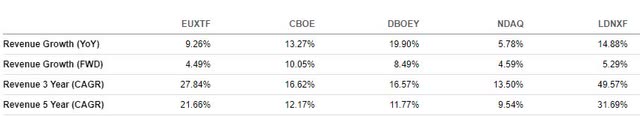

Compared to its European and American counterparts, Euronext's revenue growth over the last 5 years is second only to that of the London Stock Exchange.

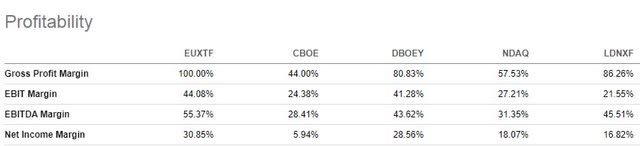

The analysis of EBIT and net income margins clearly shows that Euronext has a competitive advantage as its margins are well above those of its competitors.

And if we compare their debt levels, we again see clear advantages for Euronext.

However, we see that Euronext trades at a much lower multiple on a P/E basis. As they have better revenue growth + better margins and a better debt situation, this should allow for a multiple expansion for Euronext.

On an EV/EBIT basis, Euronext is still the cheapest company in the peer group, but this time the gap is slightly smaller. For me personally, an EV/EBIT of around 14 times is a fine level for an investment.

Risks

Investor Presentation Euronext

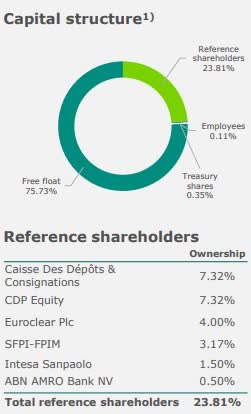

Unfortunately, employees only make up about 0.11% of the total capital structure, and as an investor I tend to favor companies where employees own more of the company's shares, so you know that your interests are aligned with their interests in improving the share price.

Investor Presentation Euronext

Rising debt levels are something to keep an eye on. They are still not as indebted as their peers, but their M&A activity is adding to their debt. But in the last earnings call they said that deleveraging is something they are prioritizing. In addition, the cash position has also increased over the last few years, so this has kind of cushioned the increase in debt.

Investor Presentation

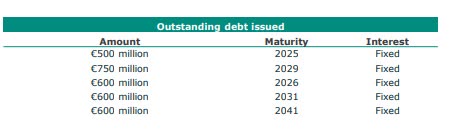

But a look at the maturities shows that they have some time before most of their debt comes due, and their positive cash flows should help them build up a good cash position in the meantime.

The growing number of shares outstanding is also worth keeping an eye on, rising from 76 million in 2020 to 106 million in 2022. While EPS is still rising, too much dilution could slow or even reverse EPS growth. As the interest rate situation has changed in recent months and is likely to change further, we should look at how this will affect the business. A lot of employees or managers in their 30s or early 40s have never worked in an environment of higher inflation and higher interest rates, so this will affect them.

Conclusion

So all in all, if we assume that EPS growth will be in line with the last few years and combine that with the dividend and a possible multiple expansion based on the metrics relative to their peers, that should lead to a CAGR of over 10%.

At the moment, one could argue for building a new position as EV/EBIT is fair at the moment. The company is not cheap, but I think you could be buying a good company at a good price.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.