QYLD: The Right Fund For Investors Looking For Inflation-Adjusted Returns

Summary

- The Global X NASDAQ 100 Covered Call ETF (QYLD) has the right amount of volatility to generate income from the fund's covered call strategy without being an overly risky investment.

- This fund has solid core holdings, the Global X ETF investors shouldn't be concerned about capital preservation.

- The market is likely to remain volatile as inflation risks continue and Fed policy remains uncertain, covered calls funds like the Global X ETF should outperform in this investing environment.

Torsten Asmus

Investing strategies often have to change as market conditions evolve. Investors' goals are often the same, but changing investing environments often require individuals to use different strategies to achieve similar results.

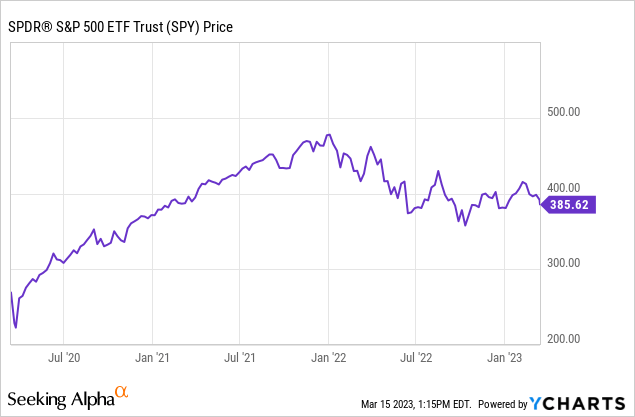

The market isn't going up at a double-digit annual rate anymore. With growth rates slowing, inflation concerns still high, and Fed policy uncertain, the S&P 500 and most of the broader indexes have become more volatile over the last two years.

The S&P 500 has gone nowhere over the last 2 years, and with prices increasing at over 5% a year since early 2021, most index investors have struggled to get inflation-adjusted income or total returns. The S&P 500 is down 7.52% over the last two years, and the current yield on this index is just 1.61%.

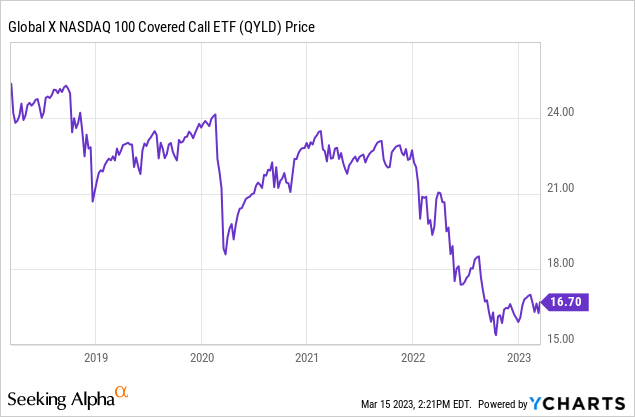

One type of fund that has performed very well over the last five years, including in this more volatile investing environment, are covered call ETFs such as the Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD). This fund uses a buy and write strategy with index options that have worked well, including over the last two years.

Even though the Global X NASDAQ 100 Covered Call ETF is down nearly 35% over the last 5 years, the purpose of this exchange traded fund is to use pay income, and this investment has been very successful at paying out consistent and significant dividends since this exchange traded fund's inception in late 2013. The average annual dividend of this fund over the last 4 years has been an impressive 12.2%.

The Global X Nasdaq 100 Covered Call ETF fund HAS an expense ratio of .60%, $6.83 billion in assets under management, and a current yield of 12.67%. This fund is indexed to the Nasdaq 100, this ETF's holdings are 49.36% technology, 16.12% communication, 15% consumer cyclical, 6.74% health care, 6.04% consumer defensives, 4.15% industrials, 1.24% Utilities, .7% financials, .43% energy, and .23% real estate. The two largest holdings of this fund are Apple (AAPL) and Microsoft (MSFT), those two stocks are each nearly 12.5% holdings, and those two companies make up nearly 25% of this ETF. The Global X Nasdaq Covered Call Fund makes monthly payouts.

This fund has paid very impressive income since the ETF's inception in late 2013, and payouts have also been significant over the last five years. The Global X Nasdaq Covered Calls Fund also paid out very consistent income since 2018. Since 2014, monthly payouts have ranged from $.09 to $.25 a share, but over the last five years monthly payouts have ranged from $.16 a share to $.25 a share. This fund has paid out 85.76% of the principal investment income since the ETF's inception in December 2013.

This fund is more volatile than the many of the broader indexes for several reasons, and that makes the index call options that the managers of the ETF sell against the holdings of this exchange traded fund each month more valuable. The best buy and write strategies use covered calls to take advantage of volatility premiums in the call options that are being sold without taking excessive risk by capping too much upside. A call option is the right to buy an asset, such as an underlying security or index.

This fund is also more volatile than some similar buy and write ETFs since the core holdings of this exchange traded fund are growth stocks such as Microsoft and Apple, and nearly 25% of the holding of this fund are in those 2 companies. This ETF has paid out significantly more income than most of the fund's peers, such as the Nasdaq 100 Covered Call & Growth ETF (QYLG). Still, Apple and Microsoft have been 2 of the best-performing stocks in the entire market, so the volatility is likely to create additional risks that some income investors may not be comfortable with. This fund has a standard deviation of 15.7%.

All investments have risks, and this fund has offered less total returns than peers such as the Nasdaq 100 Covered Call and Growth ETF, even though this fund has paid out significantly more income than that Exchange Traded Fund. The main risk with the Global X Nasdaq Covered Calls Fund is that 25% of this fund's assets are in 2 companies, Apple and Microsoft, so this ETF's overall total performance will be heavily tied to those 2 stocks, and this fund can be more volatile than some funds that are better diversified.

Investing is more difficult now. The broader indexes aren't going up double-digits every year, Fed policies have become harder to read, and growth rates have slowed. Still, the additional volatility levels that these market conditions are more opportunities for different kinds of more targeted investing strategies. Allocating funds to buy and write ETFs such as the Global X Nasdaq Covered Call Fund has worked well over the last 2 years, and this strategy should continue to be successful moving forward.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.