Issuer Direct Requires Too Much Growth To Justify Its Price

Summary

- ISDR participates in investor relations, investor compliance, and newswire businesses, focusing on the latter.

- The company has shown the capacity to grow substantially in the past decade, particularly thanks to its newswire business.

- Today, ISDR's profits are relatively underestimated because of the integration costs of a recent newswire business acquisition.

- However, even when normalizing profits, the company's current P/E multiple requires significant growth ahead to be justified. For example, the company has to grow at 15% excess CAGR for ten years.

- Although ISDR showed growth in the past decade, the next one might be very different, particularly under higher rates. I do not find a particular moat that justifies the multiple.

KanawatTH

Issuer Direct (NYSE:ISDR) is an investor relations, newswires, and investment compliance company. The company has participated in several businesses but now focuses on the corporate newswire business.

Although since its IPO more than a decade ago, the company has grown profits and revenues consistently, its growth has slowed down considerably. The company has purchased several businesses that have not performed as expected.

Today, the company is concentrating on newswires through its own company and the acquisition of a competitor. Although the company is an important competitor in the market, I do not believe it has a special moat.

Although I consider today's earnings do not reflect the company's true earnings capacity, the company is still overvalued. The reason is that even considering a return to more normal levels of profitability, the company still trades at a P/E ratio that requires substantial growth, and that growth has not materialized in almost a decade.

Still, because current earnings are low compared to the company's expected earnings capacity, the stock price might reach new highs in the medium term.

Note: Unless otherwise stated, all information has been obtained from ISDR's filings with the SEC.

Business description

Investor relations company: ISDR operates in several business segments related to how a company relates to its investors. Today, the company divides its business between compliance and communications segments.

The compliance segment offers a software suite that allows companies to manage their fair disclosure, investor communications, whistleblower mechanisms, and distributions of proxy materials. The segment is in decay.

The other segment is communications and includes IR website services and newswire. From these, the newswire is the business segment that is growing faster and on which the company plans to focus investments in the next few years.

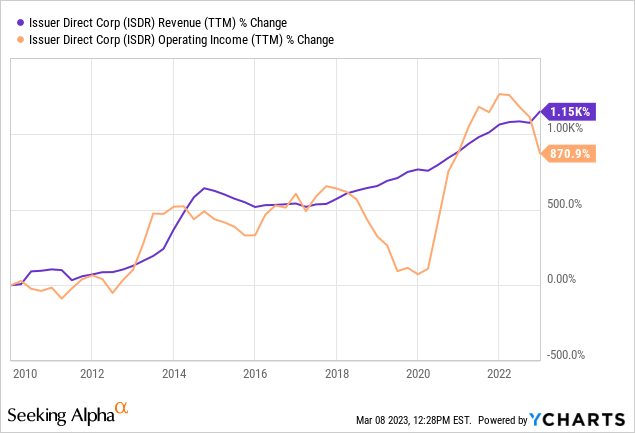

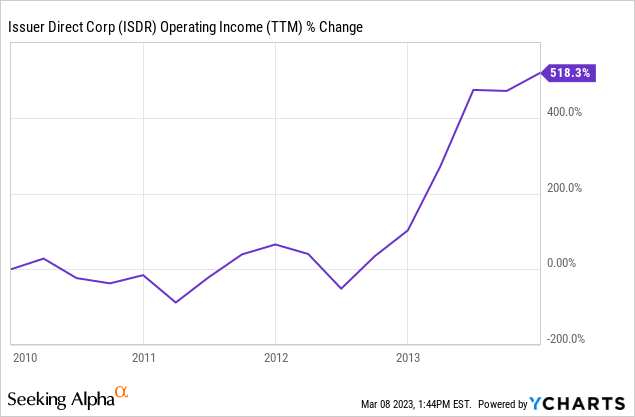

A history of growth: Since the company went public in 2010, it has considerably multiplied revenues and operating profits. This is the main reason why the company trades at a substantial premium to expected earnings.

Peppered with not-so-great acquisitions: Originally, the company concentrated on the disclosure of materials, EDGAR publication, and proxy communications (see, for example, the business description of the FY08 annual report).

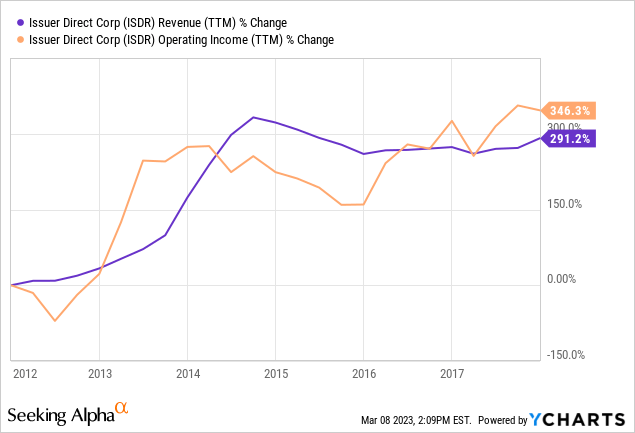

The situation changed when ISDR announced the acquisition of PrecisionIR in 2013. PrecisionIR was in the business of shareholder communication through a communications platform. It was not a regular IR agency but a software developer for IR. The price paid for PrecisionIR was $5 million, at a relatively low P/S ratio of 0.3x and P/E ratio of 10x.

The company's revenues and profits discretely jumped between 2013 and 2014 and stagnated.

In 2014, the company acquired Accesswire for $1.8 million. Accesswire is today the company's core product, a newswire outlet. ISDR did not provide proforma information in that year, but by 2016, Accesswire was already providing 90% of the company's platform revenue growth (including PrecisionIR from a few years ago).

Still, as seen above, new revenues are only useful to replace the falling revenues from legacy business lines. Total revenues and profits do not grow.

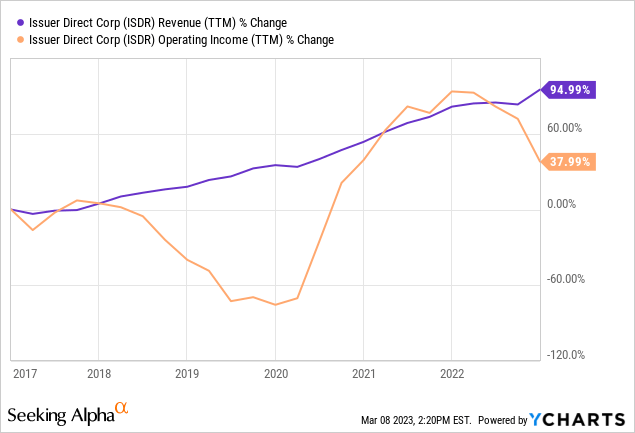

By 2019 though, Accesswire decelerated, and the company increased revenues again by acquisition, this time of a webcast platform called VWP for $3 million. Pro-forma information reveals the company paid a 1.5x P/S ratio and that VWP was not generating profits.

The company continues growing revenues and profits organically until 2022. In the middle, acquiring VWP makes the margins fall significantly, only to recover a little later.

Two periods: In my opinion, although the end-to-end income growth of the company is pretty impressive, it can be divided into two segments. The acquisition of PrecisionIR ends the first portion with a discrete jump in operating income. Previously the company had not grown significantly.

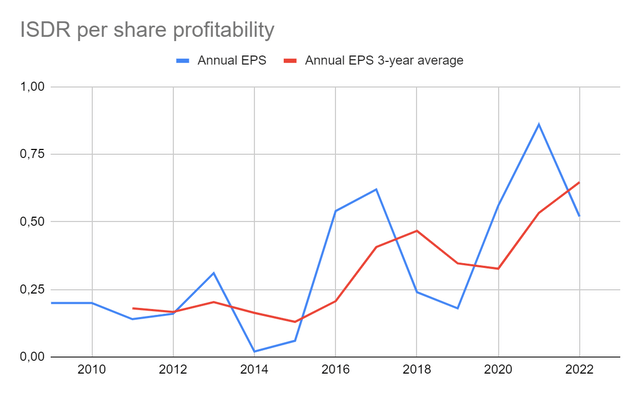

The acquisition of Accesswire marks the beginning second period. As can be seen in the chart below, after 2014, the company's EPS 3-year average grew quite consistently. Taking the 2014-2022 period averages, the company grew its 3-year average EPS at a CAGR of 20%.

ISDR EPS and EPS 3-year averages (Own)

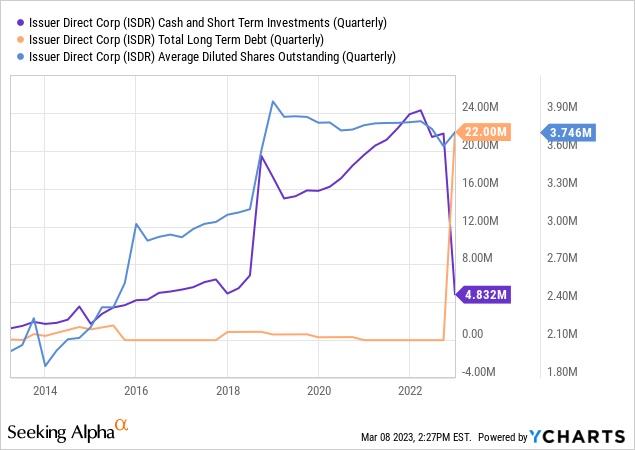

Financially strong: The company used debt and share issuance to finance its acquisitions, but overall, it is in great financial shape. It has taken debt to pay its latest acquisition (more below), but this should not be difficult to service.

High insider ownership, very reasonable compensation: According to the company's proxy statement, the company's officers own 26% of the company, a significant percentage. This aligns the company's management with the interest of other shareholders. Three funds control another 20% of the shares.

Managerial compensation is very low for a company of ISDR's market cap, at $300 thousand per officer. This, again, is a good sign because managers are getting compensated like shareholders.

Valuation

Concentrating on newswire: ISDR plans to increase its participation in the corporate newswire business.

It acquired Newswire, a competing company, for $44 million to do that. $22 million were paid with a Note maturing in 2023, $16 million in cash, and the remaining portion in shares.

According to proforma information, Newswire represents approximately $10 million in extra revenue and generated losses in FY21 and FY22.

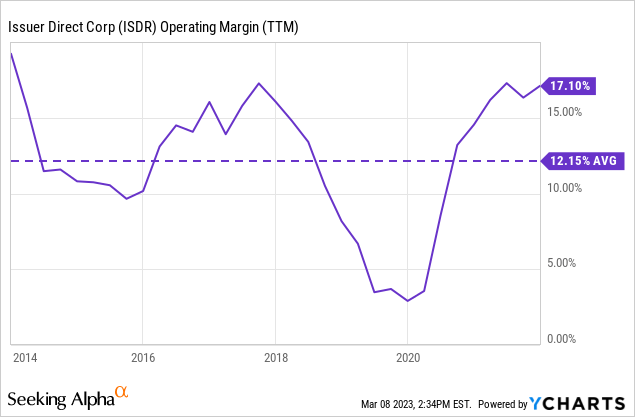

Profitability: Because ISDR has experience accommodating new businesses, I believe it will be able to increase Newswire's profit margins to the company's long-term average. In my profitability calculations below, I assume a future operating margin of 15%. The chart below ends before the recent fall in operating margin (currently close to 11%) caused by the acquisition of Newswire.

Competitiveness: It seems that Accesswire and Newswire are in the middle of the price range of their market, and both have very good customer reviews.

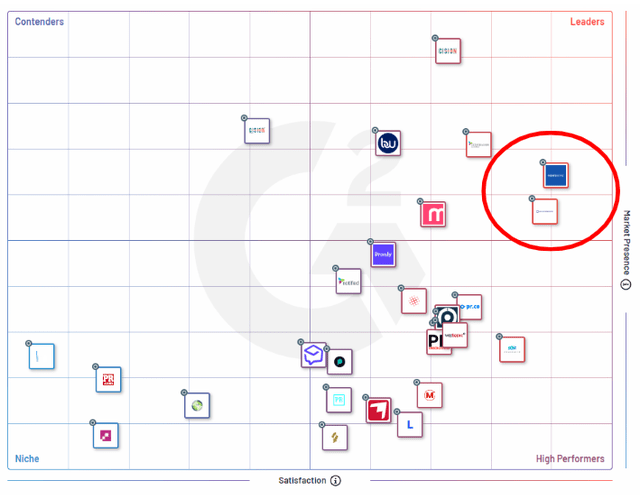

The technology comparison site G2 puts both in a very interesting position, being the best when ranked by satisfaction and relatively high market presence.

G2 ranking of newswire and PR platforms (G2 tech comparison)

However, I do not believe the G2 ranking is very accurate. To begin with, market presence does not depict company size. Accesswire and Newswire accumulate some $30 million in revenues, but giants like Business Newswire have some $250 million, and PR Newswire another $400 million.

Second, G2 does not rank for reach, which, in my opinion, is the most important metric of a newswire platform. Accesswire claims 1,500 outlets on Twitter, while BN claims 100 thousand and PRN some 300 thousand.

Given that their offering is similar, I do not find any other metric to compare a newswire than reach. So in this respect, size and reach, Accesswire and Newswire do not rank above competitors.

On the positive side, though, I believe newswires are a very recurrent business because their cost (ranging from a few hundred to one thousand dollars) is small for companies, yet their service is relatively important. Once a company's PR and IR departments establish a newswire of preference, I do not believe they change unless the conditions are much better than other ones. Again I believe the key difference for the client is reach, not cost per issue.

Income after the acquisition of Newswire: Using proforma information from the FY22 10-K report, we can expect the consolidated company to make $35 million in revenues in FY23 without assuming growth or decrease in other segments. The potential for cross-selling is low, given that both companies offer substantially the same services.

If we apply the historical 15% operating margin to that level of revenue, we arrive at $5.25 million in operating income. Then subtract the 21% average effective tax rate for the last decade, and we arrive at approximately $4.2 million in net income for the combined entity.

I believe the company can return to average operating margins because it has shown that it can incorporate acquired companies without disturbing its margins for a significant period of time. However, the company will face $2.3 million in extra amortization costs from the intangibles acquired with Newswire. This will probably depress the accrual operating income, although it should not depress the company's CFO.

We must also consider the $22 million in notes issued to acquire Newswire. They mature in 2023 and will probably be refinanced. If the debt is refinanced at the same rate as issued (6%), its after-tax cost will be approximately $1 million. The company could also pay that debt through shareholder issuance.

Therefore we are expecting income of approximately $3.2 million on a cash basis, a little lower on an accrual basis because of amortization.

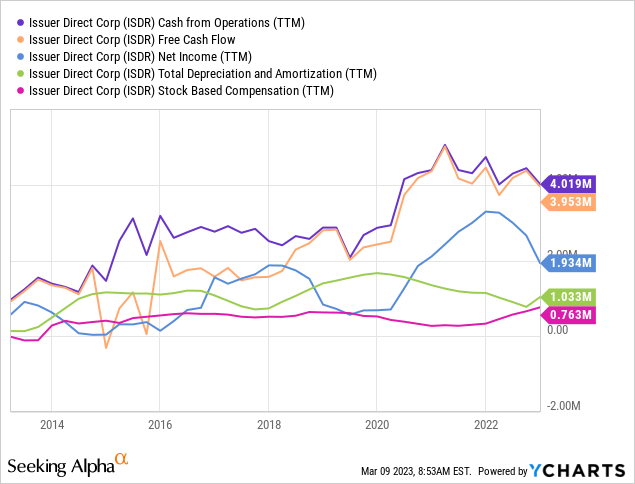

Why are cash flows better: The reader might notice that ISDR's cash flows are consistently above the company's net income. The explanation comes from two sources: first, amortization of intangibles affects net income, but the acquisitions are not removed from FCF. Second, stock-based compensation is not removed from CFO but is not an operational source of cash. When these are accounted for, the company's cash flows are not significantly above the company's net income.

Multiples and growth: ISDR currently trades at a market cap of $87 million, which implies a multiple of 27x to forward expected earnings before considering growth.

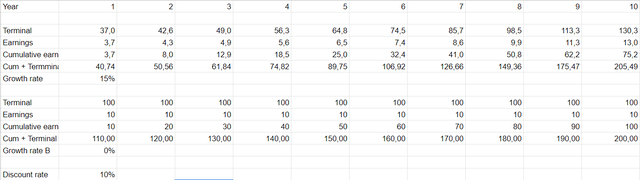

In an exercise already applied to another company, I show the growth assumptions behind such a multiple. The exercise compares the undiscounted return received from two companies: one that grows fast but is more expensive and then sold at zero-growth (the terminal value), and another that does not grow.

For a company purchased at 27x earnings to return the same as a company purchased at 10x, it has to sustain a 15% differential CAGR above the second company for ten years. If growth is reduced to a 10% differential CAGR, the period extends to 15 years.

Comparison of growth and returns for two theoretical companies (Own)

Therefore, purchasing ISDR at 27x expected earnings, with many 10x companies in the market, we assume that ISDR will grow cumulative 15% faster than those companies for ten years.

Although such an assumption is consistent with the company's recent history, I believe there is not enough evidence to support it going forward. I commented that the company competes with much larger players with the same products. Further, the 2014-2022 period has been a great time for public and private capital markets. There is no guarantee the same will be true in the next decade.

Conclusions

ISDR is a business that has grown thanks to its newswire business significantly. The company is planning to continue investing in this segment in the future.

Currently, the company is trading at a multiple of expected cash earnings (eliminating the effect of intangibles amortization), which is significantly below the past decade's average. However, the multiple is still high.

At a multiple of 27x (considering the recent acquisition's combined revenue, operating margins recovery, and without including amortization costs), current market prices imply 15% CAGR excess growth compared to a company trading at 10x for ten years.

I believe these growth expectations are high and not justified by the company's competitive position in its industry or its industry's prospects. Above all, I believe newswires were positively affected by a secular bull market between 2009 and 2021, which is not guaranteed to continue after the changes seen in 2022 and 2023.

For these reasons, I believe ISDR is not an opportunity at these prices.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.