FEN And FEI: The Trade Is Now Done

Summary

- We had three funds that were different in name only.

- Moving between them was based primarily on where they traded relative to NAV.

- Investors chasing one name at the expense of others paid a heavy price in terms of performance.

- The trade is now done, we look at where we go next.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Pgiam/iStock via Getty Images

When we last covered First Trust MLP & Energy Income Fund (NYSE:FEI) and its sibling fund, First Trust Energy Income & Growth Fund (NYSE:FEN), we had a clear trade idea for the bold.

The case to switch to FEI is in essence a continuation of that call as all three funds are virtually identical and should trade at the same premium/discount to NAV at any given point. We think selling FEN and moving to FEI (or even First Trust New Opportunities MLP & Energy Fund (FPL)) makes sense for 2023.

Source: Sell FEN And Buy FEI

With the market in turmoil, we decided to check up on the health of our trade and see if we were headed in the right direction.

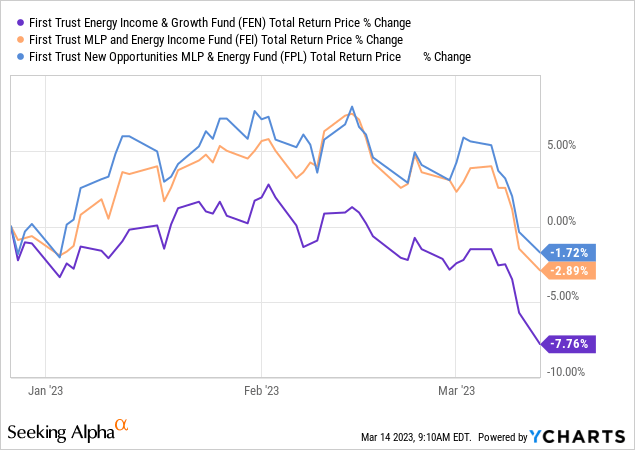

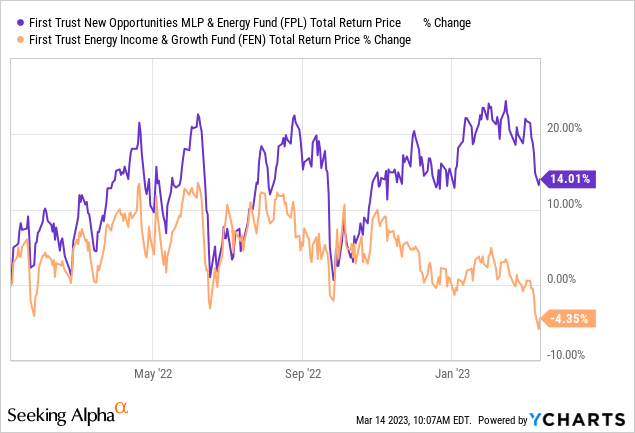

The best performer over the last 3 months was FPL, followed closely by FEI. FEN was the big laggard and provided total returns of negative 7.76%, 6% lower FPL.

In essence, the trade worked out beautifully and provided a 25% annualized alpha for very little work or compromise. We examine FEN and FEI again today and tell you if the recommendation holds.

The Funds

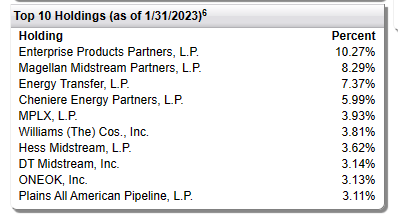

The two closed-end funds have stuck to their knitting and the latest updates show the concentrated holdings. FEI has over 50% of its assets in the top 10 holdings including very large positions in Enterprise Products Partners LP. (EPD), Magellan Midstream Partners LP (MMP) and Energy Transfer LP (ET).

First Trust -FEI

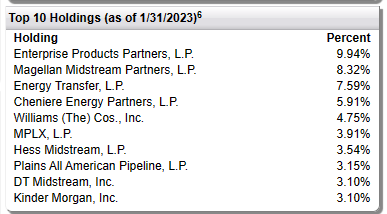

Such a concentrated fund does have additional risks but in general no one puts all their assets in a single fund. So concentration at the fund level rarely carries risks for the individual investor to the same extent. This concentration does make it easier to actually evaluate how feel about the fund by gauging their conviction picks. In that sense, we do like what we see. Next, we look at where FEN stands. Not surprisingly, the holdings still line up. The top 4 are identical and only one new name appears in the top 10, Kinder Morgan Inc. (KMI). This is in lieu of ONEOK, Inc. (OKE).

First Trust -FEN

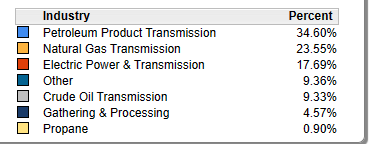

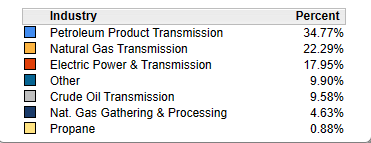

FEN has about 40% of the assets in utilities. You can see that below in Natural Gas Transmission and Electric Power and Transmission.

First Trust -FEN

FEI is almost identical here as well.

First Trust -FEI

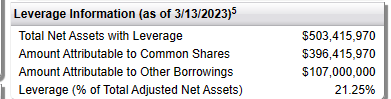

Both funds use similar leverage which works out to about 20% of net assets.

First Trust -FEI

Outlook

The outlook for the funds comes down to our thinking on midstream assets as well as utilities. On the former, we remain positive and think the low valuations will help performance. Other positives include our expectations for a continuation of an energy bull market. Midstream customers, which is essentially the upstream sector, are in excellent shape. Gone are the days of mindless drilling. Balance sheet strength and restraint are the order of the day. These great fundamentals are offset by an abundance of midstream assets relative to production. In most basins, production is coming up way short compared to what was expected 3-4 years back. Excess capacity is a problem for pricing and hence while many of these appear to be extremely cheap, trading at 15% plus free cash flow yields, we think that they are just slightly in the bargain territory.

Utilities on the other hand, remain expensive. As we recently documented, they are trading at relatively high P/E multiples and the earnings estimates are extremely optimistic. Since both these funds carry significant weight in this sector, it tempers our enthusiasm.

Verdict

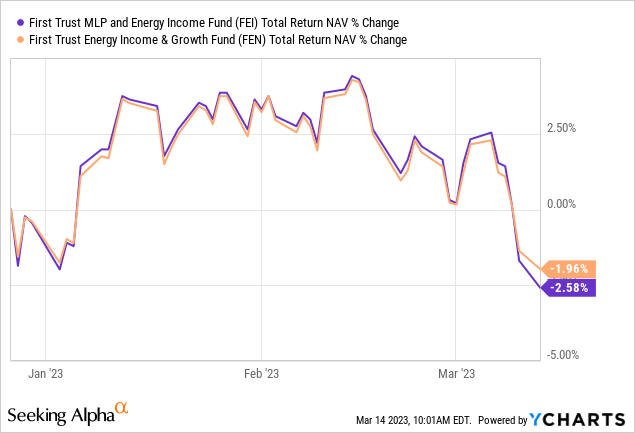

Since our last call, the two funds have continued to track each other on a NAV performance basis.

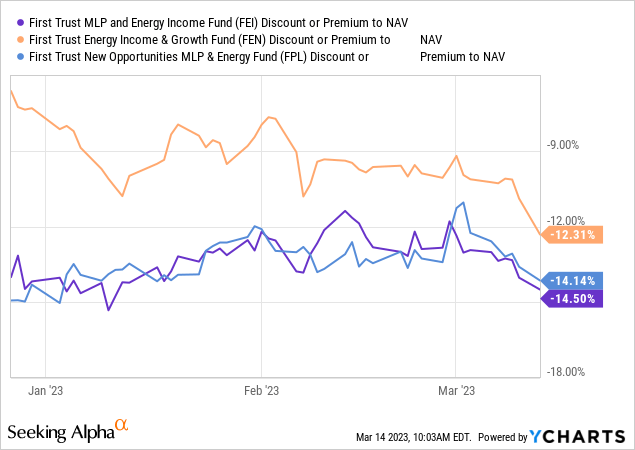

This was of course the basis of our call. As long as the NAV performance tracked closely enough, we could put the entire weight of our call behind the premium/discount to NAV. As you can see below, FEN's undeserved lower discount to NAV has almost fully corrected.

That "correction" is what explains almost all the underperformance of FEN relative to FEI and FPL. At this point we are past the signal area and into the noise. That is to say that the bulk of the thesis has been realized. This is not just since last December. We had made a similar call 15 months back, though we had suggested a move to FPL instead of FEI at the time.

Seeking Alpha

Since then, FPL has also clobbered FEN.

At this stage of the game, we are moving all funds to a neutral rating. While all do have very high yields and investors enjoy a solid discount to NAV, we are not enthralled with owning utilities in any shape or form. We will continue to look for opportunities here and might suggest a new trade if the discounts change materially.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have a beneficial long position in the shares of KMI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.