What Will The Fed Likely Do After The February 2023 CPI Report

Summary

- The BLS reported a 6% Y/Y CPI.

- Price increases in new vehicle and decreases in used automotive.

- Higher Y/Y food and energy costs matter.

- Reasons to hold a mix of cash, bonds, and dividend income are discussed.

- DIY Value Investing members get exclusive access to our real-world portfolio. See all our investments here »

Ibrahim Akcengiz

The Federal Reserve pre-empted the "improved" Consumer Price Index report for February by justifying an aggressive interest rate increase. Chair Powell's warnings implied a minimum interest rate increase of 25 bps and a likelier hike to 50 bps. By the time the BLS released its job report, Silicon Valley Bank's (SIVB) run on the bank captured the business headlines.

The Federal Reserve and the Department of the Treasury stated their action to strengthen public confidence in the U.S. banking system. What impact does the additional funding to eligible depository institutions have on the Fed's meeting? Does the CPI report carry any significance to the Central Bank from here?

February CPI Increased

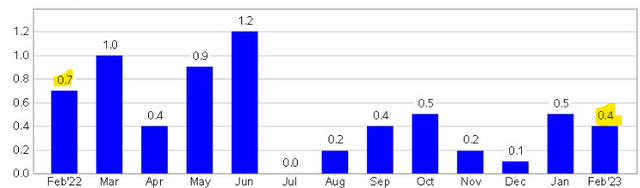

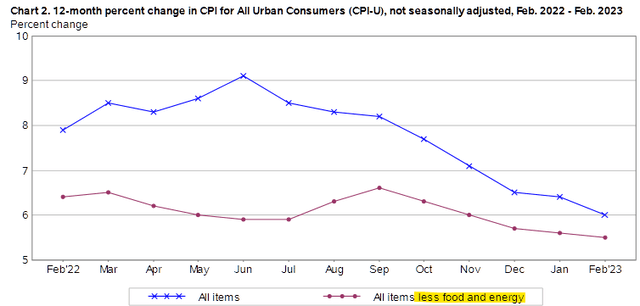

The CPI for all items increased by 6.0% Y/Y before seasonal adjustment. Shelter counted for 70% of the increase. Food, which rose by 0.4% M/M, contributed. Energy prices fell thanks to a drop in natural gas and fuel oil. After the previous report, I called the energy sector a buy. However, after singling out BP plc (BP), the stock fell by around 7%.

BP and Shell (SHEL) both need to fight climate activists. Those investors fail to comprehend the impact $100 oil will have on people when prices get there. People are fortunate that China's economy is slow to rebound after its three-year Covid lockdown. Had China's activity accelerated, energy prices would rise at rates beyond the Fed's control.

Markets reacted positively to the 0.4% M/M CPI increase.

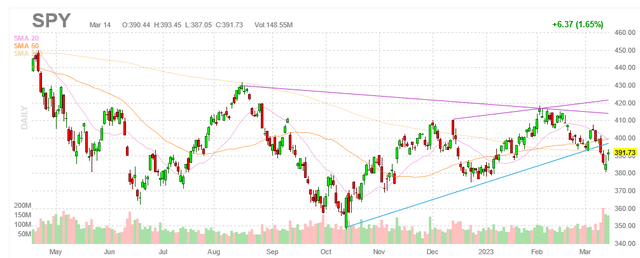

The S&P 500 (SPY) gained nearly 40 points at the last hour of trade on Mar. 13, 2023, and was up 64.8 points for the day. The index could take another run back to the 4,000 resistance point at both the 20-day and 50-day simple moving average.

The BLS likes to report CPI excluding food and energy. People must eat and need heat. It is not a cost that they may avoid.

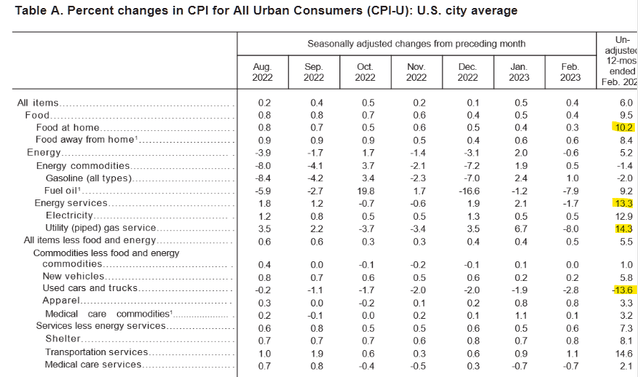

In the table below, I highlighted energy and shelter costs. Utility bills also increased.

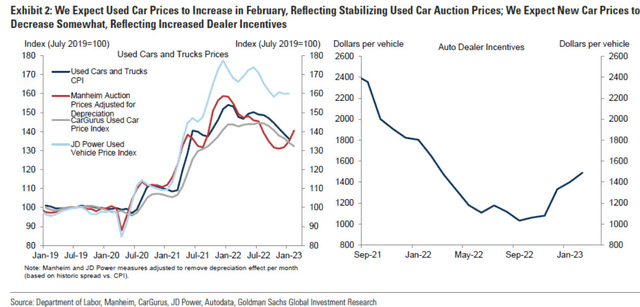

Prices of used cars and trucks fell by a significant 13.6%. But in the chart below on the left, dealers at the Manheim auction are paying more for cars. Prices on the JD Power used vehicle price index is falling. As a result, dealers will lose money on unit sales. Weak or negative operating margins are an unsustainable business model that is a common theme not limited to the car market.

BLSL, Dept. of Labor, Manheim, GS, JD Power, CarGurus

Automotive firms, which added more technology content per unit over the years, are betting that consumers will pay more. Affordability will erode regardless of disinflation. Core inflation, or the change in the cost of goods and services excluding food and energy, is stuck above 5%. This is well slightly about the Fed Funds rate. The rest of the inflation data is sticky.

Weak disposable income will discourage customers from buying pricy items like automobiles.

Get Bearish on Electric Vehicles

Lucid Group (LCID) and Rivian (RIVN) deserve close attention. Lucid depended on selling luxury vehicles first. At the higher output, it would achieve economies of scale and profitability. Its failure to meet its production target will increase its cash burn rates. Rivian has similar cost issues.

When the FDIC shut down SIVB, the boutique bank could not lend to money-losing startup firms. If Lucid and Rivian need to raise cash, its lending costs will increase. That assumes that banks will lend to them.

"Eggflation" Ended

Last month, egg prices collapsed from record prices. The index for eggs fell by 6.7% after months of increases. Investors cannot credit The Fed for the price drop. The USDA spent over $670 million to contain the highly pathogenic avian influenza ("HPAI"). The outbreak was the worst ever by the number of birds infected. Agriculture.com reported that prices are trending upward. Seasonal demand for eggs increases before Easter.

Investment Ideas

Cash

Investors should continue to hold an above-average allocation in cash. Seeking Alpha users to share their favorite cash ETFs. They include USFR, SGOV, TFLO, and OPER.

Treasury bonds with the longest maturity date will have the highest volatility. The price falls the most when interest rise, compared to bond ETFs with short-term maturities. When the Fed pauses rate hikes, their yield falls and the price rises.

Consider these bond ETFs: AGG, BND, TLT, IEI, IEF, SHY, GOVT, VGSH, VGIT, SCHO, SCHR, SPTL, TLH, and VGLT.

Investors may neither time markets nor time the Fed's rate cut. Still, the Treasury bonds like the 20+ year (TLT) have the most capital gains upside when interest rates fall.

Dividend Income

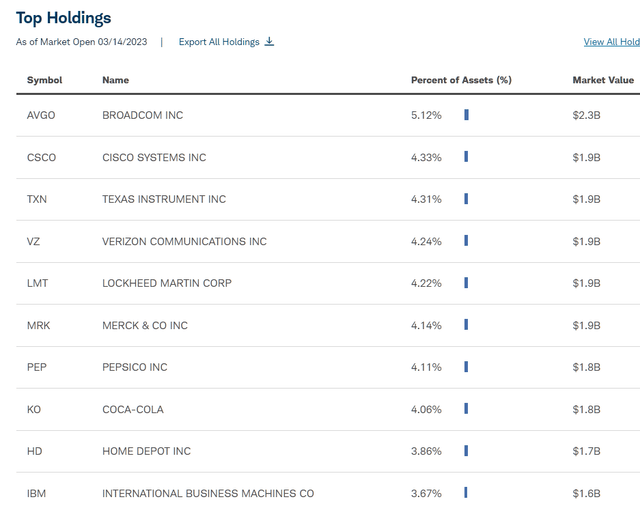

Passive investors may consider the Schwab U.S. Dividend Equity ETF (SCHD). The ETF fell back to the low $70s. It holds at least 20 regional banks. Fortunately, those are not in its top holdings.

Verizon Communications (VZ) and International Business Machines (IBM) are heading toward a 52-week low and offer income investors value.

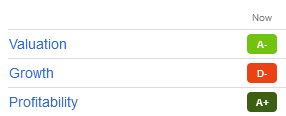

VZ stock scores an A- on value:

VZ Grade (SA Premium)

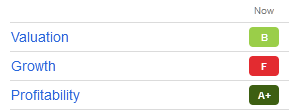

IBM has good value. Like Verizon, it has a strong profitability score. This will ensure dividend payouts will continue.

IBM Grade (SA Premium)

Your Takeaway

Stock markets are trading regional banks like penny stocks. Investors are more concerned that the Fed and Treasury department stabilized the banking system. Having achieved that, the CPI report is strong enough to warrant another interest rate increase.

The Fed rate policy is slowly working its way into the economy. Investors should collect as much yield from interest income on cash. They may allocate the rest to the S&P 500 index and dividend income ETFs like SCHD.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the "follow" button beside my name. Join DIY investing today.

This article was written by

Join DIY Value Investing. Over two decades of experience in financial markets.

Affiliate partner at StockRover.Chris (diyvalueinvestor@gmail.com) is an Hon B.Sc graduate (with distinction) in Science and Economics. He holds a PMP (Project Management Professional) designation.

Do. Act. Invest.

About Do-it-Yourself Value Investing: Sectors include life science, technology, and dividend-growth income stocks. Through top DIY model holdings, members learn how to manage their trading and investments.

Once you are convinced the ideas have merit, Act on it and put a trading plan together, together with an entry and exit point, based on the DIY Top ideas.

Invest and buy the stock. Then wait for the idea to bear fruit.

I seek undervalued, unappreciated value stock ideas and share them first with DIY members. Follows Warren Buffett's mantra: do not lose money.

Disclosure: I/we have a beneficial long position in the shares of BP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.