IHD: The Yield Is A Mirage

Summary

- The IHD fund invests in dividend paying emerging market stocks.

- The fund pays an attractive 13.6% forward yield.

- However, with a 10Yr average annual return of only 0.6%, the IHD fund is a poorly designed product that merely returns investors' own principal through the yield.

- I would urge investors to avoid this fund.

William_Potter

The Voya Emerging Markets High Dividend Equity Fund (NYSE:IHD) aims to generate superior returns and high income by investing in high dividend paying stocks in emerging markets. However, the IHD fund has underperformed the EEM ETF over 10 years, so there is no notable outperformance.

The biggest problem I have with the IHD CEF is that its high distribution yield is funded mostly from return of investors' own principal. Over the long run, this causes a decline in the NAV, and distribution cuts. Long-term investors end up losing both principal and income.

Fund Overview

The Voya Emerging Markets High Dividend Equity Fund (IHD) is a closed-end fund ("CEF") that aims to provide high current income and capital gains by primarily investing in dividend producing equities in emerging markets.

The IHD fund is marketed as a stock selection driven, emerging markets strategy that maximizes total return and higher income over a full cycle. The fund may also sell calls on regional or country ETFs and individual securities to generate additional income.

The IHD fund has $110 million in net assets and charged a 1.35% net expense ratio in fiscal 2022.

Portfolio Holdings

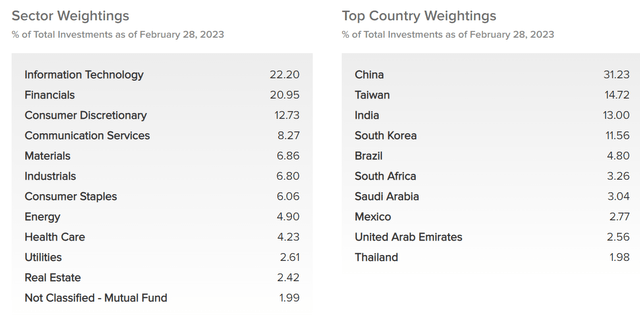

The IHD fund is heavily weighted towards Chinese equities, with 31.2% of the portfolio. Taiwan at 14.7% and India at 13.0% make up the top 3 country weights (Figure 1).

Figure 1 - IHD sector and country weights (voya.com)

Sector-wise, the IHD fund is heavily weighted in Information Technology (22.2%), Financials (21.0%), and Consumer Discretionary (12.7%).

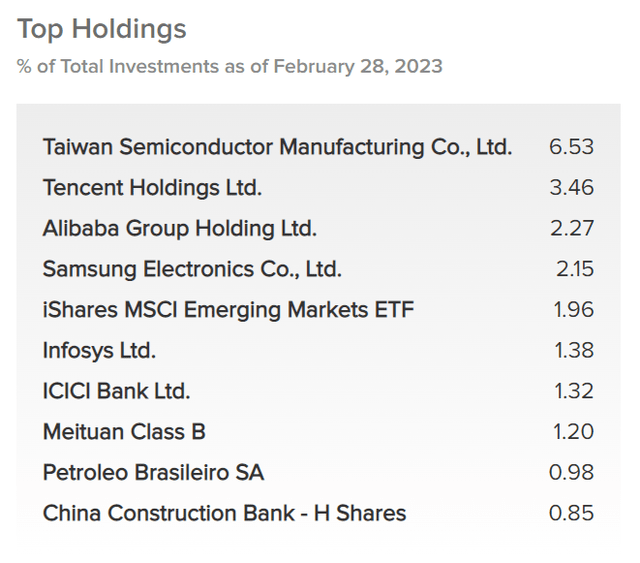

In total, the IHD fund holds over 300 positions with the top 10 accounting for 22.2% of the fund (Figure 2).

Figure 2 - IHD top 10 holdings (voya.com)

Returns

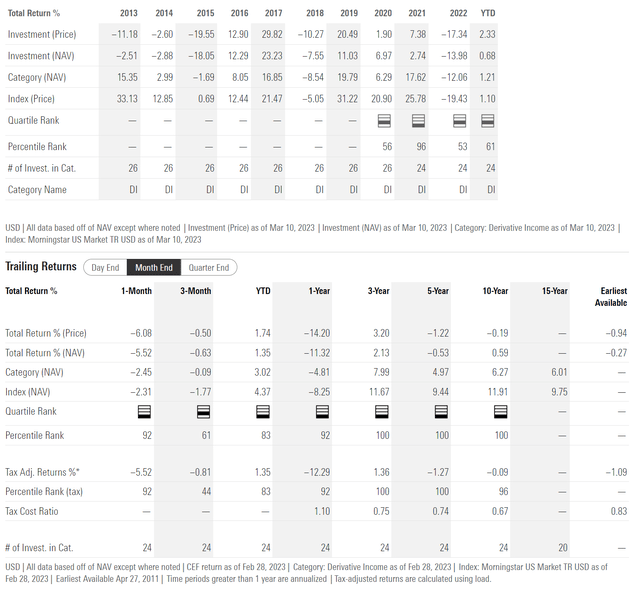

Figure 3 shows the historical returns of the IHD fund. Long-term returns for the fund has been poor, with the fund earning only 2.1%/-0.5%/0.6% average annual returns on a 3/5/10Yr basis to February 28, 2023.

Figure 3 - IHD historical returns (morningstar.com)

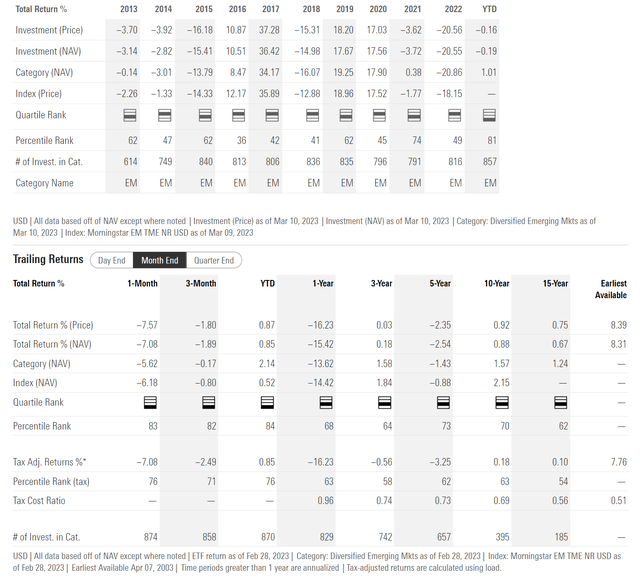

In general, emerging markets have been a tough asset class for the past decade. Figure 4 shows the historical returns of the iShares MSCI Emerging Markets ETF (EEM) for reference. Notice that the EEM ETF has 3/5/10/Yr average annual returns of 0.2%/-2.5%/0.9% to February 28, 2023 respectively.

Figure 4 - EEM historical returns (morningstar.com)

So it is not surprising that IHD has delivered poor historical returns. However, what is notable is that on a 10Yr time frame, i.e. over a cycle, the IHD has underperformed the EEM ETF with 0.6% average annual returns for IHD vs. 0.9% for the EEM ETF. So much for management's claim of outperforming over a cycle.

Distribution & Yield

The main attraction of the IHD fund is its high distribution yield. The IHD fund pays a quarterly distribution of $0.18 / share or 13.6% forward yield. On NAV, the IHD fund has a forward yield of 12.1%.

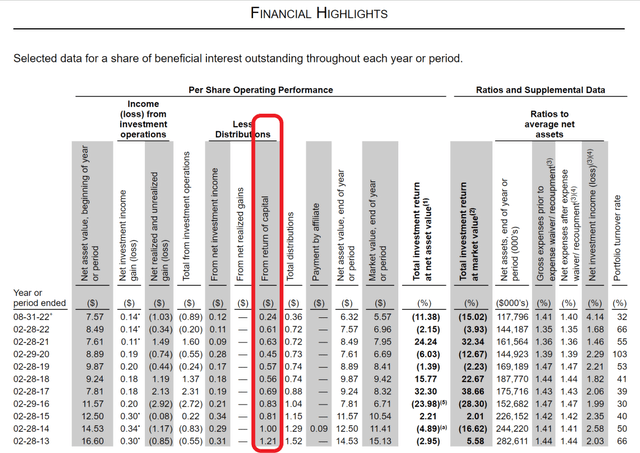

However, before investors rejoice, they should understand that the IHD fund has clearly not 'earned' its distribution, with a 5 and 10Yr average annual return of only -0.5% and 0.6% respectively. Historically, a high percentage of IHD's distribution is funded from return of capital ("ROC") (Figure 5).

Figure 5 - IHD has heavily relied on ROC to fund its distribution (IHD semi-annual report 2022)

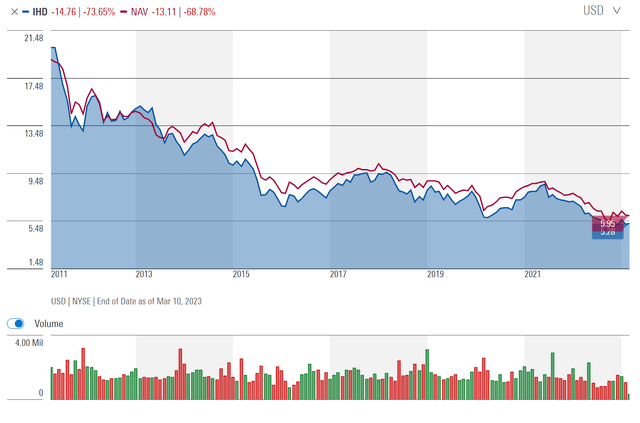

As I have been writing incessantly in the last few months, funds that don't earn their distributions are called 'return of principal' funds and must rely on liquidating NAV to fund their 'too high' distribution rates. This leads to a long-term shrinking NAV, like that shown for the IHD fund (Figure 6).

Figure 6 - IHD has a seriously shrinking NAV (Morningstar)

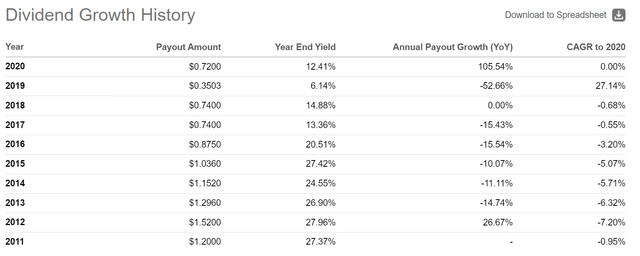

Furthermore, because the IHD fund pays 10%+ distribution yields but earns basically nothing (0.6% average annual returns over 10 years), as the NAV is amortized, the distribution rate must be cut. Since inception, the IHD fund's annual distribution has been cut from $1.52 in 2012 to $0.72 since 2020 (Figure 7).

Figure 7 - IHD has cut its distribution multiple times since inception (Seeking Alpha)

This means that long-term investors have lost both principal and income by investing in IHD.

IHD Trades At A Significant Discount To NAV

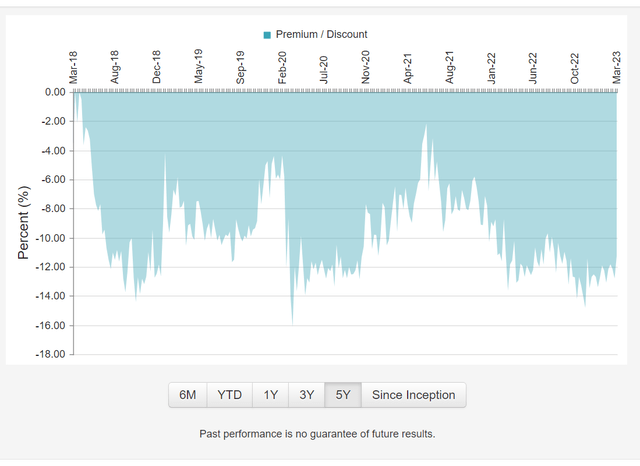

The IHD fund is currently trading at a 11.3% discount to NAV (Figure 8).

Figure 8 - IHD trades at a 11% discount to NAV (cefconnect.com)

For funds trading at steep discounts to NAV, an ROC distribution could help 'unlock' the value of the assets, as discounted assets are converted into cash and paid back to investors. However, I think IHD's discount is a reflection of the fund's poor historical returns rather than something to be celebrated.

Conclusion

The IHD fund aims to generate superior returns 'through a cycle' by investing in high dividend paying stocks in emerging markets. However, the IHD fund has underperformed the EEM ETF over 10 years, so there is no notable outperformance.

The biggest issue I have with the IHD fund, and other high paying CEFs in general, is that their high yields are a mirage. Although the IHD fund is paying an attractive 13.6% forward yield, the distribution is funded by returning investors' own principal. Over the long run, this is unsustainable and investors lose both principal and income.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.