QQQ: Lower Rates Are No Reason To Be Bullish

Summary

- The QQQ has shrugged off the recent weakness in the US financial sector, supported by the decline in bond yields, but this is unlikely to last.

- Free cash flows are down 18% from last year's peak, leaving the FCF yield at just 3.2%, 45bps below the 10-year Treasury, which is the lowest spread since 2008.

- Any large decline in bond yields would likely imply a deflationary recession, which would not be at all positive for the QQQ as we saw in 2008.

NicoElNino

The NASDAQ, Invesco QQQ ETF (NASDAQ:QQQ) has held up remarkably well over the past week in the face of the US banking sector shock, with investors appearing to see the instability as positive for Tech stocks due to lower interest rate expectations. I last wrote on the QQQ ticker in June 2021, arguing that the parabolic advance would come at the expense of future returns (see 'QQQ: Borrowing From The Future'). Since then the ETF is down 18%. Even after this correction, the free cash flow yield has barely risen as rising costs have seen free cash flows fall by 18% from last-year's peak. As a result, the equity risk premium is at levels last seen in 2008 before the market crash, despite the recent decline in bond yields. Interest rates would have to collapse in order for expected QQQ returns to match bond returns, and this would only come in the event of a deflationary recession, which would further crush earnings. The QQQ is unlikely to remain immune to spreading risk aversion as was the case in 2008.

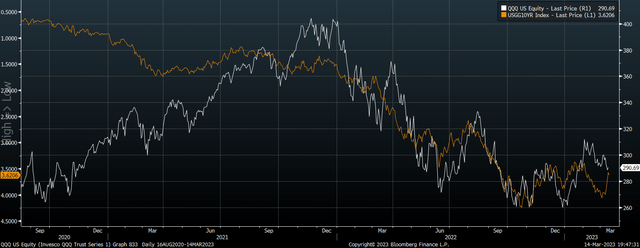

The QQQ has closely tracked bond prices over the past 18 months, with rising bond yields coinciding with weakness in Tech stocks, in both absolute terms and relative to the market. In theory this makes sense as many companies on the QQQ are only expected to generate strong free cash flows and dividends in many years from now, so a high discount rate should hurt these stock valuations in particular. The recent outperformance of the QQQ in the face of US banking sector instability may reflect the belief that lower interest rates than previously expected may support valuations.

QQQ Vs 10-Year UST Yields (Bloomberg)

Equity Risk Premium Back At 2008 Lows

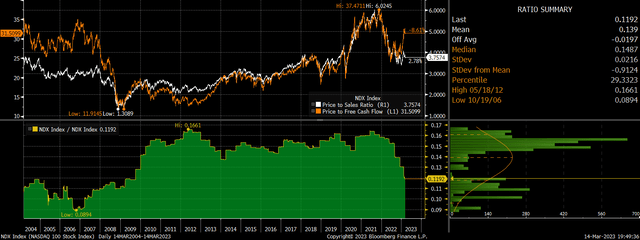

However, there are two problems with this view. Firstly, QQQ valuations remain extremely expensive thanks to the collapse in free cash flows, while the equity risk premium remains at multi-year lows as bond yields remain elevated. The earnings boost provided by the pandemic lockdowns and monetary stimulus is now wearing off, as is the positive impact on earnings from rising inflation due to the delayed nature of capex costs.

NDX FCF Yield, PS Ratio, And Profit Margin (Bloomberg)

The lagged impact of rising operational and capex costs have seen free cash flows decline 18% from their peak, which has left the free cash flow yield at just 3.2%. The crash in free cash flows has left the QQQ extremely overvalued relative to the S&P500, which itself is overvalued. The QQQ is now 26% more expensive than the S&P500 on this metric, and this is despite significantly higher profit margins. The QQQ's free cash flow yield of 3.2% is still 45bps lower than the yield on 10-year USTs, the highest spread since the start of 2008.

NDX FCF Yield vs 10-Year UST Yield (Bloomberg)

Significantly Lower Rates Would Require A Deflationary Recession

The second argument against lower rates supporting QQQ valuations is that they largely reflect expectations of slowing growth in inflation and real GDP, and therefore corporate sales growth. The 50bps decline in 10-year yields over the past week has in large part been driven by the fall in long-term inflation expectations, with 10-year breakevens falling 30bps over this period. The drop in yields also reflects the growing acceptance that the US economy is heading for a recession, and this does not tend to be a good time to buy tech stocks.

The inverse correlation between bond yields and the QQQ seen over the past 18 months is unlikely to hold up. In 2008 for instance, the last time Tech stocks were this expensive relative to bond yields as they are today, the QQQ declined alongside 10-year yields as investors anticipated a recession-driven decline in earnings. Given how low the equity risk premium is, the Fed would have to aggressively cut interest rates to justify current QQQ valuations, and it will not do this unless we see stock valuations crash in the first place, triggering a recession.

Even if we see the Fed cut rates and we avoid a recession, this would still not justify the QQQ's current valuation. Keep in mind that 10-year yields fell 260bps from March 2010 to July 2012 and the US avoided recession, yet this did not stop the free cash flow yield on the NDX rising 300bps to 7.9%. In mid-2012, the FCF yield was a staggering 6.5%, almost 7% higher than it is today. It would take a further 40% decline in the QQQ for the equity risk premium to return to its 20-year average based on current yields and free cash flows.

Summary

The QQQ has shrugged off the recent weakness in the US financial sector, supported by the decline in bond yields, but this is unlikely to last. The collapse in profit margins has seen the free cash flow yield fall back to just 3.2%, putting the equity risk premium over USTs as low as it was in 2008, just prior to the financial crisis. Any further declines in bond yields are likely to be driven by expectations of a deflationary recession, which would not be at all positive for the QQQ as we saw in 2008.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.