Shoals Technologies Ramps Up International Expansion Efforts

Summary

- Shoals Technologies Group, Inc. reported its Q4 2022 and full year financial results on February 28, 2023.

- The firm provides a range of EBOS systems and related products to the solar industry worldwide.

- Shoals Technologies Group has produced solid growth and a promising operating income trajectory, so my outlook on the stock is a Buy at around $19.70 per share.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

vm

A Quick Take On Shoals Technologies

Shoals Technologies Group, Inc. (NASDAQ:SHLS) reported its Q4 2022 financial results on February 28, 2022, beating revenue and EPS consensus estimates.

The firm provides electrical balance of systems products for solar projects, energy storage and electric vehicle charging infrastructure.

My outlook with SHLS stock now at around $19.70 is a Buy on the potential for further revenue growth and its positive operating income trajectory.

Shoals Overview

Portland, Tennessee-based Shoals was founded to develop advanced electrical balance of system [EBOS] solutions for large scale solar energy projects.

Management is headed by CEO and CTO Jason Whitaker, who has been with the firm since 2009 and was previously Co-owner at Thunder Heart Performance Corp. and holds a Mechanical Engineering degree.

The company’s primary offerings include:

Cable assemblies

Inline fuses

Combiners & recombiners

Disconnects

Wireless monitoring systems

Junction boxes

Transition enclosures

Splice boxes.

The firm sells its products primarily to engineering, procurement and construction firms [EPCs] that build solar energy projects.

However, the decision on product choices are usually made between the EPC and the project owner, "given the mission critical nature of EBOS."

Market & Competition

According to a 2020 market research report by Technavio, the global market for solar PV balance of systems is expected to grow by $42.2 billion from 2020 to 2024.

This represents a forecast CAGR of 16% from 2020 to 2024.

The main drivers for this expected growth are increasing regional investments in alternative energy solar power projects as system costs come down.

Also, 64% of the growth is expected to come from the APAC region.

Major competitive or other industry participants include:

SolarBOS

First Solar

Bentek Corp.

ConnectPV

Other industry participants include:

ABB (ABB)

Eaton Corp (ETN)

Golden Concord Holdings

Huawei

Prysmian Spa (OTCPK:PRYMF)

ReneSola (SOL)

Schneider Electric (OTCPK:SBGSF)

SMA Solar Technology (OTCPK:SMTGF)

Sungrow Power Supply

Unirac.

Shoals Technologies Group’s Recent Financial Results

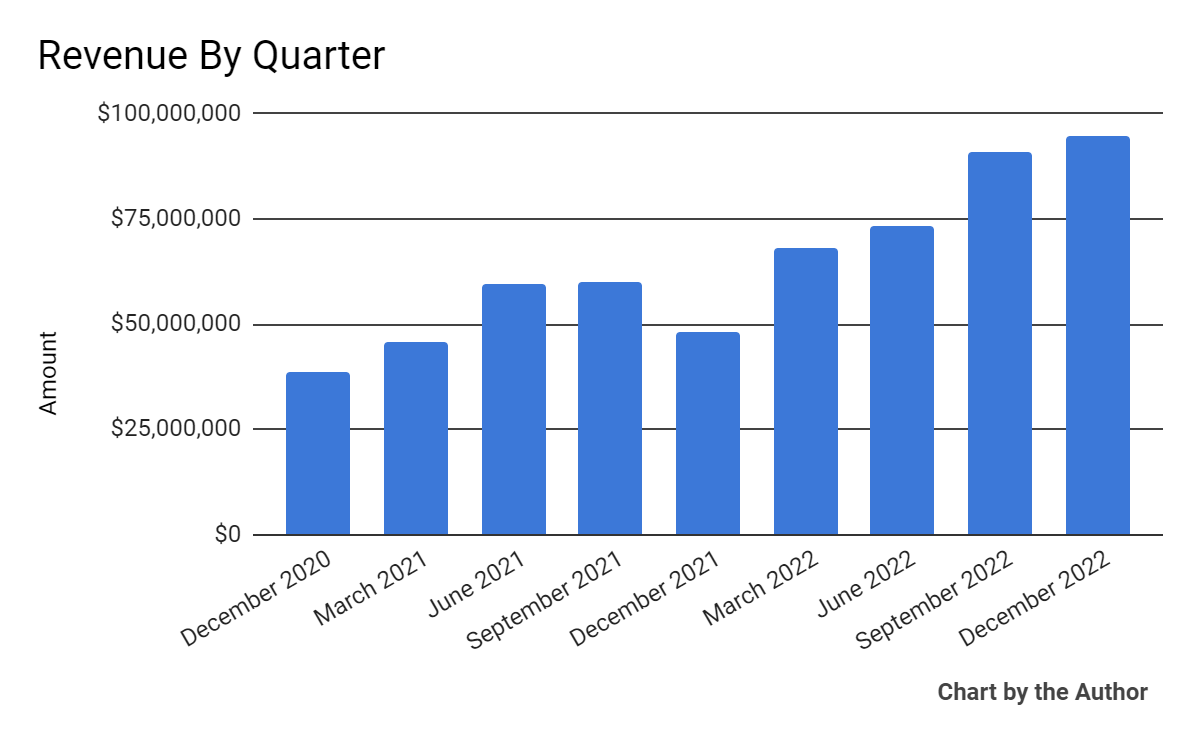

Total revenue by quarter has risen according to the following chart:

Total Revenue (Seeking Alpha)

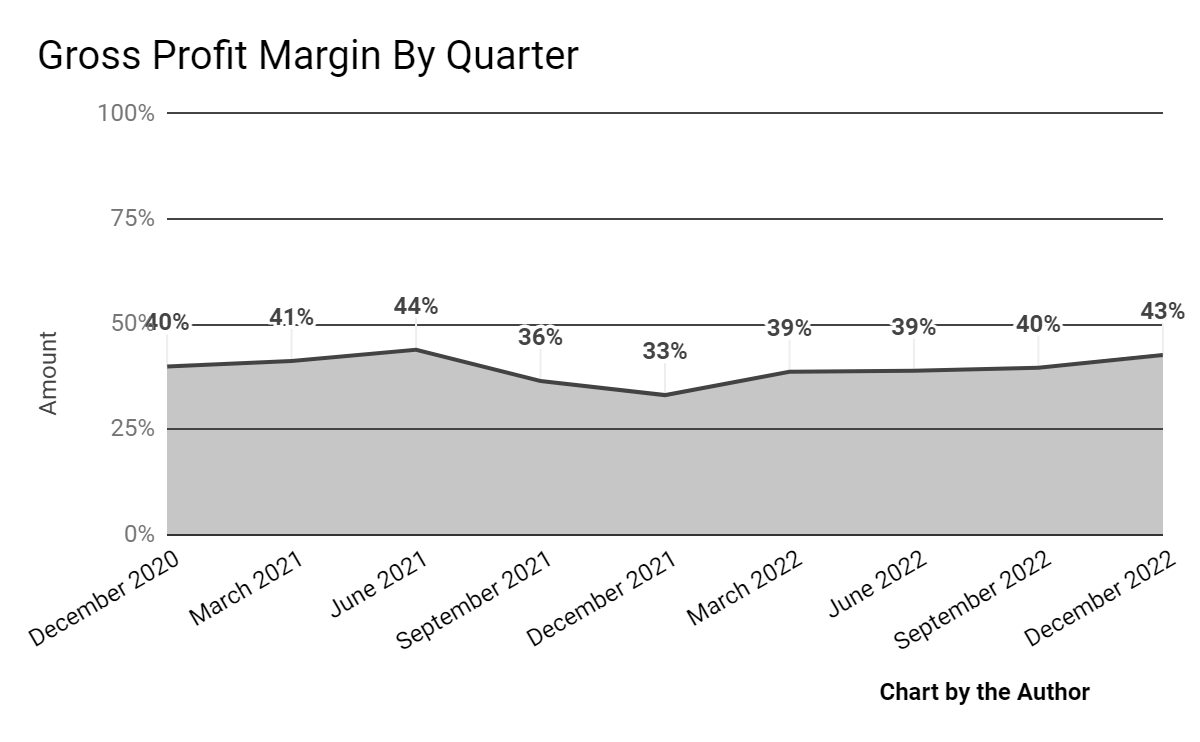

Gross profit margin by quarter has trended higher in recent quarters:

Gross Profit Margin (Seeking Alpha)

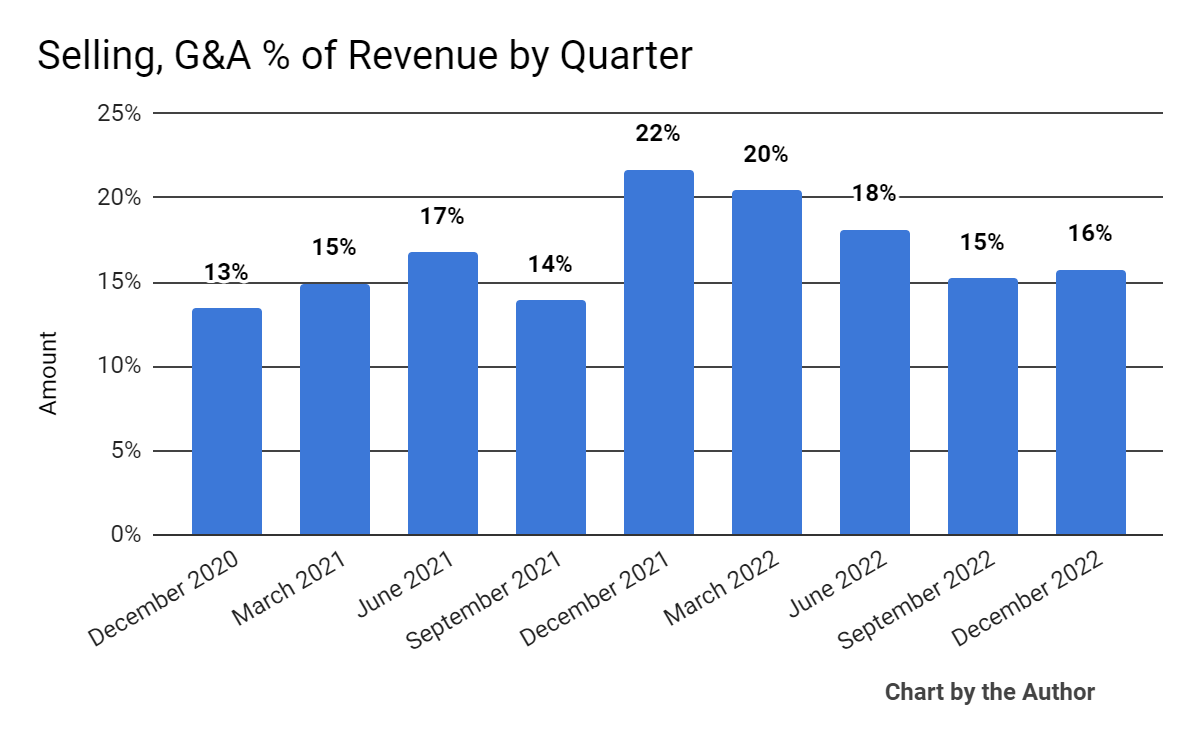

Selling, G&A expenses as a percentage of total revenue by quarter have dropped in recent quarters:

Selling, G&A % Of Revenue (Seeking Alpha)

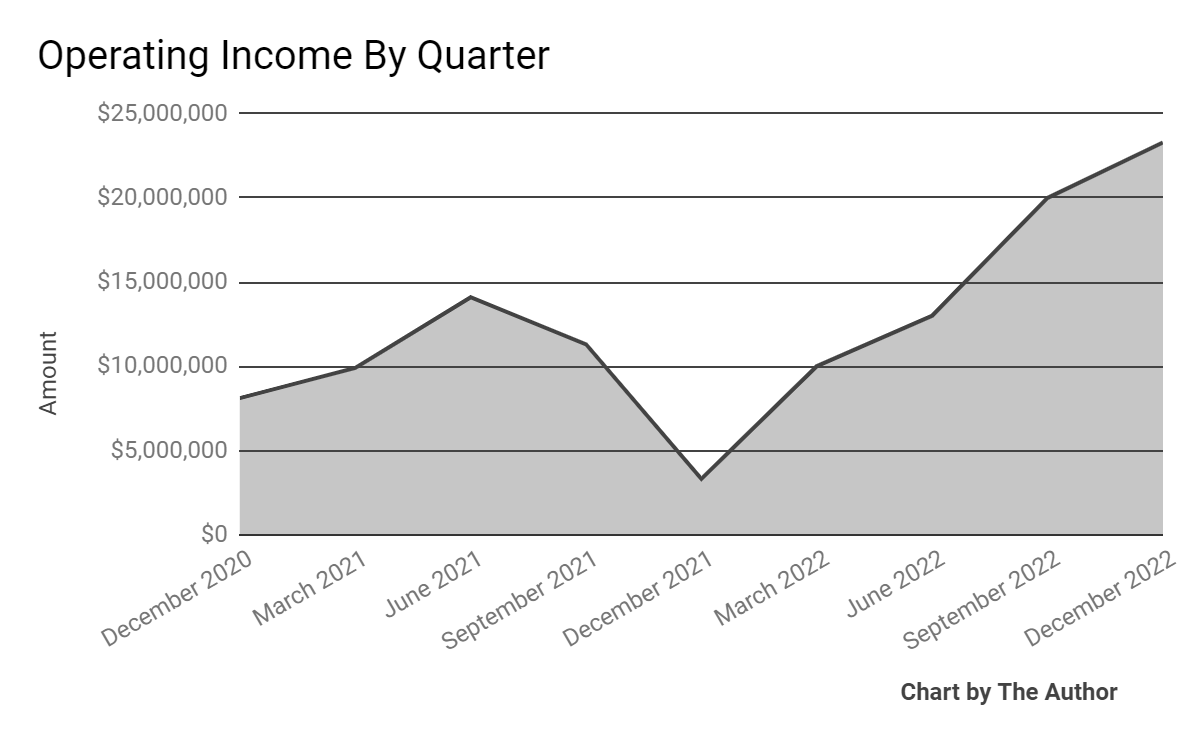

Operating income by quarter has risen quickly in recent quarters, as the chart shows below:

Operating Income (Seeking Alpha)

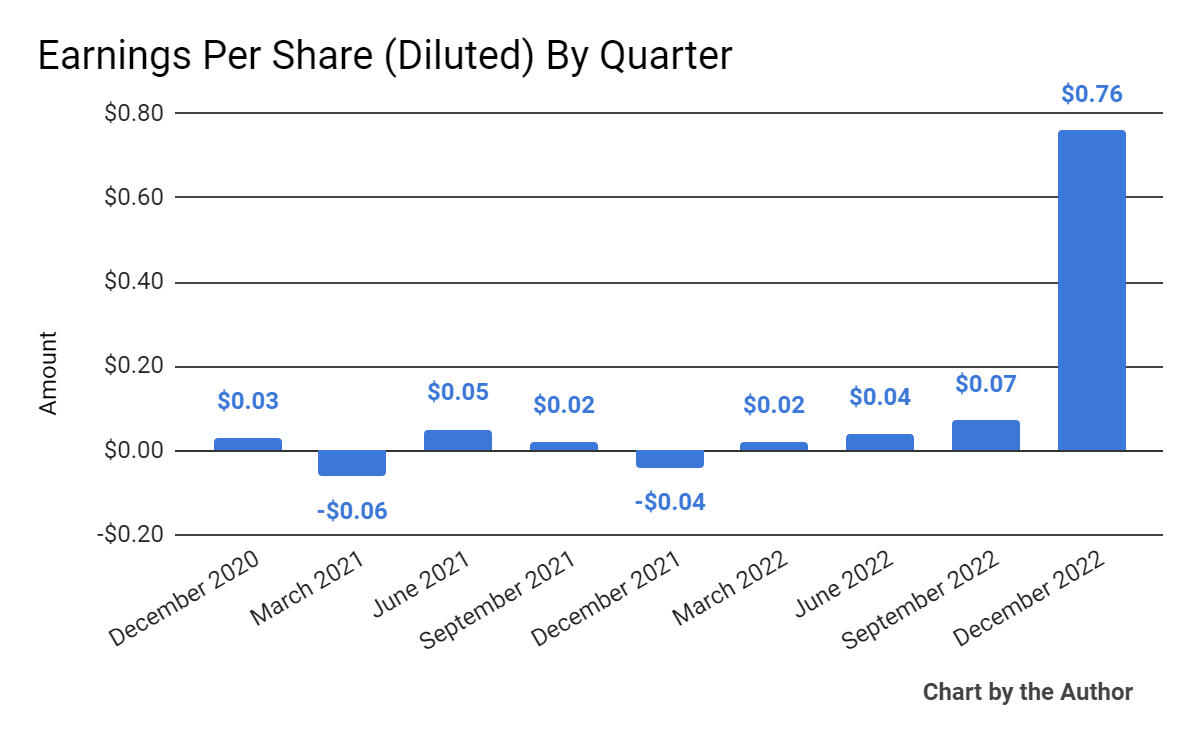

Earnings per share (Diluted) have produced a strong quarter in Q4 2022:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

As to its Q4 2022 financial results, total revenue rose 97% year-over-year, primarily due to increased demand for its solar solutions.

Gross profit rose 154% and gross margin grew by 9.5%, reaching 43% for the quarter.

Almost all of the net income was from a non-cash gain recorded during the quarter "in connection with the termination of the tax receivable agreement, or TRA, that Shoals had with Oaktree and our founder, Dean Solon."

For the balance sheet, the firm finished the quarter with $8.8 million in cash and equivalents and $239.1 million in total debt.

Over the trailing twelve months, free cash flow was $11.6 million, of which capital expenditures accounted for $200,000. The company paid $4.0 million in stock-based compensation in the last four quarters.

Notably, the firm ended 2022 with a backlog and awarded orders of $428.6 million.

Valuation And Other Metrics For Shoals Technologies

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 10.0 |

Enterprise Value / EBITDA | 42.4 |

Price / Sales | 7.7 |

Revenue Growth Rate | 53.3% |

Net Income Margin | 39.0% |

GAAP EBITDA % | 23.5% |

Market Capitalization | $3,700,000,000 |

Enterprise Value | $3,260,000,000 |

Operating Cash Flow | $39,460,000 |

Earnings Per Share (Fully Diluted) | $0.89 |

(Source - Seeking Alpha.)

As a reference, a relevant partial public comparable would be First Solar (FSLR); shown below is a comparison of their primary valuation metrics:

Metric [TTM] | First Solar | Shoals Technologies | Variance |

Enterprise Value / Sales | 7.6 | 10.0 | 31.9% |

Enterprise Value / EBITDA | 423.3 | 42.4 | -90.0% |

Revenue Growth Rate | -10.4% | 53.3% | --% |

Net Income Margin | -1.7% | 39.0% | --% |

Operating Cash Flow | $873,370,000 | $39,460,000 | -95.5% |

(Source - Seeking Alpha.)

Future Prospects For Shoals Technologies

In its last earnings call (Source - Seeking Alpha), covering Q4 2022’s results, management highlighted that it expects 60% of its revenue to be generated in the back half of 2023.

Leadership said it has added dedicated sales representatives for energy storage and has plans to "launch an eMobility energy storage offering in the second half of this year."

The company is focusing significant effort on international expansion, with Latin America, Australia and EMEA the leading areas of activity so far.

Looking ahead, management reiterated it does not provide quarterly guidance but said full-year 2023’s top line revenue growth would be 49% at the midpoint of the range and adjusted EBITDA would be around $148 million at the midpoint.

Note that adjusted EBITDA usually does not include one-time items or stock-based compensation.

The company's product mix has been favorable in light of persistent labor inflation as they serve to reduce the number of hours needed to install a solar project.

Regarding valuation, the market has rewarded First Solar’s stock tremendously since the enactment of the Inflation Reduction Act in August, while SHLS has performed only moderately, as the chart shows here:

52-Week Stock Price Return Comparison (Seeking Alpha)

A potential upside catalyst to the stock could include stronger-than-expected international expansion success as countries and companies look to diversify their energy sources away from high-volatility hydrocarbon-based markets.

I previously issued a Buy opinion with Shoals Technologies Group, Inc. stock at $12.00 which worked out well for investors.

I reiterate that Bullish outlook with the stock now at around $19.70 on the potential for further revenue growth and Shoals Technologies Group, Inc.'s positive operating income trajectory.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions.