Prudential Financial: Price Slump And Dividend Increase Make This High-Yielder Attractive

Summary

- PRU has seen its shares come under pressure, but the underlying performance was attractive.

- The company offers a high dividend yield of 6% at current prices.

- The valuation is undemanding.

- Looking for a helping hand in the market? Members of Cash Flow Club get exclusive ideas and guidance to navigate any climate. Learn More »

Torsten Asmus

Article Thesis

Prudential Financial (NYSE:PRU) is an insurance and investment management company with a solid track record that is highly profitable and that offers an attractive dividend yield of more than 6% today. Thanks to a low valuation, there is considerable upside potential for its share price as well.

Note: We last covered Prudential Financial in late 2020. Since then, shares delivered a 21% total return, beating the S&P 500 easily. If one had bought then and sold at the highs seen in 2022, returns would be substantially higher.

What Happened?

Prudential Financial has seen its shares pull back substantially over the last year:

Seeking Alpha

We see that shares started to decline in spring 2022 before stabilizing for some time, but there has been a pretty steep sell-off in the recent month that brought the share price down to the $80s from a high of more than $120.

There are several reasons for this sell-off:

First, the broad market has declined overall, and thus there was some selling pressure on all stocks, e.g. due to broad-market ETFs being sold that included Prudential Financial.

Second, rising interest rates have made fixed-income investments more attractive from a yield perspective. This, in turn, meant that some investors sold off other income investments, such as dividend stocks, to reposition their portfolios. When income investors sold income stocks to reallocate some of their funds to fixed-income investments such as treasuries, that resulted in selling pressure on income equities such as Prudential Financial.

Third, rising rates also have an impact on the value of the bonds and other long-term fixed-income assets that Prudential Financial holds on its balance sheet. All else equal, interest rate increases result in market price declines for treasuries and other fixed-income assets. While that is generally only temporary and results in unrealized losses unless these investments are sold, book value nevertheless takes a hit when interest rates increase. Since interest rates have risen rapidly over the last year, there was a meaningful negative impact on Prudential Financial's book value stemming from this macro event. When the company holds on to these investments until maturity, it will recoup all of these losses as bonds, etc. will be paid back in full, but until then, the book value of these assets is somewhat depressed when they are marked-to-market.

Last but not least, recent troubles among some financial institutions, including Silvergate Capital (SI), Silicon Valley Bank, etc. have made some investors wary of financial corporations overall. While Prudential Financial is not impacted by the themes these banks were impacted by, PRU and many other non-impacted financial stocks were still sold off in the very recent past, which has added to selling pressure.

Prudential Financial's Underlying Performance Is Strong

But while PRU has seen its shares come under pressure over the last year, actual results were far from bad. The company reported its most recent quarterly results on February 7. While the company missed earnings per share estimates marginally, profits were pretty compelling. Prudential Financial earned $2.42 per share during the fourth quarter, or around $9.70 annualized. With a 12x earnings multiple, which would be far from excessive, this would support a share price in the $116 range, which is considerably higher than the current share price of $85. If PRU continues to earn similar profits in Q1 and beyond, the current valuation is pretty low, as the earnings multiple would be below 9 in that scenario. And that might even be a conservative estimate for PRU's earnings power, both according to management's guidance and according to current analyst consensus estimates.

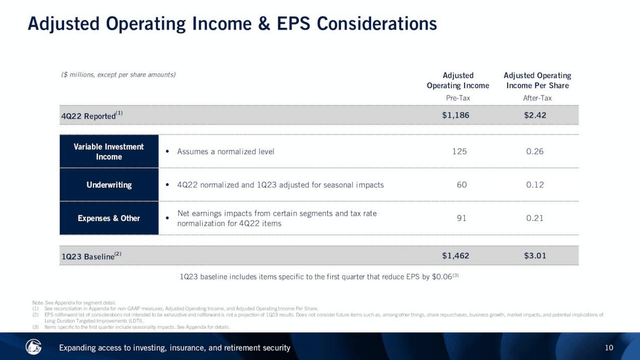

The company has outlined what earnings per share could look like during the current quarter, PRU's fiscal Q1:

PRU presentation

Based on the reported results for the fourth quarter and some adjustments that Prudential Financial's management believes make sense to gauge underlying earnings power over the cycle, Q1 profits could be slightly north of $3 per share. That's more than $12 annualized, which would make for an earnings multiple of just 7 at the current share price. In other words, PRU trades at an implied earnings yield of around 14% based on what management believes near-term profits could look like.

The adjustments make sense to me, such as assuming a more normal tax rate going forward, and assuming investment income will be more in-line with historically normal trends. There is, of course, no guarantee that this will happen, but PRU doesn't really have a track record of overpromising or making grandiose claims, thus I believe this could be a realistic scenario.

Analysts seem to agree, as they forecast that Prudential Financial will earn $12.24 this year on a per-share basis, which is even slightly ahead of management's forecast for Q1's earnings power, as that pencils out to $3.06 per share per quarter for the current year. Again, it's possible that these estimates don't come true, but PRU has outperformed expectations in 8 of the last 10 quarters, thus it seems likely that Prudential will not fall too much behind the estimate -- in fact, based on its historical performance, Prudential Financial might actually beat the $12.24 EPS estimate for the current year.

Beyond 2023, there should be some earnings per share growth as well. The company keeps reinvesting in its business to drive revenue growth in units such as its international business, where revenues rose by close to 20% over the last year. Prudential Financial is the market leader in Japan and should thus benefit from growth in this market, while PRU also has exposure to additional growth markets outside of the US.

Prudential Financial should also continue to lower its share count over time, which will add meaningfully to its earnings per share growth in the long run. Even if the company buys back just 2-3% of its shares per year, that alone would guarantee a meaningful earnings per share growth rate in the long run, even if there is no company-wide profit growth at all. Over the last five years, Prudential has reduced its share count by 13%, thus the 2-3% annual buyback rate scenario seems realistic.

The company is also focused on keeping costs under control, which naturally is beneficial for its bottom line. The current $750 million cost savings program has achieved its target prior to the target date, and investors can expect that additional cost savings programs will be announced in the future.

All in all, Prudential Financial is a company with a solid earnings per share growth outlook, although the company isn't a high-growth company comparable to what one finds in the tech industry, etc. But that's not needed.

PRU's Shareholder Returns Remain Strong

After all, Prudential Financial offers a pretty high dividend yield of 6.0% at current prices, which provides a highly compelling base for its total returns. With a dividend yield this high, not a lot of business or earnings per share growth is needed to make PRU an attractive long-term pick.

The dividend has recently been increased by a little more than 4%, which was the 14th year of consecutive dividend increases. Investors thus have a good chance of receiving regular dividend increases in the future, too, although that is not guaranteed. Based on the payout ratio being just 41% for the current year, there is ample room to lift the dividend further, and a dividend cut seems pretty unlikely.

PRU's Valuation Is Attractive

PRU has performed relatively badly over the last year, which means that its shares are now trading at a rather attractive valuation -- after all, the share price has declined while the underlying performance remained strong.

Trading for just 7x this year's earnings, PRU stock looks like a steal. Based on EPS estimates for the coming two years, Prudential Financial looks even cheaper -- the 2024 and 2025 earnings multiples are 6.4 and 6.2, using the analyst consensus estimate. While PRU has traditionally not traded at very elevated valuations, a 10x to 12x earnings multiple could be achievable in the longer run. Since PRU trades very well below that level today, multiple expansion towards the low double digits would allow for hefty total returns.

Takeaway

PRU has seen its shares come under pressure, but the underlying performance has been solid, and the outlook is positive. With a dividend yield of 6%, steady buybacks, and a low valuation, Prudential Financial looks attractive to me at the current price, for income investors and as a total return pick.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PRU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.