Brookfield, Apollo, And Other Alt Managers' Stocks Respond To Silicon Valley Bank Collapse

Summary

- Alt managers' stocks dropped heavily due to market turbulence and the Silicon Valley Bank collapse.

- Apollo was hit the hardest likely due to its massive insurance subsidiary Athene.

- Athene is not exposed to mass surrenders (similar to a bank run for a life insurer) due to the structure of its liabilities.

- Brookfield Asset Management should benefit from the current banking crisis because of new opportunities for its credit arm.

- The banking crisis provided attractive entry points for both Apollo and Brookfield Asset Management.

ra2studio

It is well-known that alt managers' stocks (aka private equity) are very volatile. For example, the industry's leader Blackstone (BX) has a beta of ~1.8. Since the Silicon Valley Bank (SIVB) crisis has primarily affected financial companies, we expected that alt managers' stocks would respond more than their betas suggest.

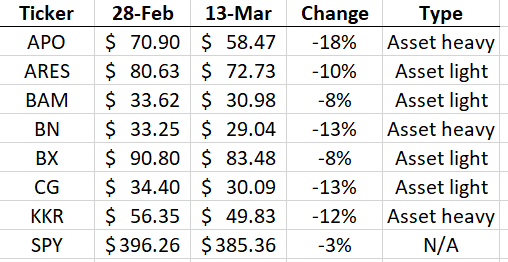

The results reflect our expectations:

Author

Strong asset-light companies like Brookfield Asset Management (BAM) or Blackstone (BX) responded most mildly, while asset-heavy companies were hit harder. While volatility is generally negative for investors, it sometimes provides an outsized opportunity to buy at bargain prices after another black swan event. However, investors must decide whether the event represents a fundamental threat to the industry each time.

We will address this question by considering asset-heavy Apollo Global Management (NYSE:APO) and asset-light BAM as examples.

Apollo

APO was hit the hardest because of its giant insurance subsidiary Athene (ATH). I have published about Athene several times and will outline the company as briefly as possible.

Even though Athene belongs to the life insurance industry, it is a retirement services company. It provides or reinsures deferred (fixed or fixed indexed) annuities purchased by individuals; provides group annuities to (former) employees of the companies that transferred their pension obligations to Athene; and enters into funding agreements (a financial instrument similar to CD) with institutions. The premiums are being invested in higher-yielding fixed income and the company generates spread-related earnings.

This activity is similar to banking financed by insurance float instead of customers' deposits. In principle, this type of business is vulnerable to a bank run (when customers would surrender their annuities) similar to the one that hit SVB and that is why APO suffered more than other alt managers.

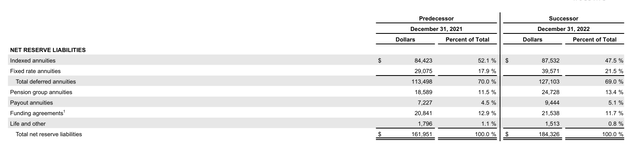

To evaluate the probability of this event, let us take a look at Athene's liabilities:

Athene

Group annuities, payout annuities, and funding agreements cannot be surrendered before maturity in principle due to their nature.

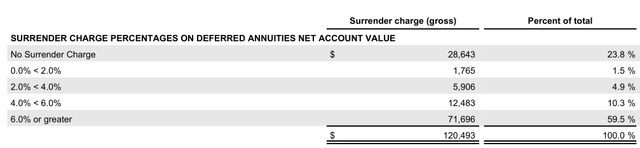

Deferred annuities are multiyear financial instruments that individuals use for long-term savings. They are similar to bank CDs but are not FDIC-insured. Instead, they are guaranteed by an insurance company subject to supervision by regulators and grow tax-free until withdrawal. Upon withdrawal, an individual pays a)taxes on accumulated multi-year gain at ordinary income rates; b) a 10% penalty if the individual withdraws before she/he is 59.5 years old; c)surrender charges if the withdrawal happens before the contractually stipulated term. A summary of possible surrender charges is displayed on the following slide:

Athene

The last line is the most important: close to 60% of liabilities are protected with hefty surrender fees of 6% and higher.

The combination of the three factors above makes withdrawals (especially premature) extremely unprofitable for customers. Most of them will try to avoid withdrawals as long as possible.

Please note the key difference between Athene and SVB: in the case of SVB, customers could easily move their deposits from low-interest accounts and invest them in short-term Treasuries gaining several percentage points immediately. In the case of Athene, such a move is penalized severely and does not make any financial sense.

Mass surrenders similar to bank runs can happen in totally different circumstances. For example, a severe recession (or even depression) with mass unemployment can deprive individuals of all income and they will have to turn to their last-resort resources such as annuities. This is not the case today.

In one of my recent articles, I valued APO at $70 at a low point. This estimate still holds.

Brookfield Asset Management

The situation is much simpler for BAM. The company's health is dependent on one powerful number - fee-generating asset under management (FGAUM). As long as FGAUM is quickly growing (close to 20% for BAM in recent years) , the company should be flourishing.

The company's insurance business is still fledgling and as we have seen in Athene's case, surrenders are very unlikely. They cannot negatively affect FGAUM.

Other parts of the company (infrastructure, renewables, real estate) are not related to SVB collapse at all. But Oaktree, Brookfield's credit arm, should be a beneficiary.

Historically, Oaktree tended to acquire discounted or distressed credit instruments that would be later sold upon recovery or exchanged into controlling equity stakes during reorganizations. Oaktree can also extend direct loans replacing banks in certain scenarios. Due to Brookfield's strong marketing presence, it is now easier for Oaktree to quickly attract funding capital from various third parties.

Summing up, SVB-related events should be positive for BAM and investors can use a low entry point that is available now. BAM can be valued by its dividend yield. Based on comps, BAM should be trading most of the time at 3-4% dividend yields (please see my previous article). A 4% yield corresponds to a $32 stock price.

Conclusion

Other alt managers are similar to APO and BAM and, in general, should benefit from the weakening of SVB and regional banks. Moreover, based on Bloomberg, APO, KKR, and BX are already on a hunt for portfolios of SVB loans.

Unless we witness another unrelated black swan, we expect alt managers' stocks to recover.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BAM, BX, APO, BN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The possible escalation of the war in Ukraine makes equities riskier than usual.