BioVie: Update On Alzheimer's And Parkinson's Programs, And Focus On Its Treatment For Refractory Ascites

Summary

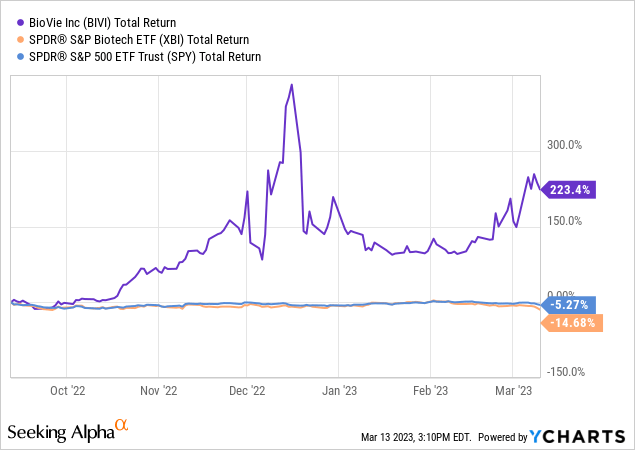

- BioVie’s stock has moved up considerably over the past 9 months in light of promising Alzheimer’s data.

- BioVie Day and full Phase 2 Parkinson’s trial results are scheduled for this month.

- BioVie has just announced strong efficacy data for BIV201 in its Phase 2b trial.

- I am excited for the rest of BioVie’s 2023, and actually expect far more upside for the stock.

Klaus Vedfelt/DigitalVision via Getty Images

Introduction: 2022 and 2023 see BioVie executing

Investing in biotech companies requires patience. In the case of NE3107 for Alzheimer’s disease and Parkinson’s disease, hereafter shortened to AD and PD respectively, both BioVie’s (NASDAQ:BIVI) Clarence Ahlem and Chris Reading have been working on this drug candidate for more than twenty years. Things are finally coming together now. I had covered BioVie in the past and was Bullish then, but the data that has been released since and will continue to be released is why I am writing this article and has made me more bullish.

BioVie investors have been profiting from the momentum in the company’s lifespan over the past 9 months. BIVI stock has been consistently outperforming indices by impressive numbers.

This success is due to continuously positive data on its drug candidate NE3107 both in AD and PD. It has allowed the company to find about $44 million of financing at the end of the last reported quarter, and possibly more thereafter, from proceeds of the issuance of common stock. The company currently has a burn rate of $16 million per quarter. With the additional financing the company should have at least another year before another round is needed.

I believe we have only seen the beginning of BioVie’s run in 2023. I see five essential reasons to support that view.

1. The biotech bear market had been particularly brutal on BioVie’s stock, which had been trading at around a $70 million market cap prior to the first positive readout in July 2022. It is currently trading at around a $300 million market cap, leaving a large upside for the stock if trial get de-risked further on the back of – hopefully - positive data.

2. BioVie has some potentially exciting catalysts coming. This includes BioVie Day on March 28, 2023, full Parkinson’s phase 2 trial data at the AD/PD conference in Gothenburg at the end of March 2023, the initiation of a presumably short Phase 3 trial in PD, efficacy data from a Phase 2b trial in refractory ascites, and its Alzheimer’s Phase 3 trial in October 2023.

3. As BioVie may report more positive data on NE3107, the conviction in this drug candidate for both AD and PD may grow.

4. With its major shareholder Terren Peizer having resigned as President of the Board in light of allegations relating to a different company Ontrak (OTRK), the stock could be considered more investable by some.

5. The stock seems to have formed a new bottom around $5, and has been moving up from there recently.

The current article will focus on BioVie’s recent efficacy data for treatment candidate BIV201 for refractory ascites, which I believe is de-risked and out of focus of many investors. I will discuss further recent data from both the Alzheimer’s and Parkinson’s trials for NE3107, which validate each other, below. I will subsequently discuss why I see further upside for the stock in the near term.

BIV201: continuous terlipressin for refractory ascites

Introduction

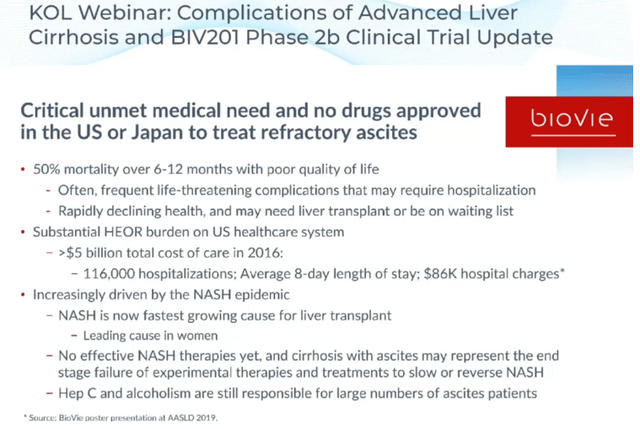

Refractory ascites, which is the massive accumulation of fluid and salt within the peritoneal cavity, occurs in about 5%-10% of all patients with liver cirrhosis. It is often seen as a symptom of late-stage liver failure, where the liver is asking for more blood flow but the body can no longer eliminate salt and water, leading to malnutrition and ultimately death. Chronic liver disease affects about 4.5 million Americans, with 600,000 of them having liver cirrhosis. That condition coincides with a risk of rapidly declining health. Where ascites can be resolved only by liver transplant, which some patients cannot undergo, there are several therapeutic measures that should provide temporary relief for the ascites such as paracentesis, shunts, vasoconstrictive drugs, or an ascites pump system. Paracentesis is a word for simply draining the abdomen, and it is the most practiced treatment.

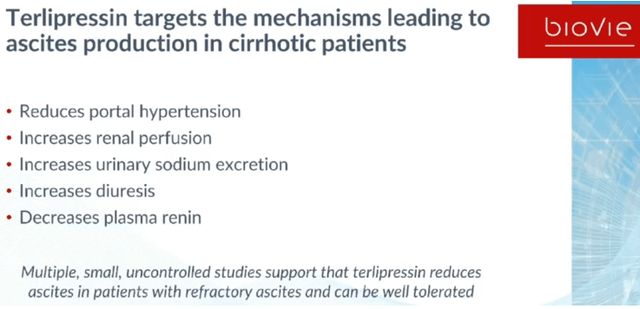

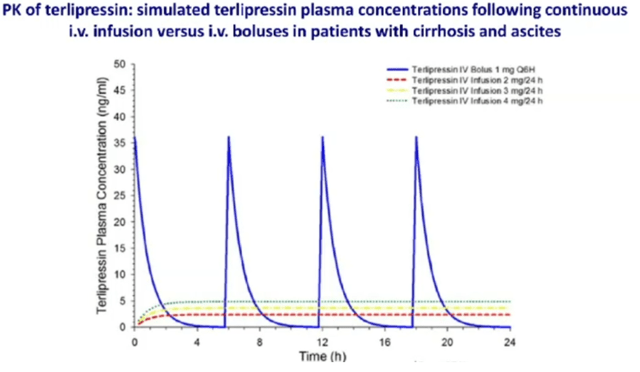

Refractory ascites coincides with repeated hospital intake and a median survival of 6 to 12 months. There is no FDA-approved drug or pharmacological treatment in the US or Japan for the treatment of this condition. In some other countries of the world, bolus infusion of terlipressin, a non-selective agonist of both V1 and V2 receptors, has been approved. That drug targets mechanisms leading to ascites production and lead to improved muscle strength and dietary intake, but its manner of administration is suboptimal which leads to serious adverse events.

Though terlipressin is the first line treatment in most of EU and several other countries, the FDA did not approve it in light of its severe adverse affects, including respiratory failure, which are related to the serum spike related to the bolus injection as shown below.

That means the unmet need remains, to reduce the need for paracentesis, reduce hospital admissions, reduce incidence of complications, improve survival and prolong the time necessary to bridge to a liver transplant.

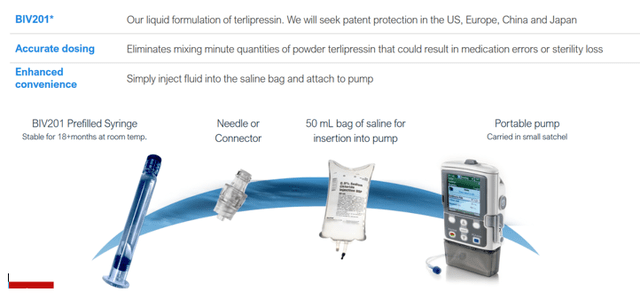

BIV201 or continuous terlipressin administered with a portable pump in an outpatient setting

Continuous terlipressin infusion is associated with improved diet intake and muscle strength in patients awaiting liver transplant.

This is the patented solution proposed by BioVie, which the company is pursuing protection for overseas, together with a new and still undisclosed patent application. It is essentially a continuous infusion of terlipressin with a portable infusion pump in a homecare setting.

BioVie has received orphan drug designation which may allow for 7-year exclusivity for first-to-market therapies, and fast-track designation for this proposed solution.

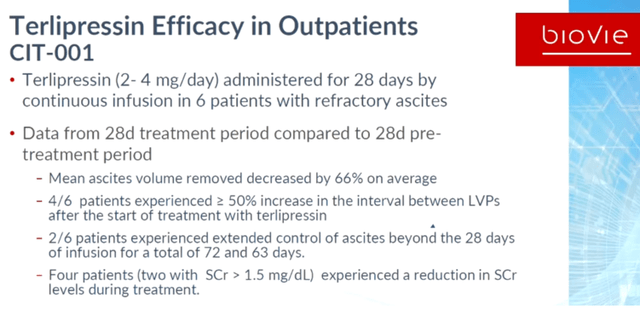

Results of the Phase 1 trial showed the treatment to be safe. The Phase 2a trial saw patients remaining hemodynamically stable, with 66% of patients experiencing a significant increase in the number of days between paracenteses, with percentages ranging from 71% to 414% compared to baseline.

The treatment was generally well-tolerated, with no treatment-related adverse effects.

Efficacy data from the Phase 2b trial

BioVie has been conducting a Phase 2b trial in patients suffering from refractory ascites over a 6-month study period. That period consists of two 28-day cycles within 4 months, with a follow-up time of 2 months. Primary endpoints were incidence of complications of grade 2 severity, and reduction in ascites fluid. Several other exploratory endpoints such as paracentesis requirements, incidence of hospital admissions, overall survival and ascites—related symptoms had been included.

The trial should have seen an update in 2022, but apparently suffered delays due to the Covid-19 pandemic. BioVie has now announced its decision to pause the trial and to engage in discussions with the FDA, in light of the compelling data in 15 patients, given the high unmet need. The efficacy data is indeed pretty strong. I present the data and my thoughts below.

1. The treatment was safe, well-tolerated, without unexpected serious adverse events. This is good, consistent with earlier findings, and should provide a rationale that allows the FDA to decide differently than how it decided when terlipressin administered through a bolus injection came up for approval.

2. Over the course of 28 days, treatment with BIV201 plus standard of care resulted in a 34% reduction in ascites fluid with a p-value of 0.0046, which was significantly different from those treated with standard of care only who saw an increase by 3.1%, with a p-value of 0.05.

That result is strong, as it shows that with BIV201, the body is capably of further removing ascites fluid from the abdomen. The trial’s goal, as announced in a 2021 KOL webinar, was to see a trend toward improvement, but not statistical significance in the incidence of ascites-related complications and removal of ascites fluid over 90 days as primary and secondary endpoints respectively. The trial hence exceeded expectations.

3. Over the complete course of treatment, treatment with BIV201 plus standard of care resulted in a 53% reduction in ascites fluid with a p-value of 0.001, this result again being significantly different from those treated with standard of care, with a p-value of 0.007.

Here as well, the trial exceeded expectations, showing such a strong and statistically significant effect in a small patient group. Further reducing ascites fluid during the entire six months of the trial by more than half provides a large benefit in this indication with an unmet medical need.

4. The improvement was sustained during the 3 months after treatment initiation as compared to the 3-month pre-treatment period, i.e. a 43% reduction with a p-value of 0.06. The same comments as mentioned above also apply here.

The full data will be presented at an upcoming scientific conference.

As this data is stronger than expected, BioVie’s upcoming discussions with the FDA to engage in a pivotal Phase 3 trial make sense. I discuss valuation in the chapter below.

NE3107 in Alzheimer’s disease: BioVie Day and October Phase 3 results

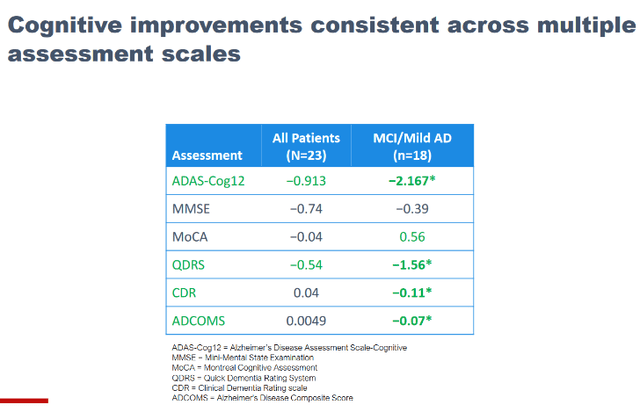

NE3107 is a potent anti-inflammatory drug candidate that was originally designed as an anti-diabetes drug, and apparently does not come with immunosuppressant side effects. Neuroinflammation, insulin resistance and oxidative stress are characteristics shared by numerous neurodegenerative diseases, such as AD, PD, frontotemporal dementia and ALS, and NE3107’s potential to inhibit neuroinflammation and insulin resistance forms the basis for BioVie’s work. The brain ends up in an inflammatory loop, and its immune cells overreact to misfolded proteins which they cannot seem to remove. BioVie has presented good results from a small 3-month open label study in Alzheimer’s disease. The three datasets presented at CTAD 2022, which are to be combined with information contained in other press releases and BioVie’s different letters to shareholders, are to be found on BioVie’s website. I have discussed these further in my earlier coverage. I am only copying the data shown on different measurements of cognition below.

BioVie has announced that on March 28, 2023, it will hold BioVie day to, among others, present additional data from the Alzheimer’s Disease, Parkinson’s Disease, and Liver Disease Programs. It will also announce details on new clinical trials, and provide guidance on its approach towards commercialization and collaboration/partnerships at that time.

I am looking forward to the additional data in Alzheimer’s disease, which I expect to further confirm the potential of NE3107 as a disease-modifying drug candidate for Alzheimer’s disease.

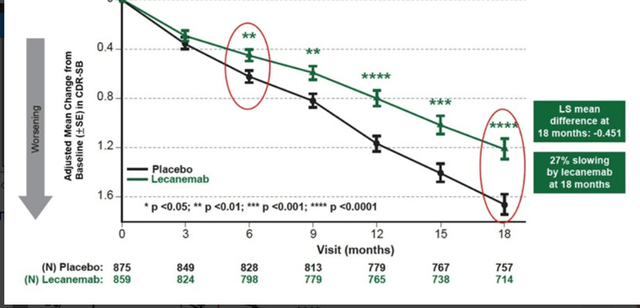

NE3107 is in a Phase 3 trial for Alzheimer’s disease, which the company announced recently is fully enrolled, with topline data expected to be released in October 2023. The market potential is obviously enormous, and I see Biogen sporting a multi-billion valuation in case of a successful Phase 3 readout. In comparison, on March 10, 2023, Biogen (BIIB) considered that Leqembi’s potential was to top $7 billion, with a market potential of $70 billion. Even excluding sales multiples, the current less than $300 million market cap is a fraction of that, hence I think there is considerable upside. As also explained in my previous coverage, I expect BioVie’s drug to do substantially better than all-in-all moderate results shown by Leqembi, as shown below.

In the US alone, six million patients are suffering from AD. Even if cognition-improving Phase 2 open label results would not be able to be reproduced given a potential placebo effect, stabilization of cognition or in any case a better than 27% slowing of cognitive decline may well be in the works.

In October 2023, BioVie is expected to report results of its Phase 3 trial at the six-month time point. At that time point, one could already see a moderate divergence in the Leqembi data. I am still unsure at this time whether the current six-month Phase 3 trial in 400 patients would be sufficient to support approval of the drug in Alzheimer’s disease, as I had always considered that a twelve-month trial would be necessary to see how the drug’s effects would evolve over a longer time frame, and to assess whether the drug is symptomatic or disease-modifying.

BioVie Day: upcoming data for NE3107 in Parkinson’s disease

BioVie’s Phase 2 trial in PD is randomized and placebo-controlled. As a reminder, the same drug candidate is tested in that trial, which makes sense if inflammation and insulin resistance may really be main drivers of disease-progression. BioVie has now made two press releases relating to results from its Phase 2 trial in PD. The press releases are:

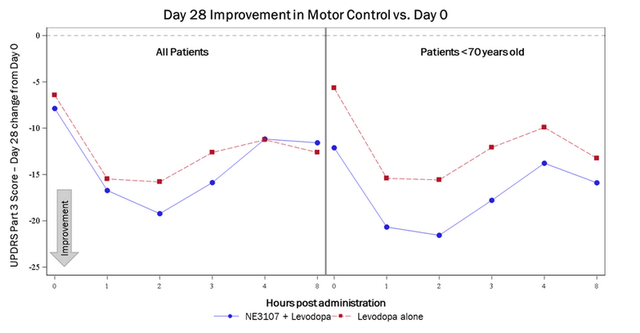

1. Patients treated with the combination of NE3107 and levodopa saw improvements in their UPDRS Part 3 (motor) score that is 3+ points superior to patients treated with levodopa alone, which is considered clinically meaningful.

2. Patients under 70 years of age treated with NE3107/levodopa experienced roughly 6 points superiority compared to those treated with levodopa alone, suggesting that younger patients with less advanced disease progression may experience greater impact from treatment with NE3107.

3. 88.9% of patients <70 years old treated with NE3107 and levodopa experienced greater than 30% part 3 score improvements from baseline at the 2-hour mark compared to 63.6% of patients treated with levodopa alone.

Company’s recent PR on Parkinson’s

Obviously this is outstanding data showing synergy with standard of care levodopa. It makes me curious as to how that data trends over a 28 day period, which I expect to be part of the full data package to be announced at the ADPD conference end of March. The data seems to confirm, as could be inferred from the 3-month open label study in Alzheimer’s disease, that NE3107’s effects are fast-acting, as expected from these drugs.

- March 6, 2023: significantly more patients were assessed as being in the “ON” state in the morning after withholding their usual standard of care for at least 8 hours before taking their usual morning Parkinson’s medications, compared to patients on standard of care alone plus placebo (p<0.02).

I see this announcement as very positive, and the stock reacted well to it in spite of a depressed downturn over the recent SVB bankruptcy towards the end of the week. It confirms that NE3107 provides beneficial action that lasts much longer than standard of care levodopa does. Levodopa’s effects end after six hours, after which patients return to an ‘OFF’ state. Patients cannot be tested at night, so it would be impossible to assess their ON/OFF state during that crucial time frame. But if, about eight hours after levodopa’s effects end, a significant part of them is still in the ON state, then that should imply that NE3107’s effects solely are responsible for that ON-state. That is very interesting, as NE3107 aims to be a disease-modifying drug, not a symptomatic treatment.

There are about 1 million patients suffering from PD in the US alone. For me, also, any positive data coming from either the AD or PD trial further validates NE3107’s potential. The above data further de-risks my investment in BioVie in both of its neurodegenerative programs.

After the announcement of marvelous data in studies targeting two large indications and investment opportunities with an unmet medical need, which validate each other, chances are investors start overlooking what the company had originally considered its most de-risked asset, namely BIV201. I will discuss that below.

Large upside potentially remaining

Companies with large risk/reward potential often don’t come this cheap.

By mid-2021, the biotech bear had slashed BioVie’s valuation ahead of its – possibly unexpected - open label Phase 2 readout in AD, and further readouts in PD.

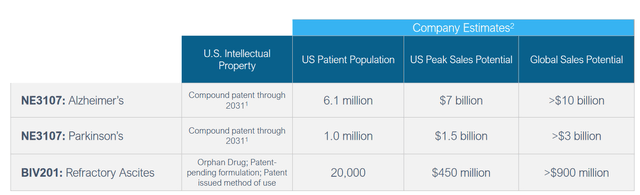

As a reminder, upon first-to-market approval of a therapy that has received orphan drug designation, typically a period of exclusivity of 7 years is granted. BioVie considers that at a price of $20,000 yearly, its revenue potential in the US is 450 million and >900 million worldwide for refractory ascites alone. I consider the trial for BIV201 as considerably de-risked, with no competition. Moderately assuming $500 million in peak sales, with a sales multiple of 6x may lead to a $3 billion valuation. This asset is considerably de-risked, contrary to many other biotech assets, which may justify a rather moderate factoring in of risk of approval.

NE3107 obviously holds more upside, with addressable markets of 6 million and 1 patients in AD and PD respectively, in the US alone. BioVie is currently heading into a Phase 3 readout in Alzheimer’s at about a $300 million valuation. In comparison, Anavex (AVXL) had a market cap of about $1 billion prior to its Phase 3 readout on much less compelling data. Cassava Sciences (SAVA) saw its market cap grow to almost $5 billion prior to the announcement of 6-month cognition data coming out of an open label study. Still in comparison, Leqembi’s results gave rise to drastic upward valuations in the billions of dollars both at Eisai (OTCPK:ESALF) and Biogen, whose stocks had gone up 58% and 40% respectively the day the news on Leqembi was announced.

Finally, two potential overhangs on this stock seem to be gone, the first relating to the company requiring additional financing which it secured over the past months, and the second relating to its former chairman who recently resigned from the board.

Therefore, despite a ~300% upside seen by investors over the past nine months, I believe a large further upside may remain for stockholders, as the company further dives into data-rich territory and only has a bit more than six months remaining until it reads out a Phase 3 trial in Alzheimer’s. Add to that, the potentially only three-month long pivotal Phase 3 trial in Parkinson’s that could be started in the course of this year.

Risks

As the present article’s focus is on continuous terlipressin for refractory ascites, which I consider substantially de-risked, I see the risks associated with this treatment candidates as rather low. Of course, a Phase 3 trial should in principle still be run, and the FDA has final control over whether or not to approve the treatment for the condition.

Further risks associated with the stock relate to NE3107 for Parkinson’s disease and Alzheimer’s disease. The competition in that field is higher, and the historical failures are numerous – though the tide is turning.

Finally, macro-economic headwinds may influence the stock, as last seen with SVB’s financial distress, which had an effect on the entire biotech market.

Conclusion

The present article’s focus was on BioVie’s continuous terlipressin as a treatment candidate for refractory ascites. Recent efficacy again confirm the straightforward case for continuous terlipressin as a treatment for refractory ascites. There is no approved drug in the US for this condition, and BIV201 has received orphan drug and fast-track designation which means the FDA is on board with the necessity for treatment. The current standard of care is paracentesis, which is essentially draining the liquid from a person’s abdomen. There is an approved drug in the EU and other countries, terlipressin administered through a bolus infusion. Not only is that less efficacious than BIV201’s continuous infusion, but the manner of administration is suboptimal and leads to serious adverse events. Efficacy data just reported by BioVie show that the treatment was safe and well-tolerated, and that BIV201 led to reduction of about 50% of the ascites fluid over six months, with a 35% reduction noticeable already after 28 days.

NE3107 appears to be a pipeline within a drug, showing improvement/stabilization of cognition patients suffering from AD at 3 months, backed by strong biomarker data. If final data would be less strong in a placebo-controlled trial which is expected to report results in about 6 months, then I still expect them to be far better than Biogen/Eisai’s Leqembi’s. Big pharma will be picking this up, and collaborations/partnerships, which BioVie will share its ideas on during BioVie day, may be in the works.

Two preliminary results from a randomized placebo-controlled trial in Parkinson’s back up these findings, showing clear and clinically relevant improvement in Parkinson’s patients on standard of care after 28 days, with statistically meaningful portion of those patients remaining in the ‘ON’ state hours after standard of care should have stopped working. Both trials validate NE3107’s mechanism of action, and show he drug candidate’s fast and persistent action.

The company’s management is executing, possible overhang on investability is no longer present, and the coming year may be filled with further good news coming from all three indications BioVie is in trials for. This includes BioVie Day on March 28, 2023, full Parkinson’s phase 2 trial data at the AD/PD conference in Gothenburg at the end of March 2023, the initiation of a presumably short Phase 3 trial in PD, efficacy data from a Phase 2b trial in refractory ascites, and its Alzheimer’s Phase 3 trial in October 2023. It is hard for me to believe BioVie will be heading into a pivotal readout later this year at the current market cap. For that reason, I see substantial further upside for the stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BIVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.