Verde AgriTech: Growing Rapidly With Strong Margins

Summary

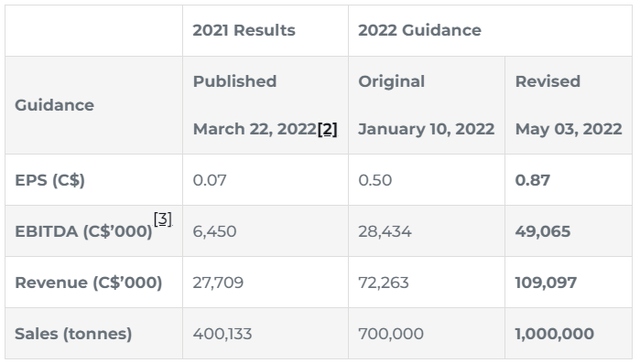

- Verde AgriTech's guidance for 2022 included sales of C$109.1 million ($79.3 million) and EPS of C$0.87 ($0.63).

- In my view, EPS could more than double in 2023 thanks to the ramp-up of its second plant as well as a partnership with Lavoro.

- In addition, Verde AgriTech plans to start building a third production plant in 2023 which has an NPV of $2.91 billion.

- Assuming a conservative valuation of 0.3x NPV for the third plant alone, this translates into C$7.60 ($5.53) per share.

- Forsaken Value and Yield members get exclusive access to our real-world portfolio. See all our investments here »

Galeanu Mihai

Introduction

I've mentioned in several articles on SA that I work as an M&A analyst covering Latin America, and I've written about several companies from the region, e.g. Betterware de Mexico (BWMX) here, Industrias Bachoco (IBA) here, Cementos Pacasmayo (CPAC) here, and Embotelladora Andina (NYSE: AKO.A) (NYSE: AKO.B) here. Today, I want to talk about Brazilian fertilizer producer Verde AgriTech (OTCPK:VNPKF) (TSX:NPK:CA). Brazil is a major importer of fertilizer and with the war in Ukraine creating supply issues, the company has been ramping up production at the right moment. The guidance for 2022 included sales of C$109.1 million ($79.3 million) and earnings per share (EPS) of C$0.87 ($0.63) and I think that earnings could more than double in 2023 as Verde AgriTech's second plant ramps up production over the coming months. Let's review.

Overview of the business and financials

Verde AgriTech was founded in 2005 and is a vertically integrated producer of potassium fertilizers based in the city of Belo Horizonte in the southeastern Brazilian state of Minas Gerais. The company's main brands include BAKS, and K Forte, and its products are sold internationally under the Super Greensand brand.

Verde means green in Brazilian and the reason the company chose this name is because it focuses on sustainability - the mined areas of its Cerrado Verde deposit are mainly composed of degraded pasturelands that are transformed in tropical forests once mining has finished. This deposit is located in the heart of Brazil's largest agricultural market and is a source of a naturally occurring potassium silicate rock. There are no tailings dams, and the production process does not generate any waste by-products. Between 2019 and 2021, Verde AgriTech planted a total of 19,188 trees, with all planted species originally native to the region.

Verde AgriTech is currently licensed to produce up to 2,833,000 tonnes per year (tpy) of potassium fertilizers and it has a combined measured and indicated mineral resource of 1.47 billion tonnes at 9.28% potassium oxide. Its first processing facility was launched in July 2018, and it has a production capacity of 600,000 tonnes per year. In August 2021, Verde AgriTech started building a second plant with a 1,200,000 tpy production capacity and the facility was commissioned in August 2022. Verde AgriTech planned to boost the capacity of this facility to 2,400,000 tpy in Q4 2022 due to strong demand for its products and if the annual production reached 3,000,000 tpy, the company will become the largest potash producer in Brazil.

Demand for the products of Verde AgriTech has been particularly strong since the Russian invasion of Ukraine in February 2022 and in May 2022, the company significantly increased its 2022 guidance. The updated sales volume target for 2023 is 2,000,000 tonnes, which represents an increase of around 100% compared to the sales expected for 2022.

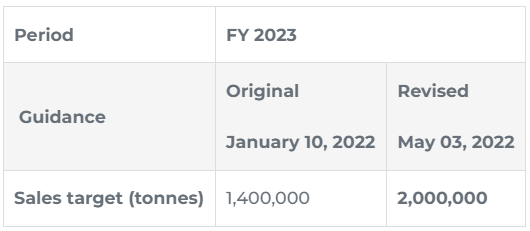

Looking at the latest financial results of Verde AgriTech, we can see that sales rose sharply in Q2 and Q3 2022 which led to a significant improvement in profitability. In my view, there is significant room for further growth as the production and financial results for these two quarters were negatively impacted by limited production at the second plant. In September, the company ran into unforeseen groundwater issues while performing roadworks activities to increase truck accessibility which led to production delivery from this facility to be limited for around six weeks during the peak demand season in the country.

In my view, the chances that the company managed to meet its 2022 production guidance are good considering that the second plant achieved its nameplate production capacity of 1.2 Mtpy in October and that the company entered into a distribution partnership with Lavoro (NASDAQ: LVRO) in August 2022. The latter is the largest agricultural inputs retailer in Brazil with over 190 stores and I expect this deal to significantly boost the sales of Verde AgriTech over the coming years. In my view, the sales volume target for 2023 seems achievable and I think that EPS could surpass C$2.00 ($1.46) thanks to economies of scale.

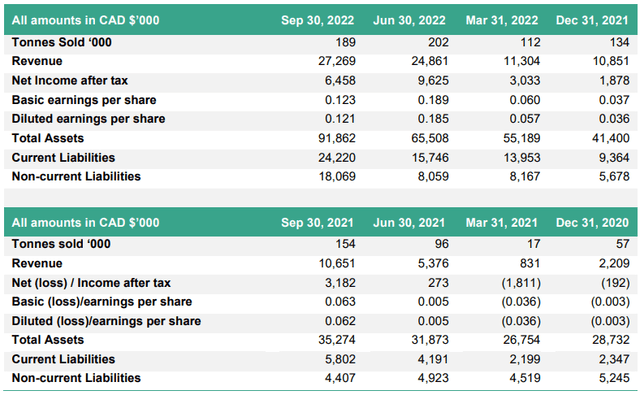

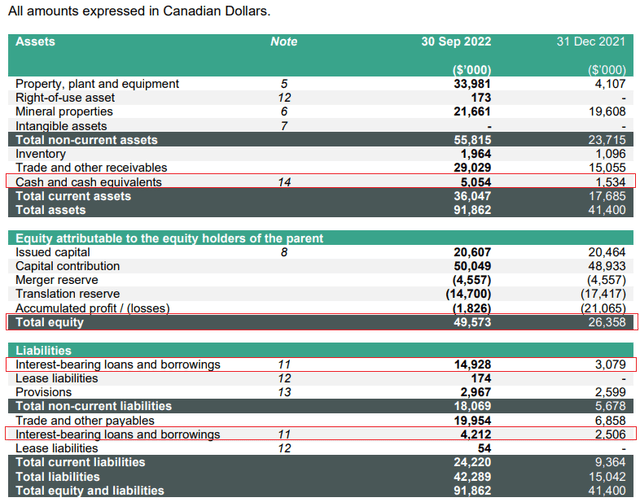

Turning our attention to the balance sheet, I think that the situation looks good as strong profitability since Q3 2021 has allowed Verde AgriTech to boost shareholder's equity significantly and thus finance the construction of the second plant without stock dilution. Net debt stood at C$14.1 million ($10.3 million) as of September 2022 and it's crucial for the company to keep increasing its production and operating income as the third plant will require significant initial CAPEX.

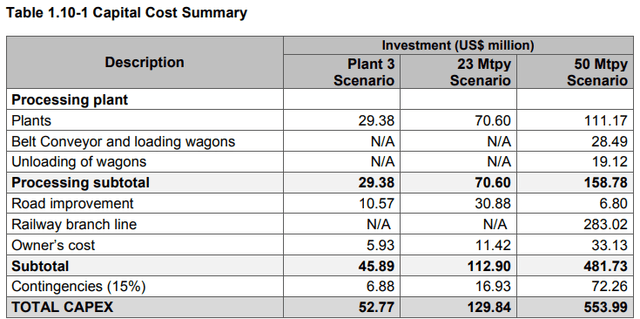

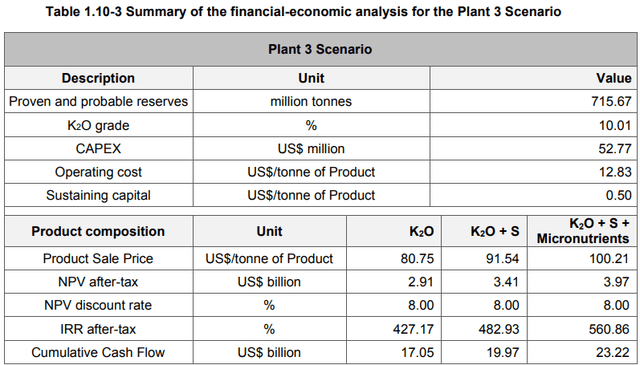

You see, Verde AgriTech plans to add an additional 10 Mtpy of capacity by building a third plant in 2023 and the results of a pre-feasibility study released in May 2022 showed that CAPEX is estimated at $52.77 million. If there is any chance to avoid the need for equity financing, the company needs to deliver on its 2023 sales target.

Looking at the key financial figures for the third plant, I think that this facility could be a game-changer for Verde AgriTech as the projected post-tax net present value (NPV) is $2.91 billion and the internal rate of return (IRR) stands at over 400%.

The NPV seems achievable considering the PFS was based on potash prices of at less than a third of the potassium chloride prices at the time. Assuming a conservative valuation of 0.3x NPV for the third plant alone, this translates into C$7.60 ($5.53) per share. In my view, there is a significant margin of safety here.

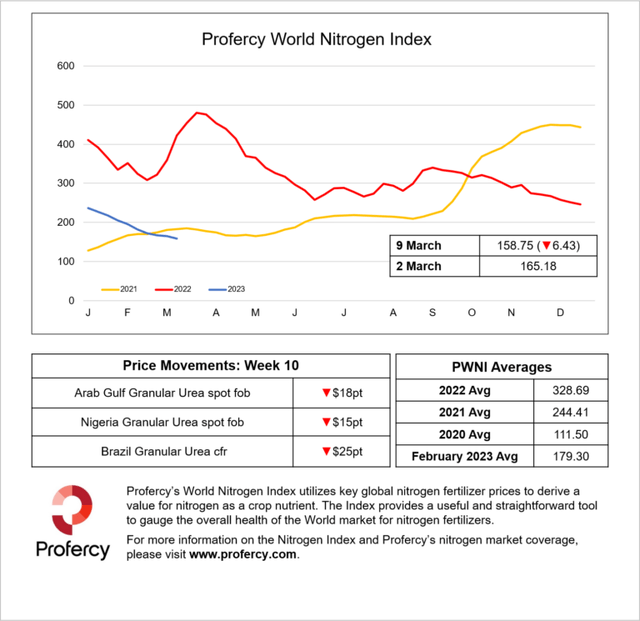

Turning our attention to the risks for the bull case, I think that the major one is lower fertilizer prices in the coming months. Ammonium nitrate is a popular fertilizer made using natural gas and with energy prices declining over the past few months, many fertilizer production facilities have been reopening, especially in Europe. Last week, the Profercy World Nitrogen Index fell by 6.43 points to 158.75 and is thus below 2021 levels.

Low fertilizer prices could potentially push Verde AgriTech to rely on equity financing to build its third plant or lead to a delay of the project.

Investor takeaway

Verde AgriTech has achieved impressive growth in terms of production and earnings over the past few quarters and I think this is likely to continue in 2023 thanks to the ramp up of its second plant as well as a partnership with Lavoro. In my view, EPS could more than double unless global fertilizer prices continue falling. In addition, Verde AgriTech seems in a strong position to fund the construction of its third plant with operating cash flow and debt. I rate this stock as a speculative buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article, consider joining Forsaken Value and Yield. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys. Both long and short ideas.

So, what can you expect to get from this service?

- Exclusive articles

- Access to my portfolio and watchlist

- Interviews, ideas, portfolios, watchlists, and comments from other investors I've invited to the service

- A chat room with access to me and the other investors

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.