Toronto-Dominion Bank And Royal Bank: Find Safety In Canada

Summary

- Recently, we saw several U.S. banks implode due to bank runs.

- Big U.S. banks tanked in tandem with their fallen regional siblings.

- These U.S. banks are fairly safe, but big Canadian banks are arguably even safer.

- Canadian banks are required to have 11% CET1 ratios.

- They also have very minimal unrealized securities losses.

Golden_Brown

The past week saw big risks materialize in the financial services sector. First, Silicon Valley Bank (NASDAQ:SIVB) collapsed after a bank run made it unable to pay off depositors. Then, Signature Bank collapsed, as the Federal Government stepped in to make both banks’ depositors whole. Even large banks like Bank of America (BAC) lost value in the wake of the regional bank implosions, as investors started to worry about their unrealized securities losses.

Receiving less mention this week were Canadian banks. Like the big U.S. banks, their prices mostly fell, but their names weren’t mentioned in the media as much as U.S. banks were. It’s a pity, because Canadian banks offer a level of stability that is unmatched elsewhere in the world. In the last 123 years, there were three major U.S. banking crises, Canada didn’t experience a single one in the same period.

Why is that?

It comes down to two things:

Concentration.

Regulations.

Canada’s banking sector is dominated by a few big banks, the biggest of which are Toronto-Dominion Bank (TD)(TD:CA) and Royal Bank of Canada (RY)(RY:CA). This concentration makes Canadian banks easier to regulate than U.S. banks. The U.S. has 4,844 banks (not branches, 4,844 entire banking companies), while Canada has 35. Having a smaller number of banks makes it easier for regulators to keep track of all of them, which means there’s more oversight (what Charlie Munger would call “adult supervision”).

The second factor that makes Canadian banks safe is the banking regulations themselves. Canada has very strict banking rules. The government makes the banking industry difficult to enter, it requires an 11% CET1 ratio, and it requires that banks report their liquidity coverage ratio. These regulations make banking crises very unlikely in Canada. Canadian banks are required by law to maintain a lot of capital relative to risk weighted assets–more than U.S. banks are. This makes Canadian bank stocks good bets for investors who are concerned about risk as much as return.

TD and Royal Bank - Canada’s Two Banking Giants

If you want to invest in Canadian banks, TD and Royal Bank are the logical ones to research first. They are the biggest banks in Canada: TD the biggest by assets, RY the biggest by market cap. The other Canadian banks are definitely worth a look too, but I’ll focus on TD and RY in this article.

First, we can look at TD Bank. This is a stock I personally own. TD is mainly a retail bank, offering savings and loans. It also does wealth management, investment banking and brokerage services, though it is very heavy on core retail banking.

TD’s main claim to fame is its large U.S. retail business. It acquired this business by buying out a number of U.S. banks, including Commerce Bank, BankNorth, and South Financial Group. Today, TD is the 9th biggest bank in the United States.

33% of TD’s net income comes from the United States. This gives TD a lot of geographic diversification. The bank’s U.S. business has generally grown faster than its Canadian business. TD owns a large stake in Charles Schwab (SCHW), which is reported as part of U.S. retail. It has some U.S. investment banking operations too, such as the recently acquired Cowen.

Royal Bank of Canada is similar to TD: a Canadian bank with a lot of U.S. exposure. It has significant investment banking operations in the United States. It has a wealth management business that operates in Canada, the U.S. and Latin America. About 40% of Royal Bank’s earnings come from regions other than Canada, making it even more geographically diversified than TD Bank is.

Both TD and Royal Bank are well capitalized. Royal Bank has a 12.7% CET1 ratio, TD’s ratio is 16.2%. TD says that it will have an 11.2% CET1 ratio if it closes its First Horizon (FHN) deal. That’s above Canada’s regulatory requirement, but only slightly. The point is that TD and Royal Bank today have very high CET1 ratios that you rarely see among U.S. banks.

Barely Any Unrealized Losses

One of the big issues that has got people nervous about banks today is unrealized securities losses. A combination of unrealized losses and a bank run caused Silicon Valley Bank to collapse. One of the reasons why Bank of America fell so much further than its peers last week is because it had large unrealized losses as a percentage of equity. With TD and Royal Bank, unrealized securities losses aren’t the biggest concern.

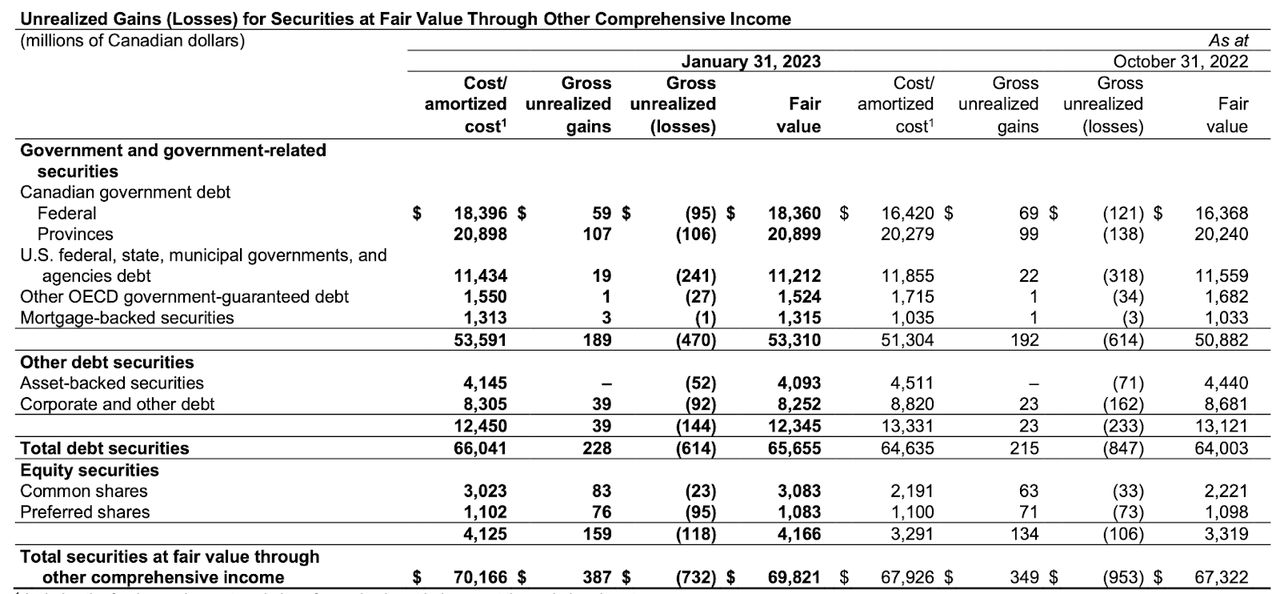

TD Bank does not have much in the way of unrealized losses on securities. In its most recent quarter, it reported only C$732 million worth, compared to C$111.8 billion in equity. So, TD is not at risk of its unrealized securities losses eating away at its capital position.

TD Bank unrealized gains and losses (TD Bank)

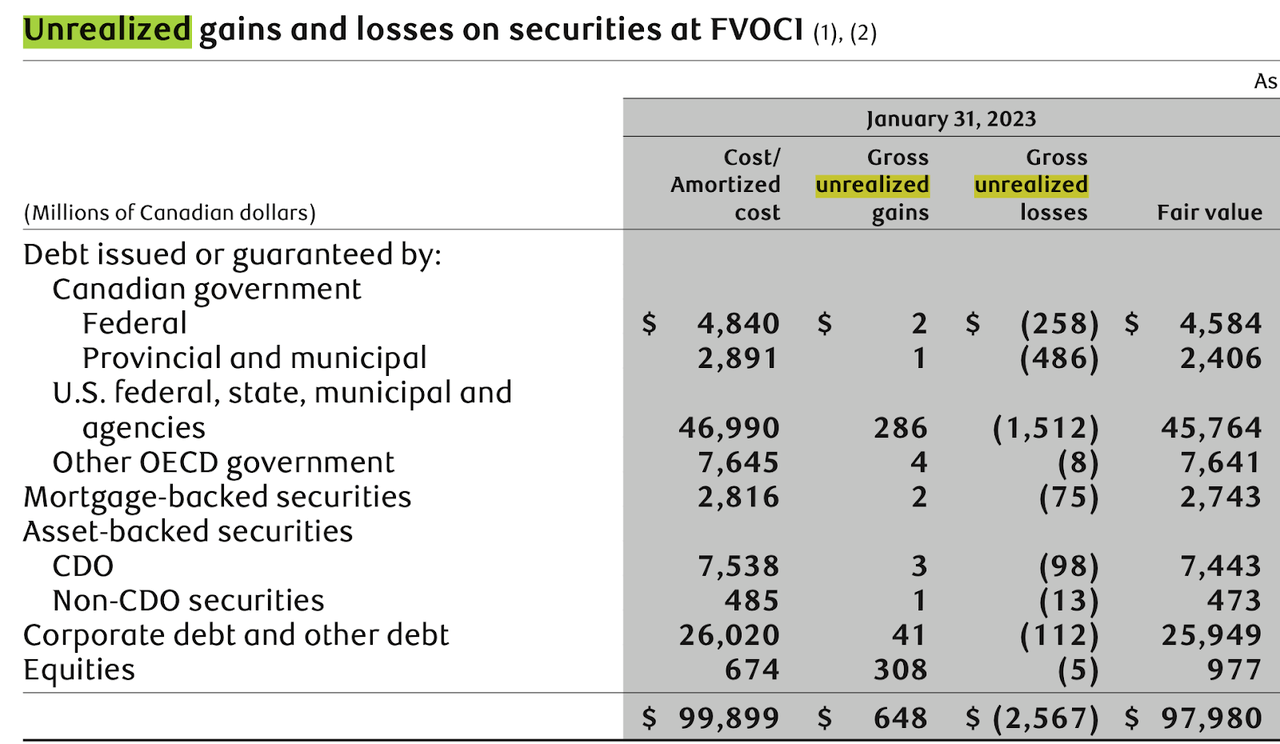

Royal Bank for its part had C$2.5 billion in unrealized securities losses, against C$107 billion in equity.

Royal Bank unrealized gains and losses (Royal Bank)

It’s worth noting that both TD and Royal Bank had significant amounts of unrealized gains offsetting their losses in the most recent quarter. If you take the $387 million gain off of TD’s $732 million loss, you end up with $345 million in net unrealized losses. As a percentage of TD’s equity, that is a mere 0.3%.

Valuations

Another appealing thing about Canadian bank stocks is their valuations. The multiples are similar to those of U.S. banks, but when you look at the various factors Canadian banks have going for them, you could argue that we’re seeing similar multiples to U.S. banks with lower risk. That could signal undervaluation.

Below are some valuation metrics for TD and Royal Bank, courtesy of Seeking Alpha Quant.

P/E | 9.13 | 11.1 |

P/sales | 2.95 | 3.5 |

Price/book | 1.35 | 1.75 |

Price/operating cash flow | 9.4 | 5.46 |

As you can see, these are both relatively cheap stocks. TD Bank stock is definitely cheaper, but Royal Bank stock is not overly expensive either. One thing neither of these stocks have right now is a low price/book ratio. You can currently buy Bank of America stock for less than the value of its assets, net of debt. TD and Royal Bank don’t enjoy that distinction just yet.

Risks and Challenges

As we’ve seen, Canadian bank stocks are fairly inexpensive, and Canada’s regulations make them a relatively safe bet. It looks pretty good so far. However, there are definitely some risks and challenges to keep in mind, including:

Canada’s housing market. Houses in Canada are 40% more expensive than in the United States. This is a potential problem for Canadian banks. Due to Canada’s higher housing costs, Canadians spend a higher percentage of their income on housing than Americans do. With the Bank of Canada hiking interest rates, this puts Canadian banks at risk of mortgage defaults. The rate hikes also mean that there are fewer mortgages being originated, because many Canadians just can’t afford them now.

Deal related issues. TD Bank is dealing with some major headaches with its First Horizon deal right now. Closing has been delayed three times already, the two parties don’t think they can close by May 27. This is a big problem because TD has to pay an amount for every single day the deal doesn’t close. It works out to $0.65 per share on an annualized basis. That’s a significant cost, considering that the deal was originally valued at $25 per share. At this point, even if the deal does close, TD will have paid a steep price just in delay costs. It wouldn’t be totally unreasonable for TD to back out of the deal at this point.

These risks notwithstanding, Canadian banks are looking pretty good right now. They plummeted in value like their American peers last week, but it’s not entirely clear why they did. Canadian banks are well capitalized, they’re growing, and they’re very profitable. They are not at risk of going bust any time soon.

Over the last 123 years, Canada’s banks have not faced a serious crisis. That speaks to the resilience of Canada’s banking system. Canada’s regulations impose certain costs on the country’s banks, but they also prevent the banks from taking on too much risk. As we saw last week with SVB Inc, too much risk can be all it takes for a bank to collapse.

So, if you’re an American investor, you can consider adding some Canadian banks to your portfolio. They offer sound risk management, high dividend yields, and modest valuations. They are worth taking a look at.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TD, BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.