Lululemon: May Outperform Peers

Summary

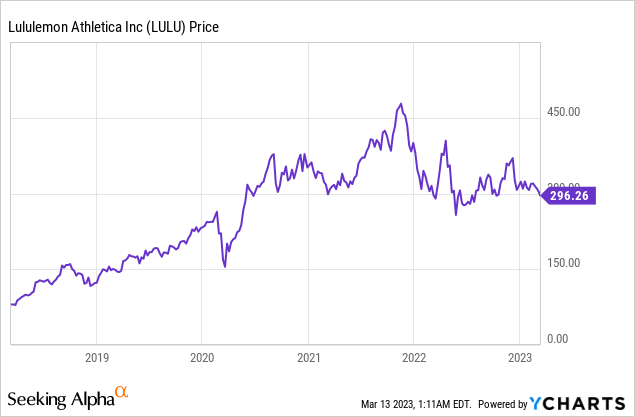

- Lululemon has pulled back nearly 30% from its 52-week high.

- The athleisure brand should show better resilience compared to other companies thanks to its affluent customer base.

- The men's segment and the reopening of China should continue to be solid growth drivers.

- Its latest earnings were strong and the current valuation also appears to be discounted on a historical basis.

- I rate the company as a buy.

Robert Way

Investment Thesis

Lululemon (NASDAQ:LULU) has been struggling in recent months, with shares down nearly 30% from its 52-week high, currently trading at the same level as May 2020. I believe the pullback presents a solid buying opportunity for long-term investors. The company’s affluent target demographic should provide strong resilience despite facing a slowing economy while the men's segment and the reopening of China are two growth drivers that should boost its financial performance in the near term. Thanks to these catalysts, the company’s latest earnings continue to show strong growth across the board with little signs of a slowdown. After the drop, the current valuation also looks discounted on a historical basis and should provide decent upside potential. Therefore, I rate LULU stock as a buy at the current price.

Why Will Lululemon Outperform?

I believe Lululemon will outperform other athleisure consumer brands in the near term thanks to a few catalysts. Firstly, the men’s segment should continue to be a growth driver. Lululemon has a strong presence among women but the penetration rate of men is still very low, which presents an opportunity. According to the company, its brand awareness for women in the United States is 38%, while for men it is only 11%. The figure in the international markets is even lower for men. In China, it is 4% while in Germany, it is 1%. The company is trying to improve its penetration rate by leveraging leading men’s fashion marketplaces such as MR PORTER as its distribution channel and is seeing huge success. It has grown the men’s segment at a CAGR (compounded annual growth rate) of 28% and the management team hopes to double the segment’s revenue in the next three years, which I believe is definitely achievable.

The reopening of China should also provide a solid boost for the company. As mentioned above, Lululemon’s brand awareness in the international markets is relatively low. China is one of its major focal points for growth, as the company expects the country to become its second-largest market within 5 years. The plan was interrupted by the extended lockdowns in China with one-third of its stores temporarily shut down, but they are now finally reopened as foot traffic returns. It aims to further expand in the country by tripling its store counts from 71 currently to 220 by 2026, which should help drive growth.

While the economy is forecasted to slow down further in the coming year, Lululemon’s demand should hold up well and show solid resilience. Unlike generic athletic brands such as NIKE (NKE) and adidas (OTCQX:ADDYY), the company has a much more affluent customer base with stronger purchasing power. They are relatively unaffected by the elevated inflation rate thanks to higher income and savings. Their customers are also very sticky and loyal thanks to the company’s strong branding. Unless we head into a severe recession, I don't foresee them changing their spending habits drastically.

Financials and Valuation

Lululemon announced its latest earnings back in December and it showed strong growth despite facing a tough macro backdrop. The company reported revenue of $1.86 billion, up 28% YoY (year over year) compared to $1.45 billion. Revenue growth was 31% on a constant currency basis. The growth is led by the strong momentum in the international segment, which grew 41% YoY. Revenue from North America was softer but still increased 26% YoY. Total comparable sales increased by 22% during the quarter. Due to inflationary pressure, the gross margin decreased by 130 basis points from 57.2% to 55.9%. The gross profit was up 25% from $829.4 million to $1.04 billion.

The bottom line was also outstanding as the management did a great job of managing the pace of spending. SG&A (selling, general, and administrative) expenses were $684.2 million compared to $545.1 million, up 25.5% YoY. This resulted in operating income increasing 37% from $258 million to $352.4 million. The operating margin also expanded 120 basis points from 17.8% to 19%. Diluted EPS was $2.00 compared to $1.44.

The most criticized part about this quarter’s earnings was the increase in inventories, which increased 85% YoY. However, I’m not too concerned. The company was preparing for the holiday season therefore it makes sense to stock up on inventories. Most of the inventories are made up of basic core styles, so the seasonal markdown risks are limited.

Meghan Frank, CFO, on inventory levels:

I‘d also note that core seasonless product continues to make up approximately 45% of our inventory. We remain pleased with our inventory levels, which position us well to fulfill guest demand in Q4.

After the pullback, Lululemon’s valuation looks very reasonable. The company is currently trading at a P/E ratio of 32.6x, which is among the lowest level in the past few years, as shown in the chart below. It represents a meaningful 40.6% discount compared to its 5-year average of 54.9x. The valuation is also slightly lower than peers such as Nike, which is trading at a P/E ratio of 33.2x. Yet, Nike’s revenue growth rate of 17.3% is much lower than Lululemon’s 28%. I believe the strong continued growth of the company should be able to support a multiples expansion back to historical averages.

Investors Takeaway

I believe Lululemon should outperform peers in the near term and the recent drop presents a great buying opportunity. The company's wealthy customer base alongside the men’s segment and China reopening should continue to fuel growth despite the economy slowing down. The latest earnings demonstrated strong broad-based growth and the inventory concern is exaggerated in my opinion. Its valuation is meaningfully below its 5-year average yet its fundamentals and growth remain excellent. The current price level should offer ample upside and I rate the company as a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.