Credit Suisse: A Triple Crisis Stock Crash

Summary

- Credit Suisse stock plunged 90% in five years.

- The bank has been haunted by scandals and internal control lapses reported recently.

- Biggest backers refuse to provide Credit Suisse with additional support.

- Credit Suisse is in crisis management mode showcasing bad crisis containment skills.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

aprott

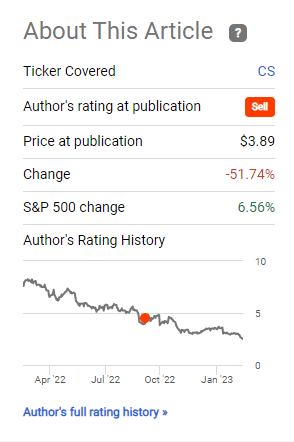

Credit Suisse stock (NYSE:CS) is trading 25.5% lower due a combination of several pressures, some impacting the entire banking sector and some are more specific to Credit Suisse. In November 2022, I issued a sell rating on Credit Suisse stock and I can already mention that I'm maintaining that rating as I have not seen any signs that the bank can deal with the banking environment which currently is more challenging than a couple of months ago.

So, Credit Suisse and its share price deals with several challenges:

- The current turmoil in the banking sector after the collapse of the Silicon Valley Bank.

- Control lapses

- Nervousness from investors

Credit Suisse: The Sell Rating Was Right

Seeking Alpha

When I assessed Credit Suisse in November 2022, the stock was under pressure due to comparisons being made between the credit default swaps of Credit Suisse and Lehman Brothers in 2008 right before its collapse. While I did not agree with the assessment with the CDS as a basis, what was clear is that Credit Suisse was and still is going through a difficult time and that's why I put a Sell rating on the stock and that seemed to have been the correct decision. On Seeking Alpha, you will see a mix of Hold, Buy and Sell ratings but the reality is that only the Sell ratings have been correct and it is good to keep in mind that going against the flow for the sake of it doesn’t mean you are right and others are not. Being contrarian can either reward you or burn you, it's not going to magically mean you're right just because you mention you're taking a contrarian view.

Since I wrote the report, the stock tumbled over 50% compared to a 6.6% appreciation of the stock market. So, clearly you should have put your money elsewhere and the weak performance is not new. Over the past five years shareholders saw Credit Suisse stock tumble 90%.

Pressures In The Banking Sector

One pressure that the entire banking sector faces right now is that interest rates are rising. Relatively safe government bonds from the near-zero interest rate era are now no longer high in demand so the portfolio value of those bonds is tumbling. For certain companies and individuals, the cost of debt is increasing so instead they might be more inclined to use cash on hand. That itself does not result in a bank run, but it could for banks that see their reputation dented. Credit Suisse is one of those names unfortunately. I'm not saying a bank run is happening, but bank runs don’t happen at the banks with the best names. The nervousness starts with the weak banks and it spreads from there.

Credit Suisse continuously points out that their capital ratios are strong and while that might be the case. Capital ratios are strong until they aren’t. With that I mean, if your bank has a bad name and has done extremely little to repair that you can expect clients to start pulling the money and then it remains to be seen how strong those ratios really are. Just because a bank can survive a crisis or bank run, does not mean you should position yourself for one to happen when you can prevent it.

So the collapse of SVB might have made one thing painfully visible and that's interest rates might have risen too quick. Higher interest rates are generally good for banks, so halting that hiking spree might not be good news for banks other than cost of debt no longer going up.

Credit Suisse: A Flurry Of Scandals

So, banks with a bad reputation are at risk. How do you get a bad reputation? Ask Credit Suisse. In my November report, I pointed out the following:

What hunts Credit Suisse is a bunch of scandals it was involved in. A non-exhaustive list includes the Malaysia Development Berhad scandal in 2015, a $10 billion involvement with Greensill Capital which collapsed in 2021 of which the majority was collected and $5.5 billion in losses linked to the collapse of Archegos Capital, also in 2021. These involvements are mostly reflected in the company's stock prices.

It seems that Credit Suisse cannot turn the page on scandals and while no industry is free of scandals for banking where the money of clients is managed, you better be free of scandals or address them adequately. Credit Suisse is not really doing that. It gets caught red-handed over and over it seems and take it on the chin. That is their battle plan and it's hardly one that deserves kudos. You could say that this is a thing from the past and they are working on it. I would agree were it not that material weaknesses in internal control were reported yesterday. Swiss is often hailed for its accuracy, thanks to its famous watches. The same held for its banking system, but that has not been the case for Credit Suisse for a very long time.

Where it becomes clear that Credit Suisse is managing a crisis and not a turnaround is on Twitter. The company issued a tweet yesterday saying its financial reports were accurate. If you have to send out a release like that, you are already in crisis management mode and not in problem-solving mode.

Just one hour ago, Credit Suisse followed up stating that reiterates its core financial. All of that is focused on containing a crisis.

So, if you look at the flurry of scandals, it seems that things are not getting better and more importantly the company remains mute most of the time when questioned on capital raises or required government assistance. While the bank tries to calm things down for clients and shareholders, refusing to address whether the bank needs or does need government aid hardly helps stakeholders.

Investors Sell Credit Suisse Stock As Backer Rules Out Assistance

What further spooked the market is that Credit Suisse’s biggest backer refused to provide additional aid. When I first read that the Saudi National Bank may exceed a 10% stake, and if it would provide assistance, I thought “well, maybe they cannot own more than 10%." The reality is that they can but additional regulations would apply. The Chairman of the Saudi National Bank explained:

The answer is absolutely not, for many reasons. I’ll cite the simplest reason, which is regulatory and statutory. We now own 9.8% of the bank — if we go above 10% all kinds of new rules kick in, whether be it by our regulator or the European regulator or the Swiss regulator.

That makes one wonder how exposed the Saudi National Bank wants to be to Credit Suisse. Do they really not want to get in a new regulatory bracket or they are looking for a way to not get even more exposed to Credit Suisse? The fact that the biggest backer of a company is not at all considering providing additional support causes nervousness and that's what we are seeing on the market today. Investors are thinking “if the biggest backer does not want additional exposure, how safe is this investment?” The answer seems to be “not so safe” and investors are selling.

Conclusion: CS Stock Goes Nuclear

We might see Credit Suisse stock gain a bit in the coming days after the share sell off. The reality, however, is that the company has built itself a bad financial reputation and that beyond the challenges in the banking sector and the difficult financial times provides little confidence in the company for clients as well as shareholders. Credit Suisse is not blowing up or belly up as I'm writing this, but it's often not a scandal that directly causes a collapse, it's the reaction from clients and shareholders causing it. We see shareholders walking away from Credit Suisse now and money is flowing out of the system at a reduced rate but it's still flowing out of the bank, and you can wonder whether the strong capital ratios will remain sufficient if that outflow increases as Credit Suisse has significant funding needs to cover its losses and turn the company around. I don’t see why anyone would want to touch Credit Suisse other than for a gamble that with a bit of luck might pay off.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.