Estee Lauder: Future Growth Hinges On China

Summary

- Estee Lauder has seen disappointing net sales performance in the most recent quarter.

- A rebound in net sales growth is largely dependent on performance in the Chinese market.

- I do not take a bullish view on Estee Lauder at this point in time.

Baloncici

Investment Thesis: Estee Lauder (NYSE:EL) is highly dependent on a strong rebound in the Chinese market to affect a strong rebound in net sales and earnings.

In a previous article at the end of January, I made the argument that Estee Lauder could see upside going forward on the basis of strong sales growth, a potential boost to sales across the Makeup segment with the lifting of COVID restrictions in China, as well as an attractive P/E ratio and cash position.

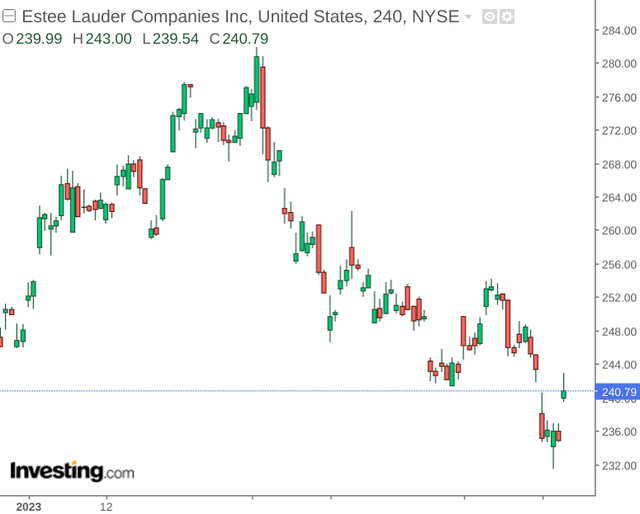

Since my last article, the stock is down by just over 10%:

The purpose of this article is to investigate whether my prior bullish sentiment was justified in light of recent results, and whether the stock could still see upside going forward.

Performance

When looking at most recent quarterly performance, Estee Lauder saw a decline of 17% in net sales from $5.54 billion to $4.62 billion.

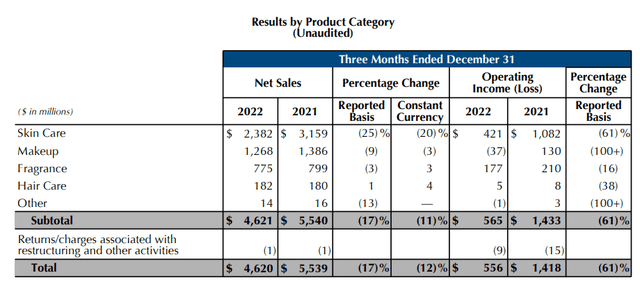

In terms of sales performance across product category, we can see that Estee Lauder saw the largest percentage drop (both on a reported and constant currency basis) across the Skin Care segment:

Estee Lauder: Fiscal 2023 Second Quarter Results

Clearly, this is concerning - as such a sharp decline in the company's largest product segment has understandably had an impact on sales performance as a whole.

The company cites the effects of low retail traffic in Mainland China as well as anticipated tightening of inventory by a number of Asian retailers - coupled with low numbers of replenishment orders in the United States. The decline in Makeup sales was also impacted by COVID-related restrictions across China.

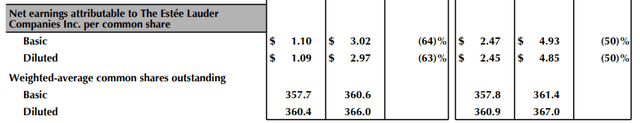

From an earnings standpoint, we can see that diluted earnings per share is down sharply - by 63% on a three-month basis and 50% on a six-month basis.

Estee Lauder: Fiscal 2023 Second Quarter Results

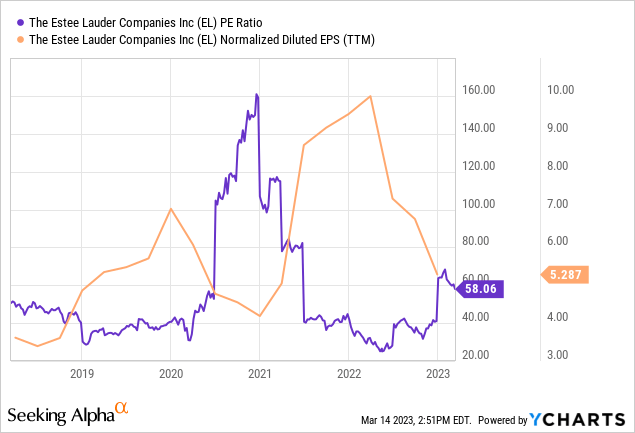

As such, we can see that while the company's P/E ratio still remains below highs seen at the end of 2020 - the ratio has nonetheless risen quite significantly from 2022 levels and earnings per share has dropped substantially:

ycharts.com

In this regard, future growth prospects for Estee Lauder seem to be very dependent on the degree to which sales growth rebounds across Mainland China.

Should we see sales growth come in lower than expected in spite of the easing of COVID restrictions across the region - then this could pose further downside risk for Estee Lauder.

From a balance sheet standpoint, we can see that while the quick ratio has declined from that of last year - the ratio still remains at 1 - indicating that Estee Lauder has sufficient liquid assets to meet its total current liabilities. Note that the quick ratio was calculated as total current assets less inventories and prepaid expenses all over total current liabilities:

| Dec 2022 | Jun 2022 | Dec 2021 | |

| Total current assets | 9,367 | 9,298 | 9,955 |

| Inventory and promotional merchandise | 3,069 | 2,920 | 2,612 |

| Prepaid expenses and other current assets | 641 | 792 | 661 |

| Total current liabilities | 5,655 | 5,815 | 5,762 |

| Quick ratio | 1.00 | 0.96 | 1.16 |

Source: Figures sourced from Estee Lauder Fiscal 2023 Second Quarter Results. Figures provided in $ millions, except the quick ratio. Quick ratio calculated by author.

Risks and Looking Forward

Going forward, the main risk for Estee Lauder is that sales either continue to see a decline outright, or renewed growth in Mainland China as a result of the lifting of COVID restrictions is not sufficient to lift overall sales growth.

Conversely, Estee Lauder could stand to see a significant rebound in the second half if net sales figures across China start to normalize, and if inventory levels in Hainan (which houses the brand's largest retail travel store worldwide) start to normalize and international travel to the region picks up - then this could represent a significant opportunity for Estee Lauder to see a strong rebound in net sales.

Overall, Estee Lauder's future growth path appears to hinge significantly on performance within China and investors will likely be paying close attention to the same throughout the rest of 2023.

Conclusion

To conclude, Estee Lauder has seen significant downward pressure on net sales and earnings as a result of weak performance in China. While performance could see a strong rebound as a result of the lifting of COVID restrictions - my view is that further evidence of this needs to emerge in order to justify a bullish view for the stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.