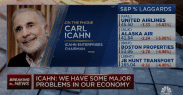

“ ‘We have some major problems in our economy…A lotta people in our economy aren’t doing well, obviously.’”

— Carl IcahnThat was Wall Street billionaire investor Carl Icahn, speaking to CNBC’s Closing Bell on Tuesday, in the aftermath of emergency action taken by the government to mitigate the impact of one of the largest bank failures in U.S. history.

The co-founder of Icahn Enterprises says that his investment portfolio is set up for more pain in the U.S. economy, which he notes is being buffeted by rapidly rising interest rates and escalating concerns about its overall health, as the Federal Reserve attempts to prevent inflationary pressures from becoming entrenched.

The Fed’s rate hikes are intended to cool economic growth by raising borrowing costs and tamping down demand, but the ill effects of those interest-rate increases appear to be surfacing in pockets of the economy.

Banks have been on a wild ride since late last week.

- What went wrong at SVB? Ex-FDIC chair and other banking experts break it down.

- SVB’s sudden collapse: 6 charts show the shock waves that ripped through global markets

- Bank debt swoons as Fed moves to contain fallout from SVB, Signature Bank collapses

- The Moneyist: ‘There was a prenuptial agreement, but our lawyers said it was poorly written’: My father married his caregiver, 40 years his junior. She’ll inherit millions.

Blame it on the failure of a slate of banks, notably Silicon Valley Bank SIVB,

Banks should be benefiting from a climate of rising rates because they borrow on a short-term basis and provide longer-term loans at higher rates, pocketing the rate differential.

Apparently, not all banks have been managing risks well and the celerity of the increase in interest rates, along with likely tactical missteps, may be part of the problem.

“ ‘The net worth of the median household is nothing basically’ ”

— IcahnShares of the SPDR S&P Regional Banking ETF KRE,

Over the weekend, the Fed announced a new emergency loan program to bolster the capacity of the banking system and the government announced that all SVB depositors would get their money back.

Stock-market investors in the Dow Jones Industrial Average DJIA,

For his part, Icahn has been concerned about the economy after a historic stretch of easy money helped to underpin asset bubbles in everything from crypto BTCUSD,

Based on his interview with CNBC, the legendary Icahn sees the business climate on a less-than-solid footing.

He said the median household net worth is “practically nothing.”

However, it isn’t clear exactly how accurate his figures are — though Americans have been contending with the challenges of rising prices and continue to do so for services as the impact of the COVID pandemic subsides.

The median net worth for American families, for example, stands at around $121,760, according to data from a survey conducted by the Federal Reserve’s survey of consumer finances in 2019, the latest available data. That was up nearly 18% from the previous survey in 2016.

That said, according to a report from Bankrate conducted last year, 56% of Americans would be unable to cover an unexpected $1,000 bill with savings.

Those are just some measures of America’s fiscal health but the overall picture has darkened for many as prices remain elevated and companies announce layoffs.

Meta Platforms Inc. META,

Icahn sees conditions getting worse before they get better and it may be worthwhile for investors to take heed.