KLX Energy Services: Solid Q4 Results; Reiterate Buy Rating, Raise Price Target

Summary

- KLX Energy Services Holdings, Inc. reported strong Q4 2022 results, and fundamentals remain strong.

- KLX Energy Services also announced the closing of an immediately accretive acquisition.

- We reiterate our Buy rating on KLX Energy Services Holdings, Inc. and raise our price target to $29.

- I do much more than just articles at Best of the Uncovereds: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

tdub303

Singular Research

Investment Thesis

KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) reported Q4 2022 results that were mostly better than our expectations. In addition, the Company announced the closing of an all-stock acquisition of Greene’s Energy Group, which is expected to be immediately accretive to earnings, EBITDA, and free cash flow. KLXE has successfully integrated several acquisitions over the last few years, and as oil prices remain elevated, the company is expected to generate significant free cash flow, which will enable it to de-lever its balance sheet and drive strong returns for shareholders. We reiterate our Buy rating for KLX Energy Services Holdings, Inc. and raise our price target to $29 per share.

Q4 2022 Results

- Q4 2022 Revenues up 60% YOY to $223.3 million. KLXE reported Q4:22 revenues of $223.3 million, up 60% YOY. Approximately 30% of revenue was from the Rocky Mountain region, while 37% was from the Midcontinent and Northeast, and 33% was from the Southwest. Sequentially versus Q3:22, revenue from the Rocky Mountain region held steady, while revenues from the Southwest increased 9%, and revenue from the Midcontinent declined by 5%.

- Adjusted EBITDA calculated to be $37.9 million. Adjusted EBITDA was up over 1,000% YOY versus the modest $3.6 million reported in Q4:21. Gross margins improved 1,045 basis points (bps) YOY to 25.4% versus 14.9% in Q4:21. SG&A expenses, while up $1.4 million, or 7.8% YOY, were down as a percentage of revenues to 9% from 13% in Q4:21. In other words, KLXE is very profitably growing revenues.

- EPS of $1.06 per share significantly beat our forecast of $0.89 per share. Higher than projected gross margins more than offset slightly higher than projected SG&A expenses to drive the earnings outperformance.

- Debt reduced by $12.8 million through equity exchange. During Q4:22, KLXE exchanged 777,811 shares for $12.8 million in principal in 11.5% Senior Secured Notes due 2025, which will result in $1.5 million in annual interest savings. Net leverage declined to 1.5x on an LTM EBITDA basis versus an incalculable figure at this time last year. KLXE exited Q4:22 with $57.4 million in cash on the balance sheet versus $313.9 million in total debt and capital leases.

Greene’s Energy Group Acquisition

In conjunction with their Q4 earnings call, KLXE announced the closure of the all-stock acquisition of Greene’s Energy Group for 2.4 million shares of KLXE common stock. Greene’s is expected to add $70 to $75 million in revenue and $18 to $20 million in EBITDA, inclusive of cost synergies, to KLXE. If KLXE is able to realize cost synergies as expected, the effective purchase prices of this business will be under 2.0x EBITDA, which is a great value.

Guidance & Outlook

KLXE offered initial FY:23 guidance of $975 to $1.04 billion in revenue, with EBITDA margins expected to be in the 17% to 19% range. We have adjusted our FY:23 projections accordingly. We are now projecting FY:23 revenues of $1.0 billion, up from our prior forecast of $907.1 million. Q1:23 revenue is expected to come in at $225.5 million, then grow to $253.7 in Q2:23, $263.7 in Q3:23, and then moderating slightly back down to $253.6 million in Q4:23. We projected FY:23 EBITDA of $165.9 million and EPS of $3.71, up materially from our previous forecasts of $126.0 million, and $1.91, respectively.

Valuation

We value KLX Energy Services Holdings, Inc. using an EV/EBITDA valuation framework, coupled with a discounted cash flow ("DCF") analysis and blend the price targets from those two valuation methods to arrive at our 12-month price target.

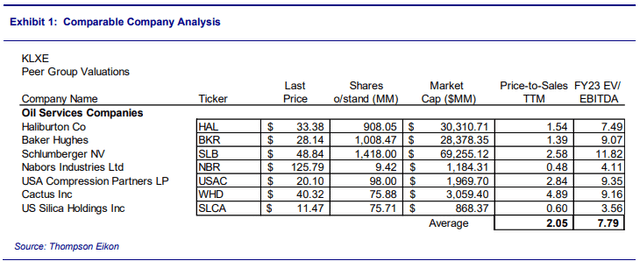

For the comparative company analysis, we look at KLXE versus several other publicly-traded oilfield services companies. Exhibit 1 below illustrates the average EV/EBITDA ratio of the comparable companies we selected.

This analysis indicates that the peer group trades at an average FY:23 EV/EBITDA ratio of 7.79x. This peer group is primarily comprised of larger companies with significantly greater financial and operational resources than KLXE. Therefore, we value KLXE at a discount of approximately 45%, or 4.3x projected FY:23 EBITDA of $165.9 million, add cash on the balance sheet at the end of Q4:22, add projected free cash flow through FY:23, and divide by projected shares outstanding at the end of FY:23 to arrive at a 12-month price target of $32.06 per share.

In our DCF model, we estimate KLX Energy Services Holdings, Inc. would earn a return on capital of 15%, reinvesting 20% of this return into their business and growing EBIT by an average of approximately 10% in FY:24 and then at 3% starting in FY:25 through FY:29. Beyond the forecast period, we assume terminal value EBIT growth of 3%. We assume a 4.0% risk-free rate and an 8% market risk premium, which, given the Company’s capital structure, results in a weighted average cost of capital of 13.04%. These assumptions lead to a DCF price target of $26.49.

We then equally blend the comparable company analysis target of $32.06 and the DCF valuation price target of $26.49 to produce an average target price for KLX Energy Services Holdings, Inc. of $29.27, which we round down to $29.00.

Best of the Uncovereds offers new initiation reports on roughly two dozen companies per year, with a focus on under-followed small and mid caps with significant potential. We provide a quarterly earnings update reports on all companies covered, as well as flash reports on significant news announcements by companies. We go further for members, providing recorded interviews with management teams of covered companies when available and a monthly quantitative based "Market Indicators and Strategy Report."

This article was written by

Disclosure: I/we have a beneficial long position in the shares of KLXE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.