Fresh Del Monte Produce: Stock Looks Unattractive In The Long-Run

Summary

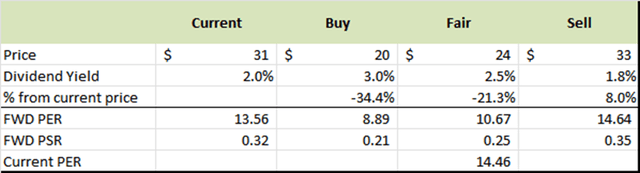

- FDP’s current dividend yield of 2.0% and limited growth opportunity make the stock unattractive.

- Technological investment will be needed to optimize crop production and balance the market’s supply and demand.

- Added risk comes from the consolidation of the grocery industry and reliance on them as a major customer.

- I recommend monitoring this industry and studying the company’s cash management and long-term strategic plans.

YelenaYemchuk

Thesis

Fresh Del Monte Produce Inc. (NYSE:FDP) is a well-known company in the food produce industry. Its financial performance in recent years has been mixed results. The company has also been facing macroeconomic challenges and other challenges such as weather-related production problems and pandemic-related supply chain disruptions. As the competition in this industry is intense, the company will have to invest more capital and resources into the technology to aid in optimizing production and the sales.

With the current dividend yield at 2.0% and limited growth opportunities, the company will have to increase its dividends or stock repurchase by about $10 to $20 million annually for it to be attractive. My analysis of the financials is that cash will remain low and tight and will be a tough call to support additional returns to investors.

All in all, I recommend monitoring this industry and studying the company's cash management and long-term strategy.

Company Overview

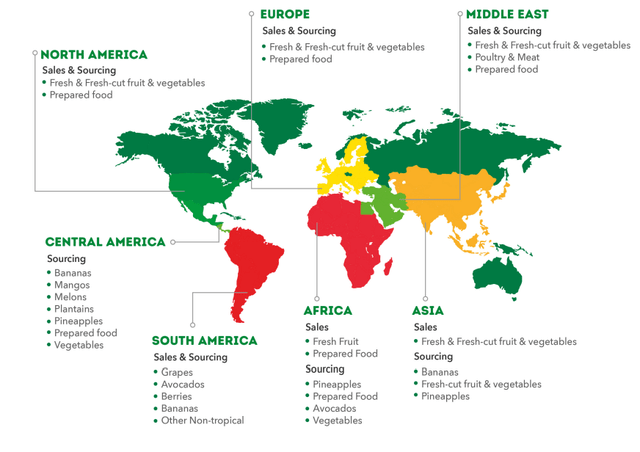

FDP is headquartered in Florida, United States, and operates in more than 100 countries worldwide. In addition to its own brand, Del Monte also has licensing agreements with other companies to produce and distribute products under their brand names. This allows the company to earn royalties and expand its product offerings.

The company sells its products through a variety of channels, including grocery stores, supermarkets, online retailers, and foodservice providers. The three business segments are Fresh and value-added products, Banana, and Other products and services.

A graphic depiction of FDP's sales and sourcing operation is extracted from the 10-K report.

FDP Sourcing and Production (2022 10-K report)

FDP competes with other players like Chiquita Brands International, Dole Food Company (DOLE), Sunkist Growers, and Driscoll's in the produce industry.

FDP recently reported its 2022 fourth quarter and full fiscal results, with Q4 2022 as their best-performing fourth quarter in recent history. However, FDP operates in a competitive environment and, in recent years, has faced various macroeconomic challenges and climate change impacts on the product predictability.

1. FDP stock offers limited benefits from dividends, stock price appreciation, and share repurchase

In this current macroeconomic environment, FDP stock offers limited benefits. The current dividend rate ranges from 1.6% to 2.0%, given the fluctuation of the stock price. The current risk-free interest rate is around 4% to 5%. In addition, FDP's history of dividend payouts is not consistent, with no dividend during the pandemic period.

FDP was more active with share buybacks in FY2013 to 2017, but that has tapered down and is rather insignificant in recent years. The stock repurchase program is on hold right now.

For a better return to the shareholder, I believe the company will have to increase its dividends or stock repurchases by about $10 to $20 million annually. Analyzing the FY2022 cash flow, the cash flow from operations is $61.8 million, while the Capex is $48.1 million. Cash flow from financing is basically a refinancing of the old loan. Over FY2013 to FY2022, there has been minimal net cash change. From my analysis, cash generation will remain low and flat, making it difficult to support additional returns to investors.

FDP is a top player in their industry but is not spared from the macroeconomic headwinds. As mentioned in the earnings call, FDP implemented inflation-justified price increases to offset some of the increased costs. As food is a staple and has low elasticity, the sales volume cannot decline as much as the price increase. However, as the inflation impact and that cost pressure are likely to continue, it will be challenging for the company to generate more free cash. The maintenance of current business operations makes it hard to reduce the operating expenses.

2. Precision farming techniques and innovative solutions are underway but may still take some time to materialize fully

In today's world, the future of the food producer and distributor is going to be shaped by various factors, such as consumers' changing demand and diet, technology-driven innovation, and sustainable production processes. The climate situation is also expected to make production harder to predict, and also more cyclical. Companies are investing in technology to develop crop products and methods that are more efficient and sustainable, as well as understanding the market's consumption needs.

Precision farming is relatively developed, where companies can reduce input costs, increase crop harvest, and have sustainable production practices. However, adoption rate is still early due to the high cost in capex investment and accessibility to the technology.

In FDP, the management mentioned that they have been working to perfect avocado predictability through artificial intelligence and data history, reaching almost 95% predictability on pricing and close to perfecting the supply-demand balance. With bananas as one of the main revenue streams, the management has also mentioned that the company is using more technology in their operations and will continue to do so in the future.

There is still room for FDP to fully benefit from using the technology, but that also means that more capital will have to be invested in that space. Investors should keep a close watch on the cost-benefits of such investments, and if the materialization of the benefits is in the near horizon.

3. Consolidation of grocery industry and reliance on them as major customer puts FDP in a vulnerable position

In the United States, the consolidation of the grocery industry has been ongoing over the last two decades. The drivers for the consolidation are due to increased competition and changing consumer preference, but also most importantly, for the grocery chains to achieve economies of scale to be price competitive.

There are four major grocery chains dominating the US market. FDP's largest customer is Walmart (WMT), which accounted for approximately 8% of the net sales in FY2022. Larger grocery chains can often negotiate better pricing with the suppliers and can put pricing pressure on the company.

FDP has their own retail stores and e-commerce platforms for customers to shop directly with them. It also has needs to maintain its strong brand presence and quality, and continue to have diverse revenue streams and outlets to distribute their products.

Valuation and opinion

My valuation for FDP is based on FDP's financial statement and earning forecast, and the data is driven by Seeking Alpha data.

FDP is a market leader in the industry and has been in business for over a century. With the macroeconomic headwinds expected to continue, there is limit in the growth prospect and financial performance in the near horizon. Competition in this industry is intense and with the climate change, the company will have to invest more capital on innovative solution and to optimize production predictability.

At a dividend yield of 2% and limited capital returns to investors (either through dividend or share repurchases), the current stock price is not attractive. Overall, I recommend monitoring this industry and the company's cash management and its long-term strategy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.