Omega Healthcare: Medical Properties Shareholders May Be Giving It A Bid

Summary

- Omega Healthcare Investors could be an alternative for MPW shareholders who are throwing in the towel.

- While risks remain elevated in the near term, operating fundamentals should improve in the second half of the year.

- Meanwhile, it carries a strong balance sheet and pays an attractive dividend yield.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

Stocks go up and down, sometimes for no rhyme and reason. However, larger movements, especially in a down market for REITs could warrant further attention.

This brings me to Omega Healthcare Investors (NYSE:OHI), which as shown below, jumped by nearly 4% on March 14, and this was on a day with no material news specific to OHI. Moreover, the Vanguard Real Estate ETF (VNQ) and real estate bellwether Realty Income Corp. (O) rose by just 1% and 0.7%, respectively.

Seeking Alpha

So perhaps this movement related to price actions within the Healthcare REIT space. For those who follow the space, Medical Properties Trust (MPW) has been the subject of a short attack, with selling intensifying in recent weeks.

As shown below, OHI and MPW have followed diverging paths over the past 12 months, and impressively, OHI’s price has held up rather well over a time in which many REITs have been in a downturn.

Seeking Alpha

I would speculate that some MPW shareholders who are throwing in the towel are moving capital to OHI as a replacement for high yield in the healthcare space. That may be a positive for OHI shareholders in the short term, and in this article, I highlight why OHI may be a good high yield candidate for a well-diversified portfolio.

Why OHI?

Omega Healthcare Investors is the largest publicly-traded owner of skilled nursing facilities. It has a long track record of 30 years as a public company and at present, 901 properties spread across the US and UK, comprising 90K beds and leased to 65 different operators. It’s also geographically diversified with exposure to nearly every U.S. region in 42 states.

To be fair, OHI has seen its fair share of issues in recent times, as it’s had to deal with underperforming operators. This has forced OHI to restructure leases through rent deferrals, tenant replacements, in some cases, asset dispositions. It also appears that OHI is not yet out of the woods, as the CEO expects first quarter earnings to be further impacted by deferred rents associated with additional operator restructurings.

This is, however, not new news for OHI, and should be well-priced into the stock, as investors have had plenty of time to digest this information and price it into the stock. Moreover, management believes that barring unforeseen restructurings, it expects for operating performance to improve as the year progresses and operator restructurings are completed.

From this point of view, it appears that OHI is ahead of Medical Properties Trust, as the former’s tenant issues showed up earlier. In the meantime, MPW’s challenges around Prospect (its third largest tenant) is more of a recent event that appears to be spooking some investors.

Admittedly, the dividend risk for OHI is elevated in the near term. While it generated sufficient FAD (funds available for distribution) per share of $0.70 to cover the $0.67 dividend during Q4, management expects for coverage to be negative in the first quarter before bouncing back, as highlighted during the recent conference call:

Based on operator discussions to-date, we believe our first quarter 2023 FAD will be less than our current dividend of $0.67 per share.

We believe as these current restructurings are resolved and already completed restructurings, principally once Agemo begin paying restructured rent, we will again return to a FAD run rate in excess of our current dividend.

While we remain optimistic regarding the long-term skilled nursing facility industry prospects, we continue to remain cautious in the near-term as our operators contend with staffing issues and occupancy slowly heads back to pre-pandemic levels. Fortunately, some states have recognized the inflationary pressures facing our operators and have responded with supportive rate increases. We are appreciative and thankful for their support.

Meanwhile, OHI maintains plenty of balance sheet flexibility, with $1.45 billion in availability on its revolving credit facility plus an additional $297 million in cash. While it does have $350 million worth of notes due in August, management entered into $400 million of interest rate swaps at an average swap rate of 0.8675%, which gives it certainty as it refinances its aforementioned notes. Plus, OHI carries a safe amount of leverage with a debt to EBITDA ratio of 5.3x and has strong fixed charge coverage ratio of 3.9x.

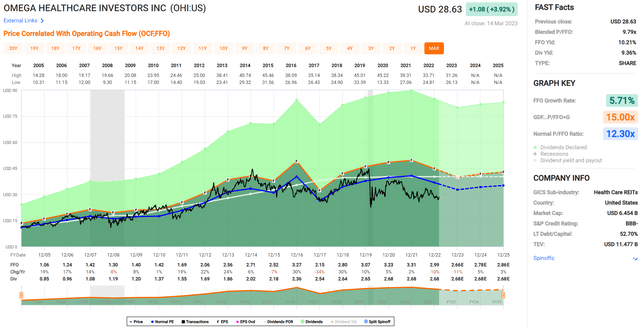

Lastly, OHI remains an attractive value stock at $28.63 with a blended P/FFO of 9.8, sitting below its normal P/FFO of 12.3. Management apparently thinks that the stock is cheap as it repurchased 5 million shares last year for $142 million. Analysts expect OHI to return to mid-single digit growth next year and have an average price target of $29.25, which translates to a respectable 12% potential total return over the next 12 months.

FAST Graphs

Investor Takeaway

OHI may be getting a bid from MPW investors throwing in the towel, as management expects its issues to improve throughout this year. While risk remains elevated in the near term, they also appear to be priced into the stock. Meanwhile, OHI maintains a strong balance sheet with mostly fixed rate debt and pays a high dividend yield, whose coverage is expected to improve by the second half of the year. As such, risk-averse investors who prize high yield may want to consider the stock while it's in value territory.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of OHI, MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.