Insiders Signal PacWest, Other Banks Oversold, Major Indices Vulnerable

Summary

- Insiders bought banks stocks big time in recent sessions. Get the full list here!

- Other insider metric don't look bullish for the market in general.

- Should SVB Financial Group insiders be forced to disgorge their recent profits?

- Looking for more investing ideas like this one? Get them exclusively at Daily Insider Ratings . Learn More »

hxdbzxy

In a quick response to the tumult in the banking sector from the mess at Silicon Valley Bank and its parent, SVB Financial Group (SIVB), a conference of banking insiders sent a clear signal yesterday that their stocks - at least - are way oversold.

After weeks of disappointingly few bullish signals from insiders, there was an absolute burst of “Significantly Bullish” Insider Company Ratings (ICRs) generated by our system during yesterday’s filing session at the SEC. And the suddenly bullish insider sentiment was weighted heavy towards banking stocks. As the Daily Ratings Report (below) on yesterday’s insiders filings relays, more than half the stocks that generated bullish-leaning ICRs were bank stocks.

The bullish bank-stock signal from insiders was apparent leading into this weekend, and obvious as the data was rolling in during yesterday’s market session. Even though stocks like PacWest Banc (NASDAQ:PACW) and Metropolitan Bank Holding Corp. (MCB) have already spiked sharply from recent lows, I still see opportunity in the group.

Yesterday’s insider action was also nice in another way. It was great to finally get a clear and solid signal from insiders after weeks of, frankly, disappointing days in the old “insider mine.” I use insider data as my first screen to determine where to focus my research time. But the “Significantly Bullish” ICRs were few, and I wasn’t much taken with the fundamentals of what insiders were sending me. Execs did send another entry signal to some energy stocks last month—a sector insiders have correctly been overweight for over a year. But I’m still not quite ready to get back into biotech--though that time may be coming.

To see the recent insider buying drought in color, take a look at this March 1 Daily Ratings Report and compare it to the one from yesterday. Only two green balls. What a yawner. If I was clever with the special effects, I’d trigger cricket sounds when this presentation is clicked:

Of course, the lack of stocks generating bullish insiders signals was a signal in-and-of itself. I keep track of these metrics and could see my universe of stocks with actively bullish ICRs contracting as the stock market rallied into February. That has not traditionally been a bullish sign for the market in general. But it was consistent with the red flag my top-down Insider-Based Market Indicator was flying.

My Insider Market Indicator has proven itself any number of times in assisting with my market outlook. Hardly perfect. But valuable. It’s the rolling 4-week average of my proprietary weekly buy/sell ratios. Along with the 2-day average it takes insiders to file their trades at the SEC, my Indicator has a built-in lag. Which is fine with me. Because I don’t pretend to have something that can predict when the market is going to spike or crash in the future. Instead, my Indicator has been valuable in confirming—or not—when a real trend change in the market has occurred asap after it has happened. And if you’re looking for more out of any indicator, there’s a guy selling a crypto investment next door who wants some of your time.

Anyway, my Market Indicator started a new bullish move in the week ending January 6 this year, and the inflection of the move was stronger than normal. It seemed completely in synch with the sharp and largely unexpected rally that began this year, but the absolute level of the Indicator dropped so sharply that it hit a level that was clearly flashing “oversold” for the rally by the end of February. And remember, at this same time insiders were not interested in the least in buying their stocks—even though trading windows were wide open after earnings reports. As I relayed in my March 4 Weekly Report: “this just is not consistent with the start of another leg up for the market.”

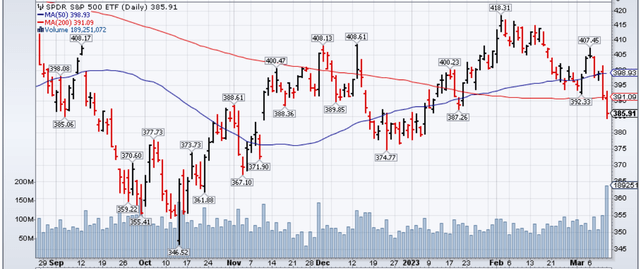

Even so, the technicals of the market still looked promising on March 4, and if the threat of a more-aggressive-than-expected Federal Reserve or a resumption of economic disruptions from renewed aggressions in Ukraine couldn’t slice the major indices through technical supports, what could?

Well, turns out that a good ol' fashioned banking crisis was “all” it took. I have to say, I didn’t see THAT coming.

S&P Slices Through Technical Support! (StockCharts.com)

As per an 8-K filing made on Friday, “Silicon Valley Bank was closed by the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation was appointed as receiver.” SVB Financial Group (SIVB) had an $8 billion market cap and over $200 billion in assets a week ago, making it the second-largest financial institution ever to be taken over by the Feds. Fears of contagion from the bank’s failure and/or related issues with peers were (and still are) completely understandable.

Disgorging Behavior

What’s not understandable—or credible—is that both the CEO and CFO of SVB Financial were absolutely clueless about the gross and growing mismatch between Silicon Valley Bank’s assets and liabilities at the end of January of this year. CFO Daniel Beck set up a new “Rule 10b5-1” trading plan on January 24, 2023 and CEO Gregory Becker set up a similar plan two days later. These plans justified CEO Becker harvesting $2.27 million in risk-free profit by exercising incentive options on February 27, and CFO Beck selling a third of his SIVB holdings for $575k on the same day.

I think there’s a good argument for demanding this duo disgorge these recent profits. The SEC only just adopted amendments to modernize the oversight of 10b5-1 insider trading plans in December 2022. No time like the present to test out the supposedly strengthened rules. Specifically, I don’t find it credible that these managers had or knew of “no concerns” about their bank’s balance sheet just four weeks before their planned sales and less than six weeks before their bank went bust. As such, the pair could not have “adopted their plans in good faith,” and should not be allowed the benefit of the doubt that they were “not aware of any material nonpublic information about the issuer or its securities” when they set up their 10b5-1 programs.

But that’s just me. We’ll see if Becker and Beck use the all-too-worn and successful playbook used by the “Banksters” back in 2008 to feign shock over how complicated all this financial stuff is. One would at least hope taxpayers won’t be forced to help save the reputations and personal wealth of SIVB’s failed bankers as was the case less than 15 short years ago.

Regardless, SIVB’s failure is everyone’s pain now. With all the major indices again below major moving averages, the increased uncertainties regarding the next Fed rate hike could easily weigh on markets again after the bank stock rebound ends. With increased fears of recession after the banking crisis swirling around with bullish expectations of China opening up after its (remarkably underreported) exposure to COVID, it seems like the Fed could end up anywhere from no action to a 50 bp rise depending on what happens in the next week.

As usual, I’ll be watching insiders for my next clues. If the market does decide to finally take a serious breather, the number of “green balls” on my Daily Ratings Reports will undoubtedly move in the opposite direction. There is always a spike in bullish insider activity when the market pulls back.

But while it paid to move quickly on the sudden bullish signal insiders sent in bank stocks over the past two sessions, I wouldn’t be so quick to use the first burst of insider buying into a general market decline as the sign that it’s suddenly “all good” for the market. I mentioned that the absolute level of my Insider-Based Market Indicator was way down in overbought territory. Well, it would take weeks of bearish market action (and the bullish insider behavior it causes) to move the Indicator back up into any semblance of a neutral absolute level. Hmmm.

No indicator is perfect, and no approach always in favor. But using insiders as a first screen to determine what stocks, options, chains, and distressed debt to research further has made both money and sense for me over the decades. And even with my “overbought” market conclusion for the near-term and recent dearth of new long ideas from insiders, I’m staying long the energy, infrastructure, material, banking, and manufacturing names insiders got me invested in over the past twelve months.

If you're serious about using insider data in your investment process, you can't find a better source of investment ideas (or a better value!) than our Daily Ratings Reports. Subscribe or Trial Now!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.