Starbucks: Quality Has Its Price

Summary

- Major financial crises are probably the only time you can get companies like this on the cheap.

- Despite being overvalued on an EV/EBIT basis, they have produced fabulous returns over the past decade.

- I would not count on such returns in the future, but who knows if they will deliver again.

minemero

Thesis

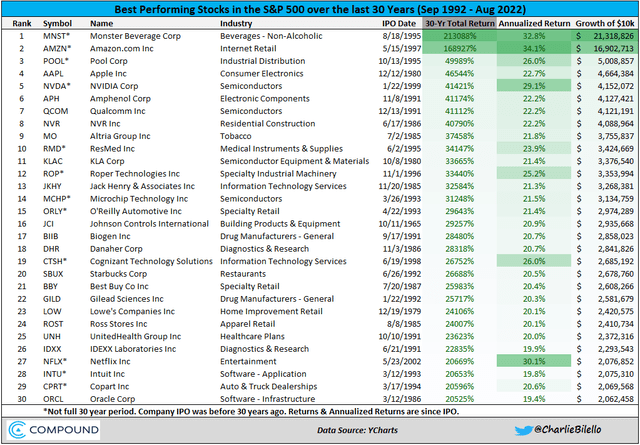

From time to time, I like to look at companies with an astonishing track record to see how they did it. And Starbucks (NASDAQ:SBUX) is one of them. They are the 20th best company in the S&P 500 over the last 30 years if we look at total return.

20.5% over 30 years. And they did it in a different way than Altria (MO), which I also looked at. Do I think they can maintain that CAGR over the next 10 years? Probably not. But they can still beat the S&P 500 because they changed their strategy to return cash to shareholders.

However, their future returns are heavily dependent on the Chinese growth story continuing as they have focused their strategy on this area. So you should expect sales to increase over the next few quarters as China opens up, but this over-reliance on China could also lead to problems in the future. So my bet would be that you can expect returns in line with the S&P 500 over the next few years, and if they can do well in China, they should be able to beat those market returns.

Short Introduction

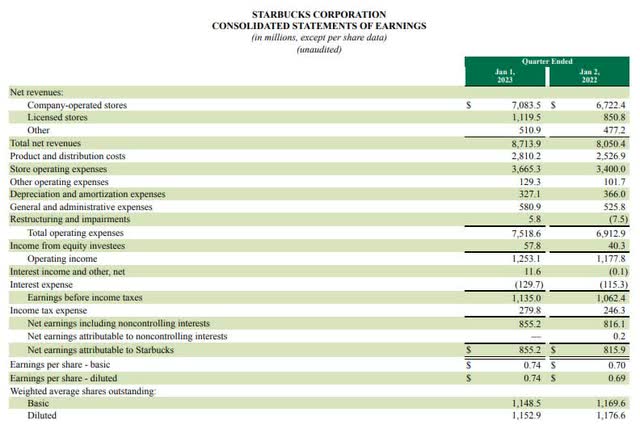

In more than 80 markets, Starbucks roasts, markets and sells premium coffee through company-operated stores as well as licensed stores. They also sell coffee and tea products through an alliance with Nestle (OTCPK:NSRGY). 82% of total sales came from Company-operated stores and 11% from licensed stores. The rest comes from other activities such as the alliance with Nestle. Overall, beverages account for 75% of sales, food 20% and other 5%.According to the latest 10-K, the key operating metrics are as follows:

- New store openings and store count

- Comparable store sales

- Operating margin

Analysis

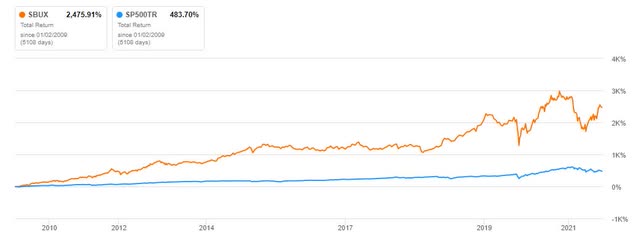

Even over the last ~14 years, Starbucks returns have been nearly 5x the S&P 500 returns. And that was at a time when many analysts were predicting that the outperformance would end and that Starbucks was too expensive. I really agree that this is not a cheap stock. The only time it was reasonably valued on an EV/EBIT basis was in 2008 when the GFC happened. But the thing is, quality has its price and Starbucks has delivered.

During this period it briefly traded at an EV/EBIT of ~10, but quickly returned to its historical average of over 20 and currently trades at an EV/EBIT of ~29.

In its first phase, it was a classic growth stock that expanded rapidly, built a remarkable brand that now acts as a competitive advantage or moat, and improved its margins over the long term. Their really good brand and really good marketing means that people are willing to pay a premium price for coffee. Films and TV series also help to communicate this way of life.

In 2013, they also started to buy back shares as a new strategy to return cash to shareholders. And they reduced the number of shares by almost 400 million during this period. In their last 10-K, they said that 52.6 million shares remained available for repurchase under the current authorization, and in Q1 2023 they resumed repurchases after a brief pause.

The second phase of returning cash to shareholders is the dividend, which was introduced almost 12 years ago and has grown at an astonishing CAGR of ~20% per annum. First, they used their capital to grow sales and store numbers as quickly as possible, and when they were a more mature company they also introduced a dividend and started buying back shares.

In the recent Q1 earnings call, they said they would return 20 billion to shareholders through share buybacks and dividends over the next few years. This is almost 1/6th of the current market cap and could therefore have a real impact on total shareholder returns.

But none of this means that Starbucks' growth story is over. They still grew sales by 8% last quarter, and the end of zero COVID in China is likely to boost sales even more, as they were a big part of total sales before the pandemic. In the earnings call they mentioned that Starbucks is the number one away-from-home coffee brand in China. This, combined with the huge number of potential customers in China, could lead to nice revenue growth in the coming years.

Another interesting fact is that Starbucks sells more gift cards than the next four brands combined. This should tell us that the brand and brand loyalty are still intact. They have also been able to use capital efficiently in the past, as the return on capital shows. The long-term trend is around 20%.

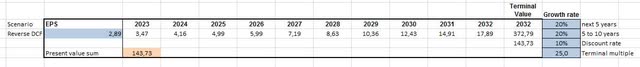

Now I want to see what is priced into the share price. And I have used a TTM EPS of $2.89 and a discount rate of about 10% because in most cases that is the total return you can expect if you invest in the S&P 500 over the long term. The multiple I used is 25x because I think that might be possible in the future. So, as a result, I came up with the fact that EPS would have to grow by 15% a year over a 10-year period to justify the current share price.

On the earnings call they gave an EPS growth target of 15% to 20%. This could mean that the shares are fairly valued or slightly undervalued if they can achieve this. EPS growth of this magnitude is not easy to achieve. But Starbucks has done it before, and they can probably do it again.

If they were able to achieve the higher end of the forecast EPS growth, this would result in the shares being undervalued at the moment. But as with all predictions about the future, there is a good chance you will be wrong. So a margin of safety is a good thing to have. So lower entry points would be better for someone looking to build a new position. But existing investors should prefer to hold as long as there is no bad news for the Chinese operations in the near future.

If the 20% growth rate were to materialize, there would be a ~50% upside to the estimated fair value. But for a 20% growth rate over 10 years, you have to do a lot right, and even a 15% growth rate, which they forecast as the low end, is not easy for most companies in the world to achieve.

Risks

On 1 April 2023, there will be a new CEO and it will be interesting to see how this plays out. Narasimhan previously worked at Pepsi and Reckitt. Will he be able to repeat the success, or will Howard Schultz have to come back in a few years' time? It is certainly no easy task to take over Starbucks, which has been an American success story for the last 30 years.

I think Schultz had a reason for choosing Narasimhan as the new CEO. Maybe he valued his experience working in China, or maybe they have bigger plans for India, which could be a big market in the future because of its population.

India is set to overtake China as the world's most populous country. And at the moment it does not have the ascribed tensions that China has. But India still has its own problems and a long way to go.

Speaking of China, they currently have ~6k stores there and plan to have 9k stores in the next few years. This could lead to more than 40% of sales coming from China. For many people this is too much exposure given the tensions in Taiwan and the general business environment in China.

Luckin Coffee, which has had some problems with fraud in the past, is also a strong competitor, although it targets a different consumer group with lower prices. However, as a Chinese company, they may have some advantages in the Chinese market.

In the US market, they may face some competition from Dutch Bros (BROS), which plans to have ~800 locations by the end of 2023. At the moment they have far fewer locations than Starbucks, but this could lead to some loss of market share in the future if they can expand their business.

Seeking Alpha Balance Sheet Tab

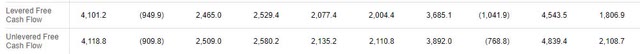

You also need to address the sharp increase in total debt in recent years, which has led to a weaker balance sheet. This, combined with the highly volatile and declining free cash flow, could lead to problems in the future.

Conclusion

If Starbucks can achieve the lower end of its guidance of 15-20% EPS growth, it should be able to deliver returns in line with the S&P 500 if historical returns are anything to go by. If, on the other hand, they deliver EPS growth in excess of 15%, they should comfortably outperform the S&P 500, but the days of 20%+ CAGR are probably over. But who knows, maybe Starbucks will surprise us again and deliver a decade of 20%+ returns.

In the near future, the price could be strongly influenced by the Fed's potential rate hikes, as the market is currently reacting strongly to the Fed's moves. A share price in the $80s or lower should be a good bet for long-term investors. So all in all, for the long term, you need to see how the Chinese market develops and over the next few months the general market environment will decide whether you get the chance to buy Starbucks at better entry prices.

So my recommendation would be to hold SBUX stock for existing investors and for new investors to wait for a better entry point to get some margin of safety.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.