Taking My Lumps With Greenbrier

Summary

- The company has reported financial results since I bought back in last January. The results were not great in my view.

- Rising input costs may linger, and the dividend is currently yielding far less than the risk-free rate. This makes no sense in my view.

- While I'm taking a $1,200 loss on my shares, I'm keeping my short puts, as the shares would be a good buy at $24.35.

jimfeng

It’s been about 2 ½ months since I announced that I’m buying back some of The Greenbrier Companies, Inc. (NYSE:GBX) shares I had previously sold at a nice profit, and in that time, some of my profit has eroded. I remember bragging to an odious degree about my gains, and now the phrase "pride goeth before the fall" is bouncing around in my head. Anyway, my shares are down about 12.5% against a gain of about 2% for the S&P 500. The company has announced financials since, so I thought I’d review the name again. Do I buy more at this lower price? Do I hold? Do I take my $1,200 loss on the stock and move on? I’ll make that determination by reviewing the latest financial results and comparing those to the current valuation. Additionally, I wrote June puts with a strike of $25 for $.65 each, and I think it’s worth checking in on those also.

The intersection of the fact that we’re all busy people, combined with the fact that I’m absolutely possessed by a burning desire to make the lives of my readers as pleasant as possible has led me to create the “thesis statement” paragraph. This is a paragraph that I write at the beginning of each of my articles that gives readers the opportunity to understand my thinking without needing to wade through the entirety of an article, with all of the “Doyle mojo” that might entail. You’re welcome. I will be selling my Greenbrier stock today but will remain short the June puts I wrote previously. The financial performance has been bad so far in my view. The company is far less profitable than it was this time last year, or on the verge of the pandemic, and that is troublesome in my estimation. While the shares are a bit cheaper than they were previously, they’re not cheap enough to justify pouring more capital into this. I particularly don’t like the fact that an investor can earn about 20% more on the risk free rate than they can on this “risk heavy” investment. In spite of this, I’d be happy to be exercised at a net price of $24.35, so I’m not buying my puts back at a (much smaller) loss.

Financial Snapshot

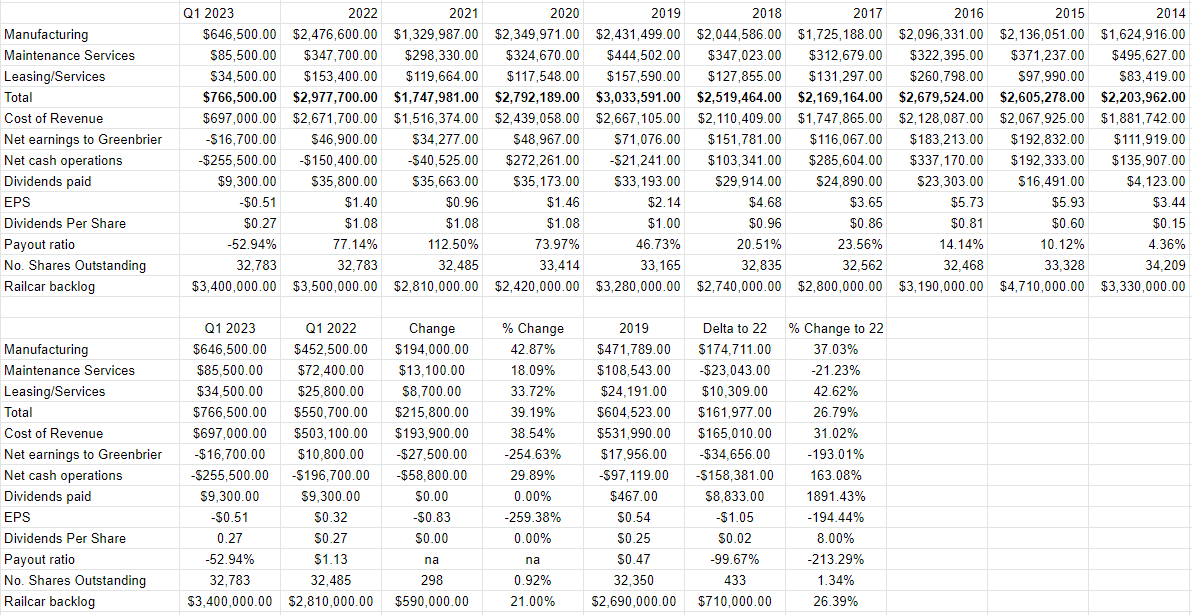

I’d characterise the most recent financial results as troubling. Specifically, net earnings swung from a positive $10.8 million last year to a loss of $16.7 million this year, in spite of a $194 million, or 43% uptick in revenue from last year to this.

If net income fell for reasons relating to so-called "one off" situations, that wouldn’t bother me so much. In this case, though, the causes of the reduction in income relate to more pernicious, and potentially ongoing issues. Interest and foreign exchange expenses rose 56%. Cost of revenue in all of manufacturing, maintenance, and leasing were up by 43%, 11.8%, and 25% respectively. Earnings from operations dropped from $11.8 million last year to a loss of $4.8 million this year. I don’t like the swing from positive earnings of $10.8 million last year to a loss of $16.7 million this year relates to these potentially intractable problems, and that is a “thing” as the young people say.

Finally, I think we could say that the most recent period was not great when compared to the pre-pandemic era. Revenue is about 37% higher than it was in the pre-pandemic era, but net income is off by about $34.6 million when compared to the same period in 2019. So, the company seems to be selling more, but is earning less.

Since owners keep what’s left over after employees have been paid, steel has been paid for, various governments have wet their beaks, I find this distressing. I’ll continue to hold, or may add to my position, at the right price. The shares must be very inexpensive to get me interested, though.

Greenbrier Financials (Greenbrier investor relations)

The Stock

My regulars know that I've talked myself out of some profitable trades with the words "at the right price." I insist on only ever paying "the right price" because I'm of the view that it's better to miss out on some gains than lose capital. Given my most recent performance on Greenbrier, this doesn’t always work out well. My regulars also know that I consider the "business" and the "stock" to be quite different things. Every business buys a number of inputs and turns them into a final product or service. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd's rapidly changing views about the future health of the business, future demand for railcars, future margins, and so on. The stock also moves around because it gets taken along for the ride when the crowd changes its views about "the market" in general. A reasonable sounding, if counterfactual, argument can be made to suggest that my returns on Greenbrier would have been even worse had the market not held its value so far this year. In other words, had the market dropped precipitously since I bought 300 shares, the shares would have likely done even worse. Of course, it's impossible to prove this point definitively, but it's worth considering. In any case, the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it's a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: By determining the crowd's expectations about a given company's performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I've also found it's the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

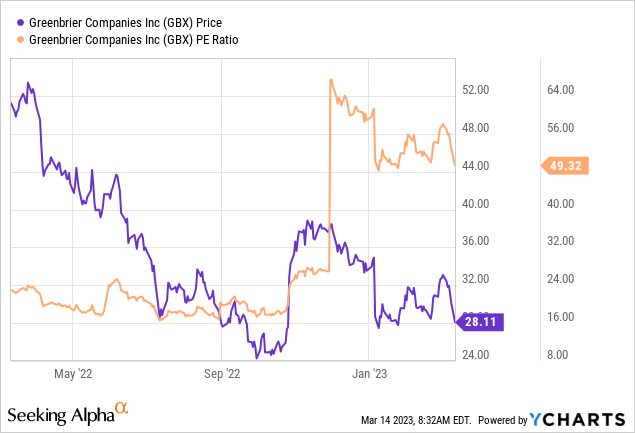

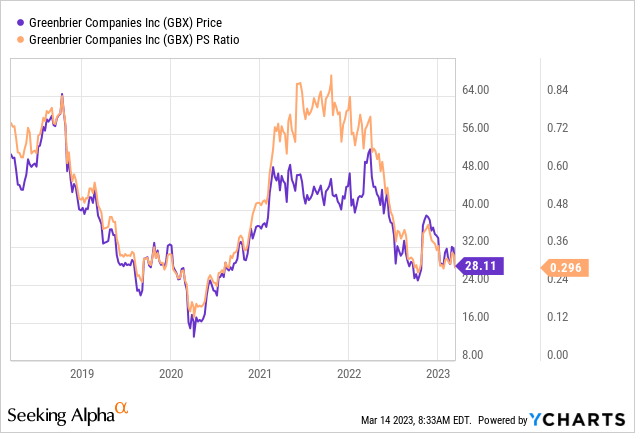

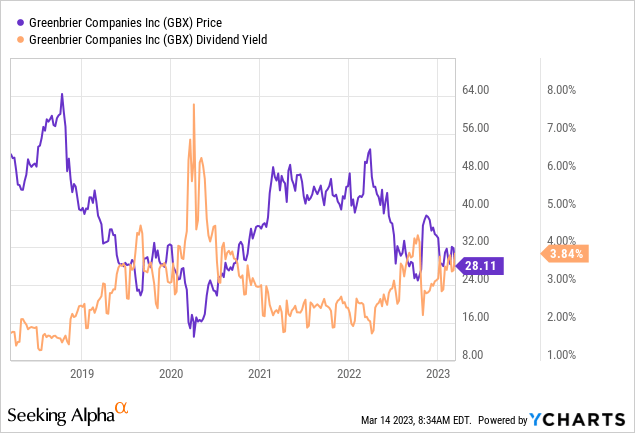

As my regulars know, I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. I bought the shares when the market was paying only $.38 for $1 of sales, and the dividend yield was 3.22%. Additionally, the shares were trading at a PE of just under 24. Fast forward to the present, and the shares are about 105% more expensive on a PE basis, given the earnings collapse already discussed. The market is also paying about 28.4% less on a price to sales basis, and the dividend yield is about 19% higher than it was previously, and is currently sitting at about 3.84%.

I think it’s great that the dividend yield is higher, but I should also point out that it’s currently about 80 basis points lower than the risk free rate. My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is "thinking" about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book "Accounting for Value" for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is "thinking" about a given company's future growth. This involves isolating the "g" (growth) variable in this formula. In case you find Penman's writing a bit opaque, you might want to try "Expectations Investing" by Mauboussin and Rappaport. These two also have introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently "expecting" about the future. Applying this approach to Greenbrier at the moment suggests the market is assuming that this company will grow earnings at a rate of ~.5% in perpetuity. I consider that to be a pretty pessimistic forecast.

Taking all of the above into account, I’m going to have to take my lumps and sell my shares. The shares are in some ways cheaper, and in some ways the market is quite pessimistic about the future with this company, but the dividend yield is still relatively low. In the domain of investing, everything’s relative. Given that, it makes no sense to me to tolerate a lower dividend yield on a risky investment such as this one, when it’s possible to earn 20% more on a 1 year Treasury Bill. For that reason, I’m taking my lumps, and selling. I’d rather lose potential upside than capital.

Options Update

In addition to buying 300 shares, I also sold 5 Greenbrier puts back in January. Specifically, I sold the January puts with a strike of $25 for $.65. These are currently priced at $.90-$1.40, and last traded hands at $.59. So, in spite of the erosion of time value, the options are underwater. I’m not going to take any action on these, though, because I’m comfortable owning GBX stock at a net price of $24.35. At that price, the shares represent decent value in my view.

So, I’m going to be selling my shares at a price of about $29.40, while holding my puts. I think there is a chance that they will expire worthless, and even if they don’t, I’m comfortable buying at $24.35.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GBX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I'm selling my shares as soon as I submit this article. As I point out in the article, I'm holding my short put position.