3 Financials On My Watchlist After Silicon Valley Bank's Detonation

Summary

- Silicon Valley Bank imploded last week, leaving investors wondering what will happen to the financial system in coming weeks.

- My knee jerk reaction is that the bank failure doesn't represent systemic risk, but I'm waiting to see more information before I come to any firm conclusions.

- The government is stepping into bail out the parties involved (moral hazard anyone?), but its just another example of privatizing profits and socializing losses.

- I highlight three stocks on my watchlist if the events at Silicon Valley Bank cause a selloff in the financial sector.

Justin Sullivan

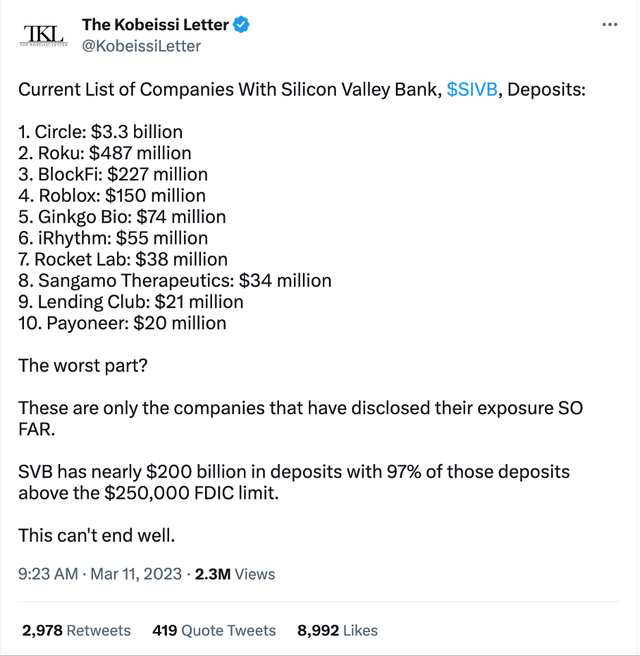

The biggest news in the markets from last week was the collapse of Silicon Valley Bank (NASDAQ:SIVB). The bank was known as a Venture Capital and startup bank, which worked fine as the unprofitable tech bubble was inflating. Deposits basically tripled since the end of 2019, and from what I have seen, 97% of those deposits were over the $250,000 FDIC insured limit. All the dog walking apps, scooter rideshares, involvement with speculative cryptocurrencies and cryptocurrency related firms, and other cash burning tech ventures that SIVB was involved in never deserved investor capital. In my mind, this is just another consequence of the zero-interest rate policy.

The tide has started to go out, and SIVB was definitely swimming naked. Do I think the collapse of SVB represents systemic risk to the financial system? No. Do I know that for sure? No. While I’m sure this will start a chain reaction that we will see play out in the coming weeks, I don’t see it as the first domino to fall in the banking system. We will see how things play out, but I think that bailing out depositors and other parties will lead to moral hazard, which we saw in the throughout the financial circus in 2008/2009. While hindsight is 20/20, there were definitely signs that trouble could be on the horizon for SIVB.

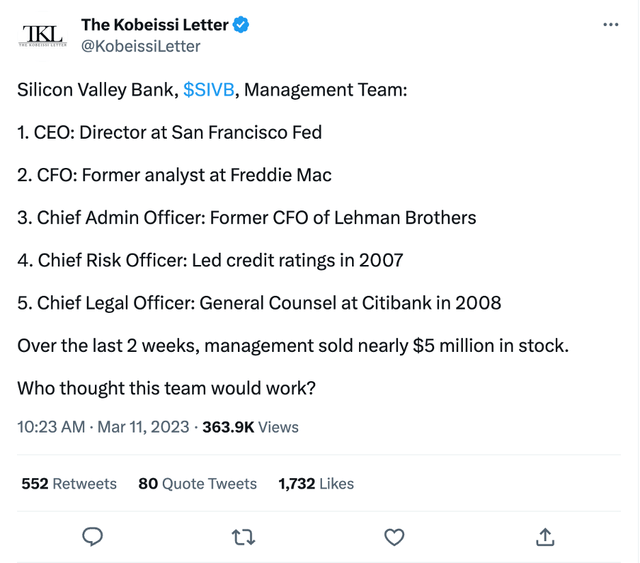

There were a couple things that happened in recent weeks that are interesting. Not only did the bank pay out its annual bonuses, but the CEO sold over $3.5M in stock in the last couple weeks. Inverse Cramer also struck again. He was bullish on SIVB in early February, which was probably a sign that investors might want to look at put options. Another thing that looks ridiculous in hindsight is SIVB’s management team.

SIVB Management (Kobeissi Letter on Twitter)

Just type in $SIVB on Twitter, and you can get a ton of information mixed with commentary from people celebrating to venture capitalists talking about systemic risk. Many of these companies had covenants with SIVB that forced them to do their banking with SIVB, and the bank’s implosion will certainly be a complicated web to untangle for whoever steps into the wreckage. A huge portion of the VC backed companies in the US did business with SIVB and it could spell trouble for these companies assuming the government doesn’t step in.

Notable Depositors (Kobeissi Letter on Twitter)

Roku (ROKU) had about a quarter of their cash at the bank, and Circle’s stable coin (USDC-USD) lost its peg to the dollar. It dipped below $0.90 but has been recovering and is at $0.98 as I wrote this Saturday night. In my opinion, the only systemic risk I see is with the venture capital and startup industry, along with SIVB’s counterparties. It is possible that things spread, but I think it will mostly be isolated to the tech and venture capital sectors. Again, this is just conjecture on my part, but I’m sure investors will be watching closely to see how SIVB’s collapse impacts the financial system.

On Tuesday, I started reading The Great Deformation by David Stockman. Interesting timing given what has been going on with SIVB, but I’m almost 300 pages in, and it’s definitely a book worth reading. It covers central banks, sound money, inflation, and other topics. It has been a page turner so far and is an impressive critique of the crony capitalism on display in the 2008/2009 implosion. There are some obvious parallels to what is going on today with SIVB.

Personally, I think SIVB’s depositors should be wiped out after the $250,000 FDIC insurance. The equity holders will be wiped out, and some bond holders might be able to recover a portion of their investment, but it will likely be a mess all around. While I think letting SIVB collapse would be the right thing to do, it looks like the government has stepped in. Here are three recent latest SA headlines on the issue.

- Bids for Silicon Valley Bank due Sunday in FDIC auction (NASDAQ:SIVB) | Seeking Alpha

- Federal Reserve creates lending facility for banks after Silicon Valley Bank failure | Seeking Alpha

I was curious to see what happened on Monday morning, but I knew it would be a volatile and unnerving situation. There are a couple financials now on my watchlist in the wake of SIVB’s collapse, but I don’t plan to make any purchases until things calm down a bit and more information comes out. The first is JPMorgan (JPM), but I am also watching Charles Schwab (SCHW) and T. Rowe Price (TROW).

JPMorgan – A Rock In The Storm

JP Morgan is the largest bank in the world by market cap, with a valuation just under $400B. It’s telling that on the day that markets were selling off and banks in particular had a rough day that JP Morgan was up 2.5%. The bank is widely regarded as one of the best run in the country, and I think that they are in a position to weather any financial storm that could be brewing as a result of SIVB’s collapse. Shares look fairly attractive today with a P/E just over 10x and a yield of 3%. Like I said earlier, I won’t be making any hasty decisions, but if we do see a selloff across the banking sector, JP Morgan would be one of the first stocks to take a closer look at.

Schwab – My Broker, Potentially On Sale

Shares of Charles Schwab have been smoked in the last week, going from the mid-$70s to the low-$50s. Shares were down more than 11% on Friday alone, and another 12% on Monday. While I’m pretty confident that SIVB won’t lead to a collapse of JP Morgan, I’ll be the first to admit I have no idea what kind of impact it will have on Schwab’s business. Assuming that Schwab can come out of this in one piece, shares have become much more attractive after the recent decline. Shares have a P/E of 13x and a yield of 1.9%. It’s also a high-quality business with the potential to grow for years to come. The company had margins over 30% for 2022 and solid balance sheet. I will be waiting longer on this one, but I think that if shares head lower from here, Schwab will be a tempting way to add some exposure to the financial sector.

T. Rowe Price – A Debt Free Asset Manager

I wrote an article on T. Rowe Price recently, so I will keep this section relatively short. Shares were down over 5% on Friday. They have a debt free balance sheet, and I don’t see how SIVB’s collapse could eventually lead to problems for TROW because of their focus on asset management. It could create problems for markets, but I don’t think issues with the financial system make TROW a bankruptcy risk. Shares have a P/E of 13.8x and a yield of 4.6%. It’s a high margin business that has survived rough times in the past and earned Dividend Aristocrat status.

Conclusion

Silicon Valley Bank should be a lesson for future investors and banks alike. It does look like the government is stepping in, giving us a prime example of what it looks like to privatize profits and socialize losses. Even if they do let SIVB go down in flames, I don’t think it represents a systemic risk to the financial system. There will likely be carnage in the venture capital and tech space, but I don’t think that this is the first domino that will lead to bigger problems for the rest of the economy and/or financial system. That is just my gut reaction, and I’m reserving my right to change my mind as more information comes out, but that is my take for now.

If things get ugly for stocks in the financial sector, there could be some opportunities to be had. JP Morgan is the diversified banking behemoth, and I think they will be able to weather whatever comes as a result of SIVB’s implosion. Charles Schwab is a large brokerage firm with a solid reputation, and T. Rowe Price is a debt free asset manager with a nice 4.6% dividend. I’m not sure what all the implications of Silicon Valley Bank’s collapse will be, but I will be watching these three stocks in coming weeks to see if an opportunity presents itself.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TROW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.