Entravision: Growth In Digital Should Keep Powering Shares Forward

Summary

- Although Entravision slightly missed earnings estimates in Q4, sales growth continues to impress.

- Digital, in particular, continues to show strength, growing by 30%+ in the quarter.

- Technicals, valuation, and strong free cash flow numbers point to rising prices over time.

everythingpossible

Intro

We wrote about Entravision Communications Corporation (NYSE:EVC) at the tail-end of 2020 when we stated that downside risk was limited and initiated a buy rating on the stock. Although EVC actually cut its dividend in Q1 of that year, the stock's very strong technical basing pattern combined with robust insider buying and elevated cash flow generation led us to believe that the stock was trading very close to a multi-year bottom.

In fact, the bottom was already in at that stage, and shares now find themselves a whopping 230% north of the $1.91 price which shares traded at back in November 2020. The question now is whether this momentum can continue to the upside in Entravision Communications.

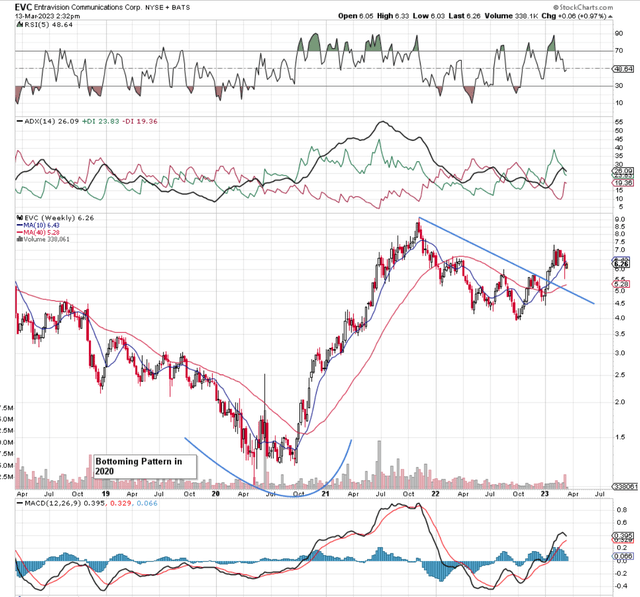

If we pull up an intermediate chart, we see that shares topped out in November 2021 and look to be completing another basing pattern due to the multi-year trend-line break which took place in early 2023. Furthermore, the stock's 10-week moving average is back trading above its 40-week counterpart, and although shares remain well off their 2023 highs to date, we still do not have a sell signal triggered through the popular MACD indicator.

EVC Intermediate Chart (StockCharts.com)

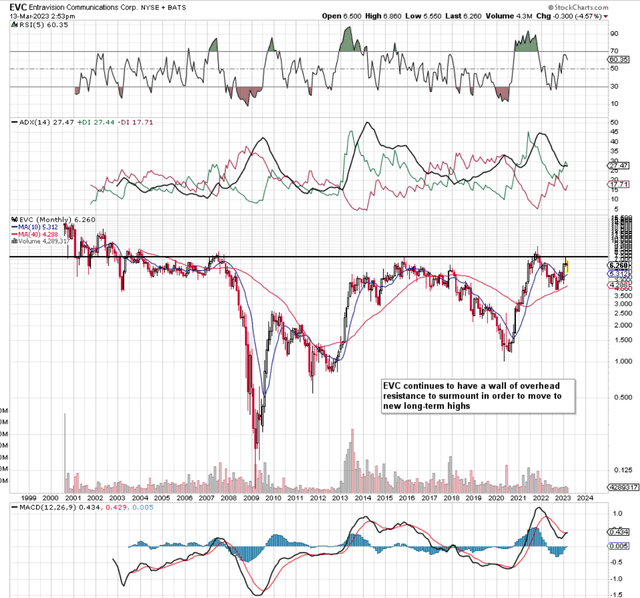

The 20-year monthly chart below illustrates exactly why EVC topped out in late 2021. Shares have tried to take out this level before but have been unable to do so for almost two decades now. The monthly chart however like the weekly chart has bullish connotations, so it will be interesting to see if shares can make another run at that heavy overhead resistance but this time succeed.

Suffice it to say, from a core technical basis the stock remains a buy but only if its major moving averages continue to justify this. The reason being is that EVC has proven that it does not perform well in stiff downturns such as the great recession of 2008 & 2009 when the company's market cap got decimated in the process.

EVC Long-Term Chart (StockCharts.com)

Q4 Momentum

However, given the numbers that Entravision posted in its recent fourth quarter, we do not see signs of a downturn here any time soon. Sales hit a new record in Q4, posting 26% growth with the digital segment growing by 35%. The exciting trend here is that "Digital" (being EVC's largest segment by far making up almost fourth fifths of the company's top-line take) is growing the fastest out of the three segments. Furthermore, when evaluating the different companies within Digital, it quickly becomes evident that there remains plenty of runway for growth here. Smadex, Entravision Lat Am, Entravision Asia & Entravision Africa all grew in Q4, with growth rates of the latter two particularly noteworthy due to successful numbers from the Twitter & TikTok platforms.

In terms of expected top-line growth rates for Q1, management guided for 21% sales growth for the Digital division and 16% growth for the company overall. For the full year, analysts who follow EVC expect approximately 10% sales growth on earnings of approximately $0.37 per share. These are really encouraging targets especially when one considers the free cash-flow firepower that the company has at its disposal. We state this because, in fiscal 2022, Entravision generated free cash flow of $63.3 million, which equates to a trailing cash-flow multiple of 6.67.

Two points we would make concerning this trend. The first is that Entravision's financials (As a result of sustained cash-flow generation) look very strong, with the company's debt load of approximately $213 million continuing to be well covered by shareholder equity. Secondly, EVC's cash flow is not expensive and will continue to drive investment behind Meta-associated operations and increase that customer base to boot. Furthermore, the recent 100% increase in the dividend should give ample confidence to shareholders that elevated free cash flow will continue for some time to come.

Conclusion

To sum up, considering Entravision Communications' valuation, bullish technicals, and growth in digital in particular, we believe there is every chance that shares at least test overhead resistance in the not-too-distant future. As long as sales growth can generate sufficient earnings and cash flow, then re-investment should continue unabated for some time to come here. Let's see what Q1 numbers bring. We look forward to continued coverage.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.