Riot Platforms: 2023 Returns Might Be Limited

Summary

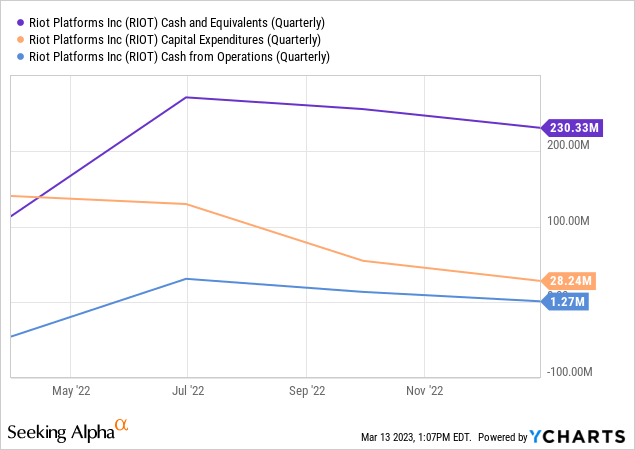

- Riot Platforms recorded positive cash from operations of $1.3 million for its last reported fiscal 2022 fourth quarter.

- The miner will face headwinds this year from the inflation and Fed funds rate dynamic.

- Long-term Bitcoin catalysts look limited as the Bitcoin institutional ecosystem is collapsing.

artiemedvedev

Riot Platforms (NASDAQ:RIOT) recently reported earnings for its fiscal 2022 fourth quarter saw revenue come in at $259.2 million, a 21.6% increase from the year-ago quarter and a beat by $4.67 million on consensus estimates. The company mined 5,554 Bitcoin through 2022, up 46% from the year-ago comp on the back of a more than 3x increase in their hash rate capacity. This would see Riot exit the year with 9.7 exahash per second in hash rate capacity with management targeting 12.5 EH/s by the end of the first quarter of 2023.

There's reason to doubt that the current surge in Riot's common share will be maintained against what I think is a bleaker long-term picture. Indeed, the collapse of Silvergate (SI) and Signature Bank (SBNY), the two most prominent publicly listed Bitcoin banks, came quickly and as a shock. Bitcoin's institutional ecosystem is now under an observed collapse on the back of the FTX failure last year.

Critically, and important for Riot's Bitcoin holdings, the dual collapse of two of the most storied crypto banks and the upcoming wall of regulation will reduce the propensity for non-crypto players to get involved with Bitcoin. Why does this matter? Bitcoin needs to have fundamental catalysts beyond interest rate movements. This has always centered on its mainstream adoption momentum and its potential as a replacement for other national currencies. The former catalyst will now be harder to realize.

Mining Net Losses Beyond The Euphoria

To be clear, Bitcoin's value has typically been driven by a mix of sentiment, animal spirits, and perceived mainstream adoption. The bearish thesis here is that the collapse of Silvergate and Signature Bank has materially reduced institutional mainstream adoption and hence, the core fundamentals of the currency have weakened beyond what's being implied by the recent price movements.

Bulls would be right to highlight the significant mining capacity coming online on the back of Rockdale by the end of March and Corsicana later this year. However, net losses for the miner continue to ramp up with Riot realizing a net loss of $509.6 million during the year, up 33x from $15.4 million in fiscal 2021. Non-cash impairments of $538.6 million drove the bulk of this with Riot impairing its Bitcoin holdings by $147.4 million and miners by $55.5 million.

The company held $230.3 million in cash on hand, no long-term debt, and 6,974 Bitcoin which are currently valued at around $167 million. Hence, Riot does not face the type of near-term liquidity risks which saw peer company Core Scientific file chapter 11. This renders a short position relatively uneventful.

Corsicana is the prize and the company's financials should improve dramatically once its hash rate comes online. Riot increased its hash rate capacity by 213% to 9.7 EH/s as of the end of its fourth quarter, a move that allowed the miner to realize record Bitcoin production. This relatively strong balance sheet positioning and the upcoming increase in hash rate renders shorting Riot to be an unnecessary position to take even against the general malaise Bitcoin faces this year.

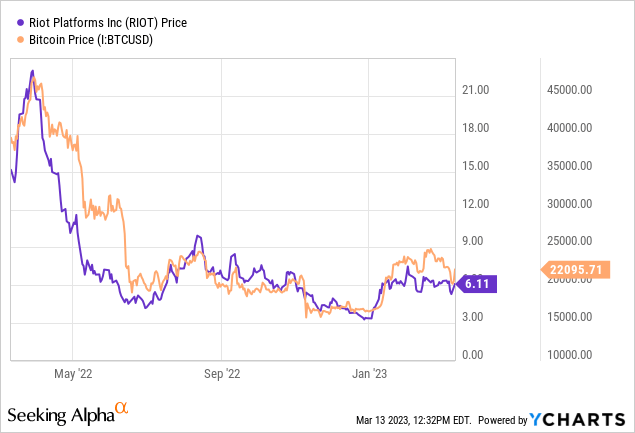

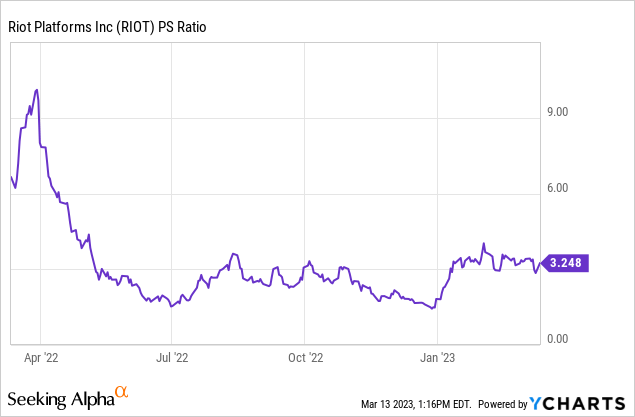

Further, even against the recent rally, Riot is still trading below its 12-month peak price-to-sales multiple. Hence, RIOT stock price could push up markedly if sentiment on Bitcoin continues to be skewed positively by the potential chaos engulfing regional US banking.

Performance In 2023

The near-term performance of Bitcoin and hence Riot will be driven by the direction of inflation and interest rates. The stock market up until last week was expecting there to be two further 25 basis points hikes to bring the upper limit of the Fed funds rate to a plateau of 5.25% sometime this year.

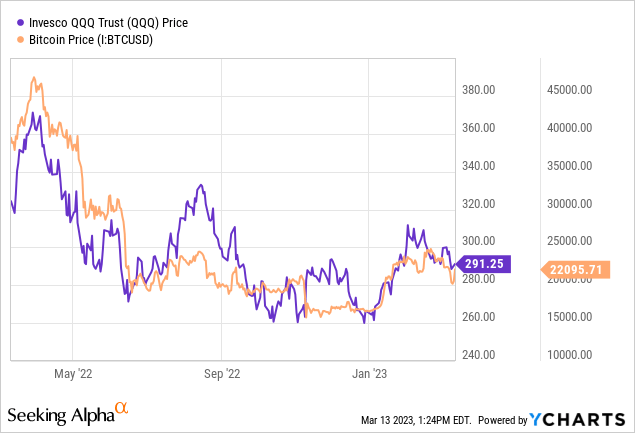

Bitcoin's price movement over the last two years has tracked the tech-heavy Nasdaq-100 ETF (QQQ). QQQ has been sensitive to rising Fed funds rates vis-a-vis the negative impact the Fed has on overall market liquidity. Hence, beyond the current chaos-inspired rally, there are limited fundamental catalysts for the Bitcoin bulls to look forward to. This would especially be the case if the Fed remains hawkish.

The institutional infrastructure of Bitcoin is collapsing from the end of the vaulted Silvergate Exchange Network to the collapse of Digital Currency Group's Genesis Global Trading. This follows the other high-profile failures last year. These were some of crypto's most prominent institutions and their respective fall fundamentally reflects a sobering possibility for Bitcoin. Its utility has possibly been overstated and the pandemic-era bull run was a generational dichotomy in euphoric expectations from its fundamental utility.

In this, there is no fundamental mainstream adoption outside of financial speculation and the gyrations of animal spirits. That's why Bitcoin materially underperformed in 2022. This was a year when the US dollar and other fiat currencies were besieged on all sides by inflation. Bitcoin will remain a too-volatile asset without institutional drivers of intrinsic mainstream value. This is the backdrop that might limit 2023 returns.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.