Charles Schwab Hasn't Been Swimming Naked

Summary

- Charles Schwab's material share price drop could present an excellent buying opportunity for long-term investors.

- SCHW stock is well-capitalized and has innovative new offerings that may appeal to younger investors.

- Also highlighted are the dividend, valuation, and other important points.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

clubfoto/iStock via Getty Images

As the saying goes, a rising tide lifts all boats, but only when the tide goes out do you discover who's been swimming naked.

Such was the case for SVB Financial Group (SIVB), when its Silicon Valley Bank imploded in a stunning 48 hrs.

While one can point fingers at the rolling back of bank regulations in 2018, management is ultimately to blame for not having the appropriate risk controls in place to prevent this from happening.

For investors who didn't have a stake in SIVB, a silver lining in this is that the whole debacle, including the fall of Signature Bank (SBNY), has created a number of bargain opportunities in the financial sector.

This brings me to Charles Schwab (NYSE:SCHW), which has fallen precipitously over the past few trading days and is now trading at close to half its 52-week high of $93. Let's explore why this creates a great buying opportunity for value investors.

Why SCHW?

Charles Schwab is a leading retail brokerage and financial services firm. It's shown robust growth over the years, and has become an industry juggernaut since acquiring the TD Ameritrade franchise. At present, it has 34 million active brokerage accounts, 2.4 million corporate retirement plan participants, 1.7 million bank accounts, and a staggering $7.4 trillion in client assets.

Admittedly, the investment community has been concerned about SCHW's liquidity, considering the bank run on SIVB. These concerns are not unfounded, as higher interest rates have devalued long-term bonds that were purchased even 1 or 2 years ago, since bond prices move inversely to bond yields.

However, it appears the Federal Reserve is putting banks such as SCHW at ease, as it recently announced a program that allows banks to pledge treasury bonds and other relatively "safe" asset classes as collateral to boost liquidity. This was highlighted by Morningstar in its recent analyst report:

Charles Schwab has always had multiple levers to increase its liquidity, and the Federal Reserve's newly announced Bank Term Funding Program, or BTFP, should provide additional confidence in Charles Schwab and U.S. banking institutions. The BTFP will offer loans of up to one year to eligible depository institutions that pledge U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral.

At the end of 2022, Schwab had about $300 billion of close to credit-risk free U.S. Treasuries and agency mortgage-backed securities at amortized cost (around $275 billion at fair value). This $300 billion of assets that can be used as collateral plus the $40 billion that the company has on its balance sheet compares with $367 billion of deposits, so wide-moat Charles Schwab should be fine from a liquidity perspective.

Meanwhile, SCHW has continued to demonstrate the strength of its underlying enterprise. This is reflected by 12% YoY revenue growth last year, driven in part by 4 million new accounts and $428 billion in annual core net new assets. Moreover, it appears that growth accelerated during the fourth quarter, as net income grew by 25% to $2 billion.

Management is also proving its ability to evolve the business with new innovative offerings cater to individual investment styles. This may be appealing to a younger generation of investors, who may not be as interested in traditional mutual funds that their parents had invested in. These innovative offerings were highlighted during the recent conference call:

We also took meaningful steps to further empower investors with more personalization options, increased access to high-quality products, and an evolved suite of tools and solutions.

We launched our proprietary direct indexing offering, Schwab Personalized Indexing for both registered investment advisors and retail clients - providing them with tax-efficient, customizable portfolio management capabilities at a much lower cost than existing alternatives in the market.

Additionally, we introduced our initial thematic stock lists, which assist self-directed clients in selecting stocks aligned with their personal perspectives and values. The current range of themes spans over 40 different categories, including environmental innovation, artificial intelligence, and medical breakthroughs.

Importantly, SCHW carries a strong A rated balance sheet (compared to no rating for SIVB), with a safe long-term debt to capital ratio of 27.5%. While the 1.9% dividend yield isn't particularly high, it's very well covered by a 21% payout ratio and comes with a 5-year CAGR of 21%.

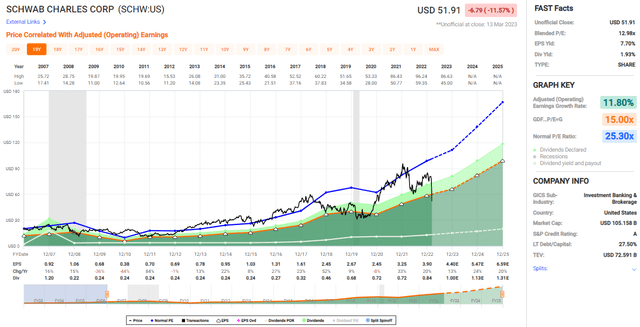

Notably, analysts from Morgan Stanley (MS) and Citigroup (C) recently called the selling of SCHW stock as being overdone, and sees plenty of value in the stock at present. At the current price of $51.91, SCHW carries a forward PE of just 11.85, sitting well under its normal PE of 25.3.

This appears to be too cheap, considering analyst estimates of 11% to 25% EPS growth over the next two years. With an average analyst price target of $91 and a Morningstar fair value estimate of $87, SCHW could produce double digit returns for investors over the next 12 months.

Investor Takeaway

Charles Schwab is well positioned for continued long-term growth. With a safe balance sheet and innovative offerings, the company should be able to capitalize on the current trend of retail investors looking for differentiated services.

In addition, its low valuation and solid dividend yield provide investors with an attractive entry point into the stock. Wall Street analysts remain optimistic around the stock. While no one can predict what the near-term price movements will be, the current downturn could be an excellent speculative buying opportunity for risk-averse investors in a well-diversified portfolio.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SCHW over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.