STAG Industrial: Price Level Seems Attractive

Summary

- STAG Industrial is a REIT with a solid customer base, with Amazon as its largest tenant. The company reported full-year revenue growth of 16.9% and adjusted FFO up 7.3%.

- STAG expects e-commerce warehouses to grow along with the industry's growth, as only 15% of retail sales are through e-commerce.

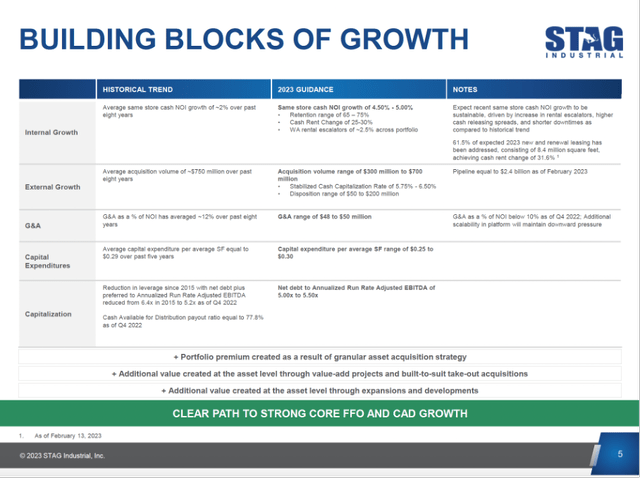

- STAG expects 2023 same-store cash NOI growth between 4.5% and 5%, and it expects to acquire properties worth between $300M and $700M at a cap rate between 5.75% and 6.5%.

- STAG pays a good dividend with a current yield of 4.7%, and 8 analysts expect the dividend to rise 4% next year.

- STAG stock's valuation looks favorable if we compare its price to funds from operations ratio to its historical figures. Therefore, STAG Industrial is buy-worthy.

Kwarkot

Introduction

STAG Industrial (NYSE:STAG) is a REIT that leases properties to tenants in industries such as manufacturers, distributors, and e-commerce. One well-known client is Amazon; Amazon is also the largest tenant with 3% of total ABR.

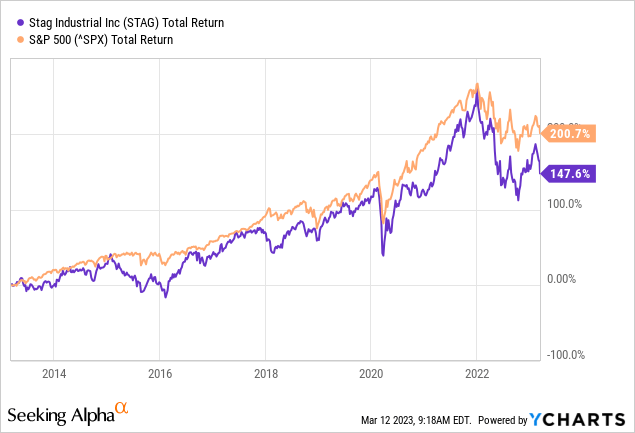

REITs pay out at least 90% of their taxable income as dividends, and the dividends largely contribute to the total stock returns. The 10-year share price return is only 42%, while the total return (including dividends) is much higher at 148%. Now that the share price has returned to favorable price levels, the stock is again worth buying.

Strong Full Year Results And Outlook

STAG posted strong results, with full-year revenue up 16.9% and adjusted FFO up 7.3% year-over-year. The real estate portfolio covers more than 60 markets and the largest market exposure is less than 8% of ABR (the largest tenant is only 3% of ABR). This reduces sector and tenant risks for STAG.

31% of STAG's properties are engaged in e-commerce activities. And since the corona crisis, STAG's tenants are booming thanks to increased e-commerce activities. E-commerce sales as a % of retail sales has increased from 6.5% in 2014 to 14.6% today. Statista predicts that global e-commerce will increase by 9.6% next year. E-commerce is an interesting retail environment because lower overhead costs (no malls, no extra freight to malls) make e-commerce an attractive growth model. Much growth lies ahead for STAG as e-commerce will overtake stores and malls. Due to supply chain constraints, the inventory-to-sales ratio in retail has fallen to 1.37x. STAG expects this ratio to increase to 1.5x as supply chain constraints decrease, increasing the need for warehouse space. Overall, STAG is in a favorable position as the total size of the industrial market in the United States exceeds $1 trillion.

STAG came out with solid guidance for 2023 and expects same store cash NOI growth between 4.5% and 5%. Acquisition volume for 2023 will be between $300 million and $700 million, depending on financing terms and opportunities. These properties will have a capitalization rate between 5.75% and 6.5%. The capitalization rate will be in the historical range with an annualized ratio of net debt to adjusted EBITDA between 5x and 5.5x. A caveat is that the average lease term has decreased from 5 years to 4.4 years, increasing the risk of leases not being renewed. Furthermore, STAG has a solid balance sheet, as estimated total liquidity is $758 million (undrawn revolver balance is $741 million + cash of $17 million). STAG could handle its debt maturities well, as the first major debt amount of $375 million matures in 2025 and another $1980 million thereafter. However, interest expenses could rise if interest rates remain at this level by 2025.

Debt maturity ladder (STAG's Winter Update) STAG's outlook (Winter Update)

Dividends And Share Repurchases

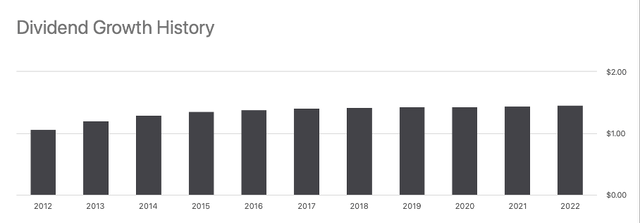

Income investors prefer REITs because they offer a good income and offer also potential equity returns. STAG's dividend yield is currently high at 4.7%, but the dividend rate has not increased much over the past 5 years (averaging 0.7% per year). The forward dividend rate will rise 4% next year, according to 8 analysts.

Dividend Growth History (STAG on Seeking Alpha)

Its dividend payout has risen sharply in recent years and its funds from operations have risen with it. As a REIT, the company finances its real estate through a bank loan, bonds or by the issuance of shares. We see STAG choosing to issue fewer shares because the share price may be undervalued. The stock issuance may negatively impact shareholders because the issuance of shares is dilutive and the growth in dividends per share is lower than earnings growth. However, the company could build new properties that will generate additional income. I think that the management has done a good job in allocating its capital.

STAG's Cash flow highlights (SEC and author's own calculations)

Valuation

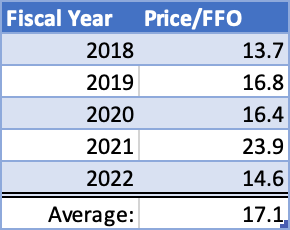

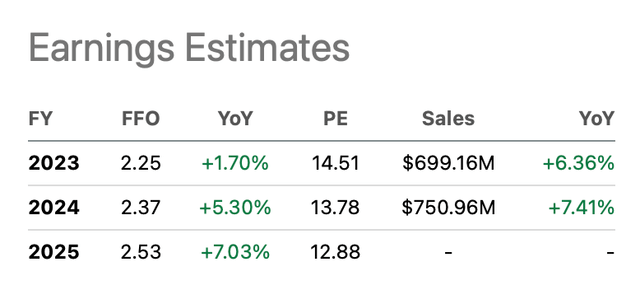

Lastly, we look at STAG stock’s valuation. To gain insight in the stock valuation of REITs, the price to funds from operation is a good metric to compare. However, YCharts does not provide this ratio in their charts, so we have to compile the table ourselves.

The average price/FFO is 17.1 for the past 4 years. Currently, the forward 2023 ratio is 14.5, indicating an undervaluation of the company. However, increased interest rates are reducing the value of stocks.

Another way to get insight into its stock valuation is to compare the dividend yield to the risk-free rate. STAG offers a dividend yield of 4.7%, which is slightly higher than the yield on 10-year Treasury bonds, which is currently 3.7%. STAG currently appears undervalued compared to future projection.

STAG's price to funds from operations (Author's own calculations)

Earnings estimates (STAG on Seeking Alpha)

Conclusion

STAG Industrial is a REIT with a solid customer base with Amazon as its largest tenant. The company reported full-year revenue growth of 16.9% and adjusted FFO up 7.3%. Risk exposure is nicely balanced, with the largest tenant accounting for only 3% of ABR. A third of the tenants in its portfolio are active in the e-commerce industry. And the e-commerce industry is growing rapidly and is expected to expand 9.6% next year. STAG expects e-commerce warehouses to grow along with the industry's growth, as only 15% of retail sales are through e-commerce. STAG came up with robust projections for 2023: it expects same-store cash NOI growth between 4.5% and 5%, and it expects to acquire properties worth between $300 million and $700 million at a cap rate between 5.75% and 6.5%. The maturity of its first major debt issue is through 2025 and is $375 million. The debt can be refinanced but at a higher interest rate, increasing interest expenses. STAG pays a good dividend with a current yield of 4.7%. And 8 analysts expect the dividend to rise 4% next year. The projected increase is good because the dividend hasn't risen much in the past 5 years. The stock price has rebounded from its all-time high and is now at a favorable price level. The stock's valuation looks favorable if we compare its price to funds from operations ratio to its historical figures. Therefore, STAG Industrial is buy-worthy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.