A Look At Bank Solvency

Summary

- Unlike the 2008 financial crisis which was mostly a credit event, the 2023 problems are mainly a duration/liquidity problem.

- There are parallels to the 2019 repo rate spike.

- The Fed is likely getting close to the bottom of their QT and bank reserve limit.

- Looking for a helping hand in the market? Members of Stock Waves get exclusive ideas and guidance to navigate any climate. Learn More »

-slav-

Recent challenges in the U.S. banking system have led to the second largest bank failure in U.S. history this past Friday, followed by a combined liquidity backstop on Sunday night by the U.S. Treasury Department, Federal Reserve, and FDIC to prevent bank runs across small and medium-sized banks.

Silicon Valley Bank was a top-20 bank in the United States by asset size, and a large percentage of venture capital backed startups in the country had a connection with them. In just a two-day stretch between March 8th and March 9th, it faced a bank run and collapsed. Their CEO was also a board member of the Federal Reserve Bank of San Francisco, which is one of the twelve “bankers’ banks” that make up the Federal Reserve System.

While this particular bank had a solvency problem, and some others like it also have a solvency problem, the majority of U.S. banks are still solvent. It’s the liquidity that is the key problem for most of them, especially for small and medium-sized banks, and that situation may keep deteriorating for them.

Large banks in general are better-positioned, including to take some market share from those smaller banks.

This newsletter issue covers some of the nuances of what has been going on in the banking sector, and how to navigate some of the potential landmines among banks going forward.

Fractional Reserve Banking 101

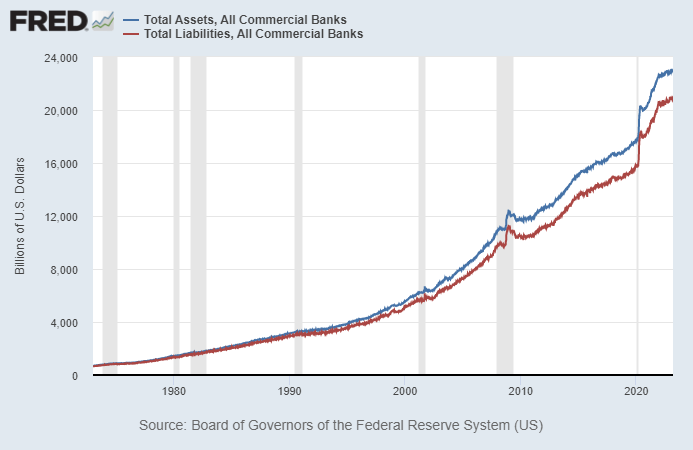

In the United States, the banking system as a whole has $22.9 trillion in assets and $20.7 trillion in liabilities. The problem, of course, is that their assets are riskier and less liquid than their liabilities, and so they face both liquidity risks and solvency risks if things aren’t managed well, or if they face external shocks that are larger than they can deal with.

St. Louis Fed

We can quantify this another way. The majority of bank liabilities are deposits for individuals and businesses, and these deposits currently total $17.6 trillion. That’s what you and I consider to be our “money”. They offer very low interest rates, especially for checking and savings accounts.

Deposits are fractionally-reserve bank IOUs; when you see $10,000 in your account balance for example, that figure is not actually backed up by dollars. Instead, that figure is backed up by a broad mix of less-liquid assets including Treasuries, mortgage loans, credit card loans, business loans, a bunch of other assets, and then a small percentage of actual dollars.

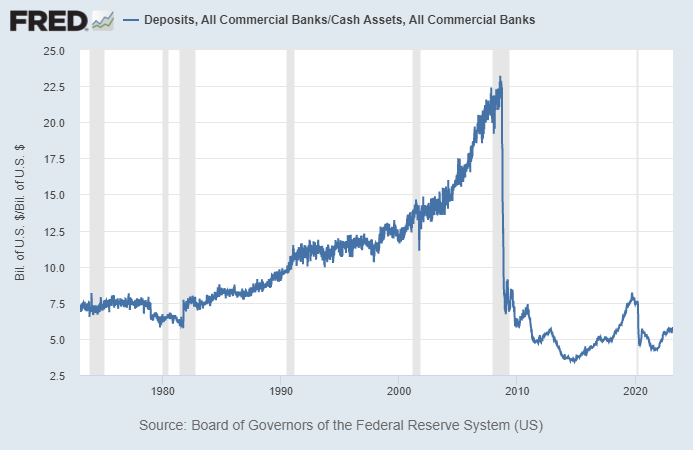

Banks currently have just $3 trillion in cash to back up their $17.6 trillion in deposits. The majority of this cash is just a ledger entry with the U.S. Federal Reserve, and so it is not tangible. Somewhere around $100 billion of it ($0.1 trillion) is held by banks in the form of actual physical banknotes in vaults and ATMs. So, the $17.6 trillion in deposits are backed up by just $3 trillion in cash, of which perhaps $0.1 trillion is physical cash. The rest is backed up by less liquid securities and loans.

Back in 2008, banks had 23 dollars of deposit liabilities for every dollar they had in liquid cash, which is insanely leveraged and illiquid. Due to quantitative easing and a slew of new requirements, their ratios aren’t that high anymore, and so it’s more like a 5x or 6x ratio these days.

St. Louis Fed

From a depositor perspective, banks are basically highly-leveraged bond funds with payment services attached, and we treat it as normal to keep our savings in them.

To help normalize that and make it seem less weird, the FDIC provides insurance against deposit losses up to $250,000 which mitigates some of the risk. However, at any given time, FDIC only has about 1% of bank deposits’ worth of insurance in their fund. They can protect depositors against individual bank failures, but they don’t have enough to prevent against system-wide banking failures, unless they draw in aid from elsewhere or are backstopped by Congress with a fiscal bailout.

Some banks, such as TNB Inc. and others, have attempted to make bank models that just store all of their assets as cash at the Federal Reserve and therefore operate full-reserve banks, but they have not been allowed by the Federal Reserve to exist. This would basically be the safest possible bank, but if it were allowed to exist it could suck deposits out from other banks, threaten the whole fractional-reserve banking model, and reduce the Federal Reserve’s ability to control monetary policy.

So ironically, regulators want banks to be reasonably safe, but not “too safe”. They want all banks to be leveraged bond funds to a certain degree, and won’t allow safer ones to exist.

2008 vs 2023: Credit vs Duration

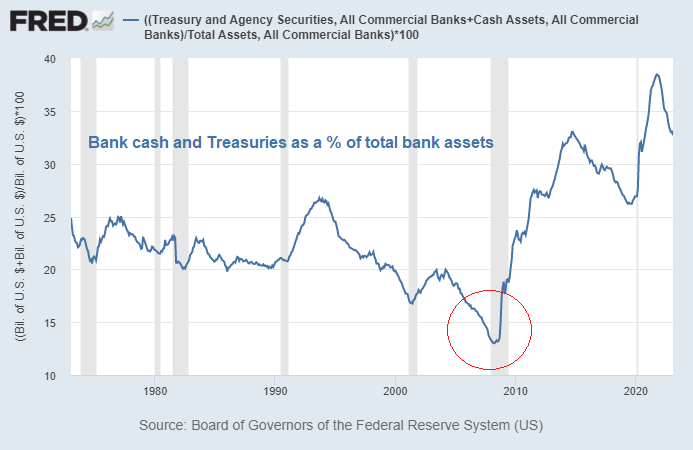

Back in 2008, banks in aggregate had a credit problem. They made risky loans, they had very little safe assets, and some of those risky loans started to default. Given how leveraged they were, it wouldn’t take much to render large portions of the U.S. banking system insolvent.

This chart shows banks’ holdings of cash and Treasuries (the safest assets in terms of credit risk) as a percentage of total bank assets:

St. Louis Fed

As we can see, the 2008 situation was very different than what’s happening here in 2023. Today, banks have a much higher ratio of their assets in cash and Treasury/agency securities, which are nominally risk free if held to maturity. Banks also have a much higher cash-to-deposit ratio in 2023 than 2008. In addition, the rest of their asset base is in better shape in terms of credit risk too: on average banks have less subprime lending exposure, and instead they are rather concentrated into providing loans to entities with decent credit metrics.

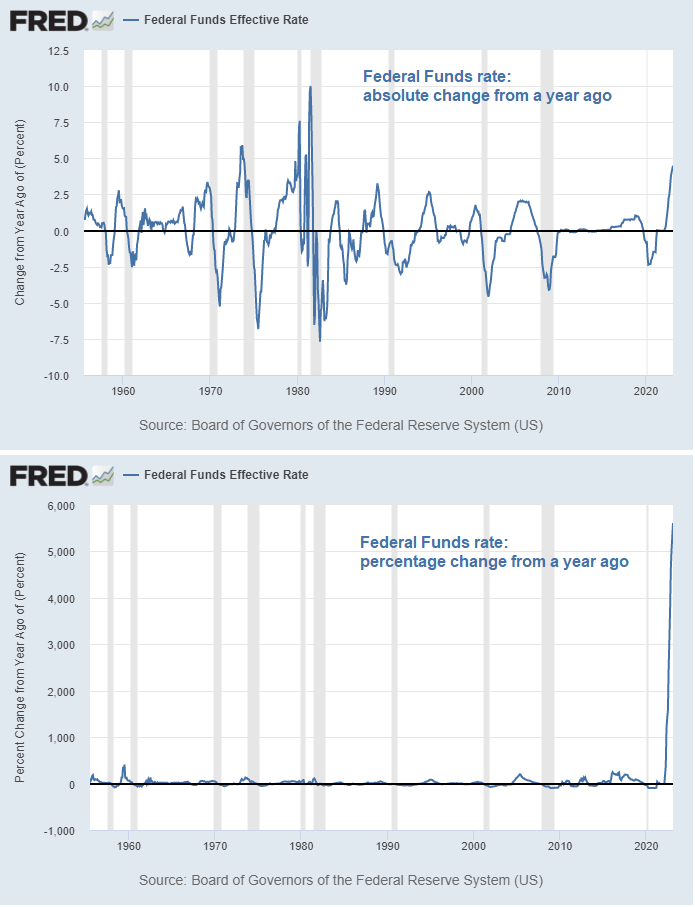

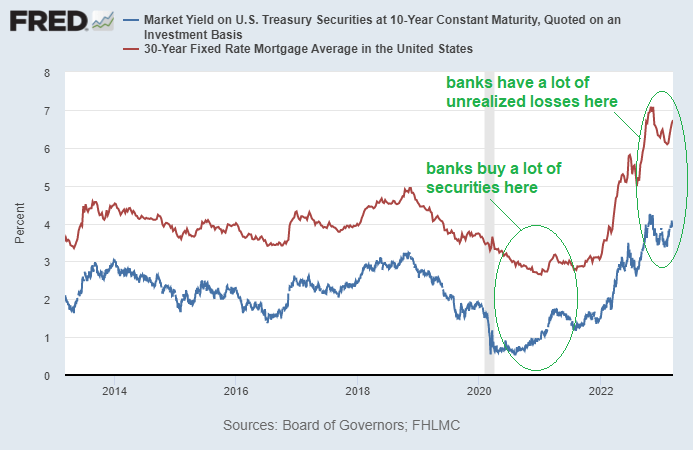

So what’s the problem? This time the problem is liquidity and duration (interest rate) risk. This is similar to the 2019 repo spike, but more severe. Some of the safest securities that banks own might not have credit risk, but they do have duration risk. The Federal Reserve raised interest rates at the quickest absolute pace in decades (a 4.49% move in one year), and the quickest percentage pace of all time (from 0.08% to 4.57% in one year, or a 57x increase).

St. Louis Fed

Banks were given a ton of new deposits during 2020 and 2021 thanks to fiscal stimulus to people, and banks used those deposits to buy a lot of securities, which were low-yielding at the time. After a year of rapid interest rate increases, the prices of those fixed income securities are now lower than they were when banks bought them.

In other words, if they bought a 10-year Treasury note when yields were 1.5%, and today they are 4%, then those older Treasuries will be discounted in terms of price by about 15-20% by any potential buyers, so that they have the same effective yield to maturity (4%) as these newer Treasuries do.

Due to buying so many securities when interest rates were low that are now heavily discounted if they were to be sold, banks have a lot of unrealized losses.

St. Louis Fed

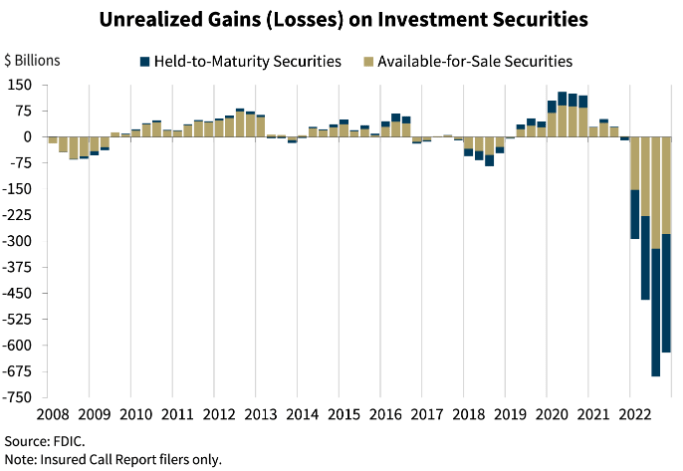

Over $600 billion worth of unrealized losses, in fact:

FDIC

That seems quite “doomy” at first, but there’s good news. Normally, banks can hold these securities to maturity and get all of their money back. That’s why they are classified into the “hold to maturity” segment. And unlike 2008, most of this has little or no credit default risk, so if they can hold on, they’re fine.

However, if depositors pull their money out of a bank above and beyond the amount of cash that the bank has on hand, then that bank might have to sell securities at a loss, rather than hold onto securities until maturity as planned. If that happens, it can turn a liquidity problem into a solvency problem, not because the securities are defaulting like they did in 2008, but instead because the banks are selling otherwise high-quality securities at a loss (due to those securities being priced at a discount in light of recent interest rate increases) and locking in those losses. The unrealized losses become realized losses for banks that can’t keep their deposits from running away.

So, the irony of the situation is that a bank can literally fail even if they hold 100% nominally risk-free assets that are guaranteed to be paid back in full. If a bank uses depositor funds to buy those assets at low interest rates for lack of anything better to buy at the time, and then those assets go on to trade at a discount due to higher interest rates by an amount that exceeds the bank’s capital, and then the bank is forced by a depositor run to sell those assets for a realized loss rather than holding them to maturity and getting their money back as they intended, then the bank is bankrupt.

Silicon Valley Bank had 1) a ton of recent new deposits from one concentrated industry, 2) an unusually high number of large depositors (business-sized accounts) that were not covered by FDIC, and 3) an unusually high ratio of securities with unrealized losses relative to its total capital. Therefore, due to weak risk management practices, it was uniquely vulnerable to this type of depositor rug-pull that made them sell securities at a big loss. A number of other banks, especially ones focused on serving large depositors above the FDIC limit (and thus highly exposed to a bank run), have found themselves in a similar position, so there has been a localized contagion among banks that have similar asset and deposit profiles to Silicon Valley Bank.

On one hand, the $17.6 trillion in bank deposits in aggregate can’t all flow somewhere and wreck the whole banking sector with realized losses by forcing them to sell. Other markets including Treasury securities wouldn’t be big enough to absorb an outflow from bank deposits at that scale. Money markets are the most expandable option but would likely be blocked if inflows go out of control. And physical cash certainly isn’t an option; with only around $100 billion in nationwide bank vault cash on hand, if too many deposits try to come out in physical form, they’ll get told “no” since banks have hardly any physical cash.

So, most of the top ten banks are big enough that it’s hard to pull enough deposits out to make them sell any of their securities for realized losses. It’s not impossible, but it’s hard. So far, the large regional banks and the huge money-center banks are not reporting major deposit outflows.

On the other hand, any given small or medium-sized bank with unrealized losses on their book is indeed quite vulnerable. It’s easy for deposits to move around and concentrate into the larger banks and money markets, leaving a lot of smaller banks out of liquidity and forced to sell their less liquid assets at a loss. Small banks with significant cash on hand, less unrealized losses relative to bank capital, and a large number of small depositors (rather than a small number of large depositors) are generally as safer relative to others in the peer group.

Due to the low credit risk of most bank assets, I certainly don’t see it as a “2008 repeat” like many commentators on social media have recently. Does this acutely threaten the whole financial system? No.

Is it a serious liquidity concern for many banks outside of the top ten or so? Absolutely. And that’s why the Treasury and Federal Reserve stepped in.

2019 Redux

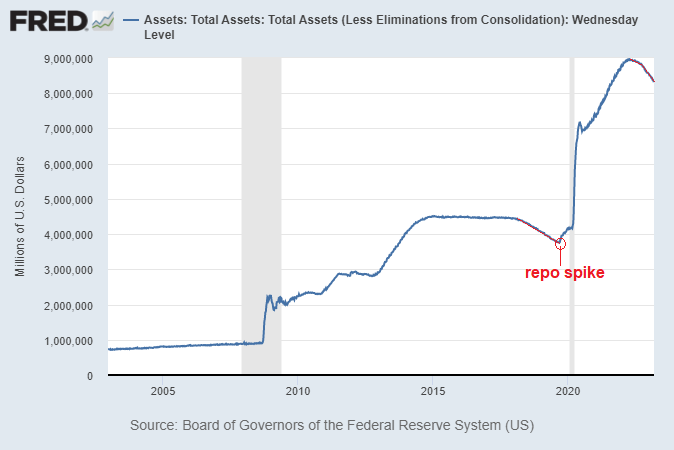

Back in 2018 and 2019, the Federal Reserve was performing quantitative tightening or “QT”, meaning they were letting bonds mature off of their balance sheet and thus destroying bank reserves. They were sucking liquidity out of the banking system as a method of tightening monetary policy.

St. Louis Fed

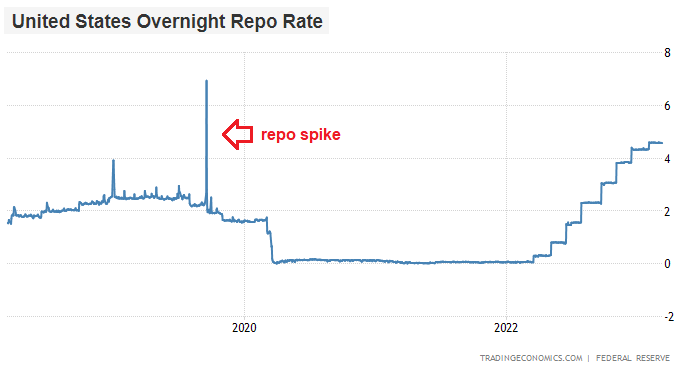

This worked until September 2019 when the repo rate suddenly blew out. The repo rate is an important overnight financing method between financial institutions.

Trading Economics

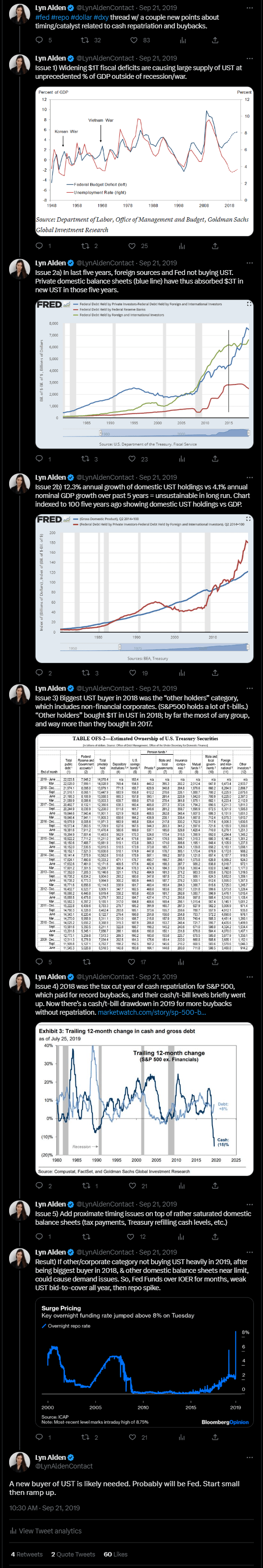

When that happened, the Federal Reserve stepped in the next day by lending in the repo market directly. They also stopped doing quantitative tightening. At the time, I wrote that the repo spike was mostly a problem of too many T-bills flooding the market, and the Federal Reserve would likely have to step in and buy some of them (a form of quantitative easing or “QE”). In other words, while the problem was initially showing up in the repo market, it was ultimately a matter of T-bill oversupply.

Twitter

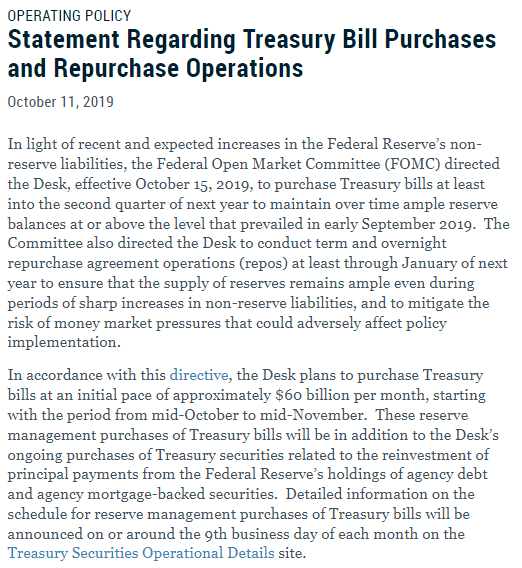

A few weeks later in October 2019, the Federal Reserve indeed began buying T-bills, even though on its surface it was a repo problem:

Federal Reserve

However, they insisted that their purchase of T-bills was “not QE” because the intention wasn’t for stimulus. It was for financial stability. That’s a polite way of saying “forced deficit monetization due to fiscal dominance”.

A few months later in spring 2020 due to the pandemic and lockdowns, the Federal Reserve did switch to doing outright QE, and at a massive scale. They bought many types of securities throughout 2020 and 2021. But that period of buying of T-bills from October 2019 into early 2020 was for financial stability and deficit monetization reasons rather than stimulus purposes.

Starting in 2022, in the face of high inflation, the Federal Reserve began to raise interest rates and resume a period of QT, to try to tightening monetary policy and reduce inflation. Each month, they are letting securities mature off of their balance sheet, and retire those reserves. This once again sucks money out of the banking system. And once again, it contributed to banking problems.

This time it wasn’t a problem of too many T-bills. In fact, there is arguably an undersupply of T-bills currently. Instead, this is a problem of banks having low cash levels relative to how much illiquid securities and loans they have, even if most of those securities and loans have good credit profiles (unlikely to default).

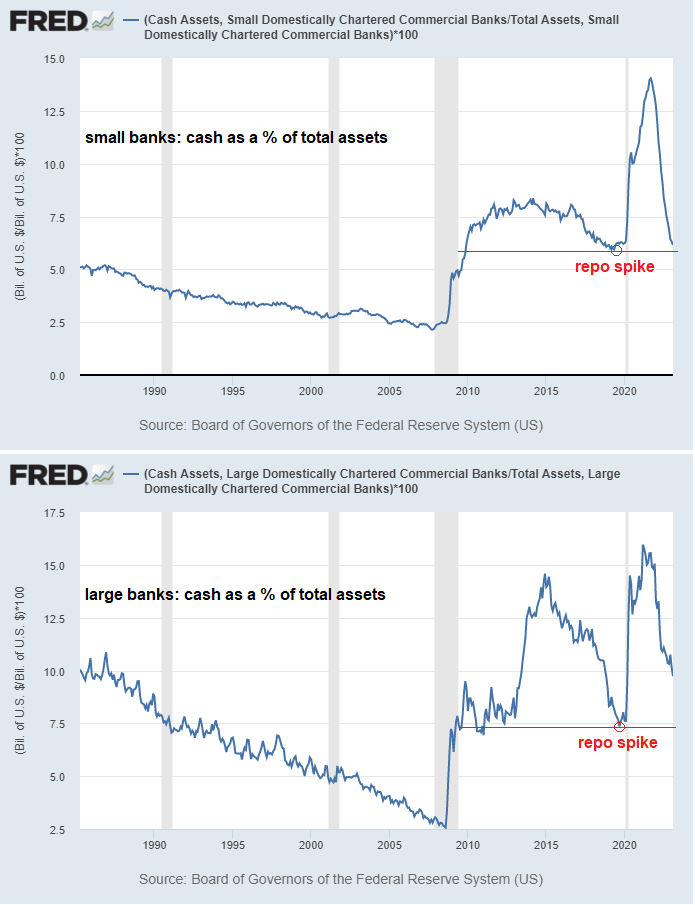

More specifically, it was small banks that were drained of cash more quickly than large banks this time. This chart shows cash as a percentage of total assets for small banks and large banks:

St. Louis Fed

Here in 2023, small banks are already back down to cash levels they had at the time of the 2019 repo spike, while large banks aren’t yet. This draining of liquidity has sucked cash out of smaller banks at a faster rate than large banks, which didn’t really happen during the 2018-2019 period of quantitative tightening.

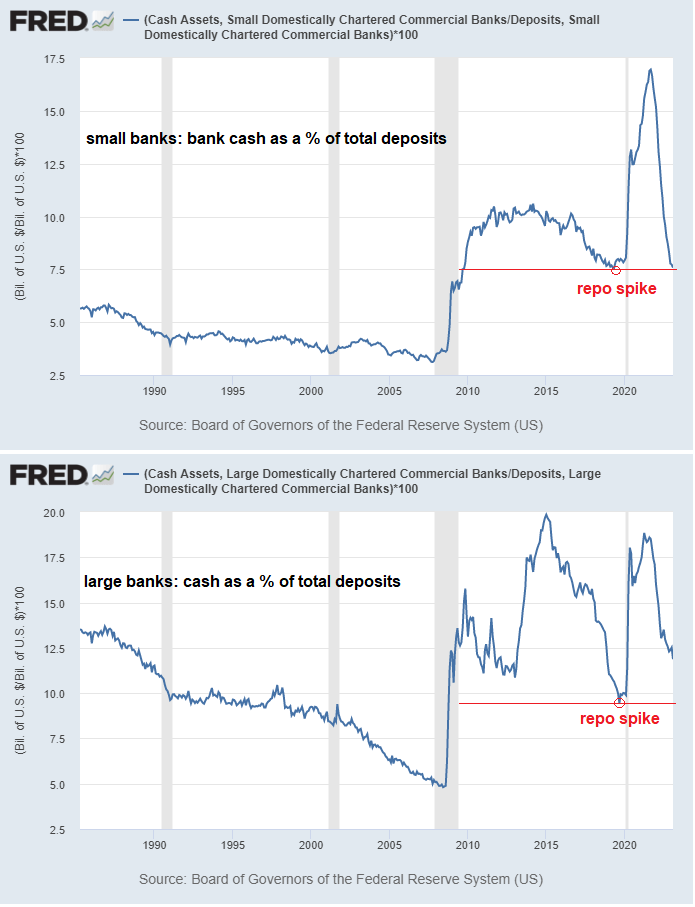

This chart shows cash as a percentage of total deposits for small banks and large banks, and indicates the same problem:

St. Louis Fed

This difference in the speed of cash drain between large and small banks was under my radar in recent months. I was mostly looking at the banking system as a whole, which in terms of assets mainly means the big banks. However, the problem this time specifically originated in the long tail of small and medium-sized banks, as well as banks with unusual depositor profiles, and I don’t invest in either of those categories from an equity perspective due to their higher risk level.

As a result of this uneven cash drain, I think it will be pretty hard for the Federal Reserve to continue interest rate increases and quantitative tightening for much longer. They could continue it for a few months more into mid-year if the Treasury General Account draws down quickly enough and offsets some of it, but outside of that, it seems that continuing to reduce the amount of bank reserves in the system risks putting a lot of banks outside of the top ten banks into a persistent liquidity problem.

On Sunday night, the Treasury and the Federal Reserve coordinated to make a new facility called the Bank Term Funding Program “BTFP” which lets banks use various securities at face value for loan collateral, rather than having to sell them. This gives banks a lot more liquidity against bank runs for now, but just papers over the underlying problem.

If the Federal Reserve does continue to push forward by raising interest rates and performing quantitative tightening, the long tail of small and medium-sized banks are at risk of ongoing liquidity drains, starting with the most vulnerable and moving up from there. If the small banks sharply raise interest rates to keep deposits, then they risk getting into solvency problems. The beneficiaries of this flight to safety would most likely be several of the largest banks and money market funds.

Due to the way the system inherently operates, there has been a long-term consolidation of small banks into big banks, and this recent episode provides more fuel for that trend.

In 1971, according to FDIC, there were 13,612 banks in the country with 23,336 branches. Fifty years later, in 2021, there were only 4,237 banks with 72,405 branches. Although the population increased and the number of branches increased (not to mention all of the online banking that the industry shifted wards), the number of separate banks dropped dramatically and consolidated into fewer, larger ones. And even those statistics understate the level of concentration; in 2022 the top ten banks alone had approximately half of all bank assets, with the other 4,200+ banks combined holding the other half.

The more the Federal Reserve tries to push interest rate increases and quantitative tightening in this business cycle, the more they will likely benefit the mega-cap J.P. Morgan Chase’s of the world over the small community banks, as reserves will likely continue to drain out of the smaller banks and threaten their liquidity profiles. The Federal Reserve’s BTFP on its own won’t prevent this process; it just make the liquidity drain out of small banks less disorderly.

What About Reverse Repos?

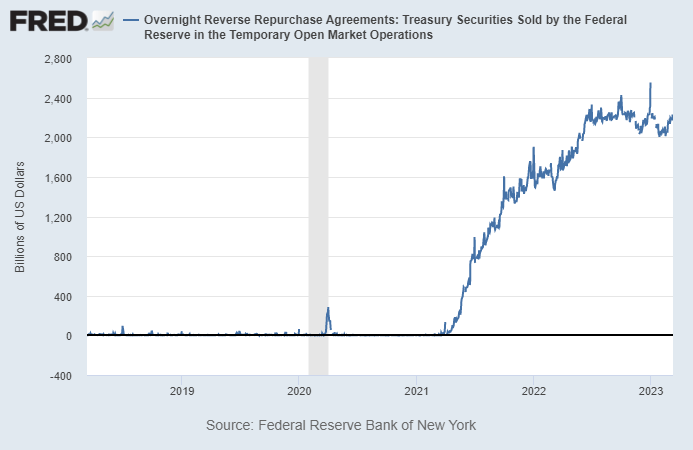

There is nearly $2.2 trillion sitting in reverse repos, and this aspect is very different than the 2018/2019 period of quantitative tightening:

St. Louis Fed

A lot of this is held by money markets; people hold their dollars in money market funds, and those funds stick that cash into the Federal Reserve. The Fidelity Government Money Market Fund, for example, has $245 billion in assets, of which 72% are in reverse repos with the Federal Reserve.

Technically, this $2.2 trillion in reverse repos could be drained and pulled back into bank deposits and bank reserves. If that were the case, the Federal Reserve could still have a long runway of quantitative tightening ahead. However, reverse repo exposure has a higher yield and is backed up by the Federal Reserve, so why would that money want to go back into banks, and especially small banks?

The main way to suck dollars out of reverse repos would be for banks to raise depositor interest rates and entice dollars out of money markets and back into deposits. The problem is that those who don’t need to raise deposit rates very much (the big banks) are the ones that could, and the ones who do need to raise deposit rates (the small banks) are the ones that would have trouble doing so. If a bank raises its deposit rates too much while holding low-yielding securities, then they risk having operating losses and solvency problems.

The secondary way to suck money out of reverse repos would be for the U.S. Treasury to issue a ton of T-bills. However, due to the debt ceiling impasse, they cannot. So, that money is pretty much stuck there for at least a while.

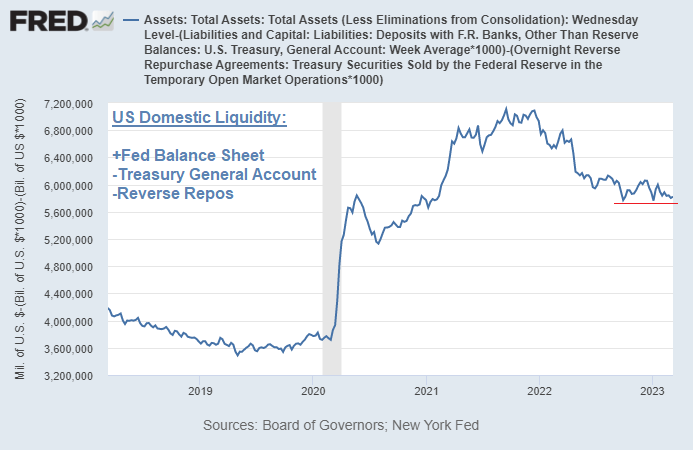

The constraint is basically that total domestic liquidity (the Fed’s balance sheet minus the Treasury General Account minus reverse repos) will have a hard time going much below the red line in the chart below, unless it is offset by widening usage of liquidity facilities like the BTFP:

St. Louis Fed

When domestic liquidity first hit that red line in late September 2022, the U.S. Treasury security market started to become quite illiquid, and the U.K. sovereign bond market outright broke and required liquidity intervention by the Bank of England. Since then, domestic liquidity has trended sideways, as reductions in the Treasury General Account have offset reductions in the Federal Reserve’s balance sheet, and things avoided breaking until recently when the Federal Reserve had to step in with liquidity intervention to prevent bank runs.

Actionable Takeaways

-Unlike 2008, most of the large banks don’t appear to have credit problems from over-aggressive lending, and they are less at risk of liquidity draining from them than small banks. Therefore, most large banks are in decent shape.

-Smaller banks, meanwhile, aren’t out of the woods yet due to the combination of less cash on hand and significant unrealized losses sitting on their balance sheets. The majority of them, at least the publicly-traded ones, don’t have the acute solvency problems that Silicon Valley Bank had, but if they raise deposit rates to try to keep deposits then they do risk experiencing a solvency problem.

-Policymakers will be watching the liquidity situation closely at this point, and are likely to find it difficult to keep moving forward with interest rate increases and quantitative tightening for much longer. Specifically, total U.S. bank reserves probably can’t go much below the current $3 trillion level without corresponding increases in the usage of liquidity facilities.

-If the Federal Reserve is unable to keep up the combination of interest rate increases and quantitative tightening for much longer due to hurting small banks too much, despite price inflation still being above-target, then a basket of anti-dollar positions such as gold, oil, commodities, emerging markets, and bitcoin would likely benefit.

-Despite the recent actions that made even uninsured depositors whole, bank depositors should ensure they are under the $250,000 FDIC insurance limit, if possible. For amounts above that, T-bills and money market accounts are preferable. They are safer and higher yielding, for amounts of money that don’t need bank-specific services (e.g. payments). The biggest challenge is for businesses, because they need to deal with bank accounts and payments in large amounts. They can split their activities among a number of banks, can use sweeps to move unneeded funds into money markets, and can do other protective measures.

Final Thoughts: The Fed’s Negative Capital

Ironically, the same problem that has happened to banks in terms of significant unrealized losses on their portfolio from otherwise-safe assets, has happened to multiple central banks as well.

This is because several central banks including the U.S. Federal Reserve are fighting 1940s-style fiscal-driven inflation with 1970s-style monetary policy, which is mainly aimed at slowing down private credit growth.

Central banks such as the Federal Reserve hold long-duration assets such as Treasury bonds and mortgage-backed securities as their assets, while their liabilities are shorter-term, including bank reserves, physical banknotes, and reverse repos.

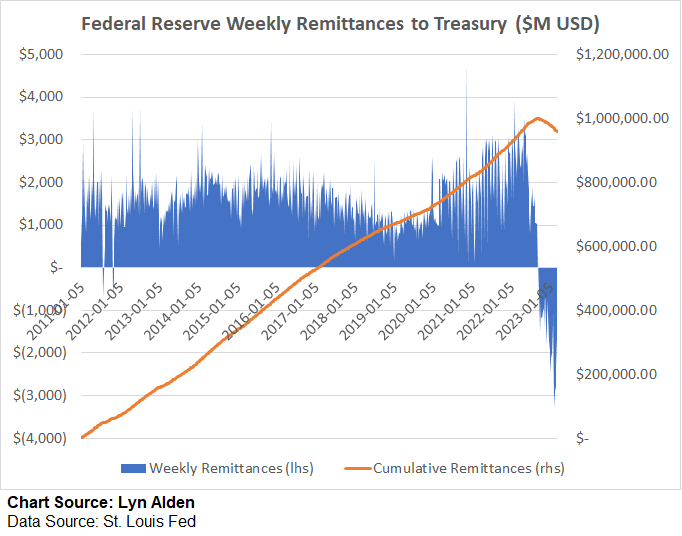

Normally, a central bank’s assets have higher interest rates than their liabilities do, resulting in operating profits for the central bank. In the United States, the Federal Reserve is required to send its operating profits to the U.S. Treasury Department as remittances, and in recent years they have been around $100 billion per year (enough to fund NASA four times over).

However, because central banks raised interest rates so quickly in 2022, many of them now have liabilities that have higher interest rates than their assets. The Federal Reserve is running operating losses to the tune of ~$2 billion per week due to this, and they are no longer sending remittances to the U.S. Treasury.

Lyn Alden

The Federal Reserve already has deeply negative capital (about -$1 trillion or so) if we mark its assets to market. Aside from that, the Federal Reserve will reach negative tangible capital in a couple weeks even without marketing assets to market, due to ongoing operating losses from paying out higher interest rates on its liabilities than its assets. The accounting method of treating its cumulative losses as “deferred assets” and avoiding mark-to-market accounting is what’s keeping it solvent on paper.

Fortunately as a central bank, it’s not subject to bank runs in the same way that individual banks are (especially small banks) and doesn’t go out of business if it has negative tangible capital or operating losses.

Instead, when a central bank has negative tangible capital and/or operating losses, it’s their level of independence from their government that becomes questionable, and the government loses out on a revenue source since the remittances stop flowing. For a variety of reasons including this one, I expect the Federal Reserve’s monetary policy to be increasingly politicized by members of Congress in the years ahead.

A lot of things in the financial system are upside down lately, as policymakers try to get a grip on price inflation. The Federal Reserve is sucking liquidity out of the long tail of small and medium-sized banks, paying out tons of money on its liabilities mostly to large banks and money market funds, and accumulating operating losses into a negative tangible capital position on its own balance sheet.

I share model portfolios and exclusive analysis on Stock Waves. Members receive exclusive ideas, technical charts, and commentary from three analysts. The goal is to find opportunities where the fundamentals are solid and the technicals suggest a timing signal. We're looking for the best of both worlds, high-probability investing where fundamentals and technicals align.

Start a free trial here.

This article was written by

.

My work can be found at LynAlden.com, ElliotWaveTrader.net, and within the Seeking Alpha marketplace where I work with the Stock Waves team to blend their technical analysis with my fundamental analysis for high-probability long-term setups.

Disclosure: I/we have a beneficial long position in the shares of BTC-USD, XAUUSD:CUR, TFC, USB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.